Shipping terms play a critical role in invoicing, especially when goods need to move from a seller to a buyer. One of the most commonly misunderstood terms is FOB, which often causes confusion around shipping costs, liability, and ownership. Understanding what does FOB mean on an invoice helps businesses avoid disputes and set clear expectations with customers.

Many billing issues arise because FOB terms are added without fully explaining what they cover. Buyers and sellers may assume different responsibilities, leading to disagreements over freight charges or damaged goods. This guide explains FOB in simple terms so businesses can use it correctly and confidently.

By the end of this article, you will understand how FOB works, the different types of FOB terms, and how to show them properly on an invoice. You will also learn how accurate invoicing and automation can reduce shipping related errors.

Table of Contents

ToggleWhat Does FOB Mean?

FOB stands for Free On Board or Freight On Board, depending on the context of the shipment. It is a shipping term that defines when ownership and responsibility for goods transfer from the seller to the buyer. FOB is commonly used in both domestic and international trade and appears frequently on invoices.

The term originated in maritime shipping, where goods were considered transferred once loaded onto a vessel. Over time, its use expanded to trucking, rail, and air shipments. Today, FOB helps clarify who pays for shipping and who assumes risk during transit.

When FOB is listed on an invoice, it sets expectations for both parties involved. Without it, disagreements can arise over freight charges, insurance, or delivery responsibility.

Why FOB Is Important on an Invoice

FOB terms clearly define who is responsible for shipping costs, which directly affects invoice totals. This clarity helps buyers understand what they are paying for and prevents unexpected charges after delivery. Sellers also benefit by limiting disputes over freight expenses.

Another important function of FOB is defining when risk transfers from seller to buyer. If goods are damaged or lost during shipping, FOB determines which party bears that risk. This distinction is especially important for insurance and claims.

Including FOB terms on invoices also supports better accounting and compliance. Clear shipping terms help businesses recognize revenue correctly and maintain accurate records.

Types of FOB Terms

FOB Origin

Ownership and responsibility for the goods transfer to the buyer as soon as the shipment leaves the seller’s location. The buyer pays for shipping, insurance, and assumes risk during transit. This term is commonly used in B2B transactions where buyers manage their own logistics or negotiate freight separately.

FOB Destination

Ownership and risk remain with the seller until the goods are delivered to the buyer’s specified location. The seller covers shipping costs and is responsible for any damage or loss during transit. This option is often preferred by buyers because it simplifies billing and reduces uncertainty around delivery.

FOB Origin, Freight Prepaid

Ownership transfers at shipment, but the seller initially pays the freight cost and may pass it on to the buyer later. This approach is sometimes used to simplify logistics while still shifting risk early. Clear invoice wording is essential to avoid confusion.

FOB Destination, Freight Collect

Ownership transfers upon delivery, but the buyer pays the freight charges directly to the carrier. This structure requires precise documentation so both parties understand their responsibilities. It is less common but still used in negotiated agreements.

FOB Origin Explained

FOB Origin means ownership and risk transfer to the buyer as soon as the goods leave the seller’s location. Once the shipment is handed to the carrier, the buyer assumes responsibility. This includes shipping costs, insurance, and any damage during transit.

On an invoice, FOB Origin typically indicates that freight charges are billed separately or paid directly by the buyer. Sellers often use this term when buyers arrange their own shipping. It is common in B2B transactions where logistics are handled independently.

FOB Origin should be clearly stated to avoid confusion. Ambiguous wording can lead to disagreements if issues arise during shipping.

FOB Destination Explained

FOB Destination means the seller retains ownership and responsibility until the goods reach the buyer’s location. The seller covers shipping costs and assumes risk during transit. Ownership transfers only upon delivery.

Invoices with FOB Destination usually include freight charges in the total amount due. This approach is often preferred by buyers because it simplifies billing and reduces risk. It is commonly used in retail and customer focused transactions.

Clear labeling is critical when using FOB Destination. Buyers should know that shipping is included and when responsibility officially changes.

FOB vs Other Common Shipping Terms

FOB is often compared to other shipping terms such as CIF, EXW, and DDP. CIF includes cost, insurance, and freight, placing more responsibility on the seller. EXW places nearly all responsibility on the buyer once goods are available for pickup.

DDP, or Delivered Duty Paid, requires the seller to handle all costs and risks until delivery. Compared to these terms, FOB offers a balanced approach depending on whether Origin or Destination is used. Each option suits different business models and transaction types.

Choosing the correct term depends on shipping distance, customer expectations, and internal processes. Clear documentation is essential regardless of the term used.

How FOB Affects Pricing, Billing, and Accounting

Invoice Pricing Structure

FOB terms determine whether shipping costs are included in the invoice total or billed separately. FOB Destination typically results in higher invoice totals since freight is included. FOB Origin often shows lower invoice amounts with shipping handled outside the invoice.

Revenue Recognition Timing

FOB impacts when a business can recognize revenue for accounting purposes. Under FOB Origin, revenue may be recognized earlier since ownership transfers sooner. FOB Destination delays revenue recognition until delivery is completed.

Cash Flow Planning

Sellers using FOB Destination must account for upfront shipping expenses, which can affect short term cash flow. FOB Origin shifts these costs to buyers, improving seller liquidity. Understanding this difference is critical for financial planning.

Tax and Compliance Considerations

FOB terms influence sales tax application and reporting, especially for multi state transactions. Incorrect FOB usage can lead to compliance issues during audits. Clear documentation helps support tax filings and financial reviews.

Billing Accuracy and Dispute Reduction

Clearly defined FOB terms reduce disputes over freight charges, damaged goods, and delivery delays. Consistent billing practices improve customer trust and reduce time spent resolving payment issues.

How to Properly Show FOB Terms on an Invoice

FOB terms should appear clearly on the invoice, typically near shipping details or payment terms. The wording should specify FOB Origin or FOB Destination along with the delivery point. Vague language should be avoided.

Consistency across invoices is essential, especially for repeat customers. Changing FOB terms without notice can create confusion and disputes. Standard invoice templates help maintain clarity.

Businesses should also train staff to understand FOB terms before issuing invoices. This reduces errors and improves customer communication.

FOB Terms in Domestic vs International Shipping

In domestic shipping, FOB is commonly used and widely understood. It helps clarify responsibility without requiring complex documentation. Most disputes arise when terms are assumed rather than stated.

In international shipping, FOB aligns with Incoterms but must be used carefully. Businesses should ensure consistency between contracts, invoices, and shipping documents. Compliance requirements may vary by country.

Proper documentation becomes more important for cross border transactions. Accurate invoicing supports customs, taxes, and insurance claims.

How Automation Improves Invoice Accuracy

Automation reduces manual errors when applying shipping terms like FOB. Standardized templates ensure consistent wording across invoices. This consistency helps prevent disputes and billing corrections.

Automated systems also maintain clear audit trails. Businesses can easily track when and how FOB terms were applied. This visibility supports reporting and compliance.

By reducing manual data entry, automation improves efficiency and accuracy. It allows teams to focus on higher value tasks instead of corrections.

How ReliaBills Supports Accurate Invoicing

ReliaBills helps businesses apply FOB terms accurately by allowing custom invoice fields for shipping and delivery details. This ensures FOB Origin or FOB Destination is clearly stated on every invoice. Consistent formatting reduces confusion for customers.

Automated invoice generation helps maintain accuracy across one time and recurring invoices. Businesses can apply the same shipping terms to repeat customers without manual updates. This is especially helpful for companies with ongoing billing relationships.

ReliaBills also provides centralized tracking of invoices and payments. This visibility supports better record keeping, dispute resolution, and cash flow management. Recurring billing features help ensure consistency where shipping terms apply to repeated transactions.

How to Create a New Invoice Using ReliaBills

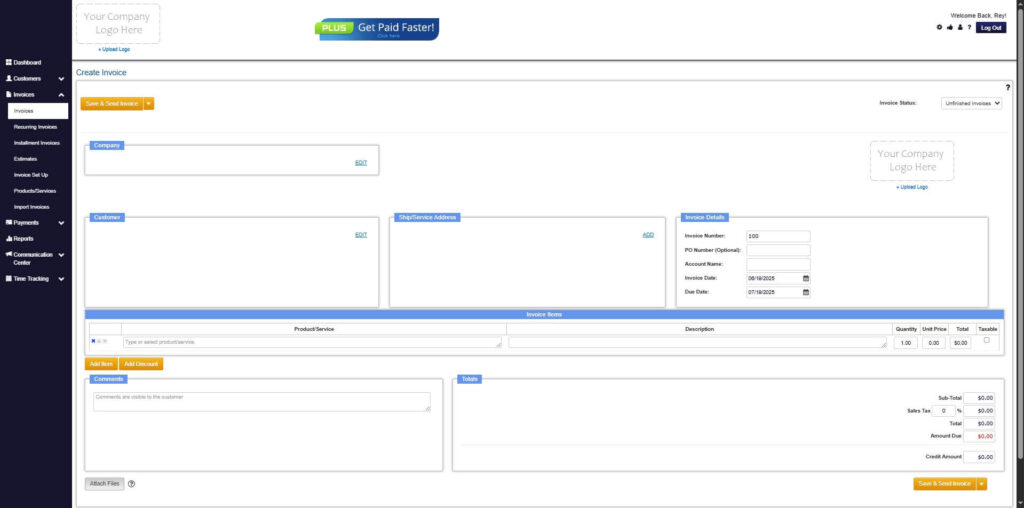

Creating an invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

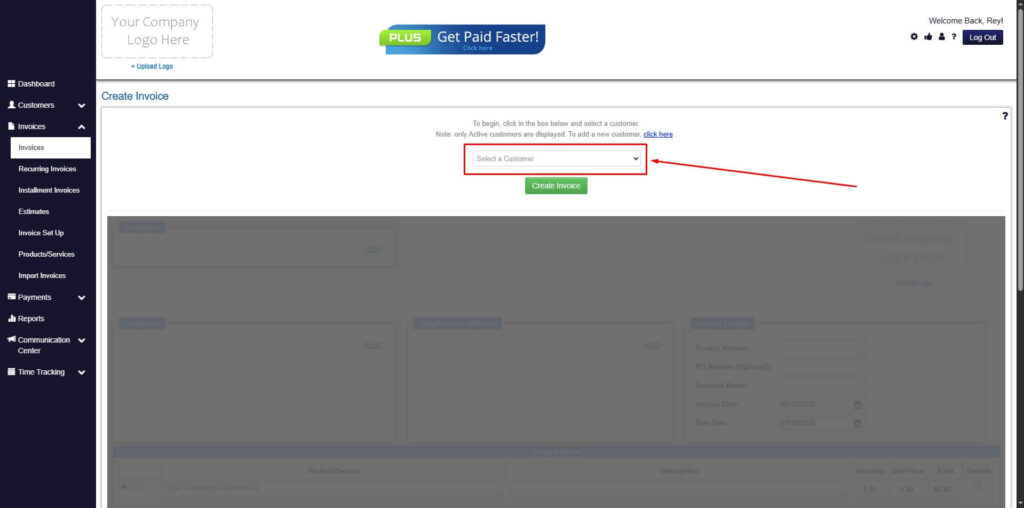

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

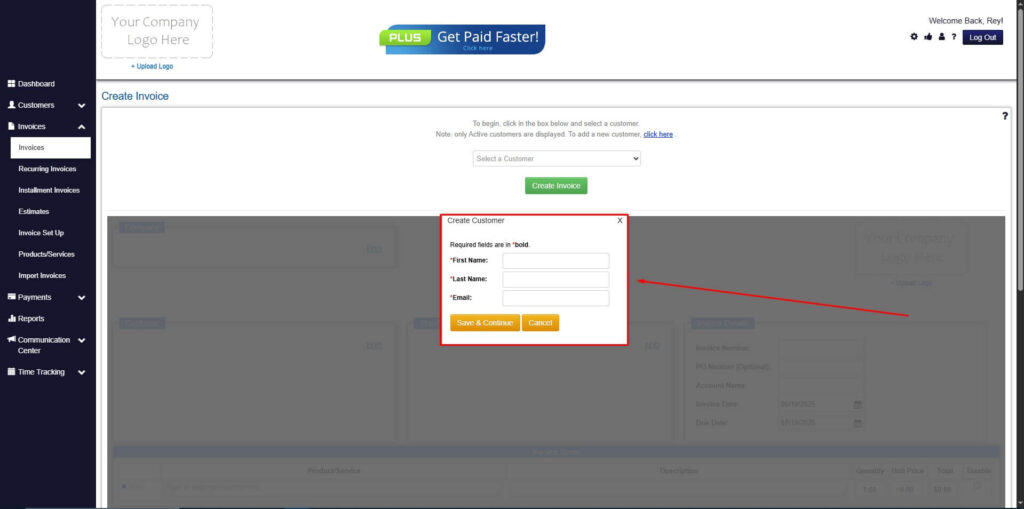

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

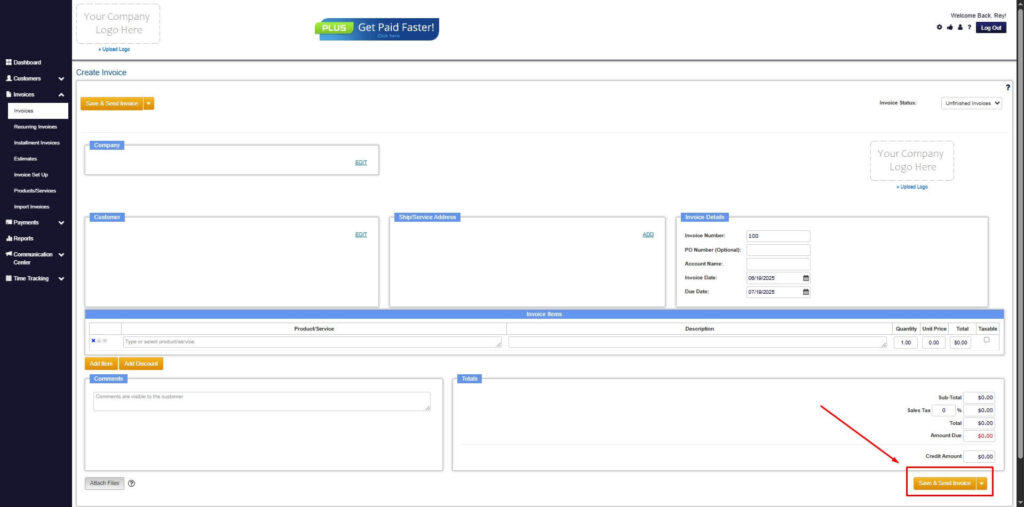

Step 7: Save Invoice

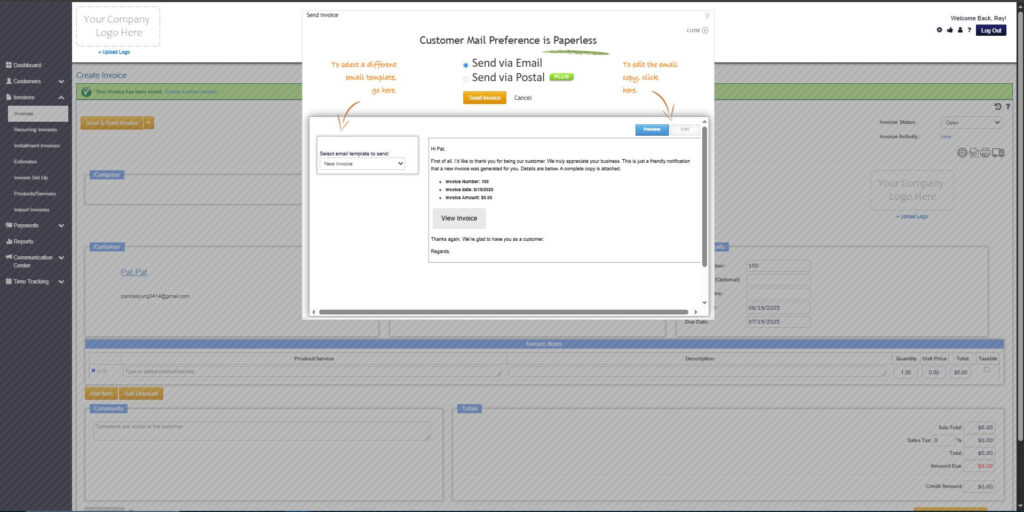

- After filling out the form, click “Save & Send Invoice” to continue.

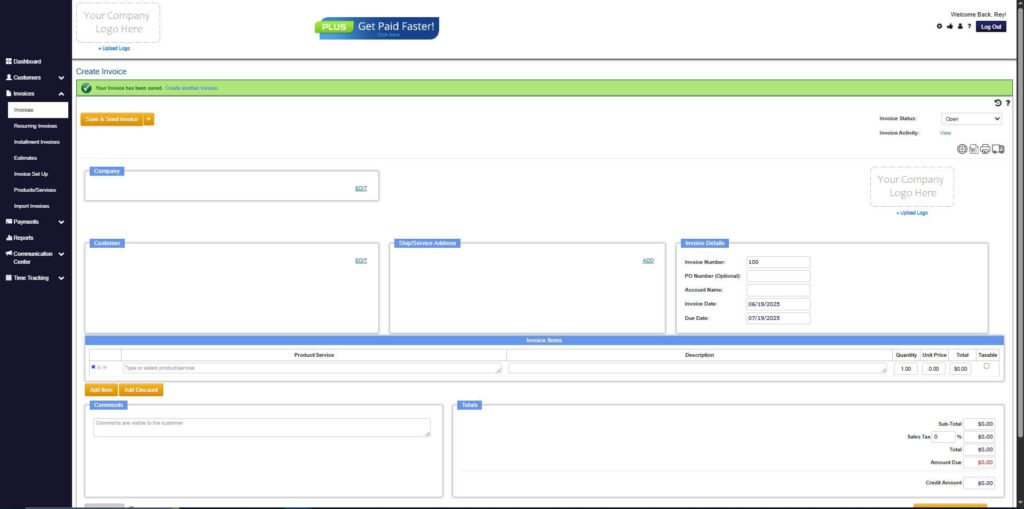

Step 8: Invoice Created

- Your Invoice has been created.

Frequently Asked Questions

1. Is FOB legally binding on an invoice?

FOB terms are generally considered binding when included in contracts or invoices, especially when both parties agree to them. They help define responsibility but should align with the broader sales agreement.

2. Who pays freight charges under FOB terms?

Under FOB Origin, the buyer usually pays shipping costs. Under FOB Destination, the seller typically covers freight. Variations should always be clearly stated on the invoice.

3. Can FOB terms be changed after an invoice is issued?

FOB terms can only be changed if both parties agree to the modification. Any changes should be documented in writing to prevent future disputes.

4. Is FOB still used with Incoterms?

FOB is still commonly used, especially in domestic shipping. In international trade, it is often used alongside Incoterms but must be applied correctly to avoid conflicts.

5. What happens if FOB terms are unclear or missing?

Missing or vague FOB terms can lead to disputes over liability, shipping costs, and delivery responsibility. Clear invoicing reduces risk and supports smoother transactions.

Conclusion

Understanding what does FOB mean on an invoice is essential for accurate billing and smooth transactions. FOB clarifies shipping responsibility, risk transfer, and pricing expectations. Using the correct term helps prevent disputes and supports proper accounting.

Businesses should clearly document FOB terms and apply them consistently across invoices. Automation and standardized invoicing play a key role in maintaining accuracy. With the right tools and practices, FOB can be used confidently and effectively.