Billing disputes are becoming more common as businesses move toward digital and subscription-based models. Customers now expect faster resolutions, clear documentation, and real-time updates when billing issues arise. When disputes are handled slowly or inconsistently, trust can erode and customer relationships can suffer.

Return invoices play a critical role in resolving disputes related to overcharges, incorrect billing, or returned goods and services. In a digital-first environment, relying on manual or paper-based return invoices often adds delays and confusion. This makes it harder for both businesses and customers to reach quick resolutions.

This guide explains how digital return invoices help resolve billing disputes faster by improving accuracy, transparency, and communication. It also explores how automation and recurring billing systems support more efficient dispute handling for growing businesses.

Table of Contents

ToggleWhat Are Digital Return Invoices?

Digital return invoices are electronic documents used to record and process billing adjustments related to returns, corrections, or disputed charges. They are created, issued, and stored digitally within a billing or invoicing system. This allows businesses to document changes without relying on paper forms or manual spreadsheets.

Unlike traditional return invoices, digital return invoices are generated in real time and are immediately available to both internal teams and customers. They often include automated calculations, time stamps, and references to the original invoice. This creates a clear and traceable record of the adjustment.

Digital return invoices are commonly used in scenarios such as subscription cancellations, partial service refunds, product returns, and billing corrections. They are especially valuable in recurring billing environments where adjustments must be reflected accurately across billing cycles.

Common Causes of Billing Disputes

Incorrect charges or duplicate billing

Billing disputes often start when customers are charged more than expected or billed twice for the same product or service. These errors are usually caused by manual data entry, disconnected billing systems, or inconsistent pricing rules. Without clear documentation, customers may lose confidence quickly.

Recurring billing misunderstandings

Subscription-based billing can confuse customers when renewal dates, prorated charges, or cancellation timing are not clearly communicated. If billing adjustments are delayed or missing, disputes become more likely. Digital return invoices help clarify these changes with accurate, time-stamped records.

Lack of supporting documentation

Disputes escalate when customers cannot easily access proof of billing corrections or returns. Missing invoices, delayed updates, or unclear explanations make it harder to resolve issues. Centralized digital records reduce this friction significantly.

Limitations of Manual Return Invoice Processes

Manual return invoice processes are slow and prone to human error. Staff must recreate invoice details, calculate adjustments, and update records manually, increasing the risk of mistakes. These errors can lead to further disputes instead of resolving the original issue.

Visibility is another major limitation. Customers often have no real-time access to return invoice documentation, while internal teams may rely on emails or disconnected systems. This lack of transparency slows down dispute resolution and increases back-and-forth communication.

Inconsistent record-keeping is also common with manual processes. Return invoices may not be properly linked to original invoices or stored in a centralized location. This creates challenges during audits, reconciliations, or repeat disputes.

How Digital Return Invoices Speed Up Dispute Resolution

Digital return invoices allow businesses to generate adjustments instantly when a dispute is identified. Automated systems calculate credits or corrections based on predefined rules, reducing delays and eliminating manual recalculations. This speeds up the initial response to customer concerns.

Documentation is immediately accessible once a digital return invoice is issued. Customers can view updated invoices online, while internal teams can track changes in real time. This shared visibility reduces confusion and accelerates agreement between both parties.

Approval and acknowledgment workflows are also faster with digital systems. Automated notifications confirm when a return invoice is created, reviewed, or finalized. This keeps disputes moving forward instead of getting stuck in manual review cycles.

Accuracy and Transparency Benefits

Accuracy improves significantly when digital return invoices are used. Automated calculations reduce discrepancies caused by human error, ensuring that adjustments align with billing terms and policies. This consistency helps prevent follow-up disputes.

Transparency is enhanced through clear audit trails and time-stamped records. Every adjustment is documented and linked to the original invoice, making it easy to trace what changed and why. This level of detail supports both customer confidence and internal accountability.

Customers benefit from transparent billing updates that clearly explain adjustments. When changes are easy to understand, trust increases and disputes are resolved more quickly. This strengthens long-term customer relationships.

Digital Return Invoices in Recurring Billing Environments

Recurring billing environments often involve prorated charges, partial returns, and mid-cycle changes. Digital return invoices make it easier to manage these scenarios accurately. Adjustments are automatically applied without disrupting future billing cycles.

By recording return invoices digitally, businesses can prevent repeat disputes in upcoming billing periods. Corrections are reflected consistently across subscriptions, ensuring customers are billed correctly going forward. This reduces ongoing support requests.

Accurate customer account balances are maintained through automated updates. Digital return invoices sync with recurring billing records, keeping payment histories and outstanding balances aligned. This improves financial accuracy and reporting.

Operational and Customer Experience Benefits

Faster dispute resolution and case closure

Digital return invoices eliminate delays caused by manual processing and paperwork. Adjustments are generated and shared instantly, reducing back-and-forth communication. This allows businesses to close dispute cases more quickly.

Lower support workload and operational costs

With clear documentation and automated workflows, support teams spend less time clarifying billing issues. Fewer repeated inquiries mean lower operational costs. Resources can be redirected toward higher-value activities.

Improved customer trust and satisfaction

Customers appreciate transparency and timely billing corrections. Digital return invoices provide clear explanations and real-time access to records. This improves trust, strengthens relationships, and increases long-term retention.

Best Practices for Using Digital Return Invoices

Standardize return invoice workflows

Businesses should establish clear procedures for when and how digital return invoices are issued. Consistent workflows ensure adjustments are handled quickly and accurately across all teams. This reduces confusion and speeds up dispute resolution.

Link return invoices to original billing records

Each digital return invoice should reference the original invoice and transaction. This creates a complete audit trail and makes it easier for customers and internal teams to understand the correction. Clear links improve transparency and trust.

Train teams on digital invoice handling

Support and finance teams should be comfortable creating, explaining, and tracking digital return invoices. Proper training minimizes errors and improves customer communication. Well-informed teams resolve disputes faster and more confidently.

How ReliaBills Simplifies Digital Return Invoice Resolution

ReliaBills simplifies digital return invoice resolution by centralizing the entire adjustment process in one platform. Instead of relying on disconnected systems or manual corrections, teams can generate, track, and reference digital return invoices alongside original invoices and payment records. This creates a clear, time-stamped trail that helps resolve billing disputes faster and with fewer follow-ups.

For businesses using recurring billing, ReliaBills adds another layer of clarity and control. Return invoices are automatically linked to ongoing billing schedules, ensuring prorated adjustments, credits, or reversals are applied correctly in future cycles. This prevents repeat disputes and keeps customer account balances accurate without interrupting automated payment collection.

ReliaBills PLUS enhances this process further by providing advanced reporting, audit-ready records, and deeper visibility into return invoice trends. Teams can identify recurring dispute patterns, monitor resolution timelines, and improve billing policies over time. With fewer manual touchpoints and clearer documentation, businesses resolve disputes faster while maintaining trust and long-term customer relationships.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

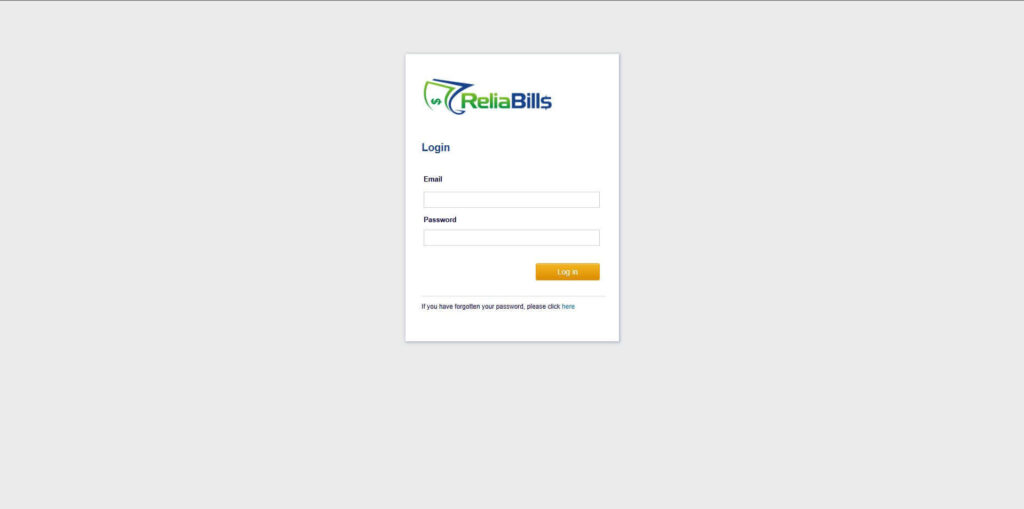

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

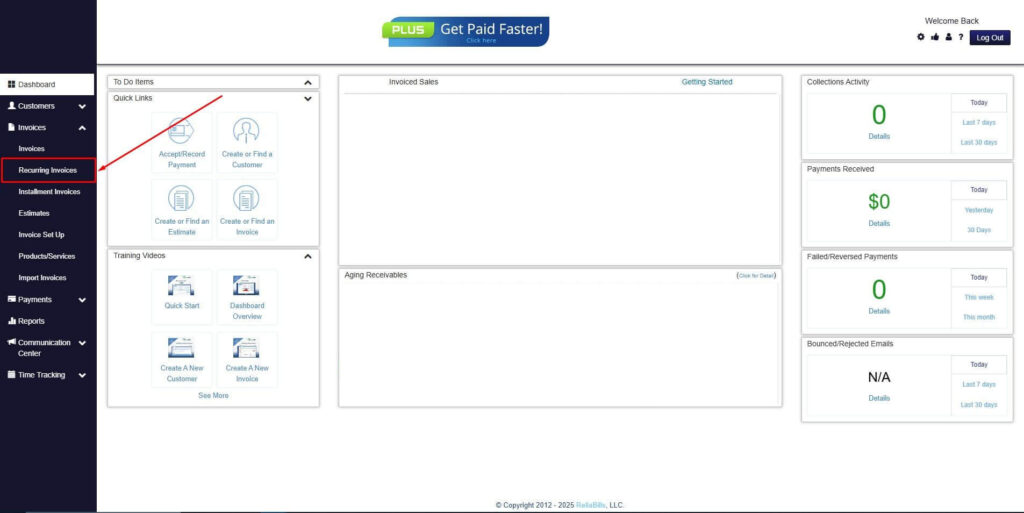

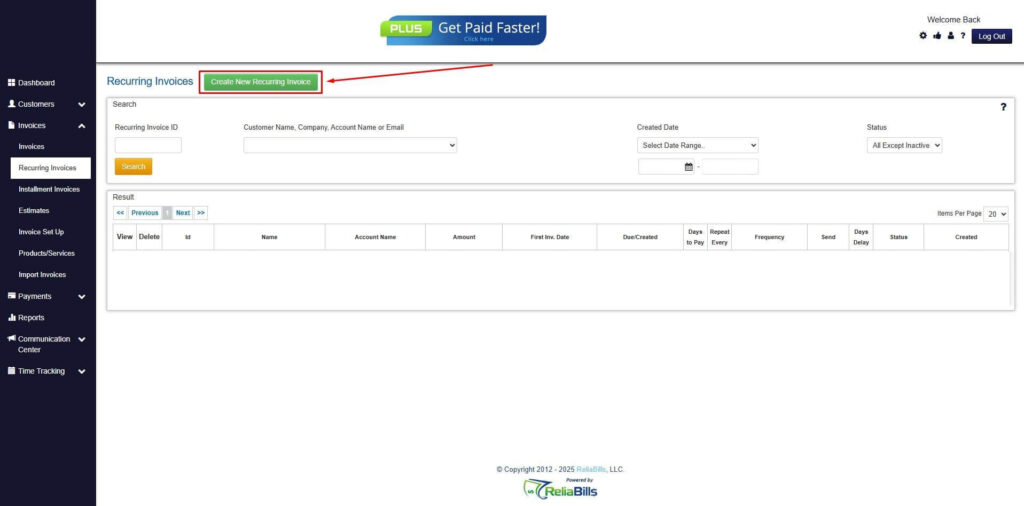

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

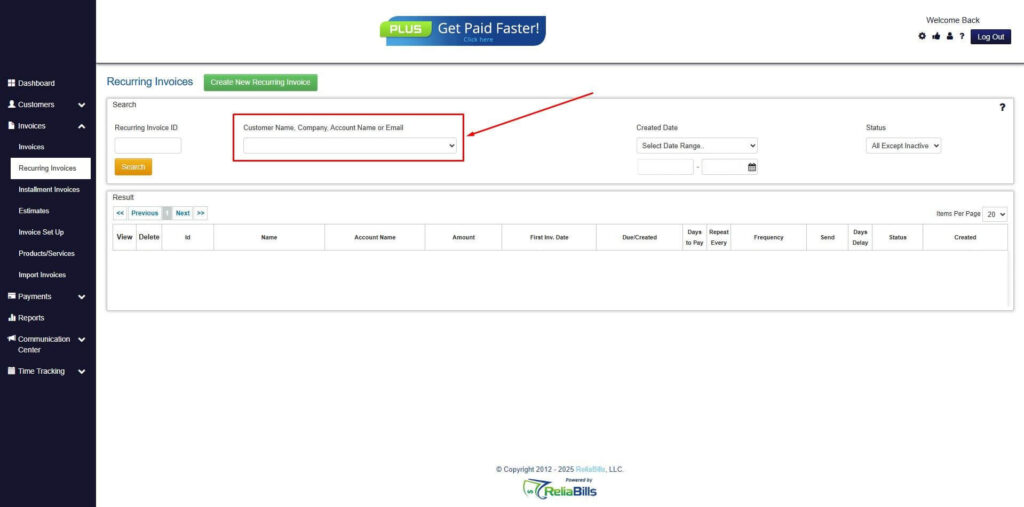

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

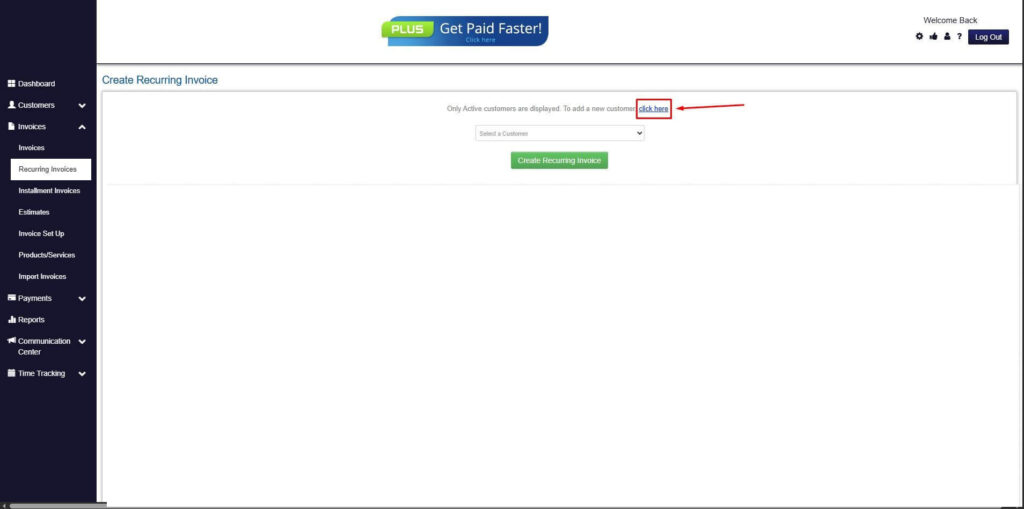

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

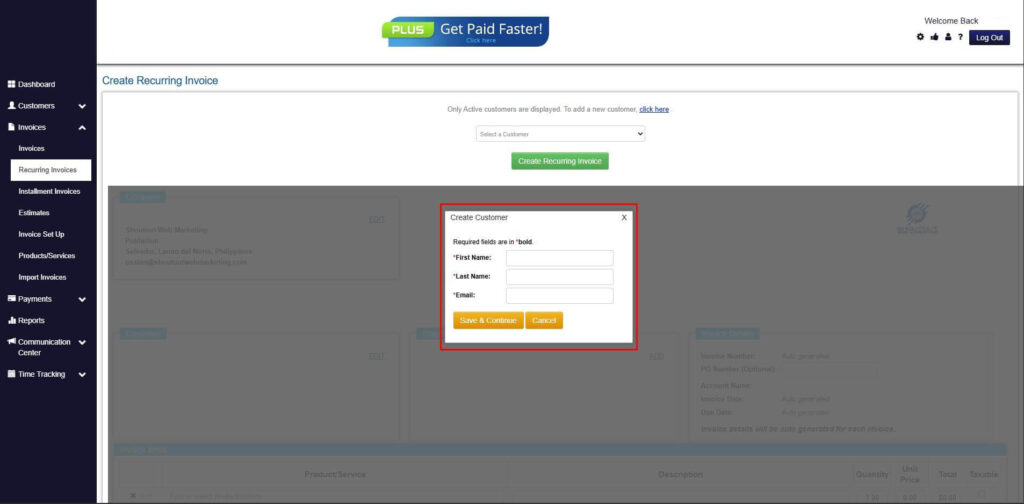

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

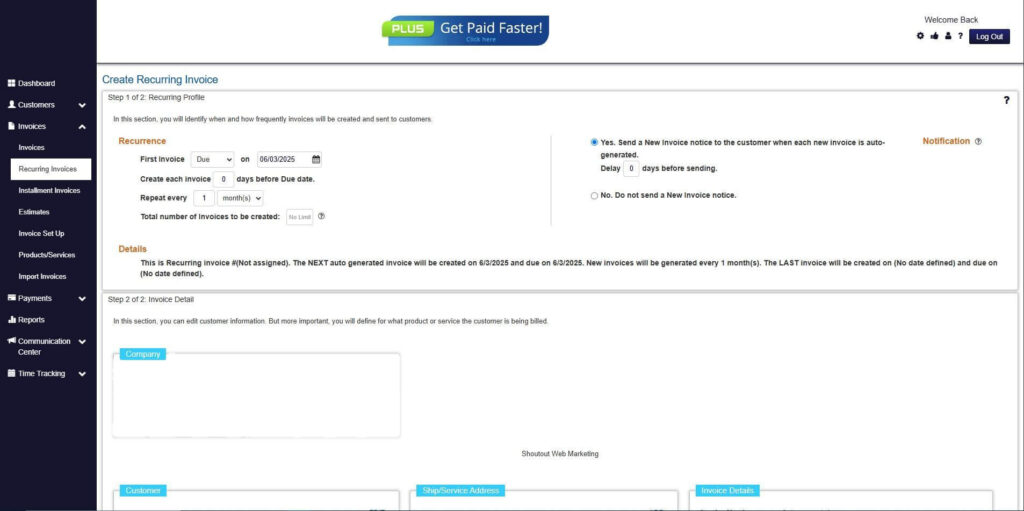

Step 7: Fill in the Create Recurring Invoice Form

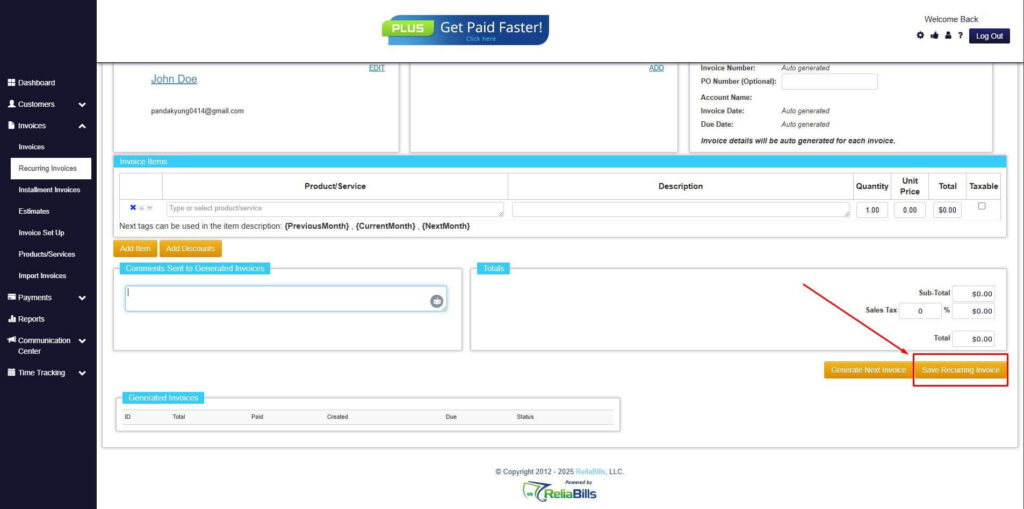

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

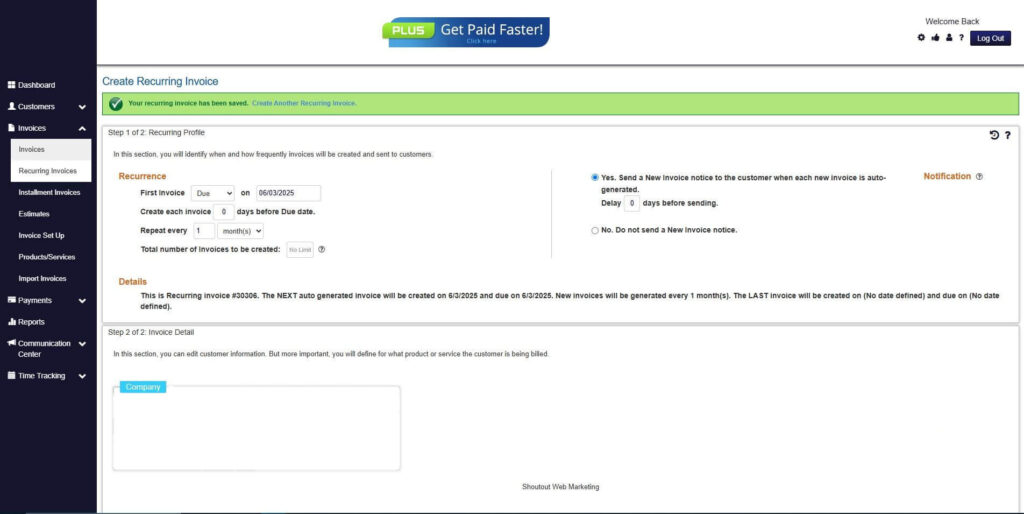

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Are digital return invoices legally acceptable?

Yes, digital return invoices are generally accepted as long as they meet local accounting and documentation requirements. In many cases, digital records provide stronger audit trails than paper-based invoices.

2. How long should digital return invoices be stored?

Most businesses retain return invoices for several years to comply with tax and audit regulations. Digital storage makes long-term record retention easier and more secure.

3. Can customers access digital return invoices online?

Yes, many billing systems allow customers to view or download digital return invoices through portals or email links. Easy access improves transparency and reduces follow-up questions.

Conclusion

Digital return invoices play a critical role in resolving billing disputes faster by improving accuracy, transparency, and communication. They eliminate many of the delays and errors associated with manual processes. This leads to quicker resolutions and stronger customer relationships.

For growing businesses, especially those using recurring billing models, digital return invoices are essential. They support scalable operations while maintaining trust and compliance. Investing in digital return invoice management is a strategic move toward better billing outcomes.