For consultants, maintaining consistent billing is crucial to sustaining revenue and minimizing administrative stress. Many rely on one-time invoices for ad-hoc services, but this approach can create unpredictable cash flow, delayed payments, and errors. Recurring invoices provide a structured method for managing ongoing client billing, streamlining processes, and fostering professionalism in client relationships.

This guide explains when consultants should implement recurring invoices, which services are best suited for automation, and practical steps for establishing an efficient recurring invoicing workflow. By leveraging automation, consultants can save time, reduce mistakes, and improve financial predictability.

Table of Contents

ToggleWhat Are Recurring Invoices?

Recurring invoices are automated bills generated on a fixed schedule, such as weekly, monthly, or quarterly. Unlike one-off invoices, recurring invoices are designed for ongoing engagements, ensuring clients are billed consistently without the need for manual intervention each cycle.

Each recurring invoice contains essential components such as the invoice amount, due date, billing frequency, and a clear description of services. Consultants typically use recurring invoices for retainer agreements, subscription-based services, or long-term advisory arrangements. Automating these tasks reduces human error, improves efficiency, and provides clients with a predictable billing schedule.

Recurring invoices also allow consultants to track billing cycles accurately, anticipate cash flow, and maintain a professional and transparent relationship with clients. The system ensures every invoice is generated on time, helping businesses avoid missed payments and disputes.

Common Consulting Engagement Models

Hourly Consulting

Consultants often bill clients based on hours worked. Hourly engagements can benefit from recurring invoices when clients require regular weekly or monthly services. Automating invoicing ensures all hours are accurately billed and reduces errors from manual tracking.

Retainer-Based Engagements

Retainers provide clients with access to ongoing consulting services for a fixed fee over a set period. Recurring invoices are ideal here because they guarantee predictable revenue, reduce administrative workload, and maintain client trust through consistent billing.

Project and Advisory-Based Consulting

For project-based work or ongoing advisory services, recurring invoices can be structured around milestones or phases. Automation ensures timely billing for each stage, prevents missed invoices, and maintains clear financial records for both parties.

Challenges of One-Time Invoicing for Ongoing Clients

- Missed or Delayed Invoices: One-time invoices require manual creation each time a service is delivered, increasing the risk of oversight and payment delays.

- Unpredictable Cash Flow: Without a consistent billing schedule, revenue can fluctuate, making budgeting and financial planning difficult for consultants.

- Increased Administrative Workload: Manually generating invoices for ongoing clients consumes time that could be spent on delivering consulting services.

- Higher Error Rates: Manual invoices are more prone to mistakes, such as incorrect amounts, missed taxes, or forgotten adjustments, which can lead to disputes and slow payments.

When Recurring Invoices Make Sense for Consultants

Recurring invoices are most beneficial when consultants maintain long-term client relationships and the scope of work is predictable. Fixed monthly or quarterly advisory fees, managed services, and subscription-style consulting offerings are prime candidates for automation.

Using recurring invoices in these scenarios ensures clients are billed consistently, reducing disputes and improving financial planning. Automation also allows consultants to scale operations efficiently, as higher invoice volumes no longer require additional administrative effort.

Services Best Suited for Recurring Invoicing

Services that are ongoing or require continuous engagement are ideal for recurring invoicing. Regular advisory services, such as strategic planning or operational consulting, benefit from automated billing, as do managed service contracts and retainer agreements for IT, marketing, or other support services. Subscription-based offerings, like monthly reporting or coaching sessions, also lend themselves well to recurring billing, ensuring clients are invoiced systematically and transparently.

Automated recurring invoices help consultants avoid overlooked payments, maintain accurate financial records, and foster trust with clients by providing predictable billing schedules.

Benefits of Recurring Invoices for Consultants

- Consistent and Predictable Revenue: Recurring invoices guarantee regular income, helping consultants plan expenses and growth initiatives with confidence.

- Reduced Billing Errors: Automated calculations and standardized templates minimize mistakes, ensuring each invoice is accurate and aligned with agreements.

- Time Savings: With automation, consultants spend less time generating invoices and more time on client work or business development.

- Scalability: As client numbers grow, recurring invoicing scales effortlessly, eliminating the need for additional administrative staff.

Client Benefits of Recurring Invoicing

- Transparent and Predictable Billing: Clients know exactly when and how much they will be billed, reducing surprises and confusion.

- Fewer Disputes: Clear, automated invoices reduce misunderstandings about services delivered, pricing, and timing.

- Improved Budget Management: Predictable payments allow clients to manage cash flow efficiently and plan for recurring consulting services.

- Professionalism and Trust: Consistent invoicing reflects a professional approach, fostering trust and long-term client relationships.

How to Set-Up Recurring Invoices Correctly

Proper setup is critical for successful recurring invoicing. Consultants should define billing terms and schedules that align with contracts, automate invoice delivery, and include clear descriptions of services. Including automated reminders for upcoming or overdue invoices further reduces the risk of missed payments and ensures clients stay informed.

Accurate setup prevents disputes, maintains transparency, and ensures both parties are aligned on expectations. Regularly reviewing recurring invoice templates and schedules is also essential to maintain accuracy and adapt to any changes in the scope of work.

How to Avoid Common Mistakes with Recurring Consulting Invoices

Common pitfalls include setting incorrect billing frequencies, failing to account for changes in project scope, and poor communication with clients. These issues can lead to overbilling, underbilling, or client dissatisfaction.

Consultants should regularly review recurring invoices, update them for any service changes, and communicate clearly with clients regarding billing terms. These practices help maintain accurate billing and reduce potential disputes.

How to Manage Changes in Ongoing Engagements

- Adjusting Fees and Services: Recurring invoices can be updated to reflect increases or decreases in services, ensuring that clients are billed accurately for changes.

- Handling Pauses or Cancellations: Automated systems can easily pause or stop recurring invoices for temporary service interruptions without creating confusion.

- Upgrades and Add-Ons: Additional services or premium packages can be incorporated seamlessly into existing billing cycles.

- Maintaining Accurate Records: Every change is tracked in a centralized system, ensuring historical accuracy and simplifying reporting for audits or client inquiries.

Best Practices for Transitioning Clients to Recurring Invoices

- Clear Communication: Inform clients of the transition, explaining the benefits of consistent billing and how it will affect payment schedules.

- Updating Agreements: Ensure contracts and service agreements reflect the recurring billing schedule and terms.

- Monitoring Early Results: Track the first few billing cycles to catch issues, resolve disputes quickly, and refine automated workflows.

- Staff Training and Documentation: Teams should understand the recurring billing process, how to manage exceptions, and how to handle client queries effectively.

How ReliaBills Helps Consultants Manage Recurring Invoices

ReliaBills provides consultants with a comprehensive platform to manage recurring invoices effortlessly. By automating the generation and delivery of invoices, consultants no longer have to worry about missing billing cycles or spending hours on manual invoicing. Each recurring invoice can be customized with client-specific details, service descriptions, and payment terms, ensuring accuracy and professionalism every time.

The platform also supports automated payment collection and reminders, reducing late payments and improving cash flow predictability. Consultants can schedule invoices for monthly retainers, project milestones, or subscription-style services, giving clients a clear and consistent billing experience. Notifications and reminders keep clients informed without requiring additional follow-ups from the consultant’s team.

Additionally, ReliaBills offers centralized tracking and reporting, giving consultants real-time visibility into outstanding invoices, payments received, and historical billing records. This feature simplifies accounting, reconciliation, and audit readiness, allowing consultants to focus on delivering high-quality services instead of chasing payments. With ReliaBills, recurring invoices for consultants become efficient, reliable, and scalable, supporting business growth while minimizing administrative effort.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

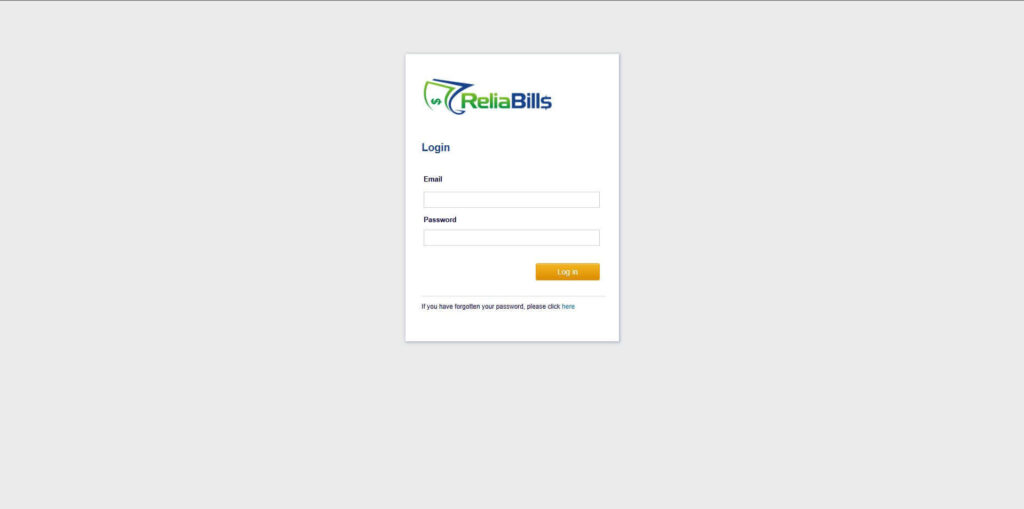

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

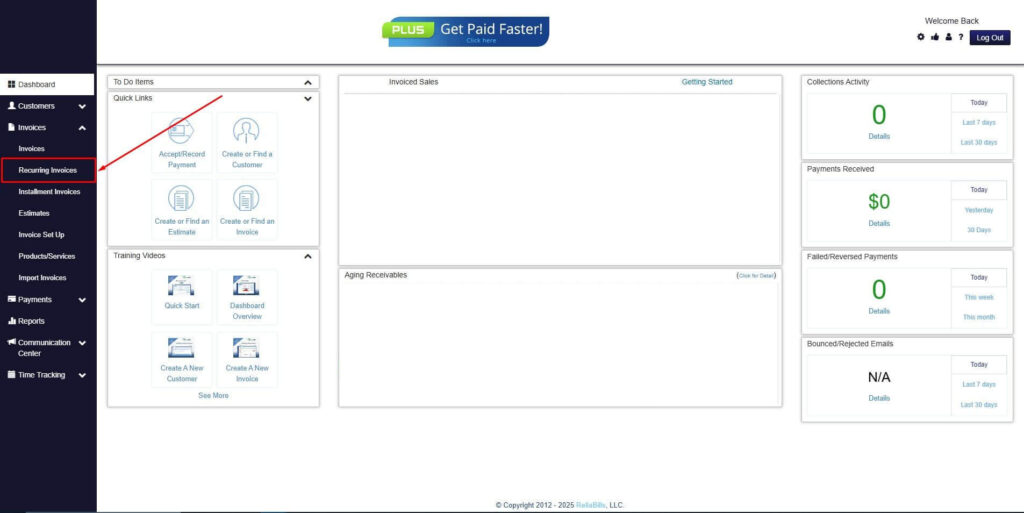

Step 2: Click on Recurring Invoices

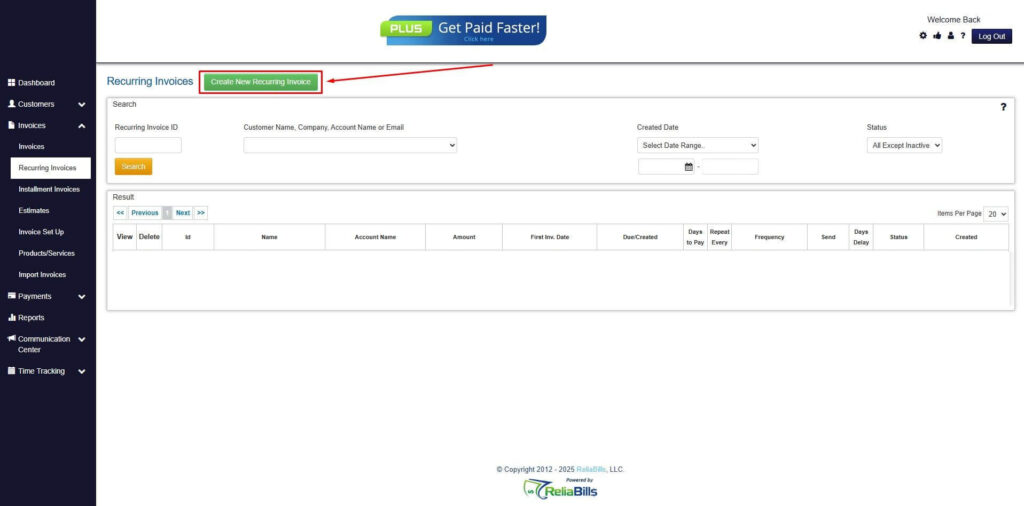

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

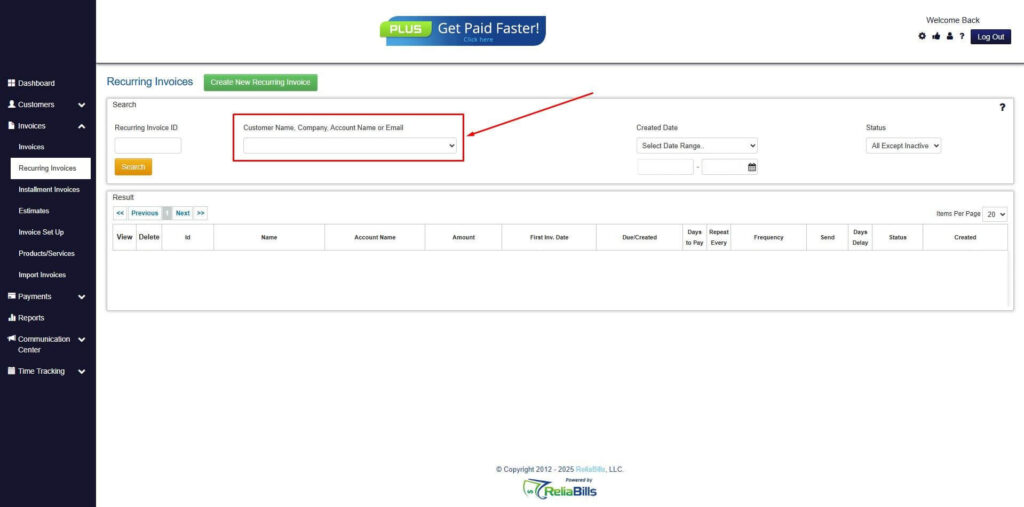

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

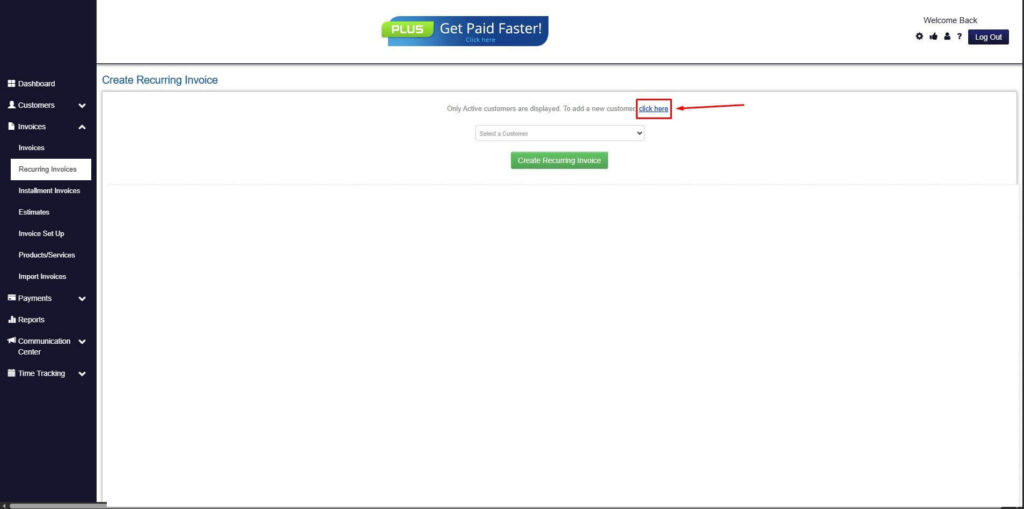

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

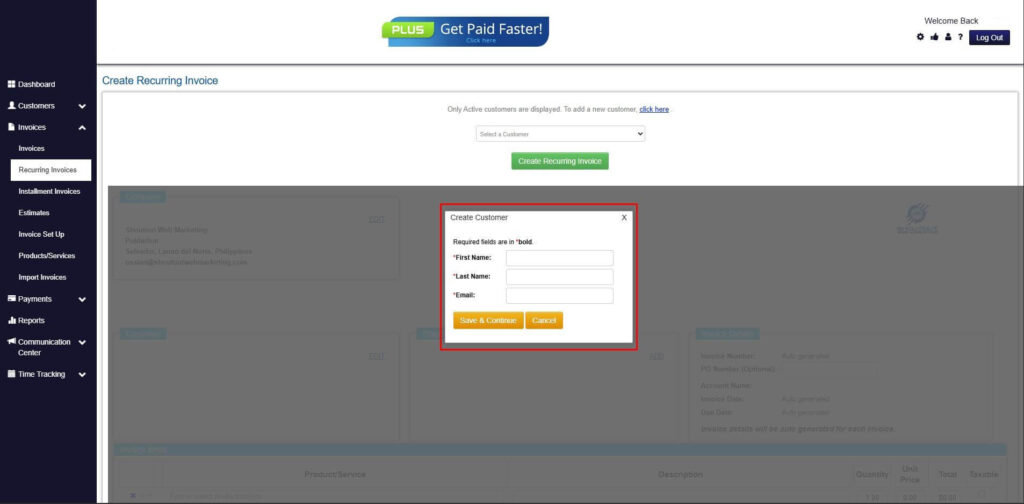

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

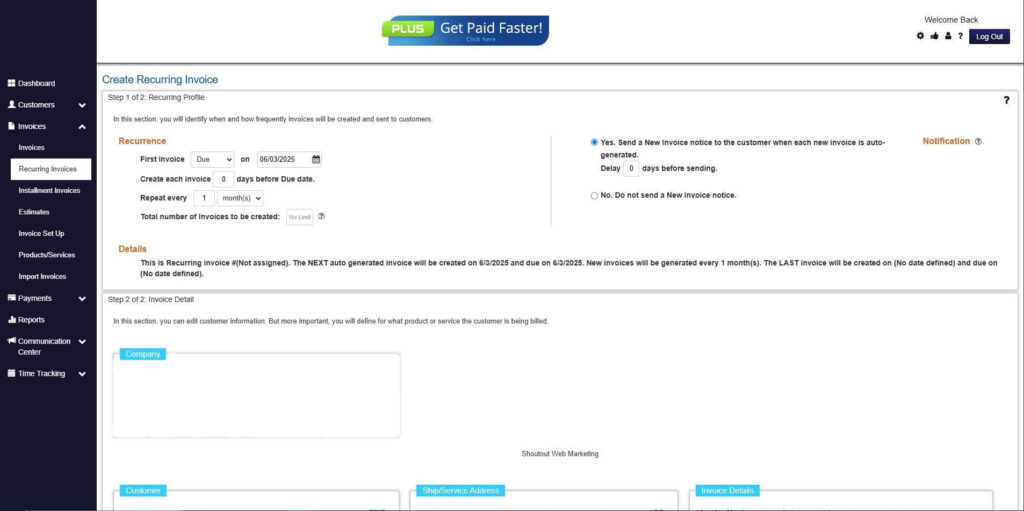

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

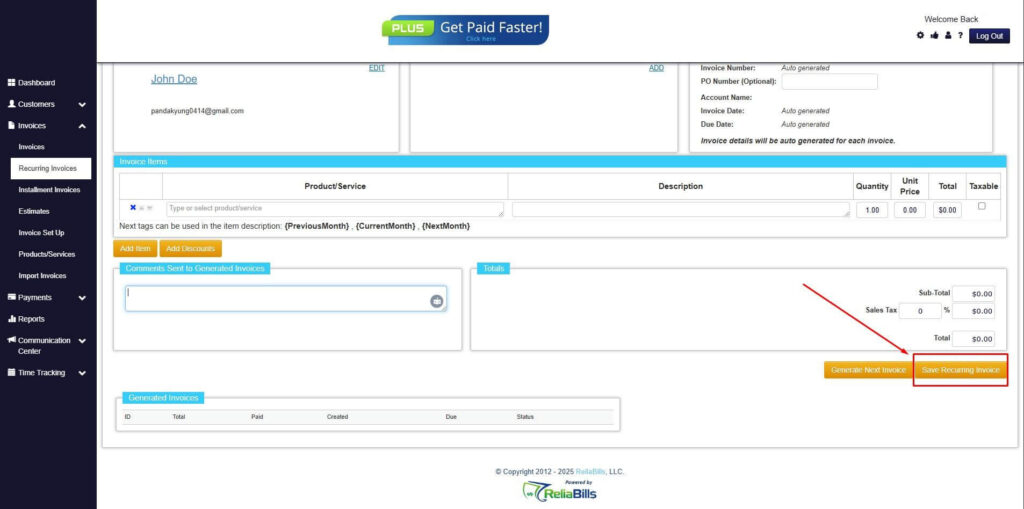

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

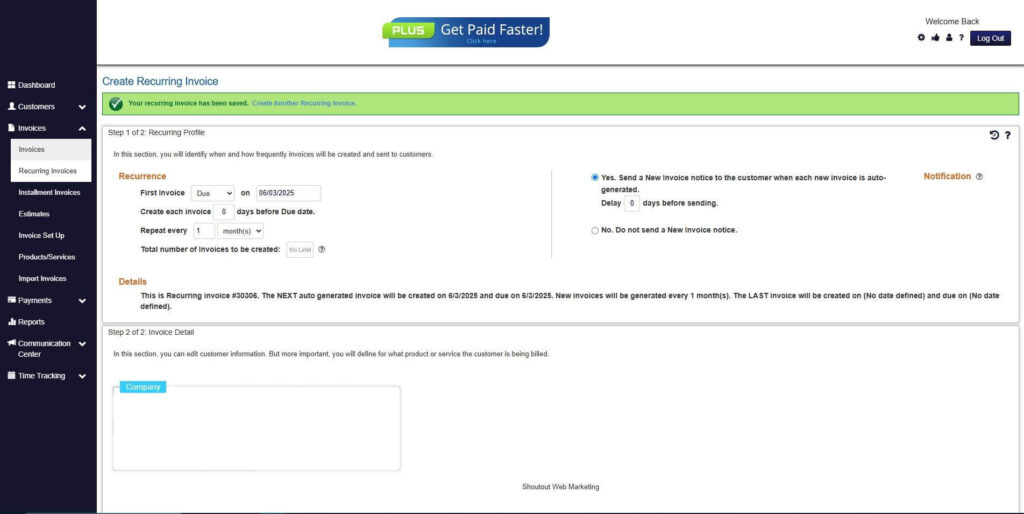

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can recurring invoices be paused or adjusted mid-cycle?

Yes, modern billing systems allow adjustments for service changes, cancellations, or temporary pauses, ensuring accurate invoicing without disrupting client relationships.

2. Is recurring invoicing suitable for small consulting firms?

Absolutely. Even solo consultants benefit from automated recurring billing to save time, reduce errors, and ensure predictable revenue streams.

3. How do recurring invoices handle variable services or hours?

Recurring invoices can include adjustable line items, prorated charges, or additional fees, ensuring flexibility while maintaining automation.

4. Will clients accept recurring billing?

Most clients appreciate predictable and transparent billing. Clear communication during the transition phase ensures acceptance and reduces potential confusion.

5. How does recurring invoicing improve cash flow?

By generating invoices consistently and sending automated reminders, recurring billing reduces late payments and ensures a steady inflow of revenue for consulting businesses.

Conclusion

Recurring invoices are a powerful tool for consultants managing ongoing client relationships. They reduce administrative workload, ensure timely payments, and provide predictable revenue. Automation platforms like ReliaBills make recurring invoicing simple, helping consultants scale efficiently while maintaining accuracy and professionalism. By implementing recurring invoices strategically, consultants can focus on delivering value, strengthening client satisfaction, and growing their businesses sustainably.