Auto repair franchises operate in a fast-moving environment where small inefficiencies add up quickly. Between multiple locations, high customer volume, and ongoing vehicle services, invoicing can become a daily headache. When billing is unclear or inconsistent, payment delays and customer frustration often follow.

Invoices are more than paperwork. They shape how customers view the business and how confidently they pay. A clean, accurate invoice tells customers they are dealing with a professional operation that values transparency.

For many franchises, the turning point is switching to auto repair billing software. With the right system in place, invoices go out on time, payments come in faster, and staff spend less time fixing avoidable mistakes.

Table of Contents

ToggleUnderstanding Invoicing in Auto Repair Franchises

Franchise invoicing is different from billing at a single repair shop. Every location must follow brand guidelines while still handling local pricing, taxes, and customer expectations. That balance makes invoicing more complex than it first appears.

Some franchises choose centralized billing so corporate teams can oversee payments and reporting. Others allow each shop to invoice independently, which can work but often leads to inconsistencies. Without coordination, even small differences can confuse customers.

Auto repair franchises typically issue repair invoices, maintenance invoices, fleet invoices, and warranty-related billing. Each type carries different documentation needs. Auto repair billing software helps keep all of these organized under one system.

Common Invoicing and Payment Challenges

Inconsistent invoice formats are one of the most common problems across franchise locations. When invoices look different from shop to shop, customers start asking questions. Those questions slow down payments and increase staff workload.

Manual invoicing introduces errors that are hard to catch in busy environments. Missed line items, incorrect labor rates, or tax miscalculations can delay payments for days or weeks. Over time, these errors damage cash flow.

Recurring customers and fleet accounts add another layer of difficulty. Tracking repeat services manually is inefficient and easy to forget. Auto repair billing software removes that risk by automating repeat billing.

Key Elements of a Standardized Auto Repair Invoice

A well-designed invoice should immediately reflect the franchise brand. Consistent layout, logos, and business details create a sense of reliability. Customers are more likely to trust invoices that look professional and familiar.

Every invoice should clearly list customer information, vehicle details, and services performed. Itemized labor and parts help customers understand exactly what they are paying for. Clarity reduces disputes and speeds up approval.

Payment terms matter just as much as service details. Due dates, taxes, discounts, and accepted payment methods should never be hidden. Auto repair billing software ensures nothing important gets missed.

Managing Payments Across Multiple Franchise Locations

Auto repair customers expect flexibility when it comes to payments. Accepting cards, digital payments, and online options makes paying easier. Convenience directly affects how quickly invoices are settled.

Franchise owners also need visibility into payments across all locations. Without proper tracking, it becomes difficult to reconcile revenue accurately. Payment data should be easy to review at any time.

Outstanding balances and partial payments are easier to manage with centralized systems. Auto repair billing software keeps everything in one place. This makes follow-ups quicker and more effective.

The Role of Automation in Franchise Invoicing

Automation changes how franchises handle invoicing at scale. It removes repetitive tasks and reduces reliance on manual entry. This alone significantly lowers the risk of billing errors.

Consistency is another major benefit of automation. Standard invoice templates and workflows ensure every location follows the same process. Customers get the same experience regardless of where they visit.

Automation also improves financial insight. Owners can see trends, track performance, and identify problems early. Auto repair billing software turns raw data into usable information.

Recurring Billing and Fleet Accounts

Fleet customers and repeat clients provide steady revenue, but they require structure. These customers often receive the same services on predictable schedules. Manual billing does not work well in these situations.

Recurring billing ensures invoices are generated automatically at the right time. This keeps revenue consistent and removes the need for staff reminders. Customers also appreciate the reliability.

Maintenance plans and subscription services benefit even more from recurring billing. Payments become predictable and easy to track. Auto repair billing software makes these programs manageable as they grow.

Best Practices for Invoice and Payment Management

- Use one invoice format across all franchise locations

- Set clear billing and payment expectations from the start

- Train staff regularly on invoicing systems and procedures

- Review billing performance using real-time reports

Common Mistakes to Avoid

- Allowing each location to bill differently

- Relying on spreadsheets or manual invoicing

- Forgetting to track repeat customers and fleet services

- Being unclear about payment terms and due dates

How ReliaBills Supports Auto Repair Franchises

ReliaBills gives auto repair franchises a centralized way to manage invoices across all locations. Instead of juggling systems, everything is handled in one place. This improves accuracy and visibility.

Recurring billing is built into the platform, making it easier to manage fleet accounts and service plans. Invoices are sent automatically and on schedule. This helps stabilize cash flow and reduce missed payments.

ReliaBills PLUS, the pricing plan for ReliaBills, is designed for growing franchises. It includes advanced automation, detailed reporting, and expanded recurring billing tools. These features support scalability without increasing administrative effort.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

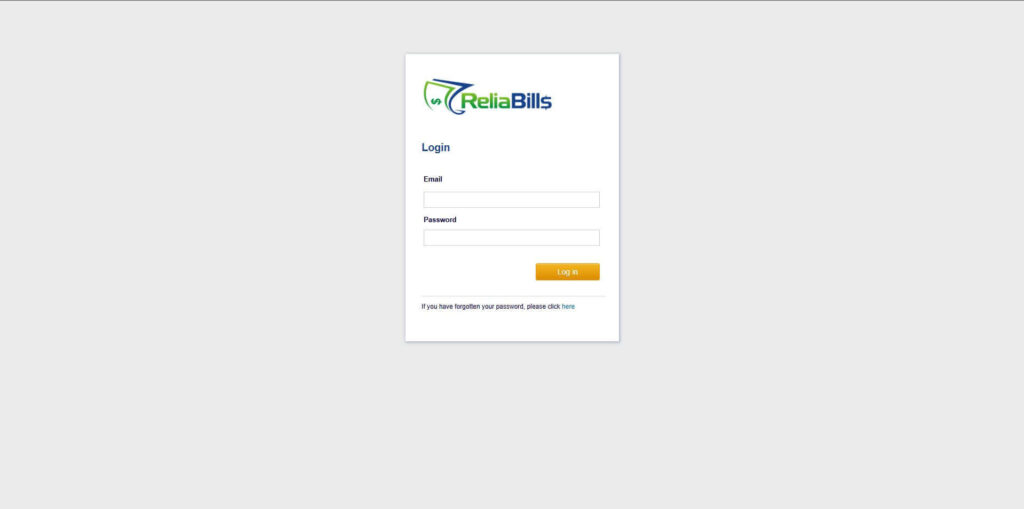

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

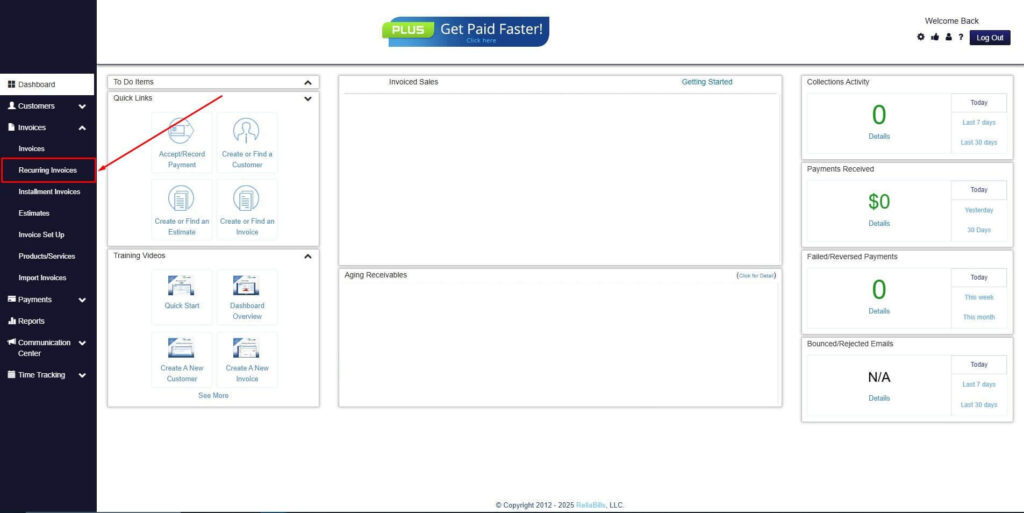

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

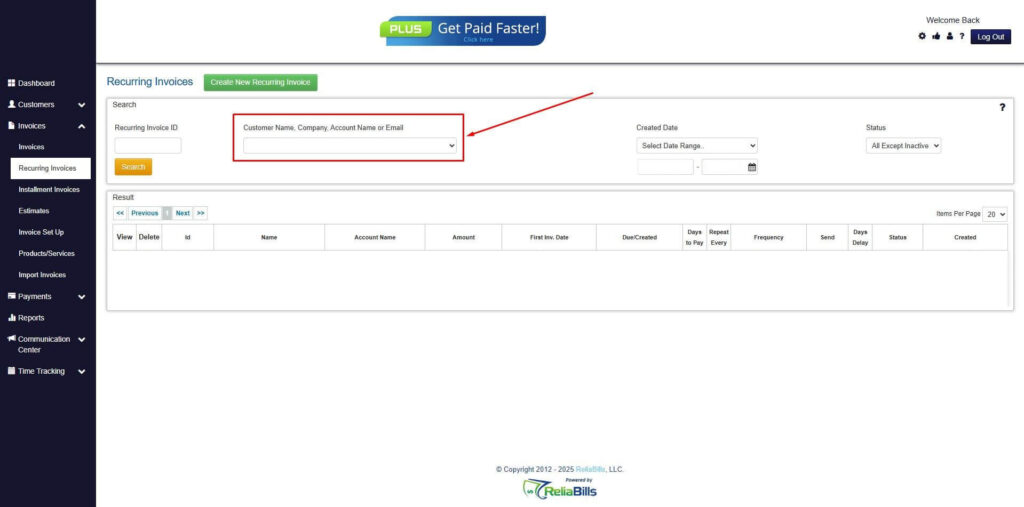

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

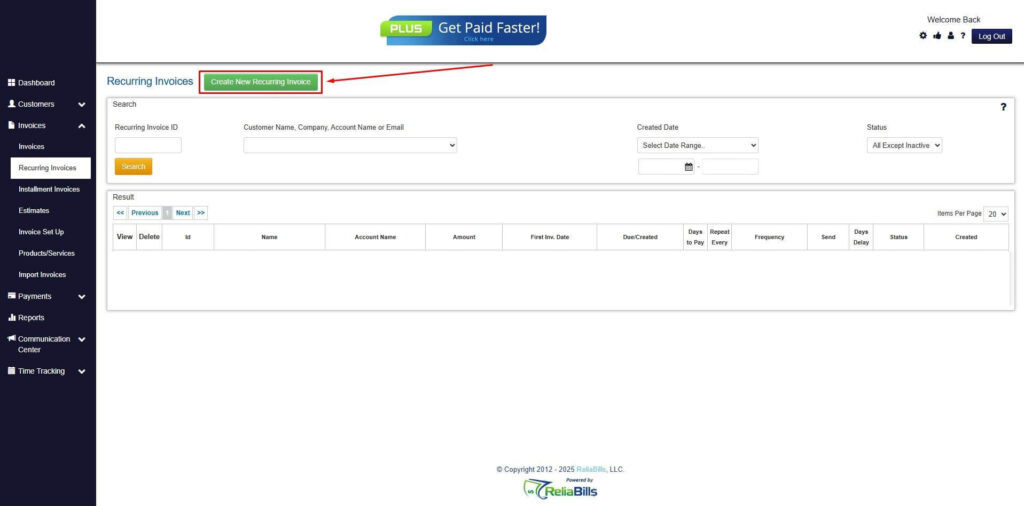

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

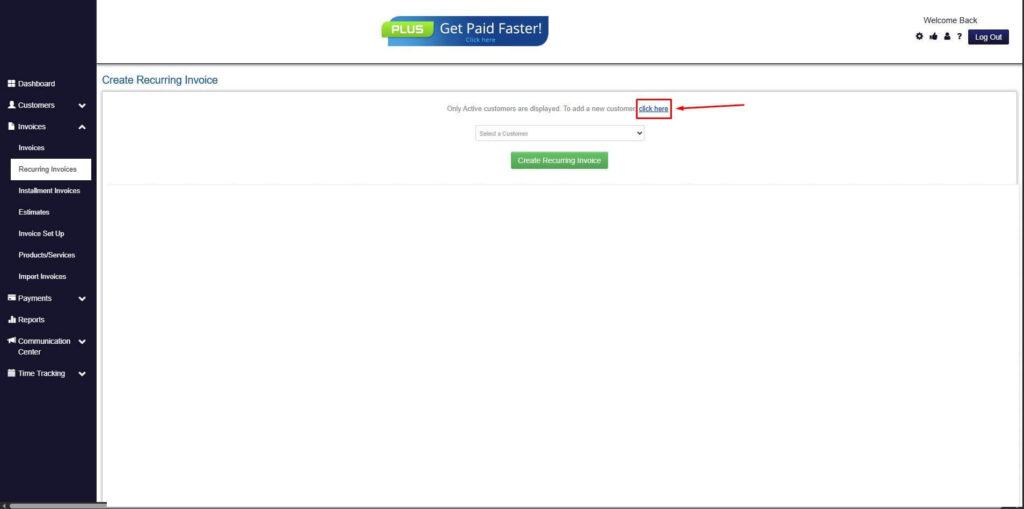

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

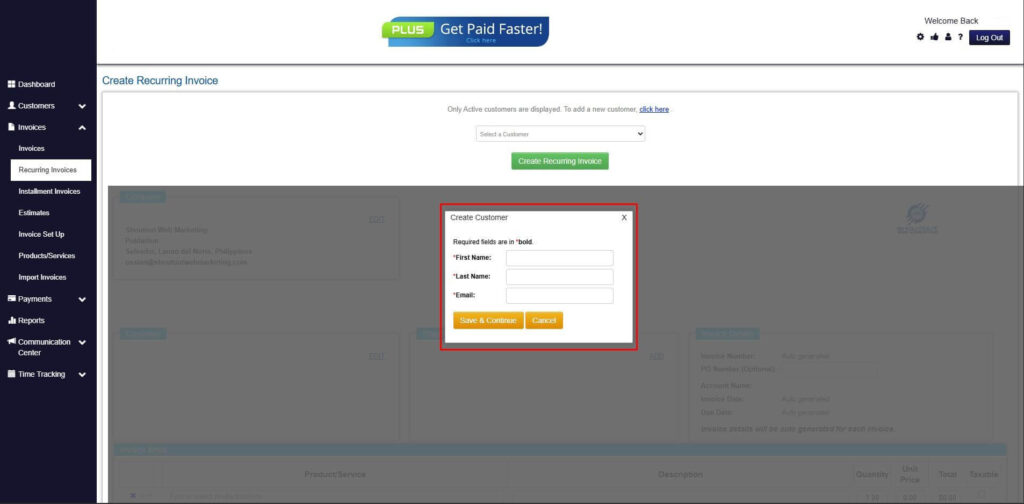

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

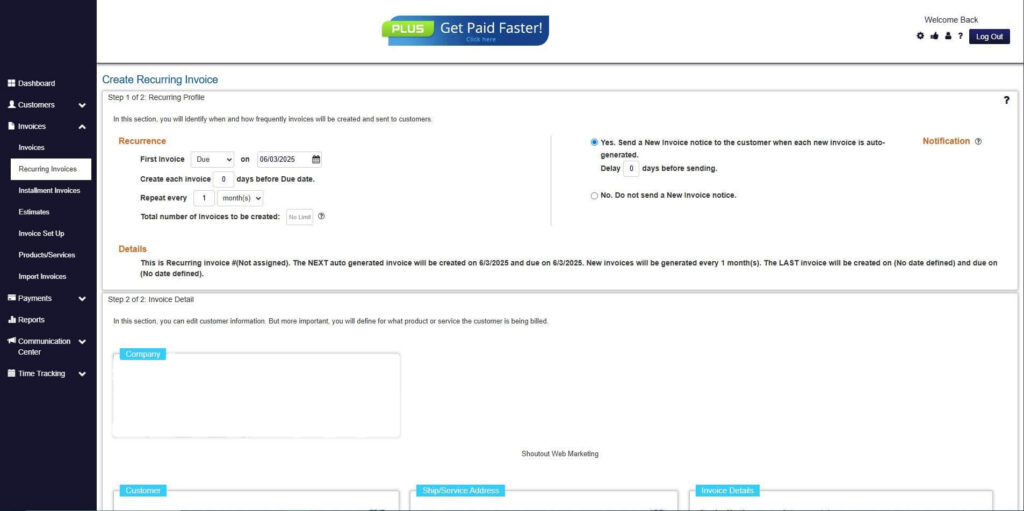

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How can franchises keep invoices consistent across locations?

Standardized templates through auto repair billing software ensure uniform invoices.

2. What works best for fleet and repeat customers?

Recurring billing removes manual work and improves payment reliability.

3. Can invoicing be managed centrally?

Yes, centralized platforms give better control and oversight.

4. Does automation really improve cash flow?

Yes, fewer errors and faster invoicing lead to quicker payments.

Conclusion

Strong invoice and payment management is essential for auto repair franchises. Clear billing builds trust and reduces delays. When invoices are easy to understand, customers are more willing to pay on time.

Auto repair billing software helps franchises stay organized as they grow. Automation and recurring billing simplify daily operations. Reporting tools provide clarity across all locations.

With the right systems in place, franchises can focus on service rather than paperwork. Solutions like ReliaBills support long-term efficiency and financial stability. Over time, this creates a smoother experience for both staff and customers.