Subscription-based business models have grown rapidly across industries. From software platforms to media streaming and healthcare memberships, recurring revenue has become a preferred model for predictable growth. As customer bases expand, billing complexity increases significantly.

Monthly invoicing becomes difficult to manage manually at scale. Tracking renewals, plan upgrades, usage adjustments, and payment statuses across hundreds or thousands of customers can quickly overwhelm administrative teams. Even small errors can disrupt revenue and damage customer trust.

This is where automation becomes essential. Automated monthly subscription invoices streamline recurring billing processes, reduce manual intervention, and stabilize revenue streams. Businesses that implement automation gain operational efficiency while protecting predictable cash flow.

Table of Contents

ToggleWhat Is a Subscription Business Model?

A subscription business model generates recurring revenue by charging customers at regular intervals. Instead of one-time transactions, customers pay monthly, quarterly, or annually for ongoing access to products or services.

Common industries using subscriptions include SaaS platforms, digital media providers, healthcare services, fitness memberships, and professional associations. These businesses depend heavily on consistent billing accuracy to maintain revenue predictability.

Compared to one-time billing, subscription models offer greater financial stability. However, they also require structured billing systems to ensure recurring charges are processed correctly and on time.

What Are Monthly Invoices in Subscription Billing?

Monthly invoices are billing documents issued on a recurring monthly cycle to reflect subscription charges. They outline service fees, usage costs, taxes, and any adjustments made during the billing period.

Some subscriptions use fixed pricing structures where the amount remains consistent each month. Others rely on usage-based billing, where charges vary depending on consumption levels. Automated monthly subscription invoices must accommodate both models seamlessly.

Billing cycles and invoice timing must align precisely with contract terms. Automation ensures invoices are generated and delivered consistently according to the agreed schedule.

Challenges of Manual Monthly Invoicing

Human Error in Recurring Charges

Manually generating invoices each month increases the likelihood of calculation mistakes, incorrect pricing tiers, or missed add-ons. Even small data entry errors can lead to underbilling, overbilling, and customer disputes. Over time, these inconsistencies can damage trust and require time-consuming corrections.

Missed or Delayed Billing Cycles

Without automated monthly subscription invoices, it becomes easy to overlook billing dates, especially as customer volume grows. A missed billing cycle directly impacts cash flow and can create revenue gaps that are difficult to recover. Manual tracking systems often lack built-in reminders or safeguards.

Inconsistent Invoice Formatting and Numbering

When invoices are created manually, formatting and numbering can vary. This creates confusion for customers and complicates accounting reconciliation. Consistent invoice sequencing is critical for financial audits and internal reporting accuracy.

Delayed Cash Flow and Slow Collections

Manual invoicing typically results in slower delivery and follow-up. When invoices are sent late, payments are also delayed. This increases accounts receivable aging and reduces the predictability of recurring revenue streams.

Administrative Burden on Staff

Staff must manually verify subscription plans, adjust pricing, apply taxes, and send invoices every billing cycle. As the business scales, this process consumes valuable operational hours that could be focused on growth initiatives. The cost of labor rises alongside the subscriber base.

Difficulty Handling Upgrades, Downgrades, and Proration

Subscription businesses frequently deal with plan changes mid-cycle. Calculating prorated charges manually increases the risk of mistakes. Without automation, billing adjustments become complex and prone to miscalculation.

Limited Visibility into Revenue Trends

Manual processes rarely provide real-time reporting. Businesses may struggle to track recurring revenue, churn rates, or payment success metrics accurately. This lack of visibility makes forecasting and financial planning more difficult.

Higher Risk of Duplicate or Missing Invoices

Spreadsheets and manual tracking systems can result in duplicated billing or skipped accounts. Both scenarios create financial and reputational risks. Automated monthly subscription invoices significantly reduce these vulnerabilities by applying structured billing logic.

What Is Invoice Automation?

Invoice automation refers to system-driven billing processes that generate invoices based on predefined rules. Instead of manually preparing invoices, the system automatically calculates charges and issues billing documents.

Rule-based invoice generation ensures consistent pricing application, accurate tax handling, and timely issuance. Automation reduces variability and strengthens financial control.

Modern automated monthly subscription invoices integrate with payment gateways and CRM systems. This integration keeps billing data synchronized with customer accounts and payment status in real time.

How Automated Invoice Generation Works

When customers enroll in subscription plans, their billing details are stored within the system. Plan type, pricing tier, and billing frequency are predefined.

The system then follows preset billing schedules. On the designated billing date, invoices are automatically generated without manual input.

Invoices are delivered electronically to customers, often accompanied by payment links or automated debit processing. This structured workflow ensures billing consistency at scale.

Automating Recurring Billing Schedules

Automation allows businesses to configure monthly billing cycles based on contract terms. Each subscription follows a scheduled recurring structure without requiring manual reminders.

Proration handling is built into advanced systems. When customers upgrade, downgrade, or modify plans mid-cycle, automated monthly subscription invoices calculate adjustments accurately.

Contract-based recurring terms can also be programmed into the system. This ensures billing aligns precisely with service agreements, reducing disputes and confusion.

Integrating Automated Payments

Automated billing systems often support stored payment methods and auto-debit functionality. Payments can be processed immediately upon invoice issuance.

This integration reduces late payments and improves collection rates. Customers benefit from convenience, while businesses maintain consistent cash inflows.

Payment confirmations and digital receipts are generated automatically. This improves transparency and strengthens the overall customer experience.

Reducing Errors Through Automation

Automation eliminates duplicate invoice creation through controlled numbering systems. Unique identifiers maintain accurate recordkeeping.

Tax calculations are handled automatically based on predefined rules. This reduces compliance risks and reporting discrepancies.

Built-in validation checks ensure invoices are complete before issuance. These safeguards significantly improve billing accuracy.

Improving Cash Flow and Revenue Predictability

On-time invoice issuance is one of the biggest advantages of automated monthly subscription invoices. Businesses no longer depend on manual tracking to initiate billing.

Faster collections result from consistent invoice delivery and integrated payment processing. Reduced delays improve liquidity and operational stability.

With reliable billing cycles, companies can forecast recurring revenue more accurately. Predictable income supports budgeting, hiring, and strategic investment decisions.

Enhancing Customer Experience

Automated invoices provide clear and transparent billing summaries. Customers can easily review service details and payment breakdowns.

Automated reminders reduce the likelihood of missed payments. Proactive communication improves satisfaction and reduces disputes.

Self-service billing portals allow customers to update payment methods, review invoice history, and manage subscriptions independently. This autonomy strengthens long-term relationships.

Reporting and Analytics in Automated Subscription Billing

Recurring revenue tracking is simplified through centralized dashboards. Businesses can monitor monthly recurring revenue and subscription growth trends.

Churn monitoring helps identify customer retention issues early. Payment success rates reveal areas where billing processes may need optimization.

Financial performance dashboards provide real-time visibility into revenue, collections, and outstanding balances. This transparency supports informed decision-making.

How ReliaBills Supports Subscription Invoice Automation

ReliaBills simplifies automated monthly subscription invoices by providing an easy-to-configure recurring billing setup. Businesses can define billing frequencies, automate invoice creation, and ensure charges are applied accurately without repetitive manual work. This reduces administrative time and improves billing consistency from the start.

For subscription businesses focused on predictable recurring revenue, ReliaBills aligns invoice automation directly with revenue tracking. Automated recurring billing schedules, built-in reminders, and payment automation tools help maintain stable cash flow. By reducing missed payments and late collections, businesses protect Monthly Recurring Revenue and minimize churn.

ReliaBills also offers branded invoice communication and centralized reporting dashboards. Real-time revenue insights allow businesses to monitor subscription performance, track payment behavior, and forecast growth confidently. The platform is designed to save time, strengthen financial visibility, and help subscription businesses scale efficiently.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

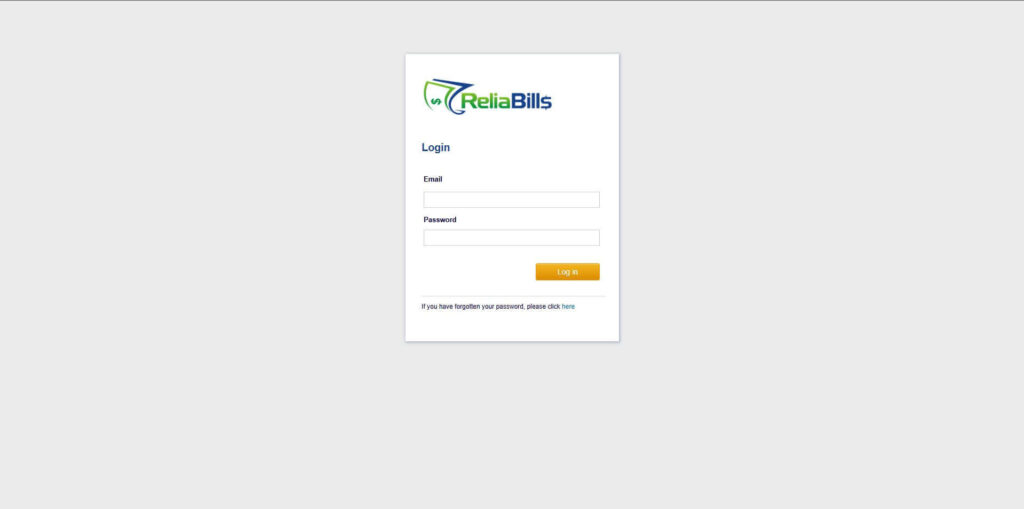

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

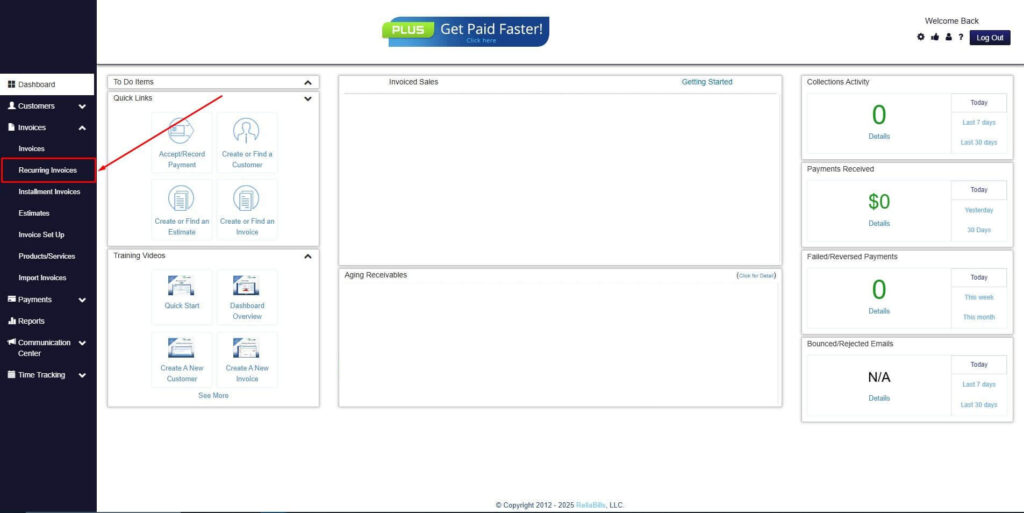

Step 2: Click on Recurring Invoices

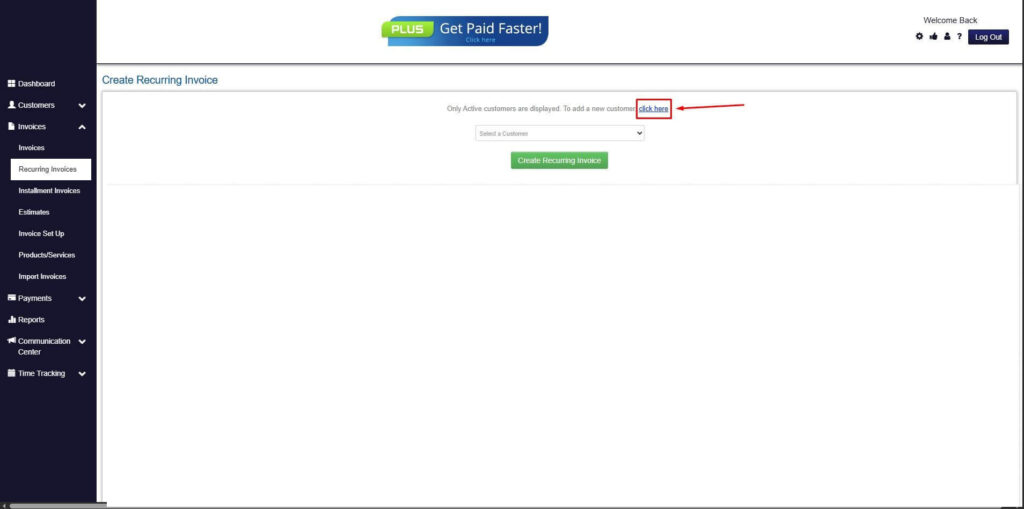

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

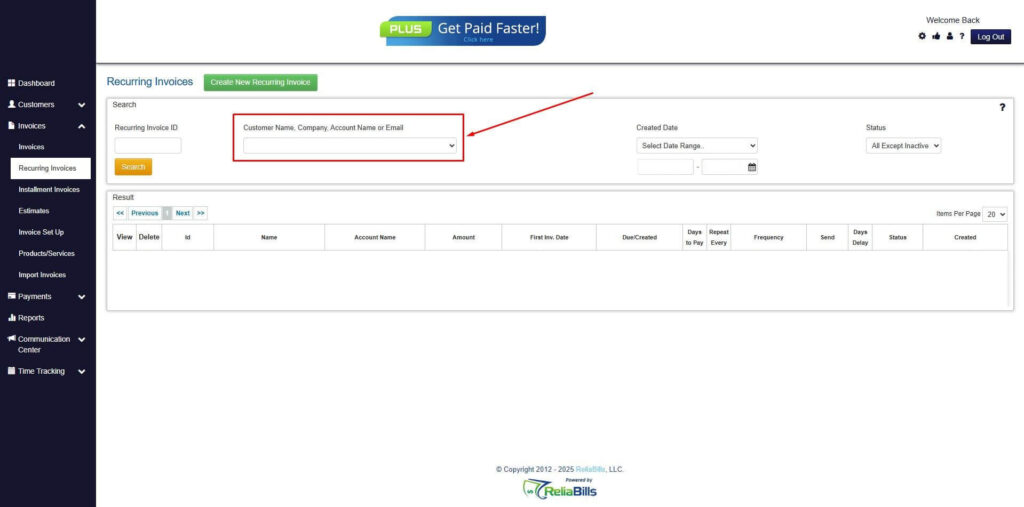

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

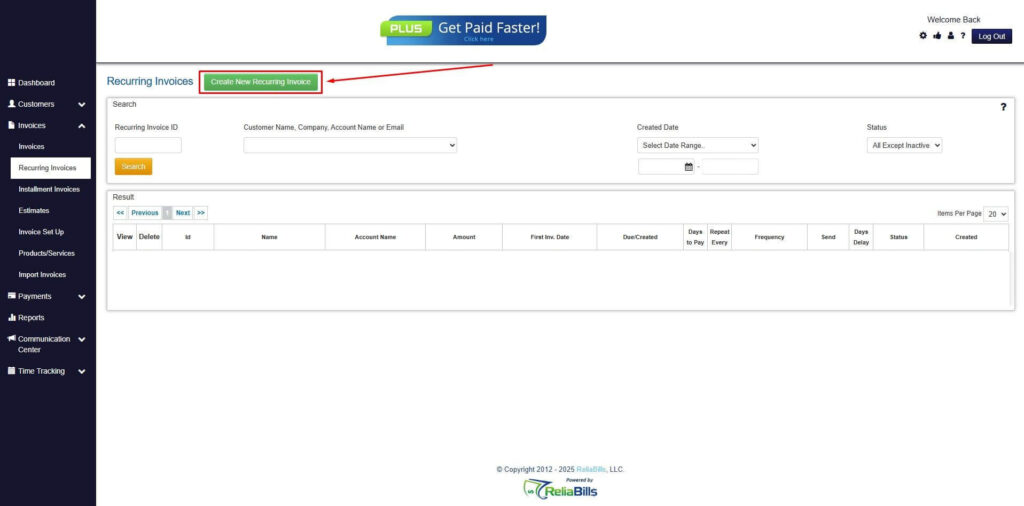

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

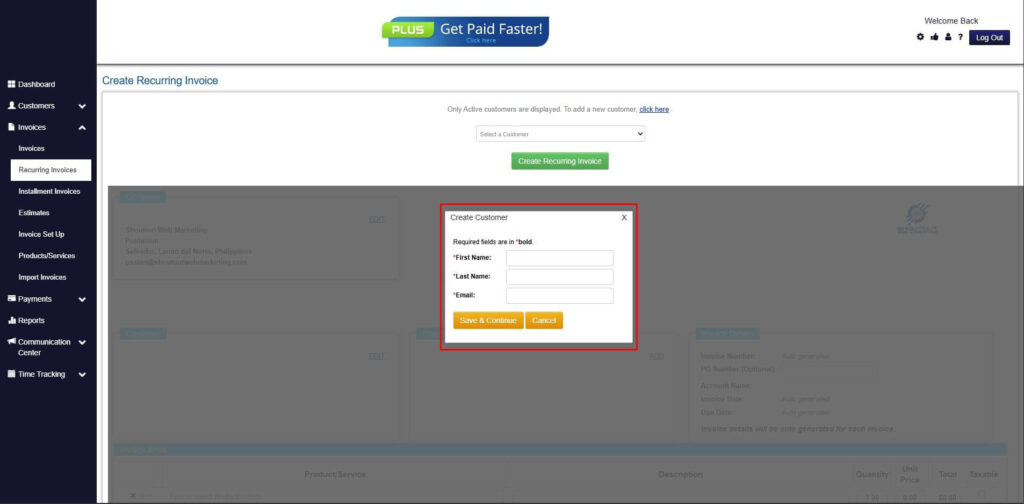

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

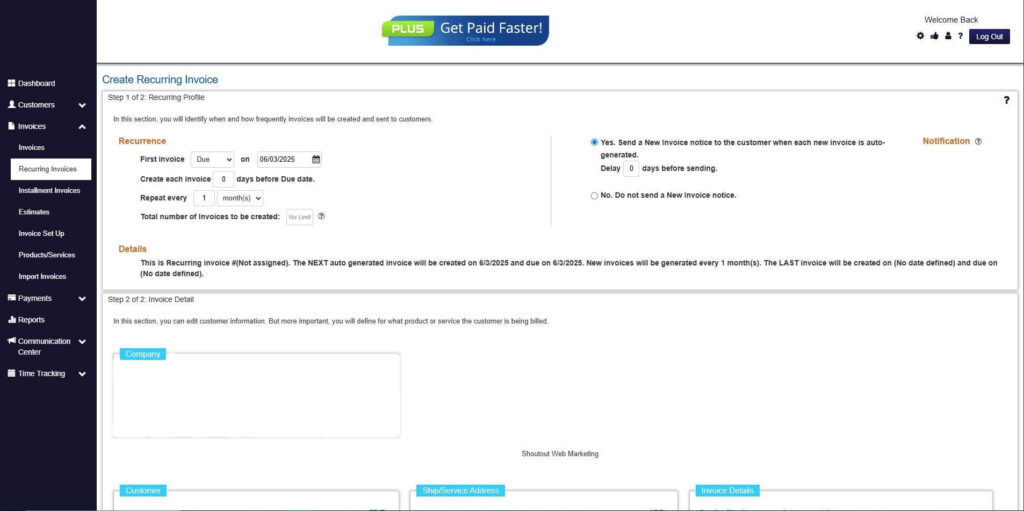

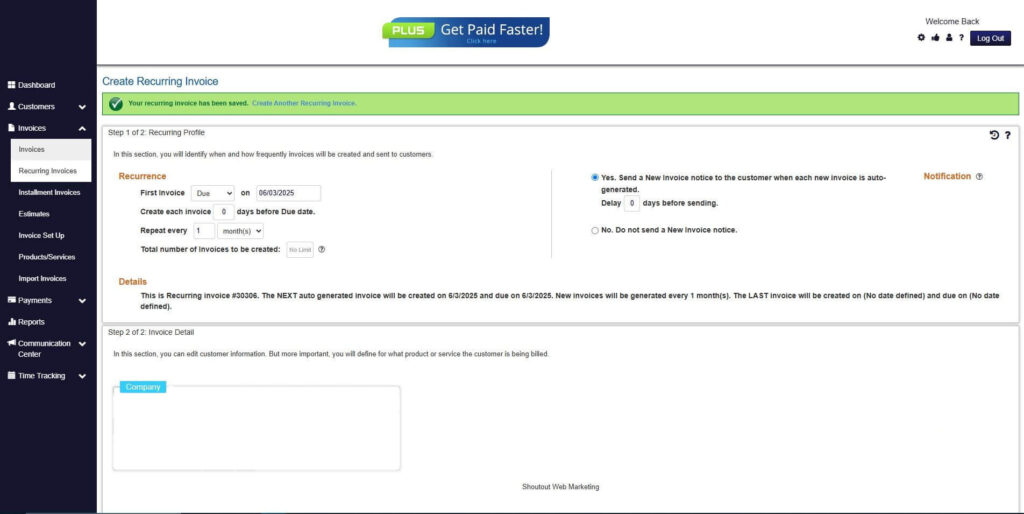

Step 7: Fill in the Create Recurring Invoice Form

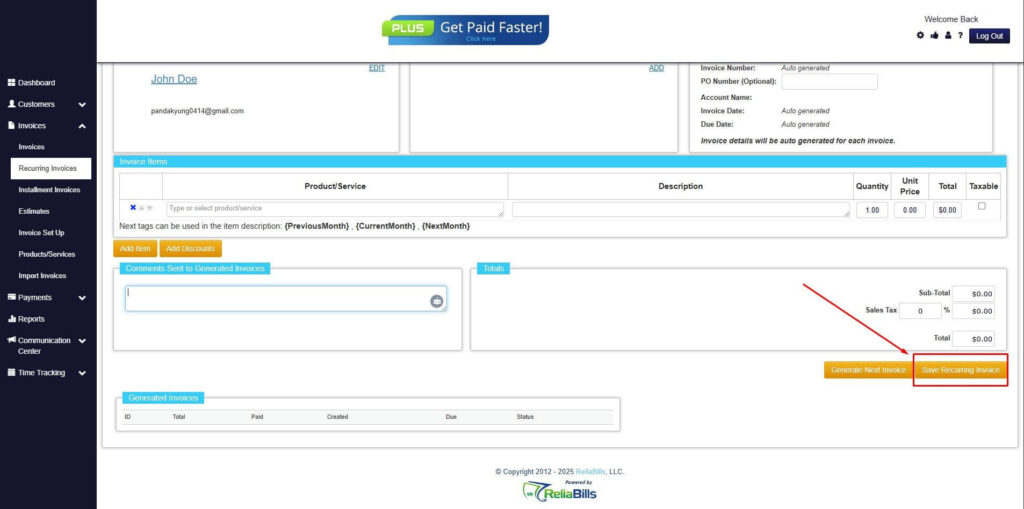

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What are automated monthly subscription invoices?

They are system-generated recurring invoices issued automatically according to subscription billing schedules.

2. How do automated invoices reduce billing errors?

Automation eliminates manual calculations, applies consistent pricing rules, and prevents duplicate issuance.

3. Can automation handle mid-cycle plan changes?

Yes. Advanced systems calculate proration automatically when customers upgrade or downgrade plans.

4. Do automated invoices improve cash flow?

Absolutely. Timely invoice issuance and integrated payments accelerate collections and stabilize revenue.

5. Are automated billing systems suitable for small subscription businesses?

Yes. Even small businesses benefit from reduced administrative workload and improved billing accuracy.

6. How do automated invoices enhance customer experience?

They provide consistent billing, clear summaries, and convenient payment options.

Conclusion

Automation is essential for scaling subscription businesses efficiently. As customer bases grow, manual billing becomes unsustainable and risky.

Automated monthly subscription invoices provide accuracy, operational efficiency, and predictable recurring revenue. By eliminating human error and standardizing billing workflows, businesses protect their financial stability.

Choosing the right recurring billing platform allows subscription businesses to focus on growth rather than administrative complexity. With automation in place, recurring revenue becomes more reliable, scalable, and manageable.