Many businesses confuse a bill of sale and an invoice because both documents are commonly used during transactions. While they may appear similar on the surface, they serve very different purposes and carry different legal and accounting implications. Using the wrong document can lead to recordkeeping issues, payment confusion, or compliance problems.

Understanding the difference between a bill of sale vs invoice is especially important for growing businesses that handle multiple transaction types. Sales of assets, recurring services, and product deliveries each require the correct documentation to avoid disputes. Clear documentation also supports accurate financial reporting and audit readiness.

This guide explains what each document is used for, how they differ, and when businesses may need one or both. It also covers common mistakes and shows how billing software can simplify invoice management. By the end, businesses will be better equipped to choose the right document for each transaction.

Table of Contents

ToggleWhat Is a Bill of Sale?

A bill of sale is a legal document that confirms the transfer of ownership of goods or assets from one party to another. It serves as proof that a transaction has been completed and that ownership has changed hands. In many cases, it includes details such as the item description, sale date, purchase price, and buyer and seller information.

Bills of sale are commonly used in one-time transactions involving tangible assets. Examples include vehicle sales, equipment transfers, or the sale of high-value items. Once the document is signed, the transaction is considered final, and no further payment is expected.

From a legal perspective, a bill of sale protects both parties by clearly documenting the transfer. It may be required for registration, insurance, or regulatory purposes depending on the industry. Because of its legal weight, accuracy and completeness are essential.

What Is an Invoice?

An invoice is a financial document issued by a business to request payment for goods or services provided. It outlines what was delivered, how much is owed, and when payment is due. Unlike a bill of sale, an invoice does not confirm ownership transfer but instead initiates the payment process.

Invoices play a central role in billing and payment collection. They support accounts receivable management by tracking outstanding balances and payment timelines. Invoices are commonly used for product sales, professional services, and ongoing client engagements.

Across industries, invoices are used for both one-time and recurring transactions. Service providers, subscription businesses, and contractors rely on invoices to maintain consistent cash flow. When paired with automation, invoices become a powerful tool for financial control.

Bill of Sale vs Invoice: Key Differences

The primary difference between a bill of sale vs invoice lies in purpose and timing. A bill of sale confirms a completed transaction and ownership transfer, while an invoice requests payment for goods or services. One documents completion, while the other initiates payment.

Legally, a bill of sale often carries more weight as proof of ownership. An invoice, on the other hand, supports financial records and payment enforcement but does not transfer legal ownership on its own. This distinction matters in disputes, audits, and compliance reviews.

From an accounting perspective, invoices impact revenue recognition and cash flow tracking. Bills of sale may support asset records but are not typically used for ongoing receivables. Using each document correctly ensures clean financial reporting.

When Should You Use a Bill of Sale?

A bill of sale should be used for one-time sales involving assets or property. These transactions usually do not involve future payments or ongoing services. Once the sale is completed, the bill of sale serves as final documentation.

Businesses often rely on bills of sale when proof of ownership is required. Industries such as automotive, manufacturing, and equipment leasing commonly use them. The document helps protect both buyer and seller if questions arise later.

Because bills of sale represent completed transactions, they are not designed for payment follow-ups. They are best used when payment is made immediately or at the time of transfer. This makes them unsuitable for most recurring or service-based transactions.

When Should You Use an Invoice?

Invoices are ideal for product sales, services, and any transaction where payment is expected after delivery. They clearly define amounts owed, due dates, and payment terms. This makes them essential for managing accounts receivable.

For businesses offering ongoing services, invoices support recurring billing and subscription models. Regular invoicing ensures consistent payment schedules and predictable cash flow. Automation further reduces manual effort and late payments.

Invoices are also flexible enough to handle adjustments, credits, and partial payments. This makes them the preferred document for most modern business transactions. When payments are not immediate, invoices provide structure and accountability.

Can a Business Use Both?

Many businesses use both bills of sale and invoices depending on the transaction type. For example, a company may issue a bill of sale for an equipment transfer and invoices for ongoing maintenance services. Each document serves a distinct purpose.

Using both documents together can improve documentation consistency. A bill of sale confirms ownership transfer, while an invoice handles payment tracking. This approach is common in industries that sell products and provide services.

Best practice is to clearly define when each document should be used. Standardizing workflows reduces confusion and ensures accurate records. Businesses benefit from documenting these rules internally.

Accounting and Tax Implications

Bills of sale and invoices affect financial reporting differently. Invoices contribute to revenue tracking, accounts receivable, and cash flow analysis. Bills of sale may support asset records but typically do not drive receivables.

From a tax perspective, invoices often include tax calculations and support tax filings. Bills of sale may still be required for certain tax or registration purposes, depending on the jurisdiction. Understanding these differences helps businesses stay compliant.

Accurate documentation also supports audits and regulatory reviews. Using the correct document ensures financial data aligns with transaction intent. This reduces risk during inspections or financial evaluations.

Common Mistakes Businesses Make

Using the wrong document for the transaction

Many businesses issue invoices when a bill of sale is required or vice versa. This can create confusion regarding ownership, payment expectations, and legal protection. For instance, selling equipment without a bill of sale may leave ownership disputes unresolved, while using a bill of sale for a service can complicate accounts receivable tracking.

Missing essential details

Omitting key information like dates, item descriptions, buyer and seller details, payment terms, or amounts can invalidate the document or cause errors during accounting, audits, or compliance checks. Invoices without proper details can delay payment or create reconciliation challenges.

Poor record management

Businesses that store documents inconsistently or rely solely on manual filing often struggle to locate transactions during audits or customer disputes. Without a central system, tracking payment history, ownership, or recurring billing becomes inefficient.

Reusing templates incorrectly

Copying a previous invoice or bill of sale without updating transaction-specific details can cause misstatements, duplicate entries, or incorrect ownership documentation. Reused templates increase the risk of compliance or accounting errors.

Neglecting legal or tax implications

Failing to distinguish between invoices and bills of sale may affect tax reporting, revenue recognition, and regulatory compliance. Certain jurisdictions require bills of sale for asset transfers, while invoices may include necessary tax details for sales and services.

Best Practices for Choosing the Right Document

Match the document to the transaction type

Use a bill of sale for one-time asset transfers that require proof of ownership and an invoice for requesting payment for goods or services. Clarifying this from the start ensures legal and financial accuracy.

Standardize documentation workflows

Create internal policies that define when to use bills of sale versus invoices. Standardization reduces errors, supports training for staff, and ensures consistent application across all transactions.

Include all necessary details

Both bills of sale and invoices should contain complete transaction information, such as buyer and seller names, item descriptions, dates, prices, payment terms, and signatures if needed. This prevents disputes and ensures compliance.

Implement review and approval steps

Have a process for reviewing each document before issuance. This includes checking accuracy, validating transaction type, and confirming any legal or tax requirements are met.

Leverage technology and automation

Use billing software to create templates and automate recurring invoices. Automated workflows can apply correct labels, pre-fill essential fields, and track payment or ownership status, reducing human error and saving time.

How ReliaBills Streamlines Invoice and Bill of Sale Management

ReliaBills makes managing both invoices and bills of sale effortless for businesses of any size. By centralizing all documents in one platform, you can generate, track, and organize invoices and bills of sale with ease. Automated templates ensure that every document includes the correct details, reducing the risk of errors and misclassification. This helps businesses maintain accurate financial records while keeping transactions professional and compliant.

With recurring billing support, ReliaBills is ideal for businesses with subscription-based services or repeat transactions. You can schedule invoices to be automatically sent at the right time, ensuring clients never miss a payment. At the same time, asset transfers documented through bills of sale can be linked to invoices for easy reference, giving businesses full visibility over all transactions.

ReliaBills also improves financial control through centralized tracking, reporting, and reminders. You can quickly see which invoices are paid, pending, or overdue, and send automated notifications to customers, minimizing follow-ups. Detailed reports help with cash flow planning, audit readiness, and compliance with tax or legal requirements. By combining automation, recurring billing, and real-time tracking, ReliaBills ensures businesses save time, reduce errors, and streamline the management of both invoices and bills of sale.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

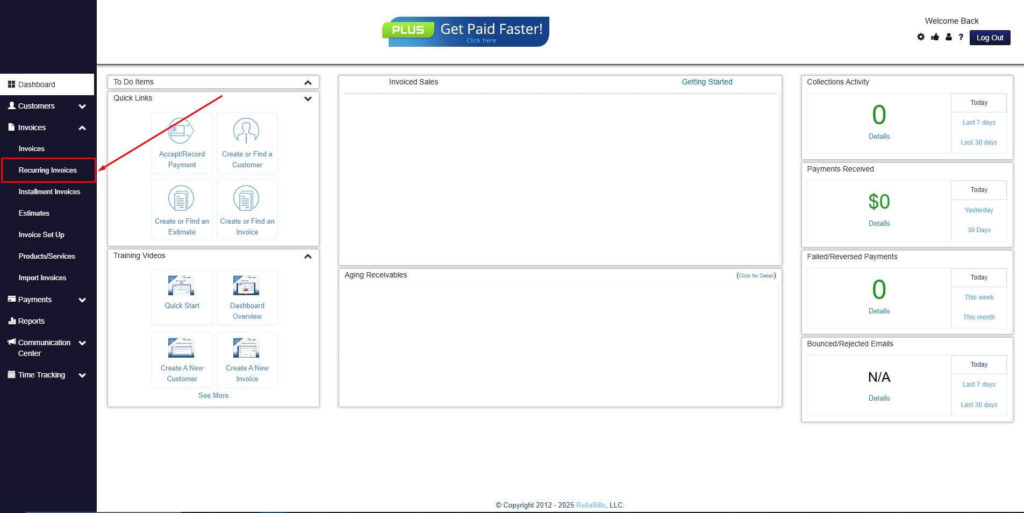

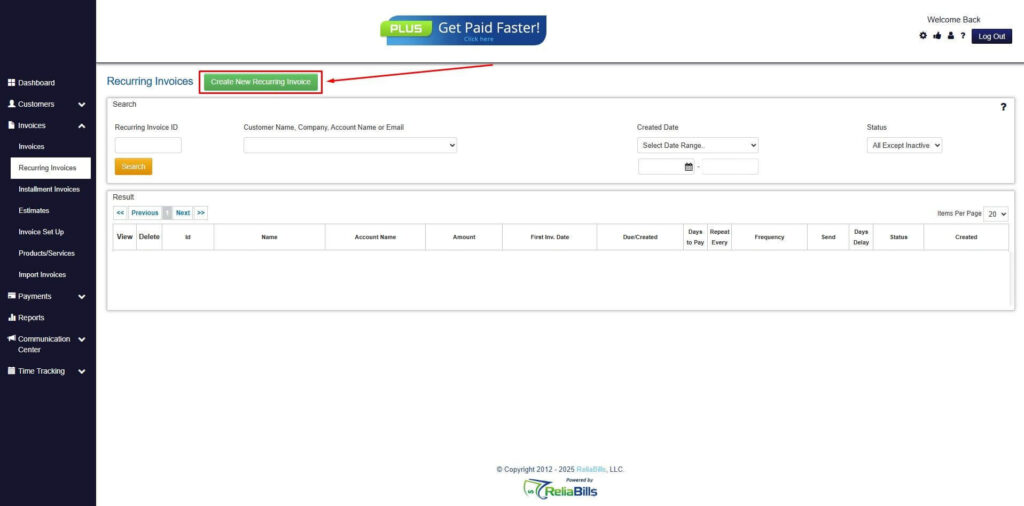

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

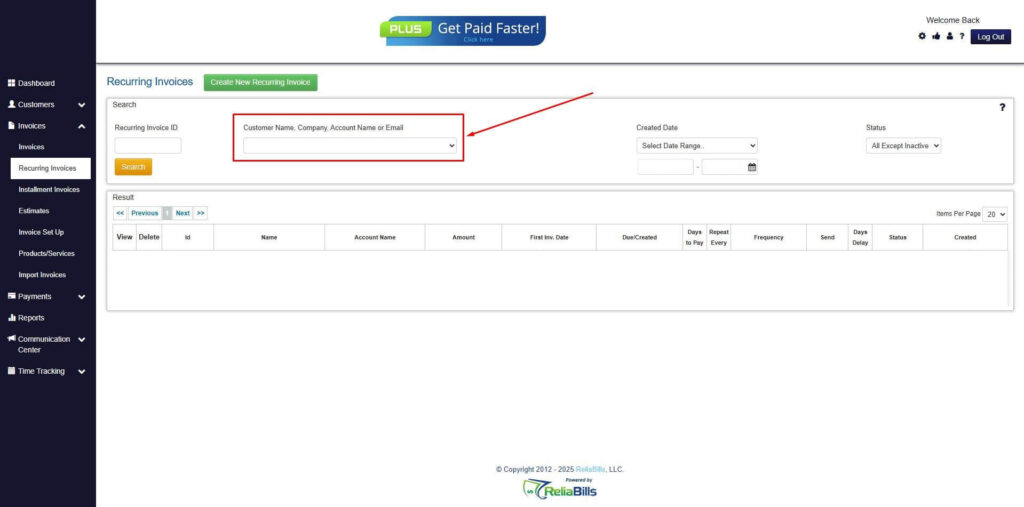

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

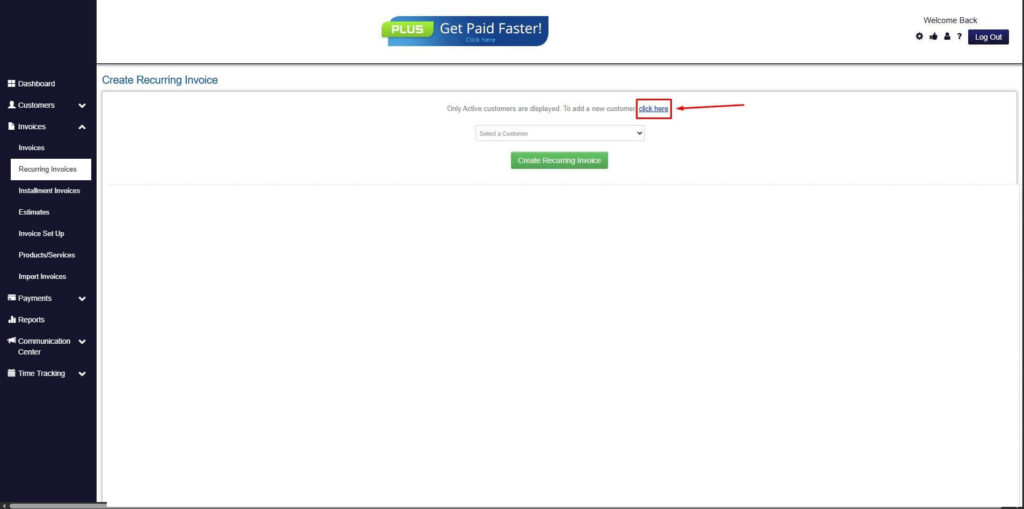

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

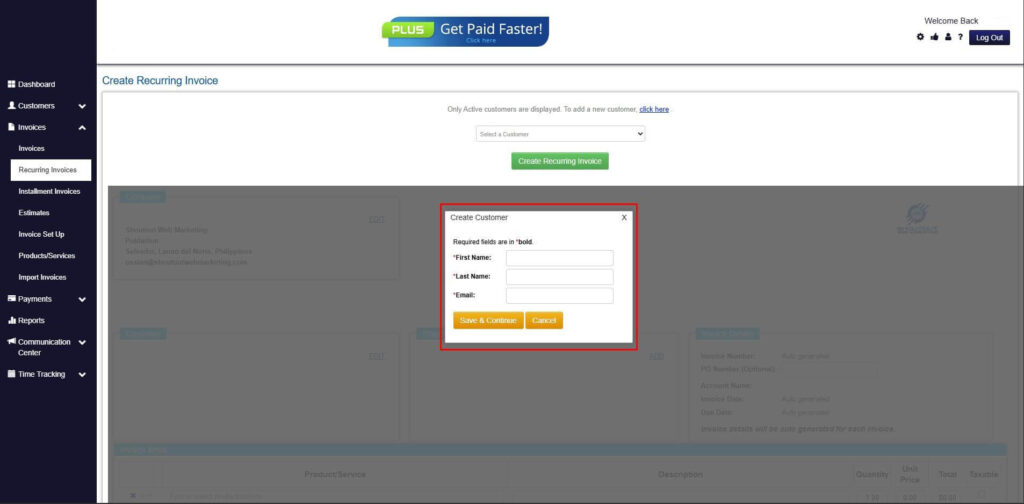

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

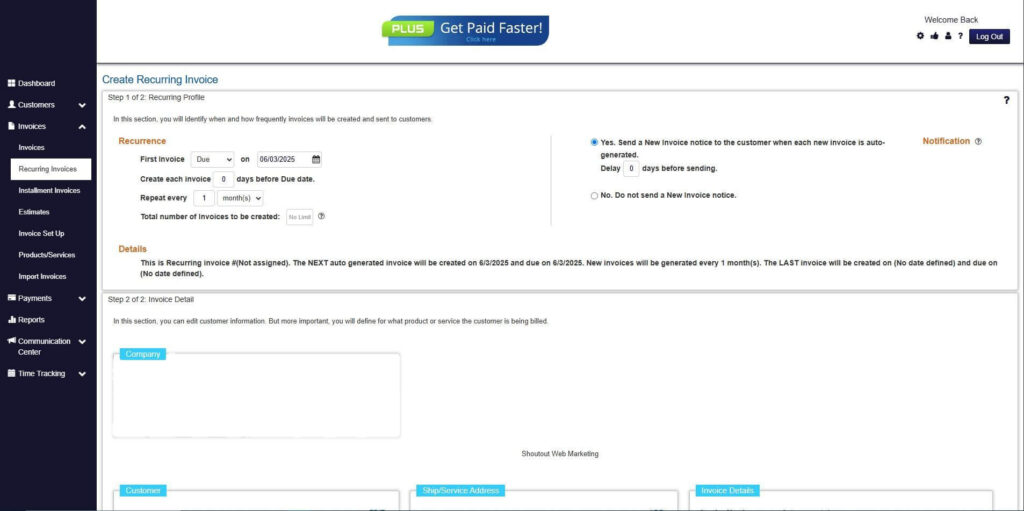

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

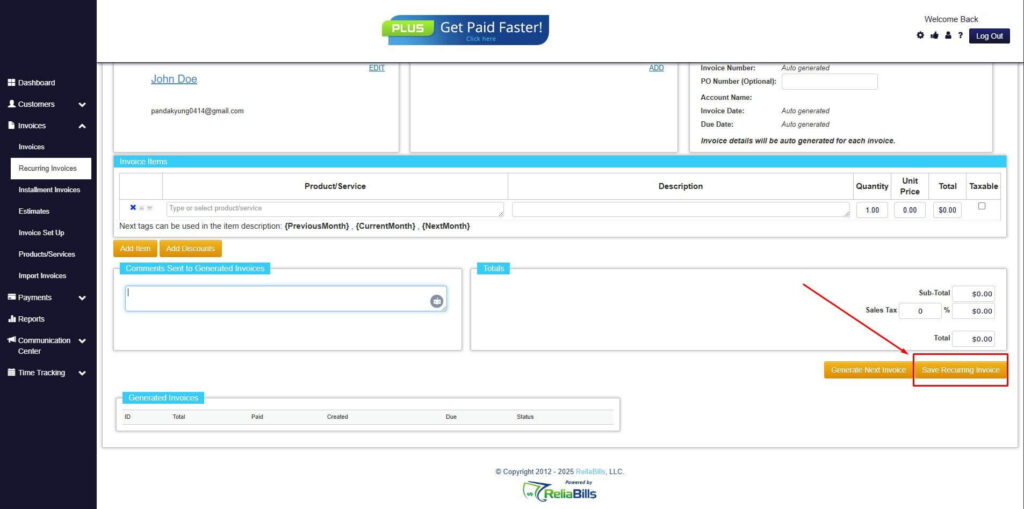

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

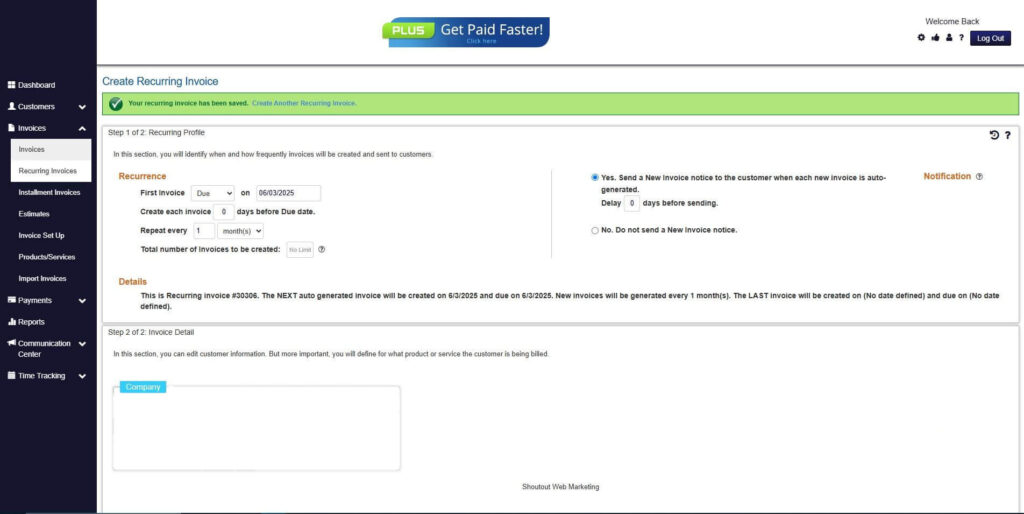

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is a bill of sale the same as a receipt?

No. A receipt confirms that payment has been made, while a bill of sale documents the transfer of ownership. Both serve different legal and accounting purposes.

2. Can an invoice serve as proof of ownership?

Generally, no. Invoices indicate the amount owed and payment terms, but they do not legally transfer ownership of assets. A bill of sale is typically required for that purpose.

3. Do service businesses need a bill of sale?

Usually not. Service businesses primarily rely on invoices to request and track payments. Bills of sale are mainly relevant for transactions involving tangible assets.

4. Can automation reduce misclassification errors?

Yes. Automated billing software can assign invoice types based on transaction details, enforce consistent rules, and track recurring billing. This minimizes the risk of issuing the wrong document.

5. Can the same customer receive both document types?

Absolutely. Businesses can issue bills of sale for one-time asset sales and invoices for ongoing services or subscription payments. Proper tracking ensures each document serves its intended purpose without conflict.

Conclusion

Understanding the difference between a bill of sale vs invoice is essential for accurate documentation and financial management. Each document serves a specific role and should be used appropriately. Using the wrong one can lead to legal, accounting, and payment issues.

Invoices support billing, payment collection, and recurring revenue, while bills of sale confirm ownership transfers. Many businesses benefit from using both in different scenarios. Clear policies help ensure consistency.

By choosing the right document and leveraging billing tools like ReliaBills, businesses can improve accuracy, cash flow, and operational efficiency. Proper documentation lays the foundation for sustainable growth.