Long-term customer retention is one of the biggest growth drivers for SaaS businesses. Unlike one-time product sales, SaaS revenue depends on customers staying subscribed month after month or year after year. Even small issues in billing can create friction that leads to cancellations over time.

Billing experience plays a larger role in customer loyalty than many SaaS companies expect. Confusing invoices, inconsistent charges, or missed billing cycles can damage trust, even if the product itself delivers strong value. Customers want clarity, predictability, and professionalism when it comes to how they are billed.

Recurring invoices help solve these challenges by creating a consistent and automated billing process. When invoices are predictable and easy to understand, customers feel more comfortable maintaining long-term subscriptions. This article explains how recurring invoices support SaaS customers while strengthening revenue stability for businesses.

Table of Contents

ToggleWhat Are Recurring Invoices in SaaS?

Recurring invoices in SaaS are automatically generated invoices that bill customers on a regular schedule based on their subscription plan. These invoices reflect ongoing access to software services rather than a single purchase. Most SaaS companies use monthly, quarterly, or annual billing cycles.

Unlike one-time invoices, recurring invoices do not require manual creation each billing period. Once set up, the system automatically issues invoices with consistent formatting, pricing, and delivery schedules. This reduces administrative effort while ensuring customers are billed accurately and on time.

Recurring invoices also allow flexibility as subscriptions evolve. Pricing adjustments, plan changes, or usage-based charges can be incorporated without disrupting the billing process. This makes recurring invoicing essential for SaaS models that need both consistency and adaptability.

The Importance of Predictable Billing for SaaS Customers

Predictable billing helps SaaS customers feel in control of their expenses. When invoices arrive on the same date with familiar line items, customers can plan budgets more effectively. This reduces anxiety around unexpected charges or billing surprises.

Consistency in billing also strengthens trust between SaaS providers and customers. Over time, customers associate predictable recurring invoices with reliability and professionalism. This trust is especially important for long-term subscriptions where billing occurs repeatedly over months or years.

From a customer experience perspective, predictable billing minimizes confusion and support requests. When customers understand what they are being charged and why, they are less likely to question invoices or delay payments. This benefits both the customer and the SaaS business.

Common Billing Challenges in SaaS

1. Failed Payments and Involuntary Churn

One of the most frequent billing challenges in SaaS is failed payments caused by expired cards, insufficient funds, or bank restrictions. When payments fail without immediate resolution, subscriptions may pause or cancel automatically, leading to involuntary churn. This type of churn is especially damaging because it often happens even when customers still want the service.

Without automated billing and retry workflows, failed payments can go unnoticed for days or weeks. Manual follow-ups delay resolution and increase the risk of customer frustration. Over time, unresolved payment failures directly impact recurring revenue and retention metrics.

Recurring invoicing systems help reduce this challenge by automating payment retries and reminders. When customers are notified early and given clear instructions, payment recovery rates improve significantly.

2. Confusing Invoices and Unclear Pricing

Many SaaS customers struggle to understand invoices that lack clear descriptions or consistent formatting. Charges for add-ons, usage, or prorated upgrades may appear without sufficient explanation. This confusion often leads to disputes or delayed payments.

Unclear pricing can also damage trust, especially for long-term customers who expect predictable billing. If invoice layouts change frequently or include vague line items, customers may question the accuracy of charges. This increases support tickets and slows down collections.

Standardized recurring invoices solve this issue by presenting charges clearly and consistently. When customers know what to expect on each invoice, billing friction is significantly reduced.

3. Manual Billing Processes That Do Not Scale

Manual billing workflows become increasingly difficult as SaaS businesses grow. Creating invoices by hand increases the likelihood of missed billing cycles, duplicate charges, or incorrect amounts. These errors compound as customer volume increases.

Finance teams often spend excessive time correcting mistakes instead of analyzing revenue performance. This slows down operations and limits the company’s ability to scale efficiently. Manual billing also makes it harder to support multiple pricing tiers or subscription plans.

Recurring invoicing automates repetitive tasks and ensures billing accuracy at scale. As customer bases grow, automation keeps billing consistent without increasing administrative workload.

4. Difficulty Managing Plan Changes and Usage Adjustments

SaaS subscriptions frequently change due to upgrades, downgrades, or usage-based pricing. Manually adjusting invoices for these changes is complex and error-prone. Incorrect proration can lead to overbilling or underbilling.

When adjustments are not clearly reflected on invoices, customers may feel confused or overcharged. This often results in disputes and delayed payments. Poor handling of plan changes can undermine customer confidence in the billing system.

Automated recurring invoices handle plan changes more accurately by applying predefined rules. This ensures invoices remain transparent and aligned with the current subscription status.

How Recurring Invoices Improve Billing Consistency

Recurring invoices improve consistency by automating invoice generation on predefined schedules. Each invoice follows the same structure, ensuring customers receive familiar and easy-to-read documents every billing cycle. This eliminates missed or duplicated invoices.

Standardized invoice formats reduce confusion and improve clarity. Line items, pricing, and payment terms remain consistent, helping customers quickly understand charges. This consistency reduces disputes and accelerates payment timelines.

Automation also ensures billing continues smoothly even as customer volume grows. SaaS teams no longer need to manually track billing dates or invoice creation. Recurring invoices support reliable billing operations at scale.

Supporting Long-Term Subscriptions and Renewals

Recurring invoices align billing directly with subscription agreements. Customers receive invoices that reflect their contract terms, reducing confusion during renewal periods. This alignment supports smoother long-term relationships.

Automated renewals eliminate the risk of forgotten or delayed invoices. Customers are billed on schedule, ensuring uninterrupted access to services. This reduces friction and improves renewal rates over time.

By simplifying subscription renewals, recurring invoices help SaaS businesses maintain steady revenue. Customers experience fewer billing interruptions, which encourages continued engagement with the product.

Recurring Invoices and Cash Flow Stability

Recurring invoices provide predictable recurring revenue, which is critical for SaaS financial planning. Consistent billing cycles make it easier to forecast monthly recurring revenue and plan future investments.

With predictable cash flow, SaaS businesses can make informed decisions about hiring, product development, and marketing. Revenue stability reduces uncertainty and supports sustainable growth.

Automation also lowers administrative costs associated with billing. Fewer errors and manual processes mean finance teams can focus on analysis rather than invoice management.

Handling Plan Changes and Usage-Based Adjustments

SaaS subscriptions often change as customers upgrade, downgrade, or adjust usage. Recurring invoicing systems support prorated charges and automated adjustments without disrupting billing schedules.

Transparent invoice adjustments help customers understand how changes affect pricing. Clear documentation prevents confusion and reduces disputes related to plan modifications.

Keeping customer records accurate over time ensures billing reflects the current subscription state. This accuracy is essential for maintaining trust and long-term customer relationships.

Improving Customer Experience Through Transparency

Transparent recurring invoices improve customer confidence in billing. Detailed breakdowns of subscription fees help customers see exactly what they are paying for. This clarity reduces billing-related questions.

Easy access to invoice history allows customers to review past charges independently. Self-service access improves satisfaction and reduces reliance on support teams.

When billing is transparent, customers focus more on product value. This leads to fewer billing complaints and stronger long-term engagement.

Reducing Churn with Automated Billing Workflows

Automated recurring invoices reduce churn by ensuring timely billing and payment reminders. Customers are notified before due dates, minimizing missed payments and service interruptions.

Automation also helps manage failed payments more effectively. Follow-up reminders and retry workflows prevent small issues from escalating into cancellations.

By maintaining uninterrupted service, recurring invoices support customer satisfaction. Smooth billing workflows protect revenue and retention over the long term.

Integrating Recurring Invoices with Payment Systems

Recurring invoices are most effective when integrated with flexible payment options. Supporting cards, ACH, and digital payments improves convenience for global SaaS customers.

Secure and compliant payment processing builds customer trust. Customers feel confident storing payment information when systems prioritize security.

Integrated payments also speed up collections. Faster payments improve cash flow while maintaining a positive customer experience.

How ReliaBills Supports SaaS Recurring Invoicing

ReliaBills helps SaaS businesses simplify recurring invoicing by automating the entire billing cycle from invoice creation to payment tracking. Instead of relying on manual processes or disconnected tools, teams can manage subscriptions, invoices, and customer records in one centralized platform. This reduces billing errors, missed invoices, and inconsistencies that often frustrate long-term SaaS customers.

Recurring billing is at the core of how ReliaBills supports SaaS growth. The platform allows businesses to set flexible billing schedules, align invoices with subscription terms, and automatically adjust charges for upgrades, downgrades, or prorated changes. By automating recurring invoices, SaaS companies can maintain predictable billing cycles while ensuring customers always receive clear and accurate invoices.

ReliaBills also improves visibility and control through centralized tracking and reporting. SaaS teams can monitor invoice status, payments, and outstanding balances in real time, making it easier to forecast revenue and reduce churn caused by billing issues. With automated reminders and branded communication, ReliaBills helps SaaS businesses strengthen trust, improve retention, and scale recurring invoicing without increasing administrative overhead.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

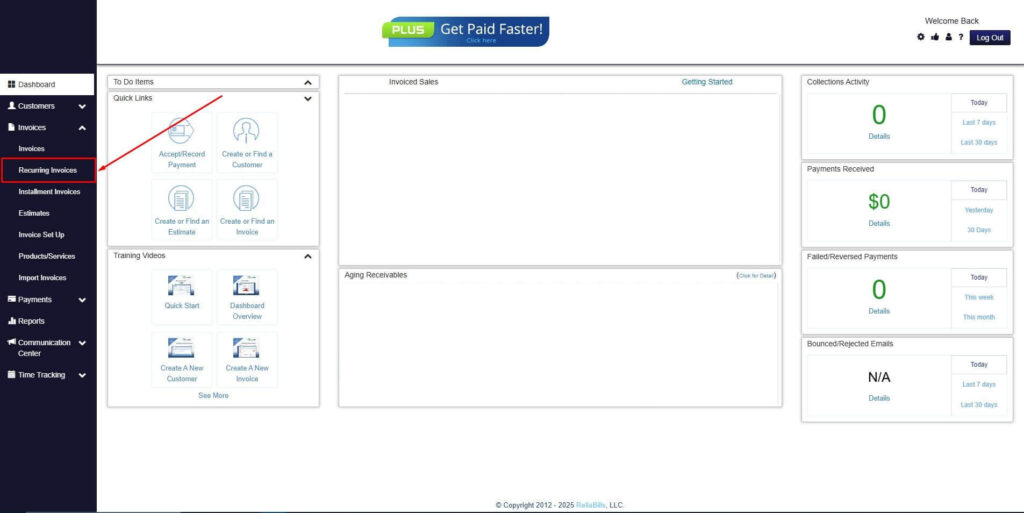

Step 2: Click on Recurring Invoices

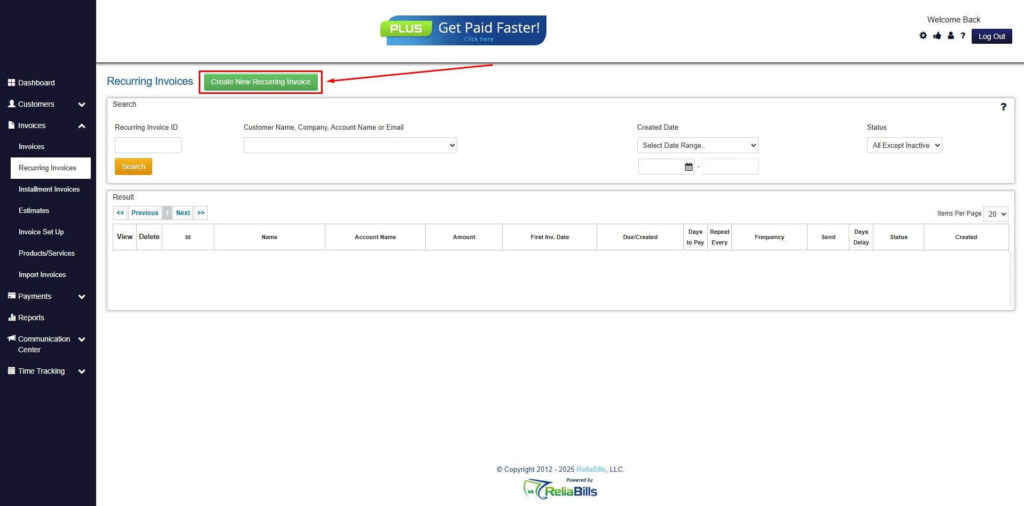

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

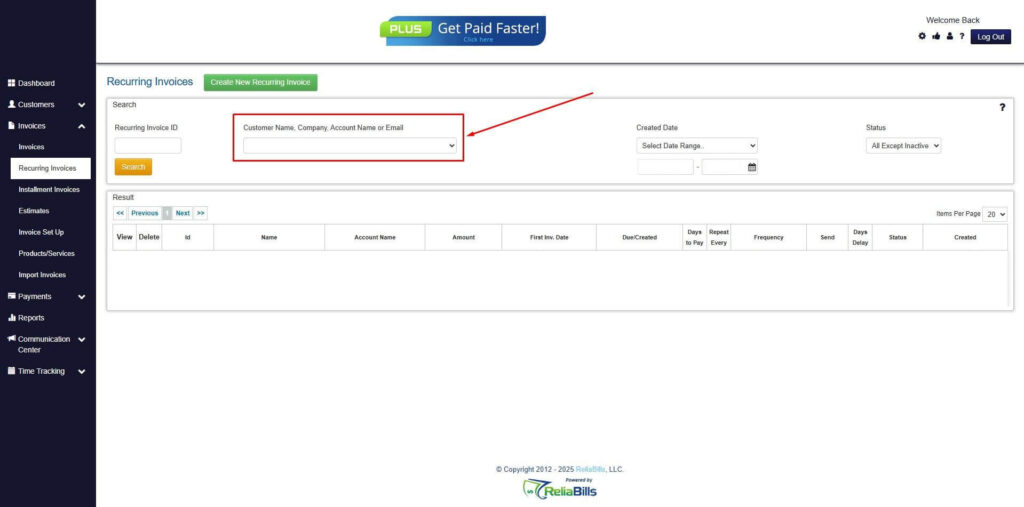

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

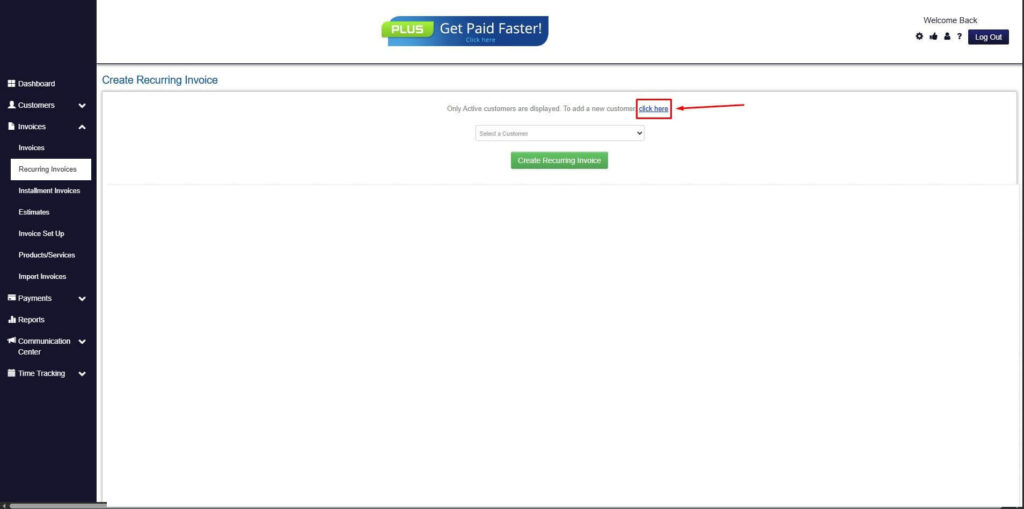

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

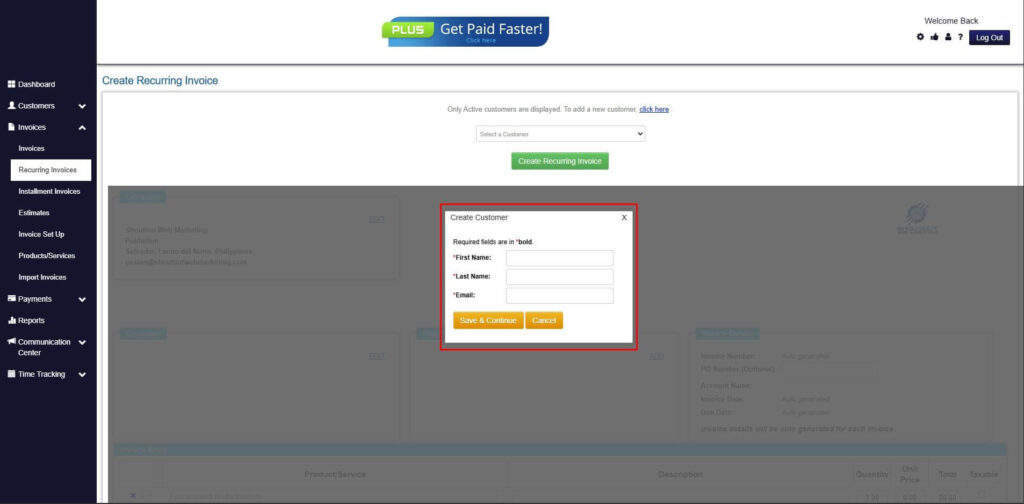

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

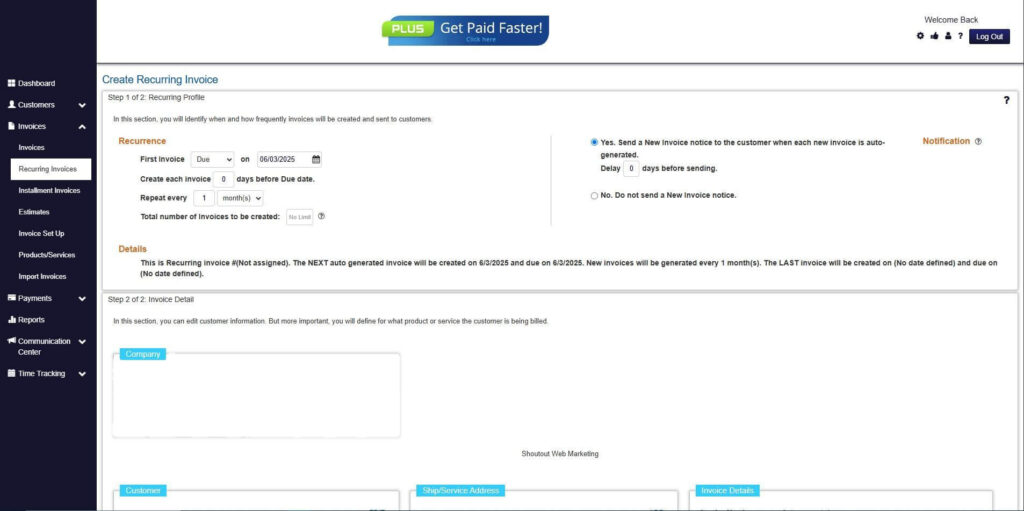

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

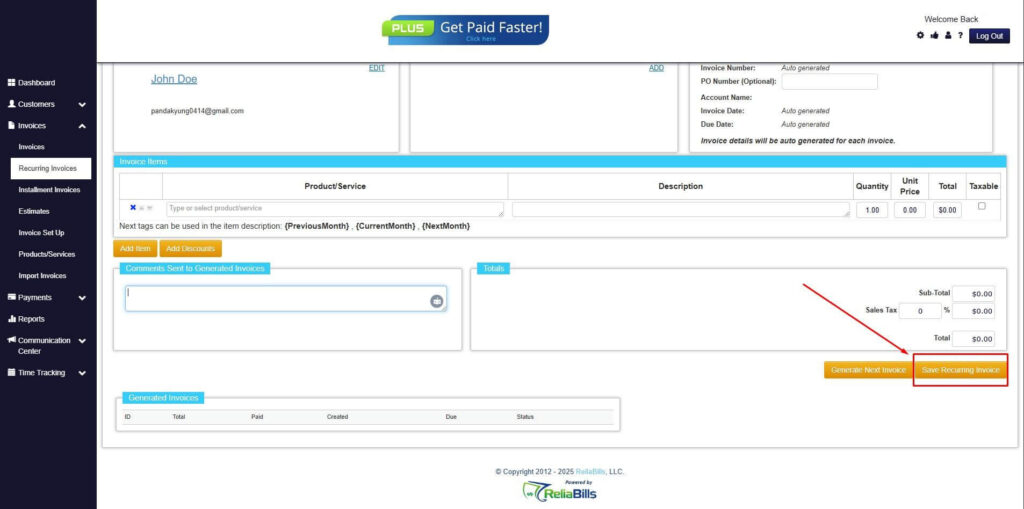

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

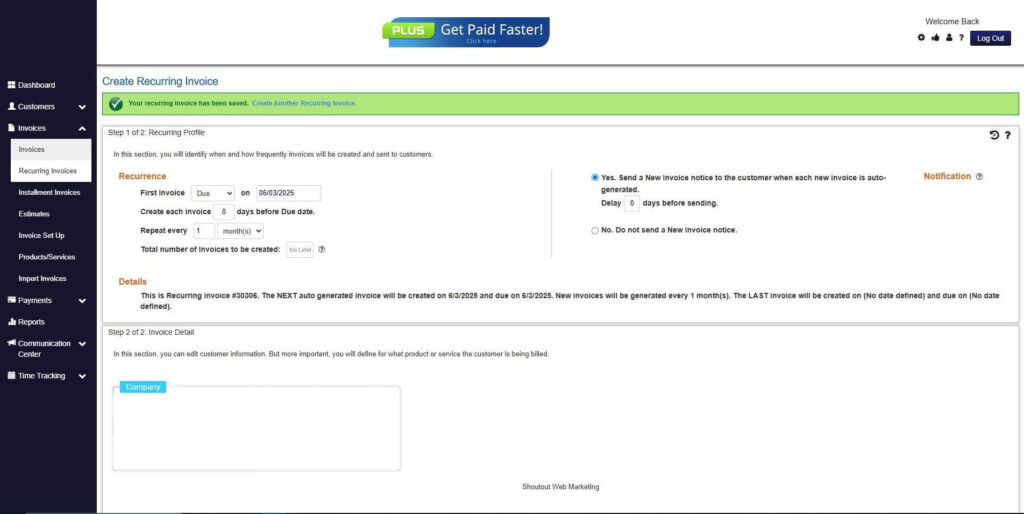

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Why do SaaS businesses experience more billing challenges than traditional businesses?

SaaS billing is ongoing and subscription-based, which means invoices are issued repeatedly over long periods. Unlike one-time sales, even small billing issues can accumulate and impact customer trust. This makes accuracy and consistency especially important.

2. Can recurring invoices reduce billing-related support tickets?

Yes, recurring invoices reduce support requests by providing consistent formats, predictable billing schedules, and clear charge breakdowns. When customers understand their invoices, they are less likely to raise questions or disputes.

3. How do recurring invoices help prevent SaaS churn?

Recurring invoices support timely billing, automated reminders, and faster payment recovery. This helps prevent involuntary churn caused by missed or failed payments. Customers remain subscribed without unnecessary interruptions.

4. Are recurring invoices suitable for SaaS companies with usage-based pricing?

Modern recurring invoicing systems support usage tracking and prorated adjustments. This allows SaaS businesses to bill accurately even when customer usage changes month to month.

5. How does recurring invoicing improve long-term customer relationships?

Consistent and transparent billing builds trust over time. When customers feel confident in how they are billed, they are more likely to stay subscribed and maintain long-term relationships with the SaaS provider.

Conclusion

Recurring invoices are essential for supporting long-term SaaS customers. They create consistency, transparency, and trust throughout the subscription lifecycle. For customers, this means fewer billing issues and better overall experience.

For SaaS businesses, recurring invoices support predictable revenue and scalable operations. Automation reduces errors while improving cash flow visibility.

By implementing strong recurring invoicing practices, SaaS companies can strengthen retention and build sustainable growth.