Payroll is one of the most sensitive operational functions in any small business. Employees expect to be paid accurately and on time, while governments require strict compliance with tax and reporting rules. Even a small payroll mistake can damage employee trust and create unnecessary financial penalties. For many owners, payroll becomes a recurring source of stress rather than a routine task.

As a business grows, payroll quickly becomes more complex, time consuming, and risky to manage manually. New hires, overtime rules, benefits deductions, and tax changes all add layers of responsibility. What once took an hour can turn into a full day of work each pay period.

Outsourcing your payroll has become a strategic decision rather than a last resort. Small businesses are increasingly turning to payroll service providers to reduce administrative burden, minimize compliance exposure, and improve operational efficiency. This approach allows owners to focus on running the business instead of navigating payroll regulations.

This guide explains how payroll outsourcing works, when it makes sense, what to look for in a provider, and how to prepare your business for a successful transition. It also explores how stable cash flow and automated billing systems support payroll reliability. By the end, you will have a clear framework for deciding if outsourcing your payroll is right for your business.

Table of Contents

ToggleWhat Is Payroll Outsourcing?

Payroll outsourcing involves delegating payroll related tasks to a third party provider that specializes in payroll processing and compliance. These providers use automated systems and expert oversight to ensure payroll is handled correctly each pay cycle. This reduces reliance on manual calculations and internal guesswork.

Typically, payroll outsourcing includes calculating employee wages, managing tax withholdings, processing direct deposits or checks, filing payroll tax forms, and maintaining payroll records. Many providers also support benefits deductions, garnishments, and year end reporting. This creates a single, consistent system for all payroll activities.

The key difference between in house payroll and outsourcing is accountability. Instead of relying on internal staff who may lack specialized expertise, businesses gain access to dedicated payroll professionals and systems designed to reduce errors and ensure compliance. This shift often improves both accuracy and confidence in payroll operations.

Why Small Businesses Choose to Outsource Payroll

Time savings is often the first benefit business owners notice. Payroll processing involves repetitive tasks, strict deadlines, and frequent interruptions. Outsourcing removes this burden and frees up internal resources for revenue generating work.

Compliance risk reduction is another major driver. Payroll regulations change frequently, and penalties for mistakes can be costly and time consuming to resolve. Payroll providers actively monitor regulatory updates and apply them automatically.

Accuracy and consistency also improve with outsourcing. Automated calculations and standardized workflows reduce manual entry mistakes, missed filings, and delayed payments. Over time, this leads to higher employee satisfaction and fewer payroll related disputes.

When Should a Small Business Outsource Payroll?

Payroll outsourcing becomes more valuable as employee headcount increases. Even adding a few employees can introduce new tax rules, benefits deductions, and reporting requirements. These changes can quickly overwhelm small internal teams.

Businesses facing increasing regulatory complexity should also consider outsourcing. Multi state operations, remote employees, and contractor classifications add layers of compliance that are difficult to manage manually. Outsourcing helps ensure these obligations are handled correctly.

Limited internal capacity is another signal. If payroll responsibilities are handled by owners or staff without payroll expertise, outsourcing provides stability and reduces reliance on individual knowledge. This also protects the business if key employees leave.

How Payroll Outsourcing Works

The process begins with onboarding and setup. The payroll provider collects employee data, tax registrations, pay schedules, and historical payroll records. Accurate data transfer is critical to avoid future discrepancies.

Once operational, payroll follows a consistent workflow. Employers submit hours or salary updates, review payroll summaries, and approve processing. This approval step maintains control while reducing hands on work.

Ongoing compliance management is a core benefit. Providers manage tax deposits, quarterly filings, and year end forms automatically. This reduces missed deadlines and helps businesses remain audit ready.

What to Look for in a Payroll Outsourcing Provider

When evaluating a payroll outsourcing provider, businesses should look beyond basic processing and focus on long-term reliability, compliance, and scalability.

Payroll and Compliance Expertise

The provider should demonstrate deep knowledge of federal, state, and local payroll regulations. This includes tax withholding rules, filing deadlines, and reporting requirements that frequently change. A strong provider proactively updates systems to reflect regulatory changes, reducing compliance risk for your business.

Data Security and Confidentiality

Payroll data contains highly sensitive employee information. Look for providers that use encryption, secure data storage, role-based access controls, and regular security audits. Transparency around data protection policies is a strong indicator of professionalism.

Accuracy and Error Resolution Processes

Ask how payroll errors are handled if they occur. Reputable providers have documented correction procedures, clear accountability, and responsive support teams. Fast resolution minimizes disruption to employees and avoids compliance penalties.

Reporting and Transparency

Payroll reports should be easy to access and understand. Providers should offer clear payroll summaries, tax reports, and historical records. Transparency helps business owners maintain oversight and make informed financial decisions.

Scalability and Flexibility

Your payroll needs will change as your business grows. The provider should support additional employees, multi-state payroll, and changing pay structures without disruption. Scalability prevents the need to switch providers later.

Customer Support and Responsiveness

Payroll issues are time-sensitive. Reliable providers offer responsive customer support with knowledgeable representatives. Clear communication channels and support availability are critical during payroll cycles.

Payroll Outsourcing Costs

Payroll outsourcing costs vary by provider and service level. Common pricing models include per employee per pay period fees or flat monthly subscriptions. Understanding how pricing scales is essential as your business grows.

Hidden fees can significantly increase costs if contracts are not reviewed carefully. Charges for tax filings, off cycle payrolls, or setup services are common pitfalls. Asking for a full fee breakdown upfront helps avoid surprises.

When evaluating costs, businesses should consider indirect savings. Reduced labor hours, fewer errors, and avoided penalties often outweigh the monthly service fee. Outsourcing can be cost effective when viewed holistically.

Pros and Cons of Outsourcing Payroll

Outsourcing payroll offers clear advantages, but it also comes with considerations that businesses should evaluate carefully.

Pros of Outsourcing Payroll

- Reduced Administrative Burden

Payroll processing involves repetitive tasks and strict deadlines. Outsourcing eliminates much of this work, freeing internal staff to focus on core business operations. - Improved Compliance and Reduced Risk

Payroll providers specialize in regulatory compliance. Their systems and expertise help reduce the risk of missed filings, incorrect tax payments, and costly penalties. - Increased Accuracy and Consistency

Automated calculations and standardized workflows reduce manual errors. This leads to fewer payroll disputes and more consistent employee payments. - Business Continuity and Reliability

Outsourcing reduces reliance on a single internal employee. Payroll continues uninterrupted even during staff turnover, vacations, or unexpected absences.

Cons of Outsourcing Payroll

- Reduced Direct Control Over Execution

While employers retain decision-making authority, execution is handled externally. This may feel uncomfortable for businesses used to managing payroll internally. - Dependence on a Third Party

Service quality depends on the provider’s reliability. Poor communication or slow issue resolution can create frustration if expectations are not clearly defined. - Costs for Additional Services

Some providers charge extra for off-cycle payrolls, corrections, or additional reports. Understanding pricing structures upfront is essential to avoid unexpected costs.

Preparing Your Business to Outsource Payroll

Preparation starts with organizing payroll data. Employee details, tax registrations, pay rates, and historical records should be reviewed for accuracy. Clean data reduces onboarding delays.

Internal payroll policies should be documented clearly. This includes approval processes, pay schedules, overtime rules, and benefits deductions. Clear policies ensure consistency once payroll is outsourced.

Employee communication is critical. Informing staff about changes to payroll processing builds trust. It also helps avoid confusion during the transition period.

Managing Payroll Cash Flow

Payroll obligations are fixed and time sensitive. Cash flow disruptions can delay payments and damage employee morale. Consistency is essential for payroll confidence.

Predictable revenue plays a key role in payroll planning. Businesses with irregular income often struggle to align payroll schedules with available funds. This creates unnecessary financial pressure.

Automated billing and recurring payments help stabilize cash flow. Better revenue visibility allows businesses to plan payroll funding more effectively. This reduces last minute financial stress.

Common Mistakes to Avoid

Avoiding these common mistakes can significantly improve the success of outsourcing your payroll.

Choosing a Provider Based on Price Alone

Low-cost providers may lack robust compliance support, security measures, or customer service. Payroll errors can quickly outweigh short-term cost savings.

Failing to Review Contracts and Service Agreements

Many issues arise from unclear responsibilities. Businesses should carefully review service level agreements, error correction policies, and compliance accountability before signing.

Providing Incomplete or Inaccurate Payroll Data

Poor data quality during onboarding often leads to payroll issues later. Employee information, tax details, and pay rates should be verified before outsourcing begins.

Assuming Payroll Is Completely Hands-Off

Outsourcing does not eliminate oversight. Employers should still review payroll summaries, monitor reports, and stay informed about payroll activity.

Ignoring Cash Flow Planning

Even with outsourced payroll, sufficient funds must be available on payroll dates. Businesses that do not align revenue collection with payroll cycles risk payment delays.

Lack of Ongoing Performance Reviews

Payroll providers should be reviewed periodically. Monitoring accuracy, responsiveness, and reporting quality ensures the service continues to meet business needs.

How ReliaBills Supports Payroll Readiness

ReliaBills helps small businesses stay prepared for payroll by streamlining invoicing and payment collection. Automated invoice creation and follow-ups reduce late payments, ensuring funds are available when payroll is due. By improving billing efficiency, businesses can manage employee wages with confidence and reduce cash flow uncertainty.

Recurring billing with ReliaBills provides predictable revenue streams, making it easier to align pay periods with incoming cash. Business owners gain better visibility into which invoices are paid, pending, or overdue, allowing for more accurate payroll forecasting. This centralized tracking also supports decision-making for outsourcing payroll or planning team expansions.

By reducing manual billing tasks and increasing payment reliability, ReliaBills allows small businesses to focus on growth instead of reacting to cash shortfalls. Automated workflows, recurring billing, and real-time insights ensure that payroll obligations are met consistently, giving owners greater financial control and peace of mind.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

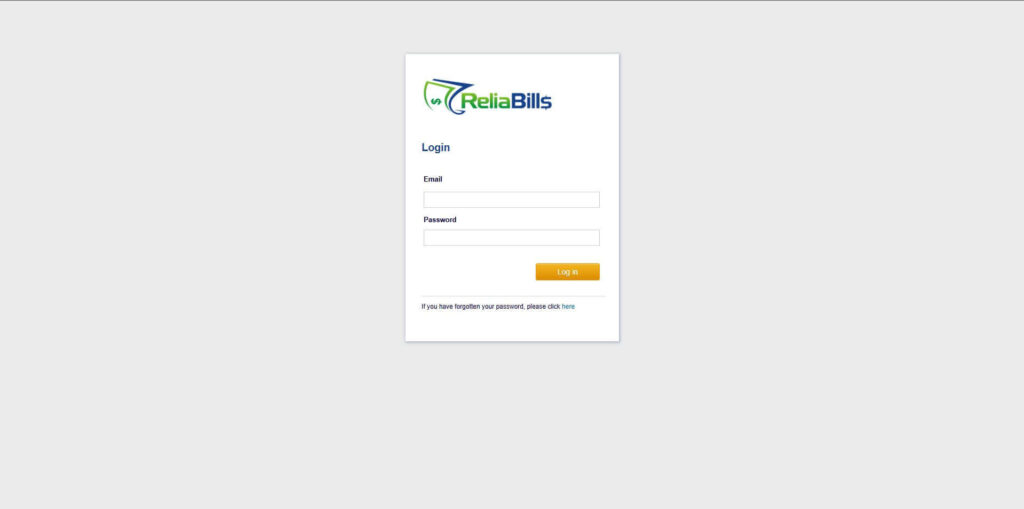

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

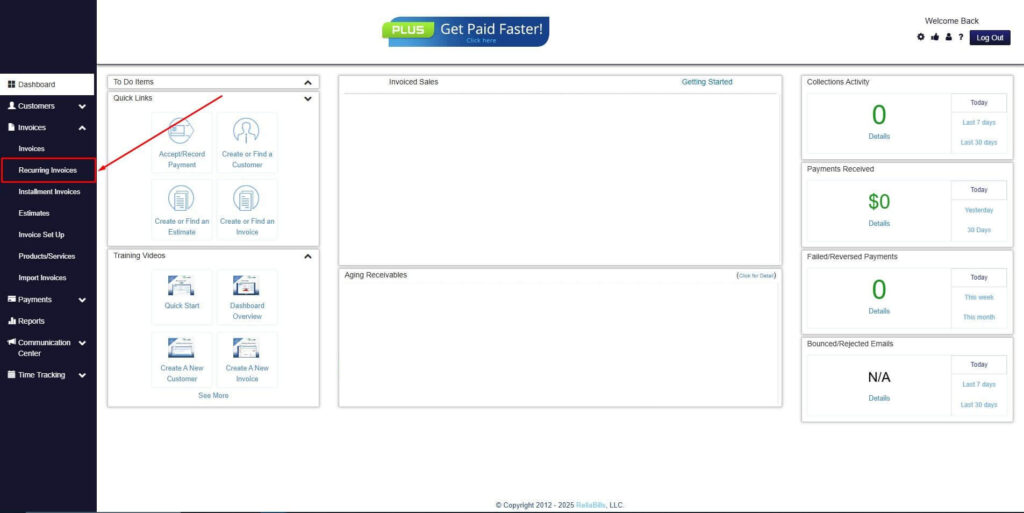

Step 2: Click on Recurring Invoices

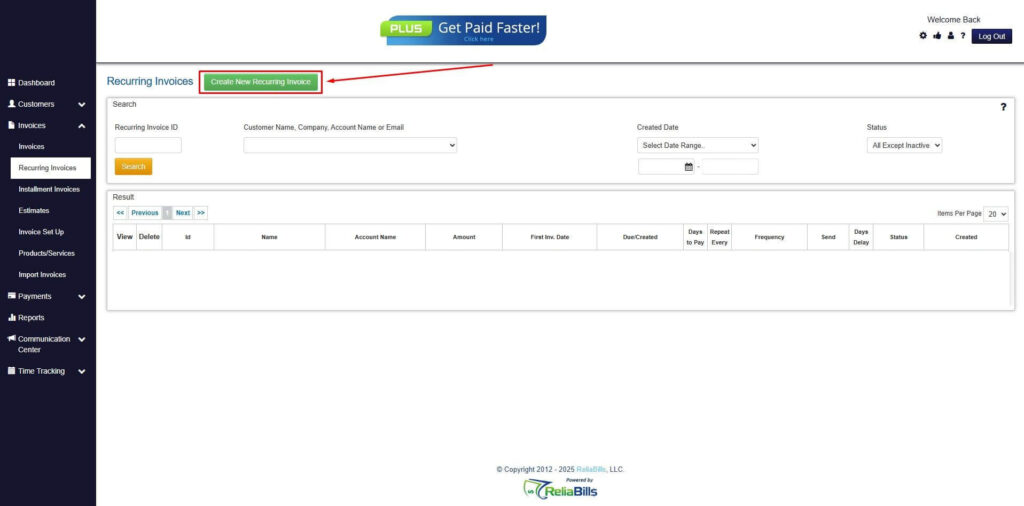

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

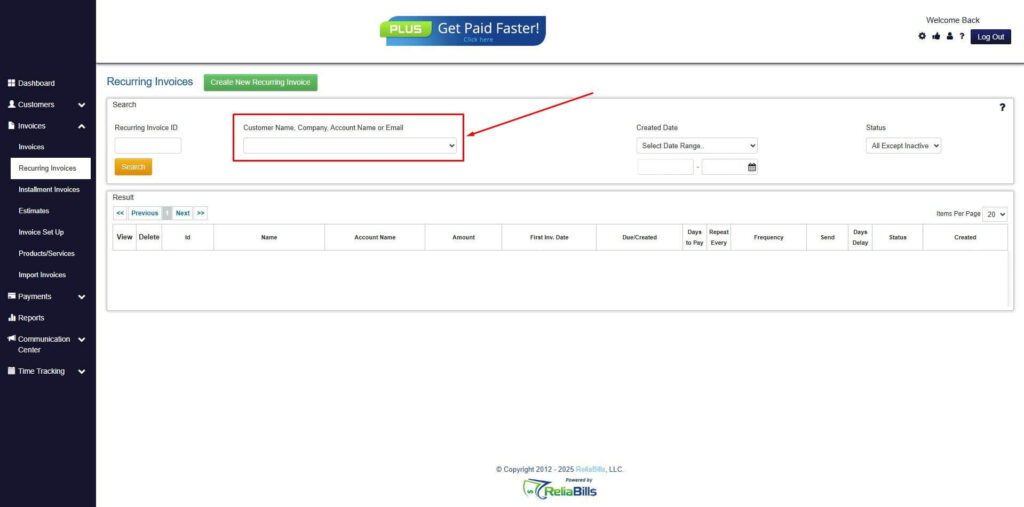

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

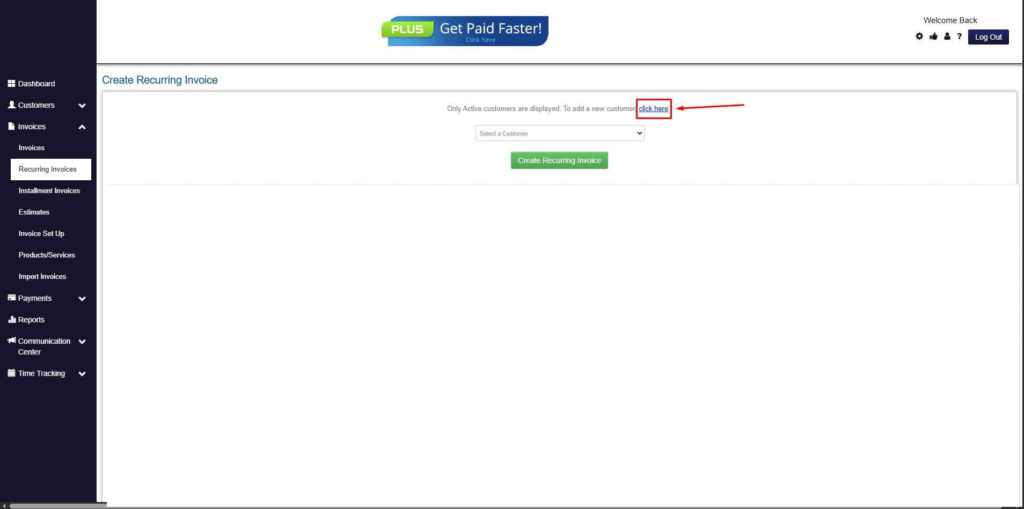

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

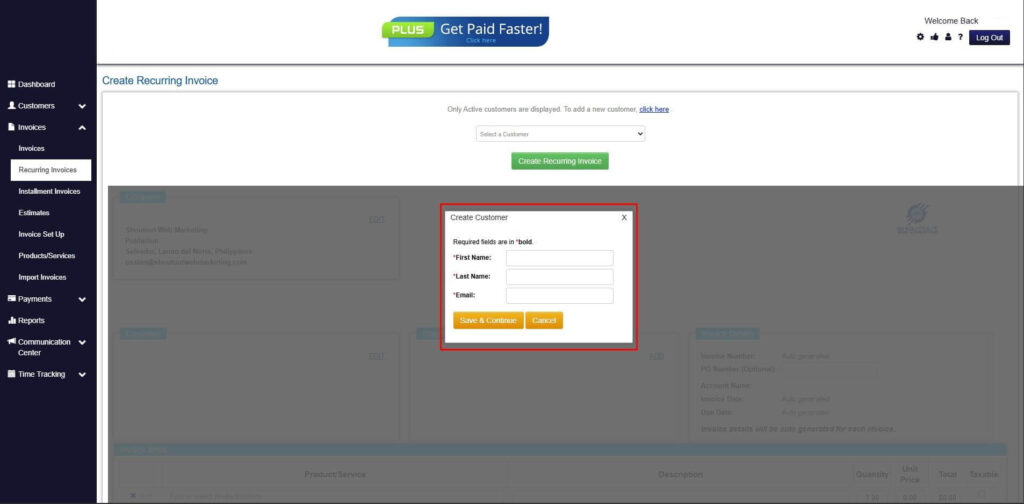

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

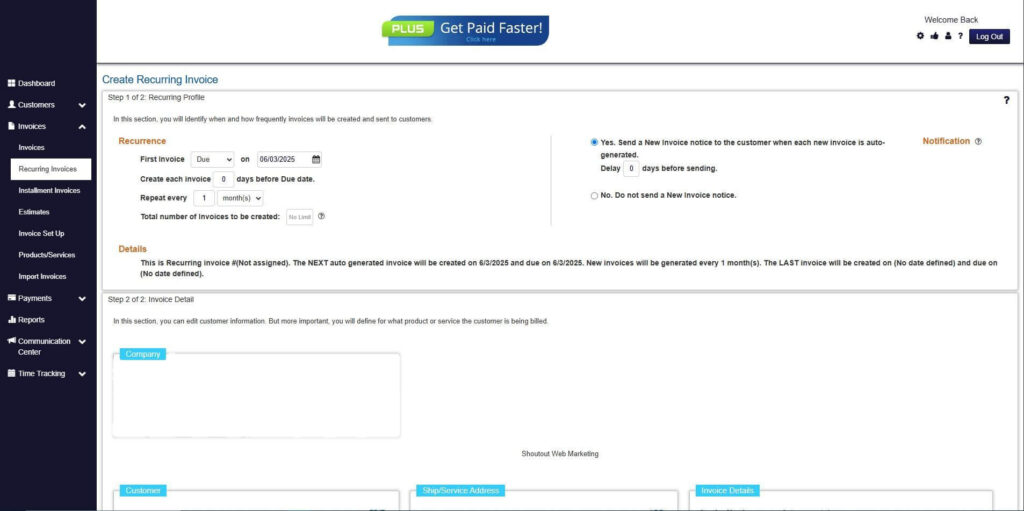

Step 7: Fill in the Create Recurring Invoice Form

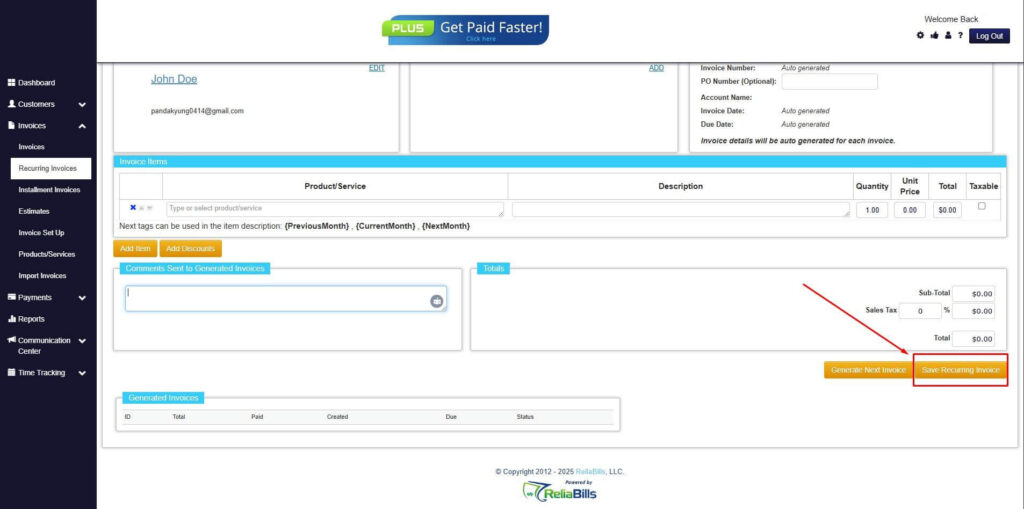

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

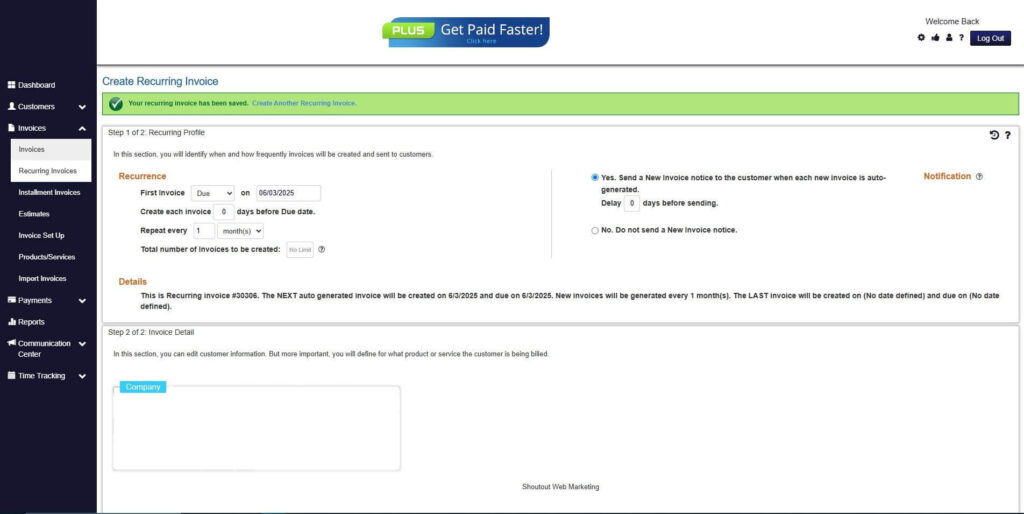

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is payroll outsourcing secure?

Reputable providers use advanced security measures and compliance standards. Businesses should confirm certifications and data protection policies before signing.

2. Can small businesses still control payroll decisions?

Yes. Employers retain control over pay rates, schedules, and approvals. Outsourcing handles execution, not decision making.

3. How long does it take to switch payroll providers?

Most transitions take two to four weeks. Timing depends on payroll cycles and data readiness.

4. What happens if payroll errors occur?

Most providers offer correction support and guidance. Accountability should be clearly outlined in the service agreement.

Conclusion

Outsourcing your payroll is a practical strategy for small businesses seeking efficiency, accuracy, and compliance. It reduces administrative strain while improving payroll reliability. This allows owners to focus on growth instead of processing details.

Success depends on choosing the right provider and preparing internal data. Strong cash flow management further supports payroll stability. These elements work together to reduce risk.

By combining payroll outsourcing with tools like ReliaBills, small businesses gain better revenue visibility and predictability. This creates a stronger financial foundation for paying employees on time and with confidence.