As businesses grow, return invoice management becomes increasingly complex. What once involved occasional corrections can quickly turn into a recurring operational challenge, especially for companies handling high transaction volumes or subscription-based billing. Without the right systems in place, return invoices can slow down finance teams, create customer frustration, and disrupt cash flow visibility.

Manual return invoice processes are no longer sustainable for modern businesses. Relying on spreadsheets, emails, or disconnected systems increases the risk of errors, delays, and inconsistent records. These issues become even more pronounced when returns span multiple billing cycles or involve recurring charges that need adjustments.

Automated billing plays a critical role in supporting long-term scalability. By standardizing workflows, reducing manual intervention, and improving accuracy, return invoice operations automation helps businesses stay agile, compliant, and prepared for future growth.

Table of Contents

ToggleWhat Are Return Invoices?

Return invoices are documents issued to correct or reverse previously billed transactions. They are commonly used when goods are returned, services are disputed, billing errors occur, or subscription charges need adjustment. Unlike standard invoices, return invoices modify existing financial records rather than creating new revenue.

It is important to distinguish return invoices from credit memos and refunds. Credit memos typically represent a balance applied to future charges, while refunds involve returning funds directly to the customer. Return invoices, on the other hand, provide a formal accounting record that adjusts the original invoice and ensures transaction accuracy.

Because return invoices directly impact revenue recognition, customer balances, and reporting, they require precise handling. Even small mistakes can lead to reconciliation issues, compliance risks, or customer disputes if not managed correctly.

Challenges of Manual Return Invoice Operations

High risk of data entry errors

Manual processing often leads to incorrect amounts, missing invoice references, or misapplied adjustments. These errors become harder to detect when return invoices involve partial returns or multiple line items.

Delayed processing and resolution times

Manual approvals, email-based communication, and spreadsheet tracking slow down return handling. Customers may experience long wait times before issues are resolved, which negatively affects trust and satisfaction.

Poor visibility across billing cycles

Tracking how a return invoice impacts future invoices, credits, or balances is difficult without automation. This lack of visibility increases the likelihood of overbilling or underbilling customers.

Inconsistent documentation and formatting

Manual processes often result in return invoices that look different depending on who created them. Inconsistent records complicate audits, reporting, and internal reviews.

Higher administrative workload and costs

Finance teams spend excessive time correcting mistakes, reconciling data, and answering customer inquiries, diverting resources away from higher-value financial analysis.

What Is Automated Billing?

Automated billing refers to systems that handle invoice creation, adjustments, payment collection, and recordkeeping with minimal manual input. These platforms use predefined rules and workflows to ensure billing consistency and accuracy across all transactions.

For return invoice handling, automated billing systems offer features such as invoice linking, automated calculations, validation checks, and centralized data storage. These capabilities reduce the need for repetitive tasks while improving reliability.

In modern financial operations, automation is essential. It allows finance teams to focus on oversight and strategy rather than manual corrections, while ensuring billing processes scale alongside business growth.

How Automated Billing Improves Return Invoice Accuracy

Automation significantly improves accuracy by eliminating repetitive data entry. Return invoices are automatically linked to the original invoices, ensuring that adjustments are based on verified data rather than manual inputs.

Consistent invoice formatting is another key benefit. Automated systems apply standardized templates and rules, ensuring return invoices include the correct references, descriptions, and calculations every time. This consistency simplifies audits and internal reviews.

Automated validation also reduces reconciliation errors. Built-in checks ensure totals, taxes, and balances align correctly, minimizing downstream accounting issues and improving overall data integrity.

Future-Proofing Return Invoice Operations

As transaction volumes increase, manual return invoice processes struggle to keep up. Automated billing systems are designed to scale, allowing businesses to process higher volumes of returns without increasing administrative workload.

Automation is especially valuable for companies with recurring billing or subscription models. It ensures that return invoices integrate smoothly with ongoing billing cycles, preventing disruptions to future charges or customer balances.

Regulatory requirements also evolve over time. Automated systems help businesses maintain compliance by preserving accurate records, audit trails, and standardized documentation as financial and tax regulations change.

Automation in Recurring Billing and Return Scenarios

Recurring billing introduces unique return scenarios, such as partial returns, prorated adjustments, or mid-cycle changes. Automated billing handles these situations by applying predefined rules that calculate adjustments accurately and consistently.

When returns affect future billing cycles, automation ensures updates flow through the system automatically. This prevents compounding errors that can occur when manual corrections are applied inconsistently over time.

Maintaining accurate customer account balances is another advantage. Automated updates ensure customers always see the correct balance, reducing confusion and improving trust.

Operational and Financial Benefits

Faster return invoice processing

Automation reduces the time needed to create, approve, and issue return invoices, allowing businesses to resolve billing issues quickly and efficiently.

Improved accuracy and consistency

Automated calculations and standardized templates ensure return invoices are correct every time, reducing disputes and reconciliation issues.

Better cash flow visibility

Real-time tracking shows how return invoices affect outstanding balances, revenue, and forecasts, helping finance teams make more informed decisions.

Lower operational costs

By minimizing manual effort, businesses reduce labor costs associated with corrections, follow-ups, and repetitive administrative tasks.

Stronger customer trust and transparency

Accurate, timely return invoices improve communication and reinforce customer confidence, especially in recurring billing relationships.

Best Practices for Implementing Automated Return Invoice Systems

Evaluate existing return workflows

Identify where errors, delays, or inconsistencies occur in the current process to ensure automation addresses real operational pain points.

Use standardized invoice templates and rules

Consistent formatting and predefined logic help ensure all return invoices meet accounting, compliance, and documentation requirements.

Integrate return invoices with recurring billing

Automation should connect return invoices directly to original and future invoices to prevent billing disruptions and compounding errors.

Establish review and exception handling processes

While automation reduces manual work, periodic reviews ensure rules remain accurate as pricing models or regulations change.

Train teams on automated workflows

Finance and operations teams should understand how automated return invoice processes work and how to manage exceptions when they arise.

How ReliaBills Supports Automated Return Invoice Management

ReliaBills simplifies return invoice operations by automating the creation, adjustment, and tracking of return invoices within a single centralized platform. Instead of relying on manual corrections or disconnected systems, businesses can link return invoices directly to the original transaction, ensuring accuracy and consistency from the start. This structured approach reduces data entry errors, shortens resolution times, and provides clear documentation for every return scenario.

For businesses that rely on recurring billing, ReliaBills plays a critical role in maintaining billing accuracy across ongoing cycles. Return invoices are automatically reflected in future invoices, customer balances, and payment schedules, preventing compounding errors that often occur in subscription or installment models. This ensures customers are billed correctly after returns or adjustments, while finance teams retain full visibility into how returns impact recurring revenue.

Beyond automation, ReliaBills supports smarter return invoice management through centralized reporting, audit-ready records, and automated customer communication. Businesses can track trends, monitor dispute resolution timelines, and maintain transparent records without increasing administrative workload. By combining automated return invoices with recurring billing and real-time reporting, ReliaBills helps businesses scale return invoice operations confidently while protecting cash flow and customer trust.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

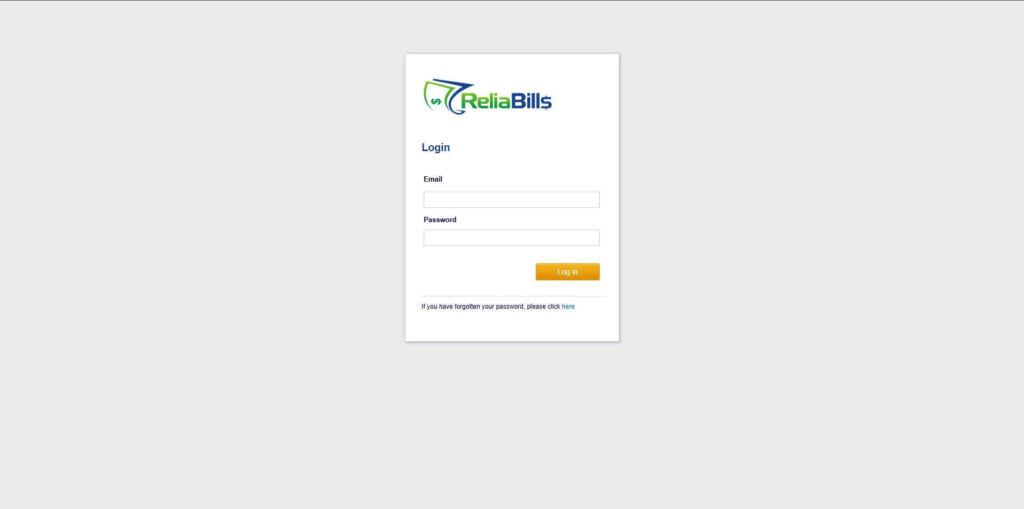

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

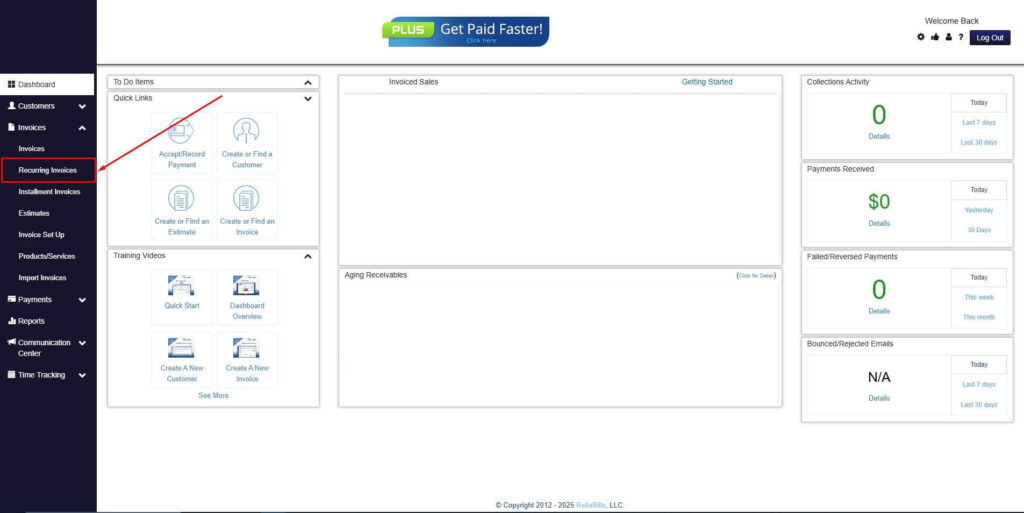

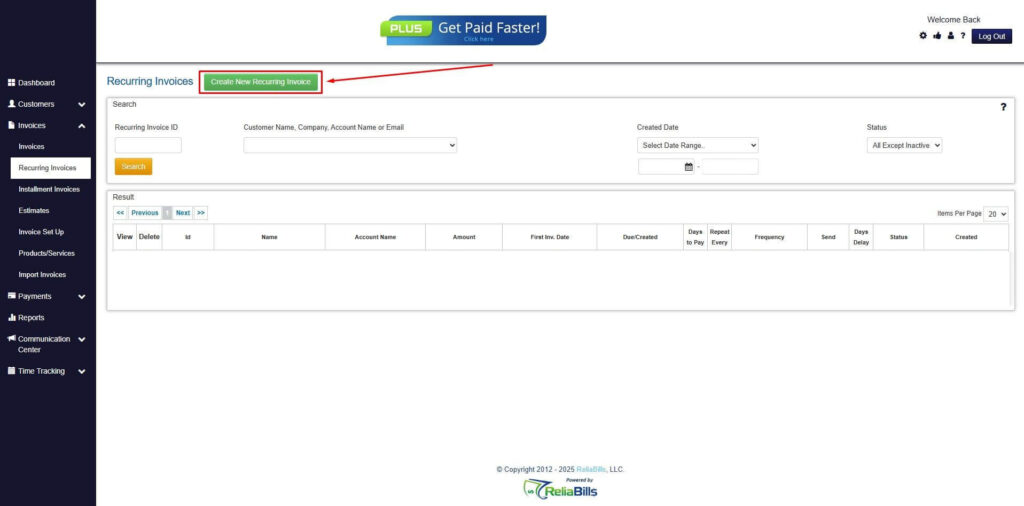

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

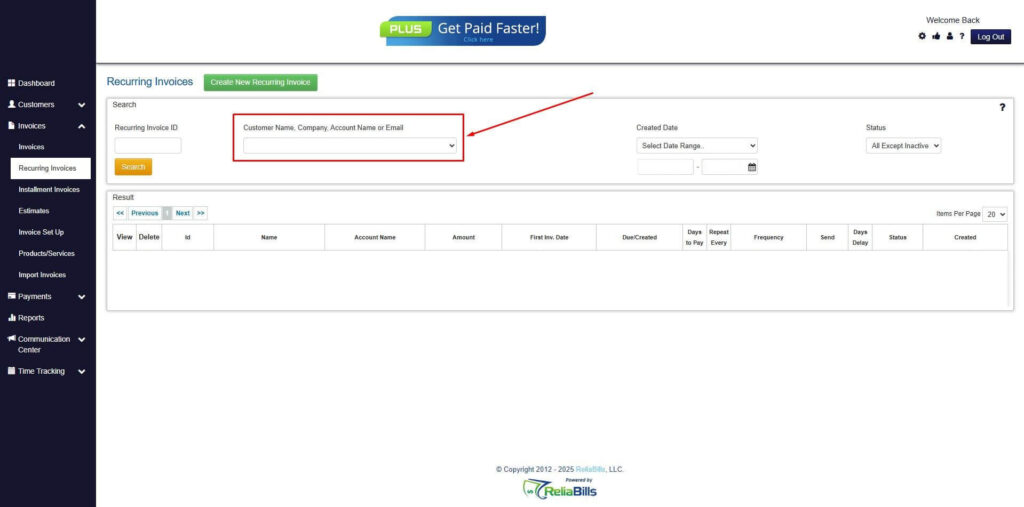

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

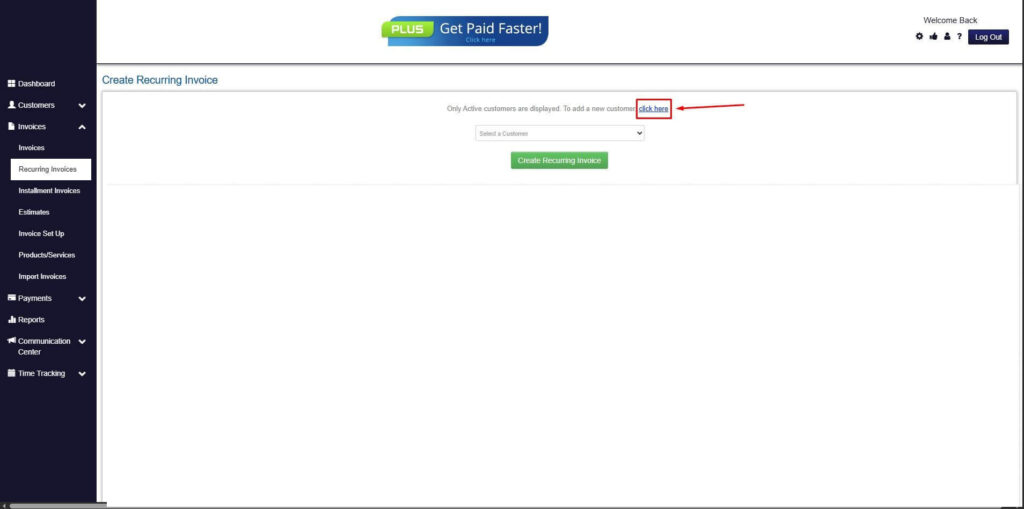

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

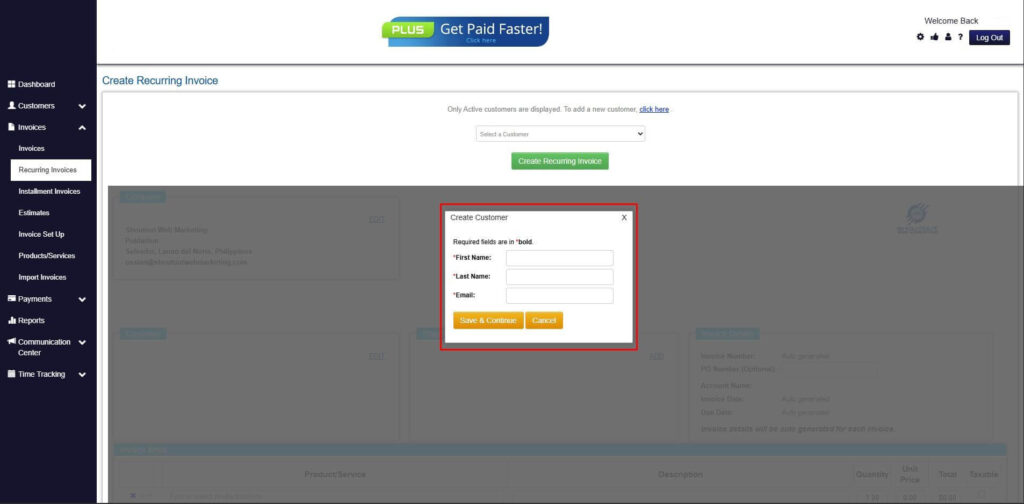

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

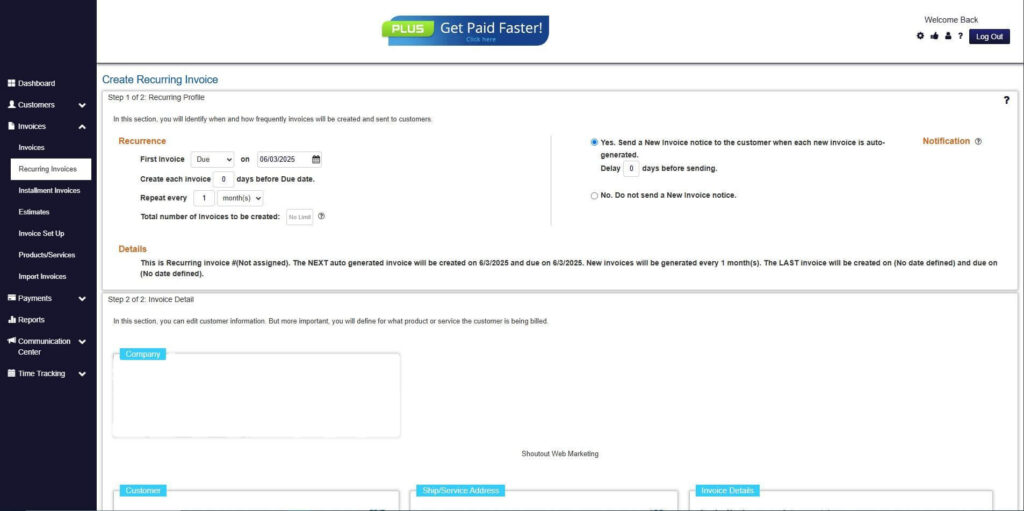

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

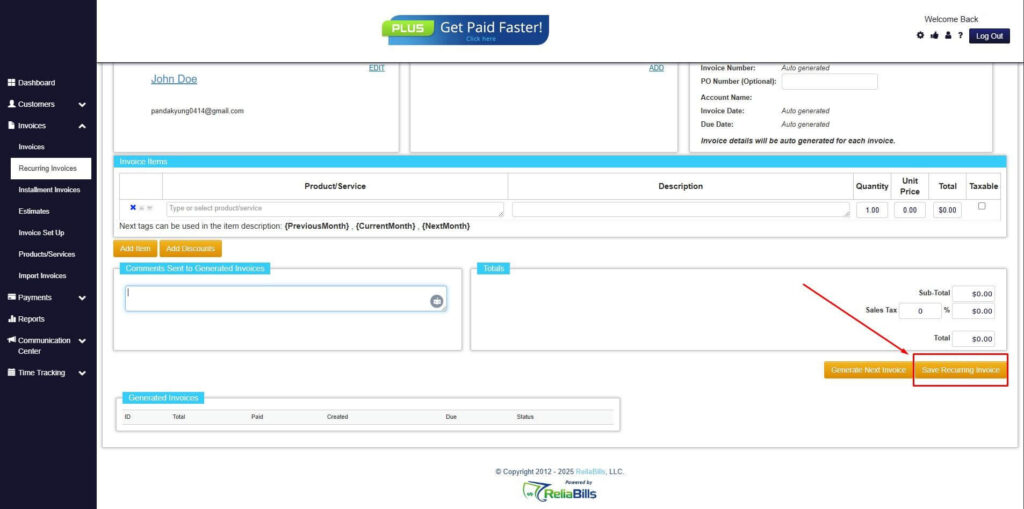

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

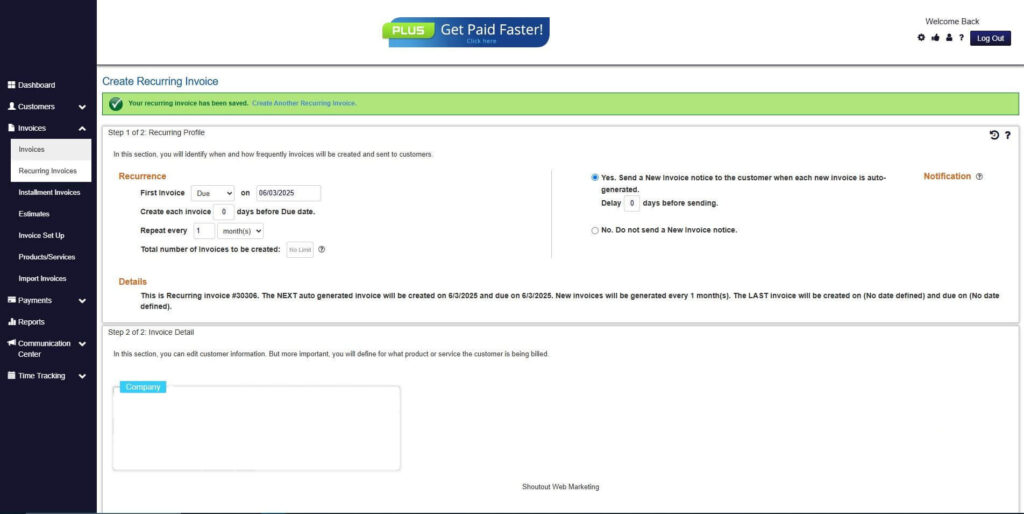

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Common Questions About Automated Return Invoicing

1. Can automation handle partial and complex returns?

Yes, modern billing systems can calculate prorated adjustments, partial returns, and recurring billing corrections accurately and consistently.

2. Is automated return invoicing secure?

Automated platforms use encryption, access controls, and compliance standards to protect sensitive financial and customer data.

3. How does automation affect audits and compliance?

Automation creates detailed audit trails and standardized records, making audits easier and improving regulatory readiness.

4. Will automation replace manual oversight completely?

No, automation reduces manual effort but still allows teams to review, approve, and manage exceptions when needed.

5. Is automated return invoicing suitable for small businesses?

Yes, automation helps small businesses reduce errors, save time, and scale operations without adding administrative complexity.

Conclusion

Return invoice operations automation is no longer optional for growing businesses. As transaction volumes increase and billing models become more complex, manual processes create unnecessary risk and inefficiency.

Automated billing improves accuracy, scalability, and visibility while supporting recurring billing and evolving compliance requirements. It enables businesses to handle returns efficiently without sacrificing customer experience or financial control.

By adopting future-ready solutions like ReliaBills, businesses can streamline return invoice management, reduce errors, and build a billing operation that scales confidently with growth.