Client billing is one of the most time-consuming operational challenges agencies face, especially when managing multiple clients, projects, and billing terms at once. Manual invoicing often leads to delays, inconsistencies, and avoidable errors that affect both cash flow and client trust. As agencies grow, these billing inefficiencies become harder to manage without adding staff or complexity.

Many agencies rely on spreadsheets or disconnected tools to track invoices, payments, and follow-ups. This approach increases the risk of missed invoices, late payments, and unclear billing communication. Over time, these issues can strain client relationships and slow down revenue collection.

Automated invoicing for agencies provides a more reliable and scalable solution. By standardizing billing workflows and automating recurring and project-based invoices, agencies can improve accuracy, reduce administrative effort, and maintain predictable cash flow.

Table of Contents

ToggleCommon Client Billing Challenges Agencies Face

Inconsistent billing schedules across clients

Agencies often manage retainers, one-time projects, and hourly work at the same time. Without automation, invoices may be sent late or at irregular intervals, causing confusion and delayed payments.

Manual billing errors and miscalculations

Spreadsheet-based billing increases the risk of incorrect rates, duplicate charges, or missing line items. Even small errors can lead to billing disputes and extra administrative work.

Difficulty tracking payments and outstanding balances

When invoices and payments are scattered across systems, it becomes hard to see which clients have paid and which invoices are overdue. This lack of visibility slows down collections and affects cash flow.

Time-consuming follow-ups and collections

Manual reminders require constant monitoring and outreach. Agencies often spend unnecessary time chasing payments instead of focusing on client work.

Limited cash flow predictability

Without recurring billing and automation, revenue becomes unpredictable. This makes it harder to plan for payroll, expenses, and growth.

What Is Automated Invoicing?

Automated invoicing refers to the use of software to generate, send, and track invoices with minimal manual input. These systems rely on predefined rules, templates, and schedules to ensure invoices are created consistently and on time. For agencies, this removes repetitive administrative tasks from daily operations.

Automated invoicing platforms typically include features such as recurring billing, automated calculations, invoice scheduling, and real-time status tracking. Many also support online payments and client communication tools. These features align well with agency workflows that involve ongoing services and repeat billing.

Unlike manual billing, automated invoicing reduces reliance on spreadsheets and individual oversight. Instead, billing becomes a structured, repeatable process that scales as the agency grows. This shift significantly improves efficiency and accuracy.

How Automated Invoicing Streamlines Agency Billing

Standardized invoice templates ensure that every client receives clear, consistent billing information. Agencies can define invoice layouts, descriptions, and terms once, then reuse them across accounts. This consistency reduces confusion and improves professionalism.

Automated scheduling allows invoices to be sent at the right time without manual reminders. Whether billing monthly retainers or project milestones, invoices are delivered automatically based on predefined rules. This ensures no billing opportunities are missed.

Real-time invoice tracking gives agencies immediate visibility into invoice status. Teams can see which invoices are sent, viewed, paid, or overdue, making follow-ups more efficient. This transparency simplifies internal coordination and client communication.

Managing Recurring and Project-Based Billing

Many agencies rely on recurring billing for retainers and subscription-based services. Automated invoicing makes it easy to schedule recurring invoices and collect payments consistently. This predictability helps stabilize cash flow and reduce billing-related stress.

For project-based work, automation supports milestone and hourly billing without added complexity. Agencies can generate invoices based on predefined triggers such as project phases or approved hours. This ensures accurate billing while saving time.

By managing both recurring and project billing within one system, agencies avoid fragmented workflows. Automated invoicing for agencies brings all billing models into a single, organized process. This reduces errors and improves scalability.

Improving Accuracy and Reducing Billing Disputes

Automated calculations help eliminate common billing errors related to rates, taxes, and totals. By applying consistent rules across invoices, agencies reduce the risk of discrepancies. This accuracy builds client confidence in the billing process.

Clear invoice breakdowns make it easier for clients to understand what they are being charged for. Detailed descriptions and line items reduce questions and misunderstandings. When clients understand invoices, disputes are less likely to occur.

Digital records also speed up dispute resolution when issues do arise. Agencies can quickly reference invoice histories, adjustments, and payment records. This transparency supports faster, more professional communication.

Payment Collection and Cash Flow Benefits

Integrated online payment options make it easier for clients to pay invoices promptly. Automated invoicing systems often support cards, ACH, and other digital payment methods. This convenience reduces payment delays.

Automated reminders and follow-ups help ensure invoices do not go unnoticed. Instead of manual chasing, reminders are sent automatically based on invoice status. This improves collection rates without damaging client relationships.

Recurring billing further enhances cash flow predictability for agencies. With scheduled invoices and autopay, revenue becomes more consistent. This stability supports better financial planning and growth.

Scaling Client Billing as Agencies Grow

As agencies take on more clients, invoice volume increases rapidly. Automated invoicing allows teams to manage higher volumes without adding administrative staff. This keeps operational costs under control.

Support for multiple billing terms, currencies, and client preferences ensures flexibility as agencies expand. Automated systems maintain consistency even as complexity increases. This reduces risk during growth phases.

By standardizing billing processes, agencies maintain quality and accuracy across teams. New staff can follow established workflows without extensive training. Automation supports sustainable scaling.

Best Practices for Implementing Automated Invoicing

Document current billing workflows before automating

Identify how invoices are created, approved, and sent today. Understanding existing processes helps prevent gaps and ensures automation supports real agency needs.

Standardize invoice templates and billing terms

Use consistent formats, descriptions, and payment terms across all clients. Standardization improves clarity and reduces disputes.

Leverage recurring billing for retainers and ongoing services

Automating recurring invoices ensures consistent billing cycles and predictable revenue. This is especially valuable for agencies with long-term client engagements.

Enable automated reminders and online payments

Payment reminders and easy payment options reduce late payments. Automation minimizes manual follow-ups while maintaining professional communication.

Review billing performance regularly

Monitor reports for overdue invoices, payment trends, and recurring billing success. Regular reviews help optimize automation rules and improve cash flow over time.

How ReliaBills Helps Agencies Automate Client Billing

ReliaBills helps agencies simplify client billing by bringing invoicing, payments, and tracking into a single automated workflow. Instead of managing invoices manually across multiple clients and projects, agencies can create standardized invoice templates, schedule deliveries, and monitor payment statuses in one place. This centralized approach reduces errors, saves time, and ensures invoices are sent consistently and professionally.

For agencies that rely on retainers, subscriptions, or ongoing services, recurring billing is where ReliaBills delivers the most value. Agencies can automate recurring invoices for monthly retainers or long-term engagements, ensuring clients are billed on time without repeated setup. This predictability improves cash flow, reduces follow-ups, and allows teams to focus more on client work instead of billing administration.

ReliaBills also improves visibility and control over agency finances. With real-time reporting and payment tracking, agencies can quickly identify outstanding balances, monitor client payment behavior, and forecast revenue more accurately. Automated reminders and branded communication further streamline collections, helping agencies maintain strong client relationships while keeping billing operations efficient and scalable.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

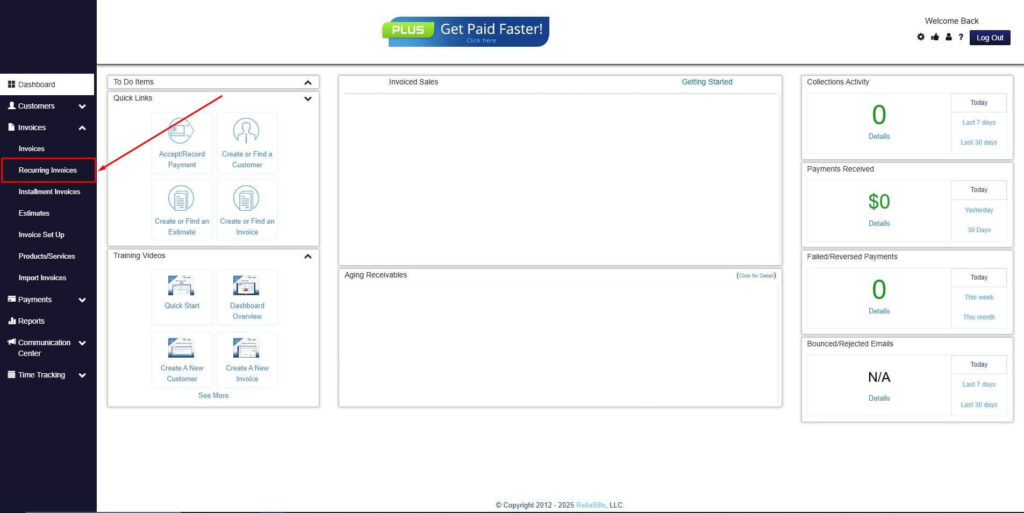

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

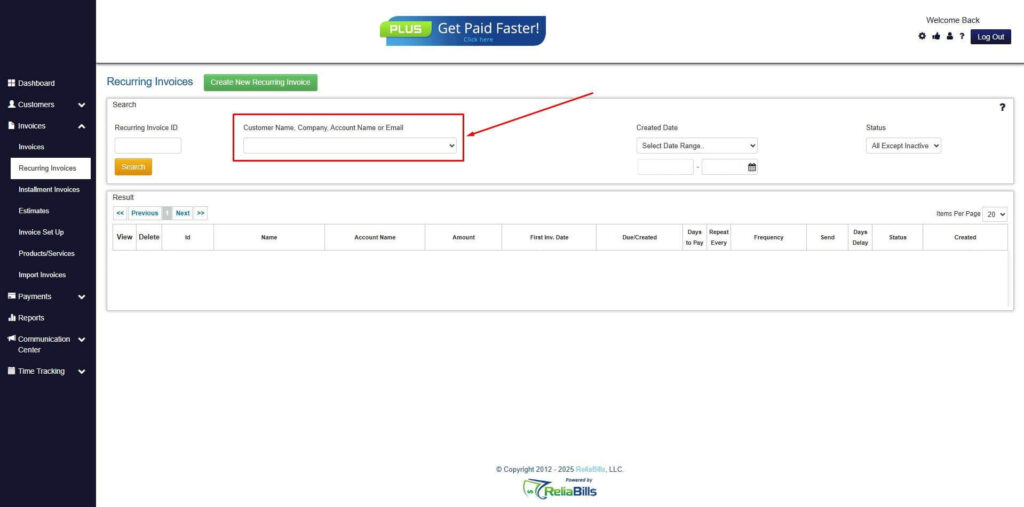

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

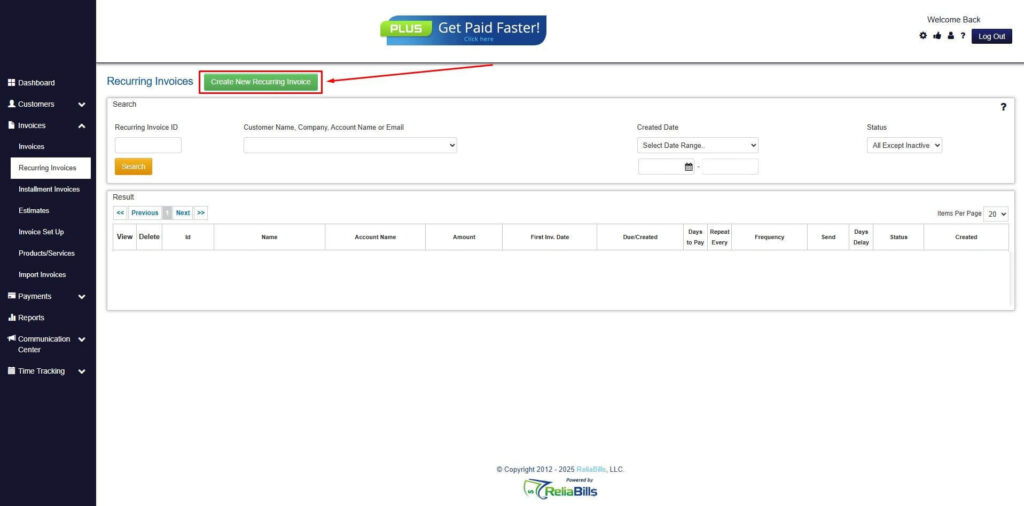

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

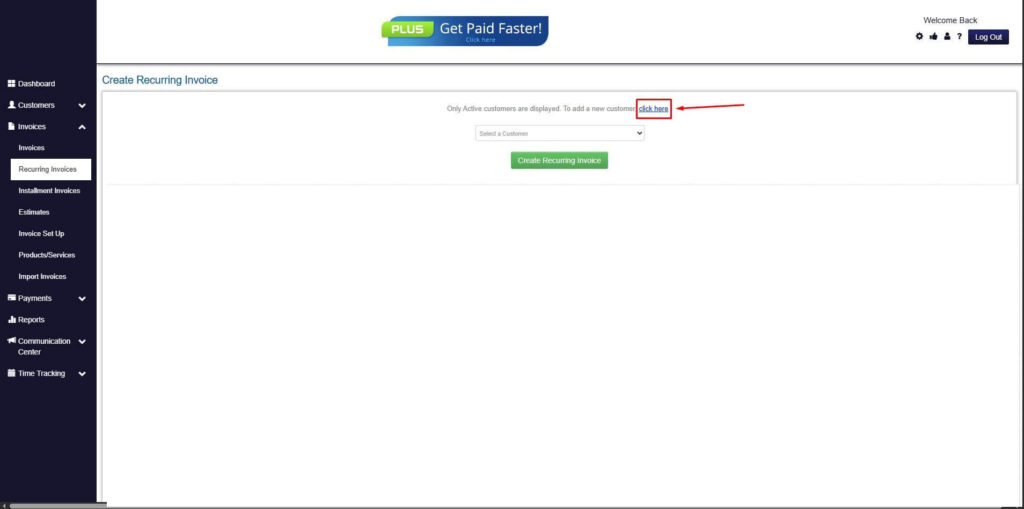

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

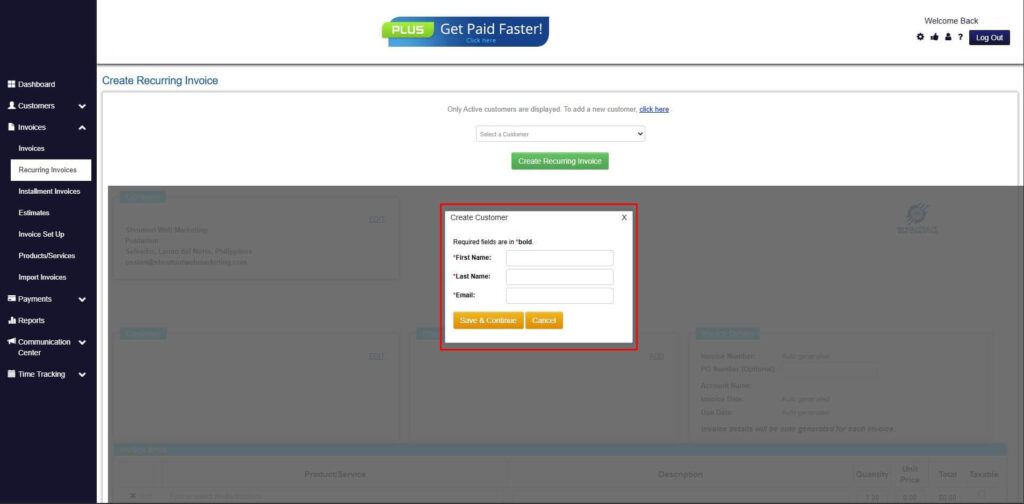

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

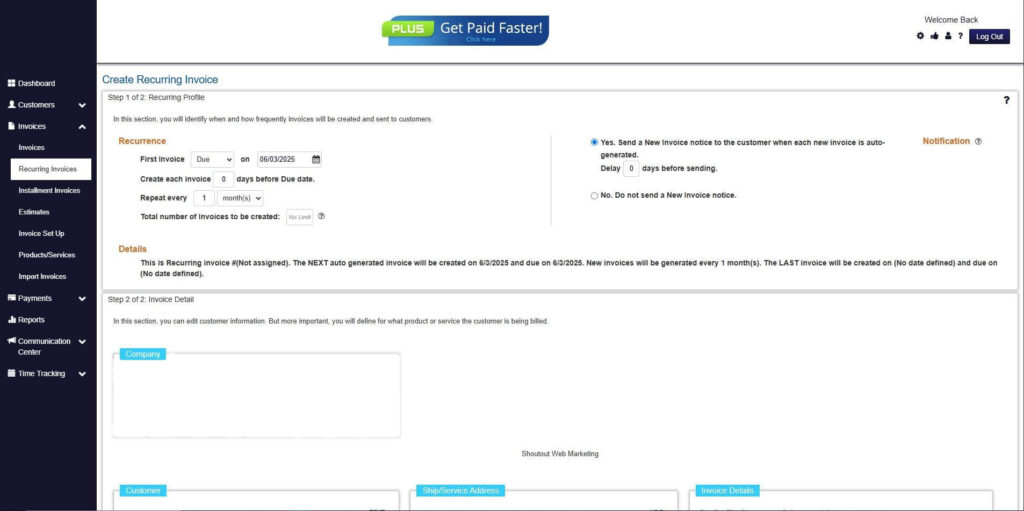

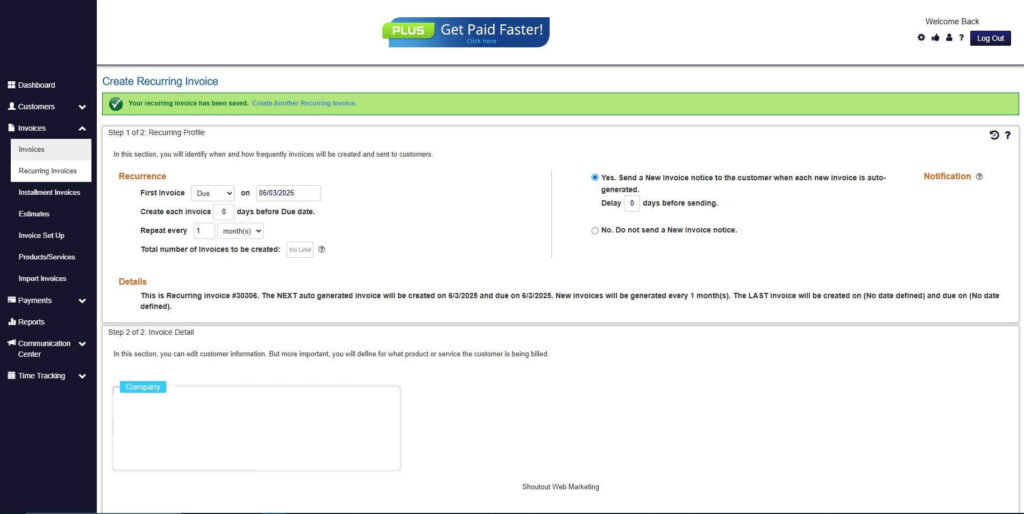

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

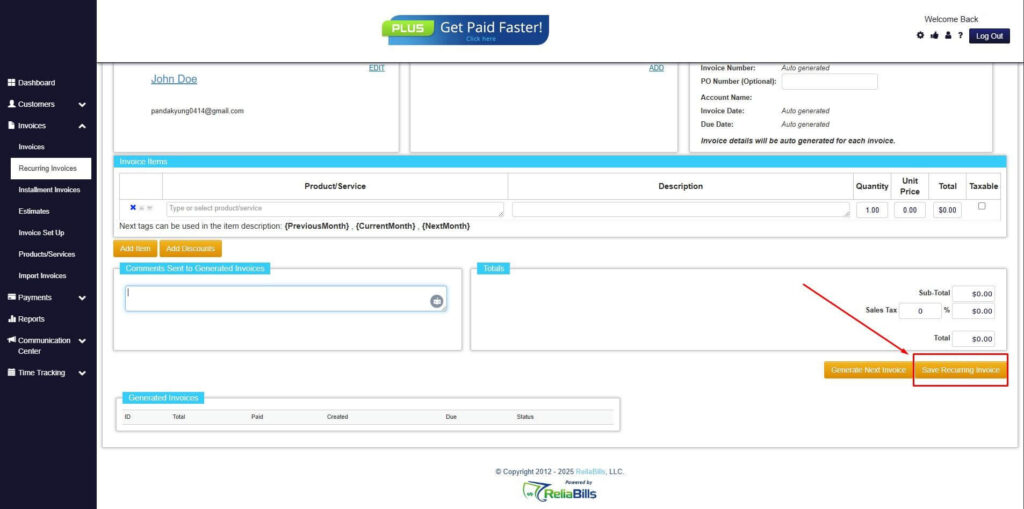

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Can automated invoicing handle different agency pricing models?

Yes. Automated invoicing systems support retainers, hourly billing, milestone-based invoices, and subscriptions. Rules can be customized per client without manual effort.

2. Is automated invoicing suitable for small agencies?

Automated invoicing works well for agencies of all sizes. Small teams benefit by saving time and improving cash flow without hiring additional staff.

3. How does automated invoicing reduce billing disputes?

Automation ensures accurate calculations, consistent invoice formats, and clear documentation. Clients receive detailed invoices on time, which reduces misunderstandings.

4. Can recurring billing be adjusted if client terms change?

Yes. Billing schedules, amounts, and terms can be updated without disrupting future invoices. This flexibility supports evolving client relationships.

5. Is client data secure with automated invoicing platforms?

Reputable billing platforms use encryption, access controls, and compliance standards to protect sensitive billing and payment information.

Conclusion

Automated invoicing for agencies simplifies client billing by reducing errors, improving efficiency, and supporting consistent cash flow. By replacing manual processes with structured workflows, agencies can focus more on client work and growth. Billing becomes a reliable operation rather than a recurring challenge.

Recurring billing plays a key role in stabilizing agency revenue and reducing administrative effort. Automated scheduling, payment collection, and reminders ensure invoices are sent and paid on time. This predictability supports better financial planning.

For agencies looking to scale without added complexity, automated invoicing is no longer optional. Choosing the right solution enables long-term efficiency, accuracy, and stronger client relationships.