Cash flow management is one of the most critical challenges contractors face, especially on long or complex projects. Unlike product-based businesses, contractors often deliver work in stages, which makes waiting until project completion for payment impractical. This is where progress payments become essential for maintaining steady cash flow.

Progress payments allow contractors to receive compensation as work is completed, rather than all at once at the end of a project. These staged payments help cover labor, materials, and operating expenses throughout the project lifecycle. Without a structured billing approach, contractors risk delays, disputes, and cash shortages.

Invoices play a central role in organizing and validating progress payments. A well-structured invoice documents completed work, aligns billing with contract terms, and provides clarity for both contractors and clients. When used correctly, progress payment invoicing creates predictability, transparency, and financial control.

Table of Contents

ToggleWhat Are Progress Payments?

Progress payments are partial payments made to contractors based on work completed during a specific phase of a project. Instead of billing the full contract value upfront or at the end, contractors invoice incrementally as milestones or percentages of work are achieved. This approach aligns payments with actual project progress.

Unlike lump-sum billing, progress payments reduce financial strain on contractors by spreading payments throughout the project timeline. Clients also benefit because they only pay for verified work that has been completed. This shared accountability helps build trust between both parties.

Progress payments are commonly used in construction, engineering, renovation, and large-scale service contracts. Any industry involving phased work, long timelines, or high upfront costs can benefit from structured progress payment invoicing.

Why Invoices Are Essential for Progress Payments

Invoices serve as formal documentation that confirms work has been completed and approved. They provide a clear record of what has been delivered, how much is owed, and when payment is due. Without proper invoices, progress payments can become unclear or disputed.

Progress payment invoices also align financial transactions with contractual milestones. Each invoice references specific stages of work, ensuring that billing matches the agreed scope and schedule. This reduces misunderstandings and reinforces accountability on both sides.

Additionally, invoices protect both contractors and clients in case of disputes. They create an audit trail that supports payment claims, compliance requirements, and project financial reviews. Well-prepared invoices act as both financial and legal safeguards.

Common Progress Payment Structures

Milestone-Based Payments

This structure ties invoices to clearly defined project milestones such as completing a foundation, framing, or system installation. Contractors issue invoices only after a milestone is achieved and approved, which helps align payments with tangible progress. Milestone-based progress payment invoicing works best for projects with well-defined phases and reduces disputes by linking payment directly to completed work.

Percentage-of-Completion Billing

Percentage-based invoicing allows contractors to bill a portion of the total contract value based on how much work has been completed. This approach is commonly used for large or complex projects where tasks overlap and progress is continuous. Accurate tracking and documentation are critical, as clients rely on clear justification for each billed percentage.

Phase-Based Invoicing

In phase-based billing, the project is divided into major stages such as design, construction, and finishing. Each phase has its own invoice schedule and payment terms, making it easier to manage budgeting and approvals. This structure supports transparency and helps contractors maintain steady cash flow throughout the project lifecycle.

Time-and-Materials Progress Billing

This structure bills clients based on actual labor hours and materials used during a specific period. Contractors typically issue progress invoices weekly or monthly, supported by detailed logs. While flexible, this method requires precise documentation to avoid disputes and ensure timely payments.

How Contractors Structure Progress Payment Invoices

Progress payment invoices typically break down costs by labor, materials, and services. This level of detail helps clients understand exactly what they are paying for and reduces payment delays caused by confusion. Clear itemization also supports faster approvals.

Many invoices also include retainage, which is a portion of payment withheld until the project is completed. Retainage protects clients while ensuring contractors meet final project requirements. Properly documenting retainage on invoices prevents disputes later.

Clear descriptions tied to the project scope are essential. Each invoice should reference contract terms, milestones, or completion percentages so clients can easily verify progress. This clarity strengthens trust and speeds up payment processing.

Timing Invoices to Match Project Progress

Issuing invoices at the right time is critical for effective progress payment invoicing. Contractors should invoice immediately after a milestone is completed or approved to avoid cash flow gaps. Delayed invoicing often leads to delayed payments.

Billing too early can create friction with clients, especially if work has not been fully verified. On the other hand, billing too late can strain contractor finances and disrupt project momentum. Timing should always align with contractual agreements.

In many projects, invoices are coordinated with inspections or client approvals. Aligning invoicing with these checkpoints ensures smoother payment cycles and reduces the risk of rejected invoices.

Managing Change Orders with Progress Invoices

Change orders are common in contracting and must be reflected accurately in progress invoices. When scope changes occur, invoices should be updated to include additional labor, materials, or services. Failing to do so can lead to underbilling or disputes.

Proper documentation is essential when invoicing for change orders. Each adjustment should be clearly explained and tied to written approvals. This transparency protects contractors from payment delays.

By incorporating change orders into progress payment invoicing, contractors maintain accurate project financials. This approach ensures that both original and modified work are billed correctly over time.

Reducing Disputes Through Detailed Invoicing

Detailed invoicing improves transparency and reduces billing disputes. Progress reports, clear descriptions, and consistent formatting help clients quickly understand invoice contents. When expectations are clear, disputes are less likely to occur.

Supporting invoices with documentation such as photos, reports, or inspection records further strengthens credibility. These materials provide proof of completion and make approvals faster.

Clear payment terms and due dates also play a critical role. When clients know exactly when and how to pay, progress payment invoicing becomes smoother and more reliable.

Tracking Payments and Outstanding Balances

Tracking paid and unpaid progress invoices is essential for maintaining accurate project financials. Contractors need real-time visibility into outstanding balances to manage cash flow effectively. Without tracking, missed payments can go unnoticed.

Retainage and final payments require special attention. Contractors must monitor how much is withheld and when it becomes due. Accurate tracking ensures that final payments are collected promptly.

Consistent payment tracking also supports better forecasting. Contractors can anticipate cash inflows and make informed decisions about staffing, materials, and future projects.

Using Digital and Automated Invoicing for Progress Payments

Digital invoicing speeds up invoice creation and delivery, eliminating delays caused by manual paperwork. Contractors can generate progress invoices quickly and send them electronically to clients. This accelerates approval and payment timelines.

Automation also improves accuracy by reducing manual data entry errors. Invoice templates and automated calculations ensure consistency across billing cycles. This reliability builds client confidence.

Real-time tracking and status updates give contractors immediate insight into invoice performance. With digital tools, progress payment invoicing becomes more efficient and scalable.

Progress Invoices in Recurring or Ongoing Contract Work

Some contractors manage long-term or recurring contracts such as maintenance or service agreements. In these cases, progress invoices may be combined with recurring billing models. This approach ensures consistent payments over time.

Recurring progress invoices work well for ongoing work that still requires phased billing. Contractors can invoice monthly while adjusting amounts based on completed work. This balance supports steady cash flow.

By combining progress billing with recurring invoices, contractors reduce administrative effort while maintaining flexibility. This hybrid approach supports predictable revenue for long-term projects.

Best Practices for Contractors Using Progress Invoices

Align Invoices Strictly with Contract Terms

Progress invoices should always reference the contract, including milestones, percentages, or phases. This alignment ensures that billing expectations are clear and legally defensible. Reviewing contract language before issuing invoices helps prevent rejections or payment delays.

Provide Detailed and Consistent Invoice Breakdown

Each progress invoice should clearly itemize labor, materials, services, retainage, and any approved change orders. Consistent formatting across invoices makes it easier for clients to review and approve payments. Detailed breakdowns also reduce questions and disputes.

Invoice Promptly After Work Is Completed

Timely invoicing is essential for maintaining cash flow. Contractors should issue progress invoices immediately after milestones are met or approvals are received. Delays in invoicing often result in delayed payments and unnecessary follow-ups.

Document and Include Change Orders Clearly

Any scope changes should be reflected in progress invoices with clear descriptions and approval references. This prevents underbilling and ensures that additional work is compensated. Transparent documentation also protects contractors during audits or disputes.

Use Digital or Automated Invoicing Tools

Automating progress payment invoicing reduces manual errors and speeds up delivery. Digital systems provide real-time tracking, automated reminders, and centralized records, helping contractors stay organized and get paid faster.

How ReliaBills Helps Contractors Manage Progress Invoices

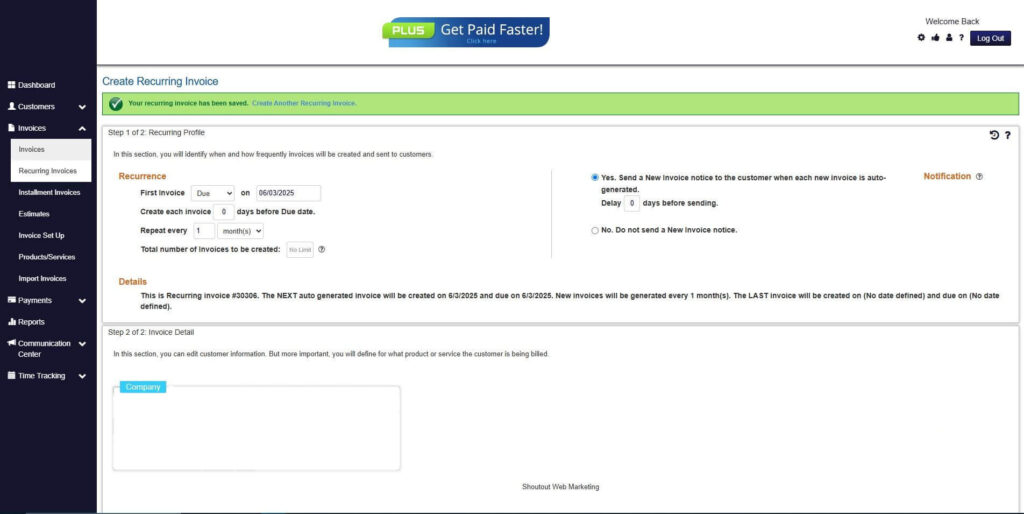

ReliaBills helps contractors simplify progress payment invoicing by automating how invoices are created, scheduled, and tracked throughout a project. Instead of manually preparing invoices for each milestone or phase, contractors can generate accurate, professional invoices that clearly reflect completed work. This reduces administrative effort while ensuring invoices are consistent, timely, and easy for clients to review and approve.

For contractors managing long-term projects or ongoing service agreements, ReliaBills supports recurring billing alongside progress invoices. This makes it easier to handle maintenance contracts, phased construction work, or repeat services without restarting the billing process each time. By combining progress payment invoicing with recurring billing schedules, contractors gain more predictable cash flow while maintaining flexibility for milestone-based or percentage-of-completion billing.

ReliaBills also provides centralized tracking and reporting that gives contractors full visibility into paid, unpaid, and outstanding progress invoices. Automated reminders help reduce late payments, while real-time reporting supports better financial planning and project oversight. With all billing activity organized in one place, contractors can focus more on project delivery and less on chasing payments or reconciling invoices.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

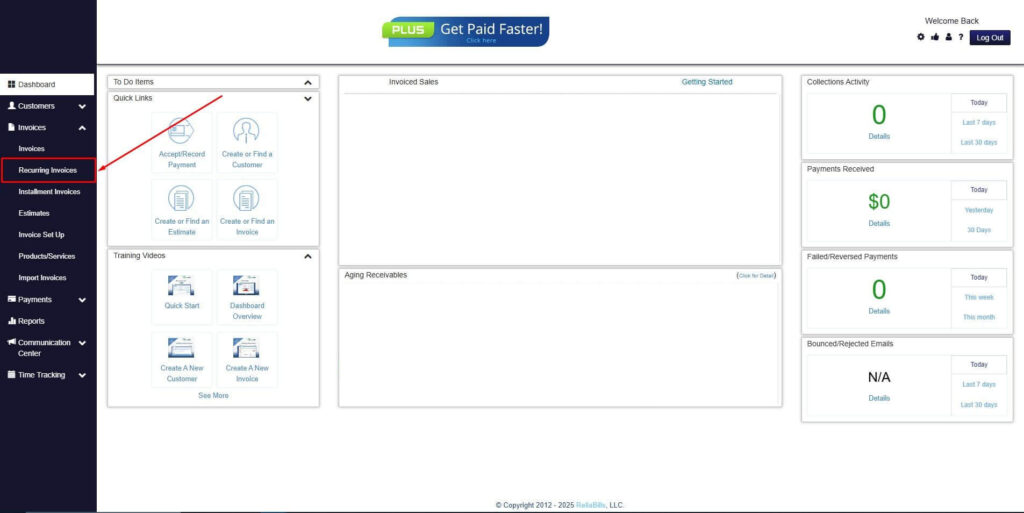

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

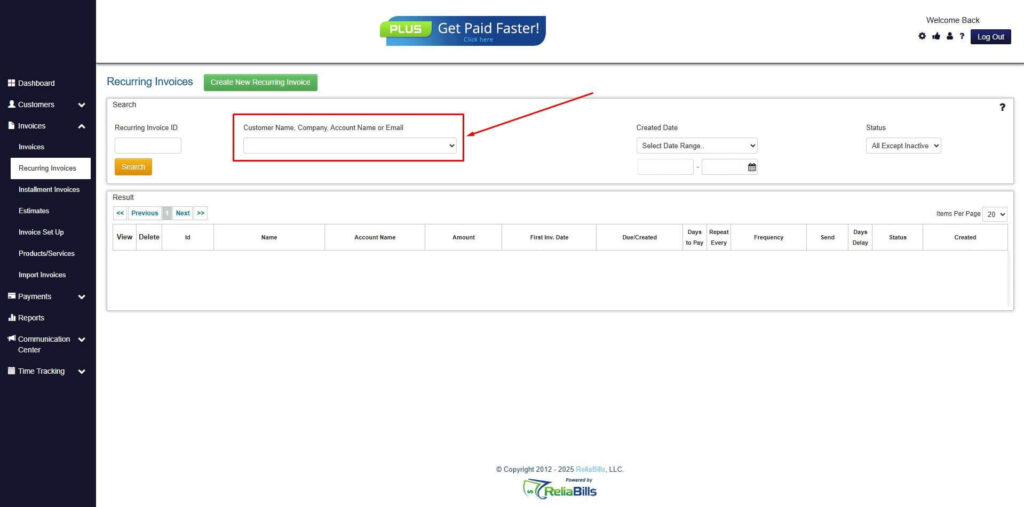

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

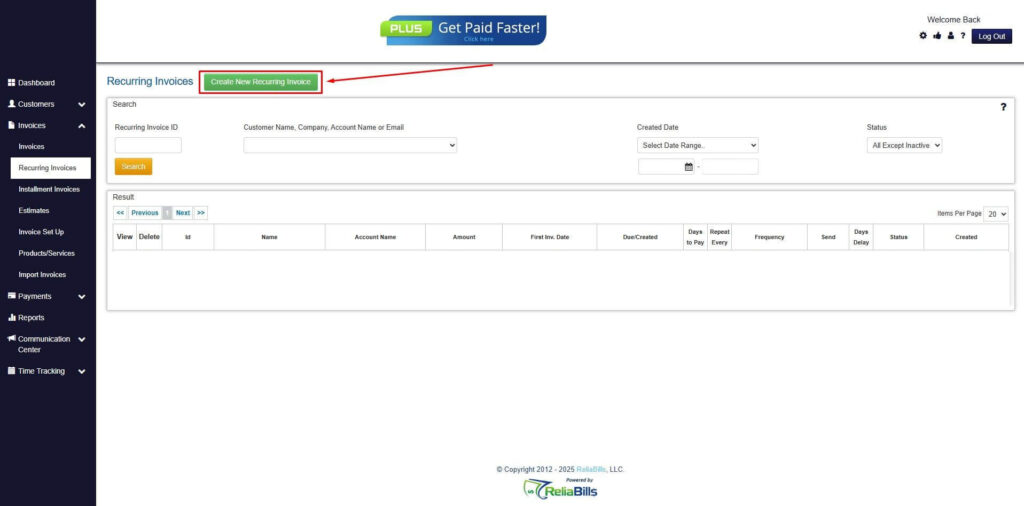

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

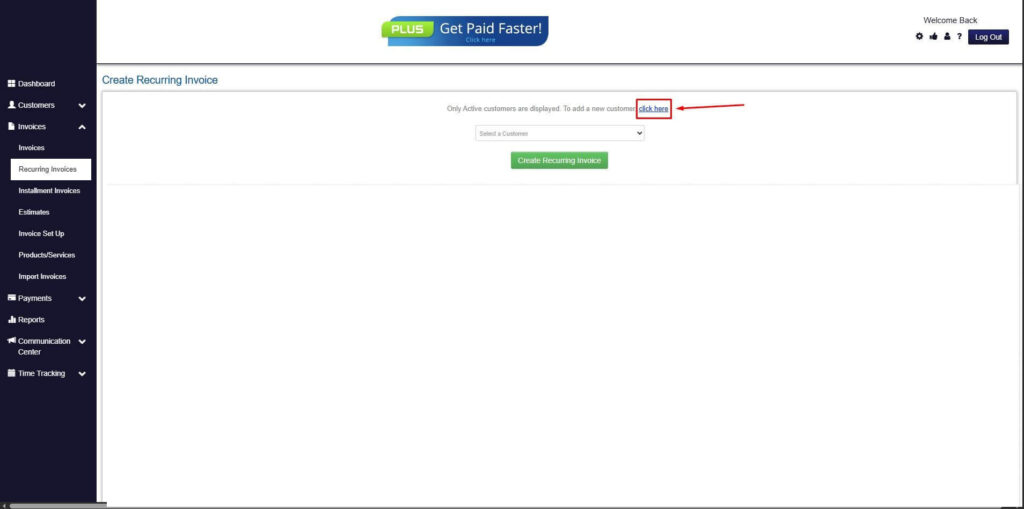

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

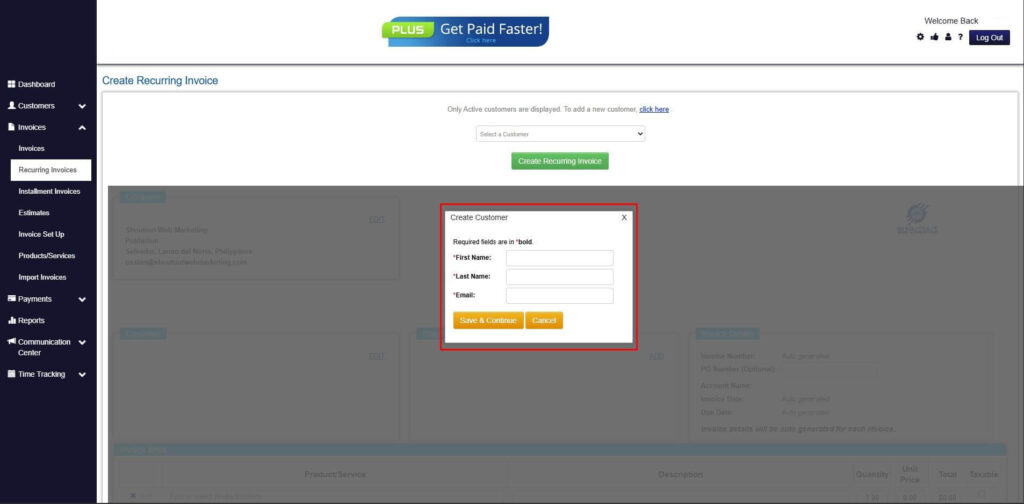

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

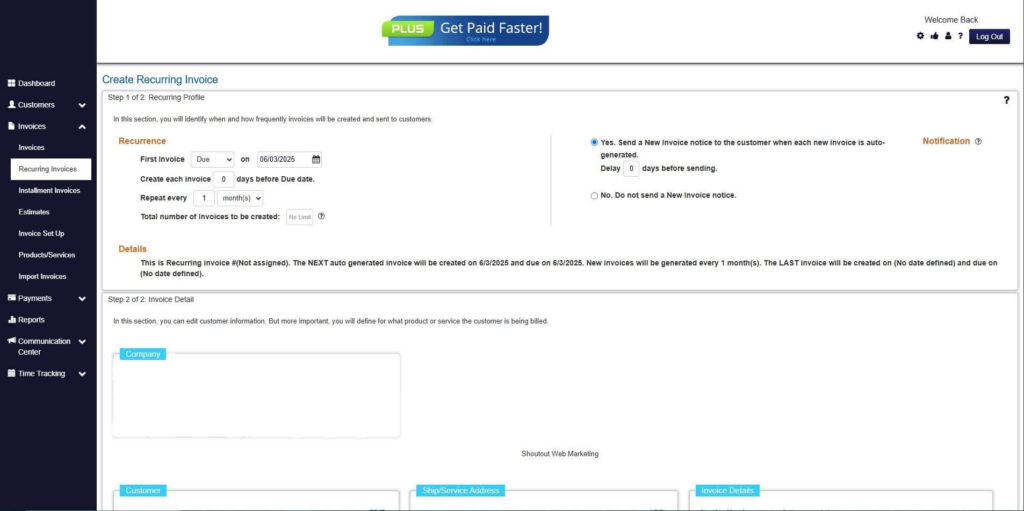

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

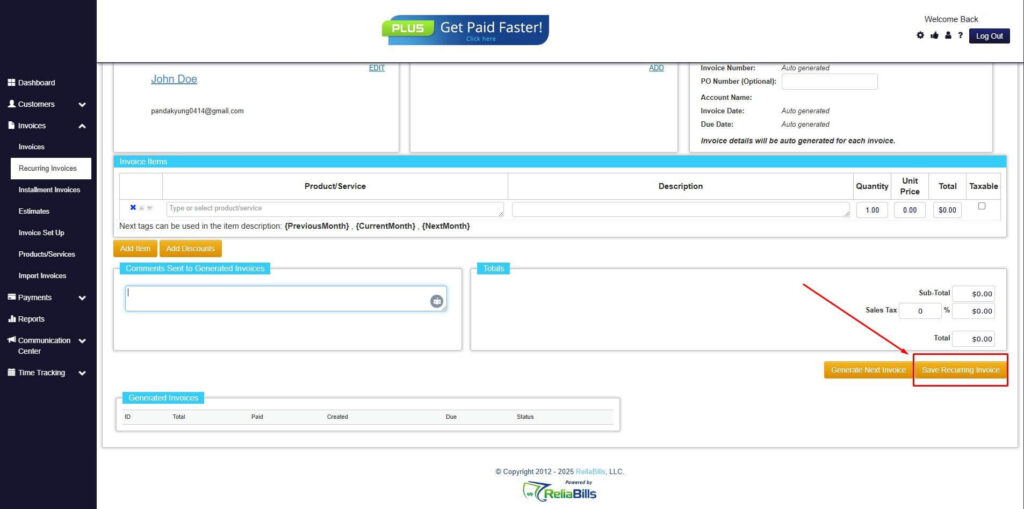

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How often should progress invoices be issued?

Progress invoices are typically issued after reaching milestones, completing phases, or at regular intervals such as monthly billing cycles. The frequency should be defined in the contract and aligned with project progress.

2. What information should be included in a progress invoice?

A progress invoice should include completed work descriptions, billing period, milestone or completion percentage, itemized costs, retainage if applicable, and payment terms. Supporting documentation helps speed up approval.

3. Can progress invoices be combined with recurring billing?

Yes, contractors managing long-term or maintenance contracts often combine progress payment invoicing with recurring billing. This approach supports predictable cash flow while still billing accurately for completed work.

4. How can contractors reduce disputes over progress payments?

Clear documentation, detailed invoices, consistent billing schedules, and transparent communication significantly reduce disputes. Using digital invoicing tools also improves visibility and trust.

Conclusion

Progress payment invoicing is essential for contractors managing phased or long-term projects. It aligns payments with completed work, improves cash flow, and reduces financial risk.

Invoices provide structure, documentation, and transparency throughout the project lifecycle. When managed correctly, they support smoother client relationships and fewer disputes.

By adopting digital tools and automation, contractors can simplify progress payment invoicing and gain better financial control. Solutions like ReliaBills make it easier to invoice accurately, track payments, and grow sustainably.