Membership-based fitness models now dominate the industry, replacing the old pay-per-visit structure in most gyms and studios. From large commercial gyms to boutique yoga and CrossFit facilities, recurring memberships provide predictable income and support long-term financial planning. However, this model only works effectively when payments are collected consistently and on time. Even small billing disruptions can create significant financial instability over time.

Missed or late payments may seem minor at first, but their cumulative impact can be substantial. When multiple members fail to pay on schedule, revenue fluctuations affect payroll, rent, equipment maintenance, and marketing budgets. Gym owners often find themselves diverting time and resources toward chasing payments instead of improving member experience. This reactive cycle can limit business growth.

This is why auto-billing for fitness centers has become a critical operational strategy rather than a convenience feature. Automated recurring billing systems ensure members are charged on a consistent schedule, minimizing payment gaps and reducing administrative workload. By removing manual billing tasks, fitness centers gain financial stability and operational efficiency that supports sustainable growth.

Table of Contents

ToggleUnderstanding the Fitness Center Revenue Model

Most fitness centers rely heavily on monthly membership fees as their primary source of income. These recurring payments grant members access to facilities, group classes, and equipment. Because overhead costs such as rent and utilities remain fixed each month, predictable membership revenue is essential for covering operating expenses.

In addition to base memberships, gyms frequently generate income through personal training subscriptions, specialty classes, and bundled fitness programs. These offerings often operate on separate recurring billing cycles or prepaid packages. Managing these varied payment structures manually increases complexity and the likelihood of oversight.

Additional revenue streams such as locker rentals, merchandise sales, smoothie bars, and premium coaching programs further diversify income. Tracking recurring versus one-time payments without automation can quickly become disorganized. Auto-billing for fitness centers centralizes these revenue streams into a unified, manageable billing system.

Why Missed Payments Happen in Fitness Businesses

Expired or declined credit cards are one of the most common causes of missed payments. Members may forget to update payment information after receiving a new card, resulting in automatic transaction failures. Without an automated alert system, staff may not notice these failures immediately.

Manual invoice follow-ups also create inconsistencies. Staff members may delay sending reminders during busy periods or overlook certain accounts entirely. Inconsistent follow-up practices lead to irregular billing cycles and unpredictable income.

Member forgetfulness is another frequent factor. Many members simply overlook due dates or ignore reminder emails. Auto-billing for fitness centers reduces reliance on manual reminders and ensures payments are attempted automatically according to membership agreements.

The True Cost of Late or Failed Payments

Late or failed payments disrupt financial planning and reduce revenue predictability. Even a small percentage of missed payments can affect monthly income projections. This unpredictability complicates budgeting and operational decisions.

Administrative workload increases when staff must contact members about outstanding balances. Time spent resolving payment issues reduces time available for member engagement and business development. Over time, this hidden labor cost can be significant.

There is also a long-term retention impact. Members who experience billing confusion or repeated payment disputes may cancel their memberships. Auto-billing for fitness centers helps reduce these friction points, preserving lifetime customer value.

What Is Auto-Billing?

Auto-billing is an automated recurring billing process that charges members according to predefined membership terms. Once a member enrolls and provides payment authorization, the system processes transactions automatically. This removes the need for manual invoice generation.

Payments are processed on scheduled dates based on monthly, quarterly, or annual cycles. Invoices and digital receipts are generated instantly and delivered to members electronically. This ensures transparency and professional communication.

Auto-billing for fitness centers aligns financial operations with membership agreements. It streamlines revenue collection while improving accuracy and reliability across billing cycles.

How Auto-Billing Works in Fitness Centers

The process begins when a member signs up for a recurring plan and securely stores their payment information. Modern systems use encrypted payment gateways to protect sensitive data. Compliance and security are essential components of automated billing.

Each billing cycle, the system automatically executes scheduled charges without staff involvement. Successful payments trigger instant confirmation emails and digital receipts. This immediate feedback reassures members and reduces confusion.

If a payment fails, automated workflows initiate retries and notifications. Auto-billing for fitness centers ensures consistent follow-up without creating additional manual tasks for staff.

How to Reduce Human Error with Automation

Automate Invoice Generation

Replace manual invoice creation with automated recurring billing schedules. This eliminates data entry mistakes, incorrect pricing, and missed billing dates. Automated systems ensure invoices are generated consistently based on predefined membership terms.

Standardize Billing Cycles

Set fixed billing dates for monthly, quarterly, or annual memberships. Standardization prevents inconsistent charge timing and reduces member confusion. It also simplifies revenue tracking and forecasting.

Use Built-In Validation Rules

Implement automated checks that verify pricing tiers, discounts, taxes, and add-ons before invoices are issued. Validation rules prevent duplicate charges and improper billing classifications. This reduces disputes and administrative corrections.

Centralize Member Data

Store membership details, payment methods, and plan changes in one secure system. Centralized records reduce miscommunication between front desk staff and accounting teams. Real-time updates ensure billing reflects the latest membership status.

Enable Automated Tax and Fee Calculations

Automatically calculate applicable taxes, service fees, and prorated adjustments. This removes the risk of miscalculations and ensures compliance with local regulations. Accuracy builds member trust and minimizes refund requests.

Track Changes with Audit Logs

Maintain automated audit trails for plan upgrades, downgrades, and cancellations. This provides transparency and reduces internal errors. It also simplifies dispute resolution if billing questions arise.

Improving Cash Flow Consistency

Predictable recurring revenue supports stable financial management. When payments are processed automatically on schedule, monthly income becomes more consistent. This reliability allows gym owners to plan expenses with greater confidence.

Reduced accounts receivable aging improves liquidity. Fewer overdue balances mean less time spent on collections and follow-ups. Faster payment cycles strengthen working capital.

Auto-billing for fitness centers enhances revenue forecasting accuracy. Management gains clear insight into expected income, enabling smarter investment and expansion decisions.

How to Handle Failed Payments Automatically

Set Up Smart Retry Logic

Configure automatic payment retries at strategic intervals after a failed transaction. Many failed payments occur due to temporary issues such as insufficient funds. Automated retries recover revenue without manual follow-up.

Send Automated Payment Reminders

Trigger email or SMS notifications when payments fail or cards are about to expire. Timely reminders increase the likelihood of prompt resolution. Clear communication reduces friction and improves member retention.

Activate Expired Card Alerts

Notify members before their stored payment method expires. Proactive alerts prevent unnecessary service interruptions. This maintains revenue continuity and reduces administrative workload.

Implement Grace Period Workflows

Define automatic grace periods before suspending access. This provides members time to update payment details while protecting your revenue policies. Structured workflows ensure consistency in enforcement.

Automate Account Suspension and Reactivation

If payment remains unresolved, the system can temporarily suspend membership benefits. Once payment is completed, reactivation occurs automatically. This removes manual oversight and keeps processes fair and transparent.

Monitor Failed Payment Trends

Use reporting dashboards to track recurring payment failures. Identifying patterns helps management adjust policies, improve communication, or update payment options. Data-driven decisions reduce future revenue loss.

Enhancing Member Experience

Transparent billing schedules eliminate confusion about payment dates. Members know when charges will occur and what amounts to expect. Clear expectations improve satisfaction.

Online access to invoices and payment history empowers members to manage their accounts independently. This reduces inbound billing inquiries. Convenience enhances professionalism.

By minimizing awkward payment discussions, staff can focus on delivering quality service. Auto-billing for fitness centers improves both operational efficiency and member relationships.

Supporting Flexible Membership Options

Modern gyms offer diverse membership plans to attract different demographics. Monthly, quarterly, and annual billing cycles must be managed accurately. Automation simplifies this process.

Family and corporate membership structures require tiered pricing and shared billing arrangements. Automated systems apply correct rates without manual calculation. This ensures fairness and accuracy.

Proration for mid-cycle signups or plan upgrades is handled seamlessly within automated systems. Auto-billing for fitness centers ensures members are billed fairly when changes occur.

Reporting and Revenue Insights

Recurring revenue tracking provides clear visibility into financial performance. Gym owners can monitor trends, seasonality, and membership growth. Data-driven insights support strategic planning.

Churn monitoring and failed payment tracking help identify potential retention risks. Early intervention can reduce cancellations. Analytics empower proactive management.

Performance dashboards consolidate revenue data into actionable reports. Auto-billing for fitness centers transforms billing systems into financial intelligence tools.

How ReliaBills Helps Fitness Centers Automate Billing

Fitness centers need more than basic invoicing tools. They need a billing system that supports recurring memberships, flexible plans, and consistent cash flow. ReliaBills is designed to simplify auto-billing for fitness centers by automating invoices, scheduling recurring payments, and reducing manual administrative work. This allows gym owners and managers to focus more on member experience and less on chasing payments.

With automated recurring billing, fitness centers can set up monthly, quarterly, or annual membership plans that charge members on a consistent schedule. ReliaBills automatically generates and delivers digital invoices, processes payments securely, and sends reminders when needed. Built-in recurring billing features help reduce missed payments, improve on-time collections, and create predictable revenue streams that stabilize gym operations.

For growing fitness businesses that need more advanced functionality, ReliaBills PLUS offers enhanced automation tools, reporting insights, and branded communication options. This helps gyms maintain a professional image while tracking recurring revenue, failed payments, and member payment history in real time. By combining invoicing, recurring billing, and automation in one platform, ReliaBills helps fitness centers save time, increase revenue consistency, and strengthen long-term member relationships.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

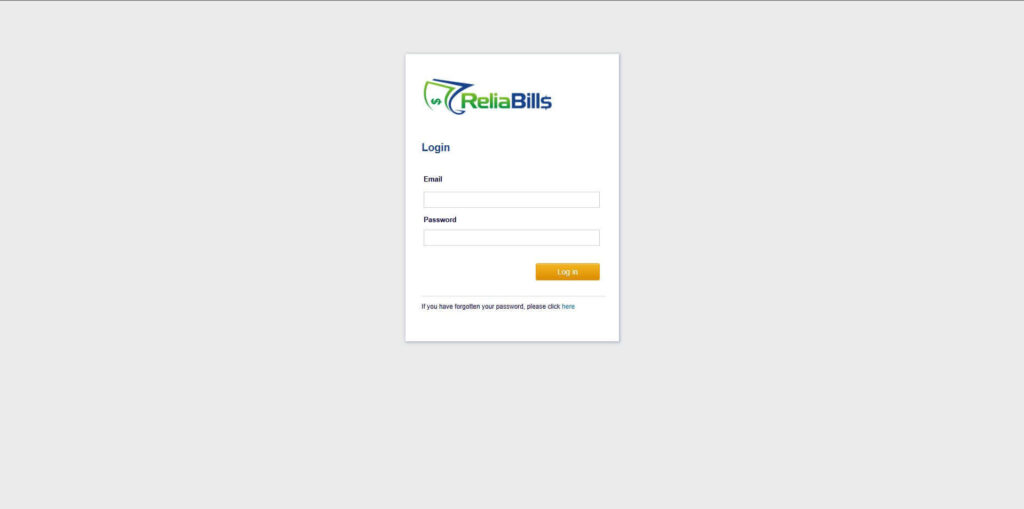

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

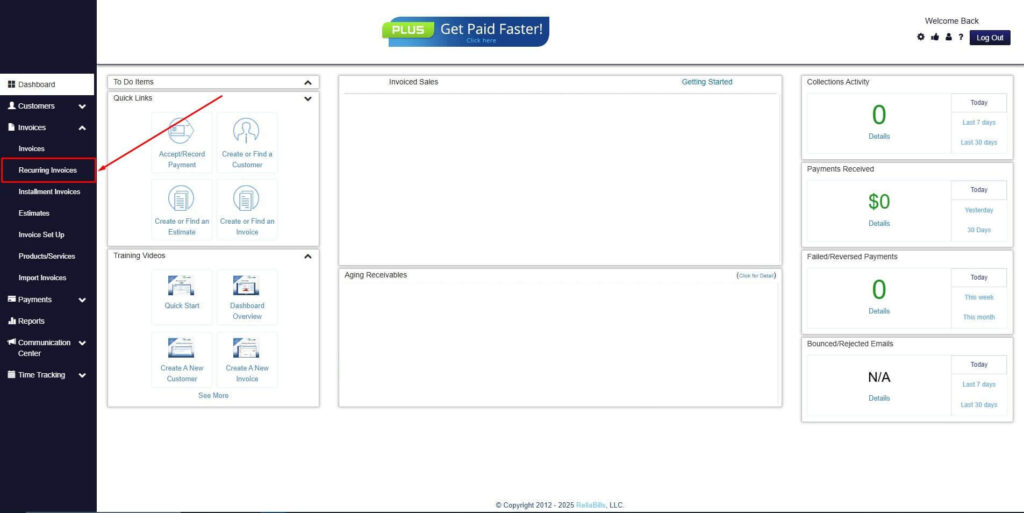

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

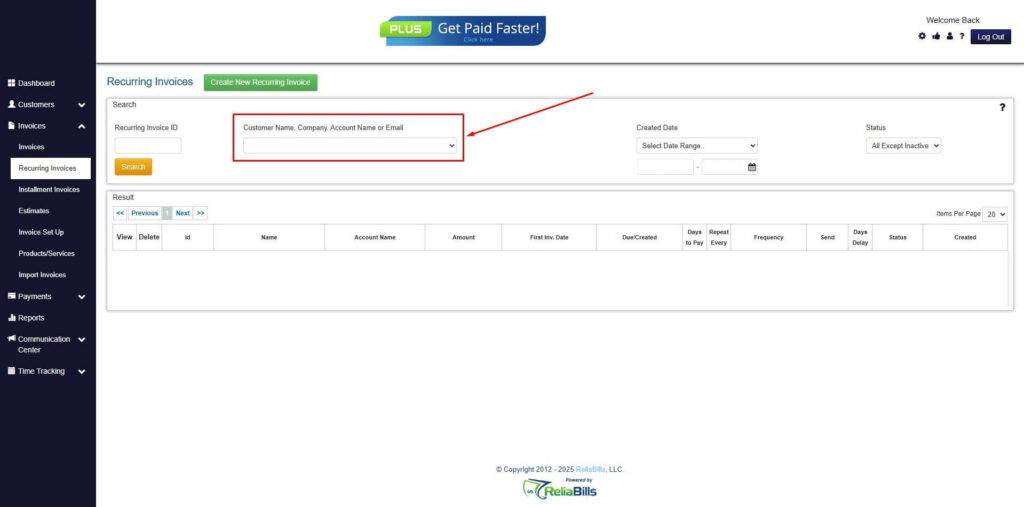

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

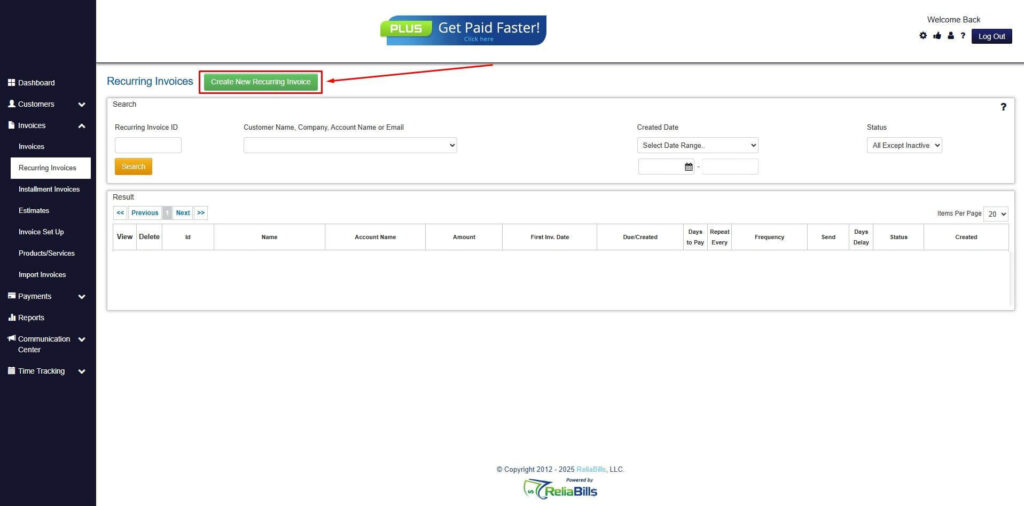

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

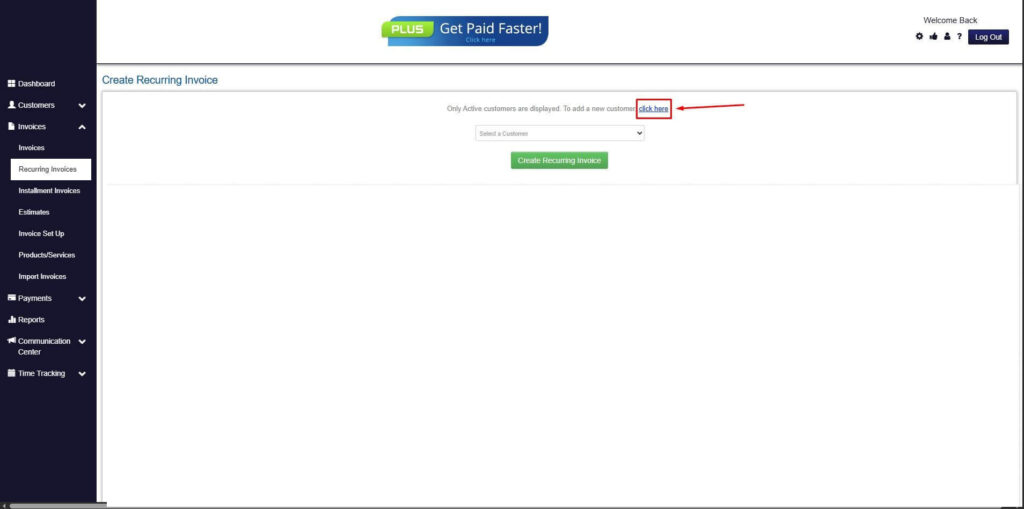

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

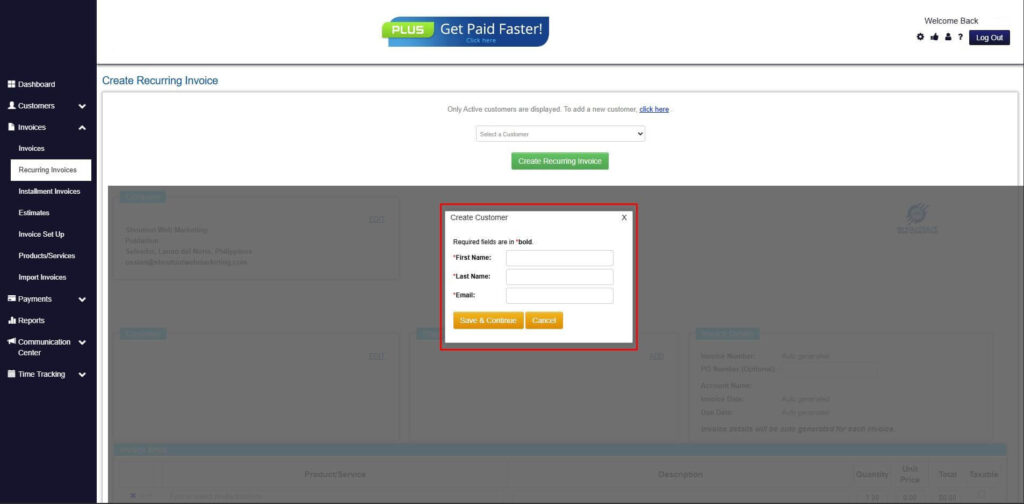

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

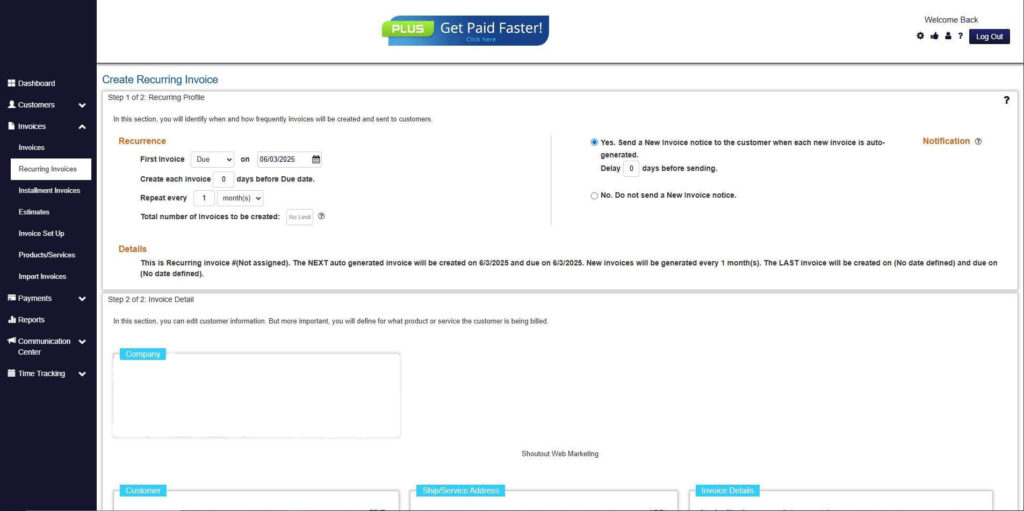

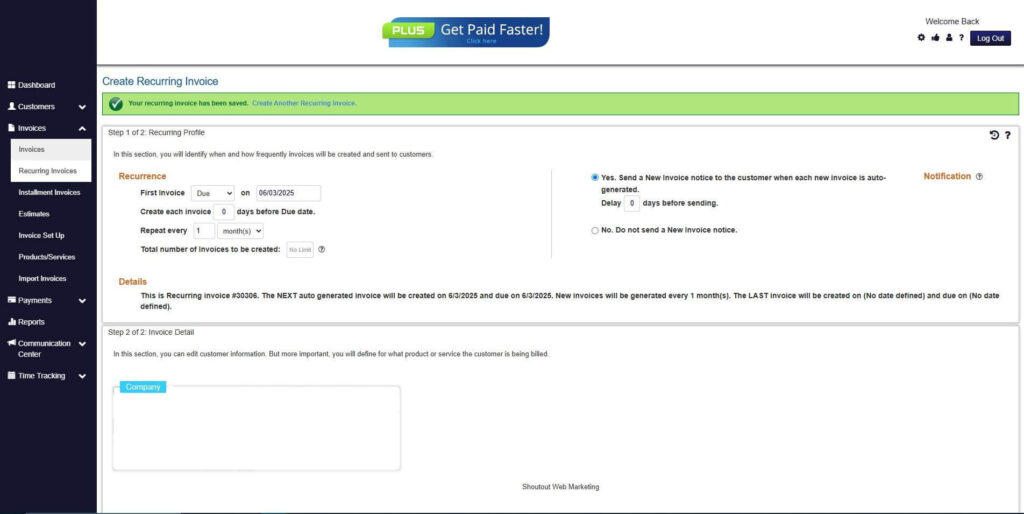

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

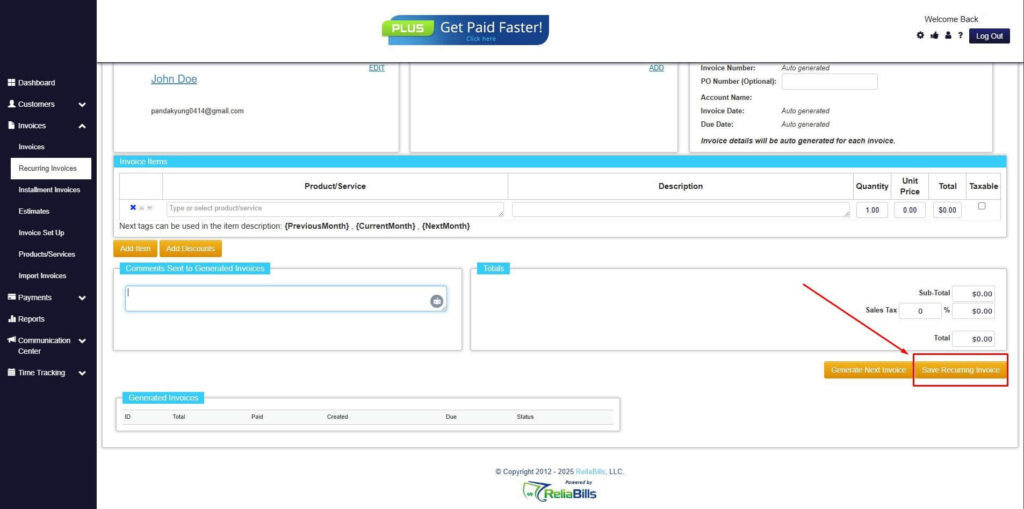

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How does automation reduce billing mistakes in fitness businesses?

Automation removes manual data entry and enforces predefined billing rules. This reduces duplicate invoices, incorrect charges, and missed billing cycles. Standardized processes create consistent, error-free billing.

2. What happens if a member’s payment fails?

An automated system can retry the payment, notify the member, and trigger a grace period if needed. If unresolved, temporary suspension workflows can be applied automatically. This protects revenue while maintaining professionalism.

3. Is automated billing secure for storing payment details?

Yes, reputable billing platforms use encrypted payment gateways and secure data storage. Compliance with industry security standards protects both the business and its members.

4. Can automation handle plan upgrades or downgrades?

Modern systems automatically prorate charges and adjust billing schedules when membership changes occur. This ensures accurate charges without manual recalculations.

5. Will automation reduce administrative workload?

Absolutely. Staff spend less time chasing payments, correcting errors, or reconciling accounts. This allows teams to focus on member engagement and business growth.

Conclusion

Missed payments create unnecessary financial strain for fitness centers. Manual billing processes increase risk, administrative workload, and revenue inconsistency. Automation addresses these issues directly.

Implementing auto-billing for fitness centers stabilizes cash flow, reduces staff workload, and enhances the member experience. Consistent recurring billing supports sustainable growth and operational efficiency.

For fitness businesses aiming to scale, recurring billing software is a strategic investment. Automation transforms payment collection into a streamlined, reliable system that strengthens long-term profitability.