Customer financing has become an essential strategy for small businesses as buyer expectations continue to shift in 2026. Customers increasingly want flexible ways to pay, especially for higher value products or ongoing services, and businesses that cannot offer options often lose sales. At the same time, small businesses must balance flexibility with cash flow stability and administrative efficiency.

For small businesses, customer financing is no longer just a competitive advantage. It is often a requirement to stay relevant, improve conversion rates, and build long term customer relationships. When implemented correctly, financing helps businesses close more deals without sacrificing predictable revenue.

This guide explains what customer financing is, how it works, the benefits and risks involved, and how small businesses can manage financing effectively using automated billing and recurring payment tools.

Table of Contents

ToggleWhat Is Customer Financing?

Customer financing is a payment arrangement that allows customers to pay for products or services over time instead of making a full payment upfront. Rather than requiring a single transaction, the total cost is divided into scheduled payments based on agreed terms. This approach makes purchases more accessible while allowing businesses to maintain steady income.

In practice, customer financing can be offered directly by the business or through third party providers. Some businesses manage financing internally with installment plans, while others rely on external platforms that handle approvals and collections. The structure depends on the business model, transaction size, and risk tolerance.

Unlike traditional one time payments, customer financing focuses on flexibility and long term value. It supports recurring revenue, improves customer affordability, and often increases overall sales without reducing pricing integrity.

Why Small Businesses Are Adopting Customer Financing

Small businesses are adopting customer financing largely because customer buying behavior has changed. Many customers prefer spreading costs over time rather than paying upfront, especially in uncertain economic conditions. Offering financing helps remove price resistance and makes purchasing decisions easier.

Customer financing also improves conversion rates and average order value. When customers are given flexible payment options, they are more likely to complete a purchase and may choose higher priced offerings. This directly impacts revenue growth without increasing marketing spend.

In 2026, competition is tighter across most industries. Small businesses that offer financing appear more professional, modern, and customer focused, giving them a clear edge over competitors that still rely solely on upfront payments.

Types of Customer Financing Options

Installment Payment Plans

Installment plans allow customers to divide the total cost of a product or service into equal payments over a fixed period. This option is commonly used for higher value services, long term contracts, or equipment purchases. For businesses, installment plans work best when paired with automated and recurring billing to ensure payments are collected consistently without manual follow up.

Buy Now, Pay Later (BNPL)

Buy Now, Pay Later options let customers receive goods or services immediately while payments are deferred or split into short term installments. These options are often offered through third party providers that handle approvals and collections. BNPL can significantly increase conversion rates, especially for price sensitive customers, but businesses must account for provider fees and settlement timing.

In-House Customer Financing

In-house financing is managed directly by the business, giving full control over payment terms, approval criteria, and customer relationships. This approach offers flexibility and branding consistency but requires strong billing systems, clear policies, and reliable payment tracking. Without automation, in-house financing can quickly become difficult to manage as volume grows.

Third-Party Financing Providers

Third-party financing shifts credit risk and payment collection to an external provider. The business receives payment upfront or on a scheduled basis, while the provider collects from the customer. This reduces administrative effort and risk but typically involves higher fees and less control over the customer experience.

How Customer Financing Works for Small Businesses

Customer financing typically begins with defining payment terms and eligibility. Businesses may require upfront deposits, credit checks, or approval criteria depending on the financing model used. Clear communication at this stage is critical to avoid misunderstandings later.

Once approved, payments are scheduled according to the agreed plan. This can include monthly installments, milestone based payments, or recurring charges for ongoing services. Automated invoicing and reminders are essential to ensure consistency and reduce late payments.

Risk management plays a key role in financing. Businesses must monitor payment behavior, track outstanding balances, and address issues quickly. Proper documentation and billing records help protect both cash flow and customer relationships.

Benefits of Offering Customer Financing

Higher Sales and Conversion Rates

Customer financing removes upfront cost barriers, making it easier for customers to commit. When buyers are offered flexible payment options, they are more likely to complete purchases instead of delaying or abandoning them. This is especially impactful for small businesses selling higher value services or products.

Improved Average Order Value

Financing often encourages customers to choose premium options or add services they might otherwise decline. By spreading payments over time, customers feel more comfortable increasing their overall spend, which boosts revenue without increasing acquisition costs.

More Predictable Cash Flow

When financing is supported by recurring billing, businesses benefit from scheduled and predictable incoming payments. This consistency improves budgeting, payroll planning, and overall financial stability, particularly for service based businesses.

Stronger Customer Relationships

Offering financing signals flexibility and understanding of customer needs. This builds trust and positions the business as a long term partner rather than a one time vendor. Over time, this can lead to higher retention and repeat business.

Competitive Advantage in 2026

As customer expectations continue to evolve, businesses that offer financing stand out. Flexible payment options are increasingly viewed as standard, not optional, especially in competitive markets.

Risks and Challenges of Customer Financing

One of the primary risks of customer financing is late or missed payments. Without proper systems in place, businesses may struggle to track balances and follow up consistently. This can lead to revenue leakage and strained customer relationships.

Administrative workload is another challenge. Managing financing manually increases the risk of errors, missed invoices, and inconsistent communication. Compliance and record keeping also become more complex as financing volume grows.

Cash flow timing is a critical consideration. While financing increases sales, it spreads revenue over time. Businesses must ensure they have enough working capital to cover expenses while payments are collected gradually.

Customer Financing vs Traditional Payment Models

Traditional payment models rely on full payment at the time of purchase. While this simplifies billing, it can limit sales and exclude customers who need flexibility. Financing, on the other hand, removes barriers while maintaining total revenue.

From an accounting perspective, customer financing affects revenue recognition and cash flow timing. Businesses must align billing schedules with accounting practices to ensure accurate reporting and forecasting.

Customer financing also supports recurring revenue models, whereas traditional payments are transactional. This shift helps small businesses build more stable and predictable income streams over time.

Best Practices for Implementing Customer Financing

Define Clear Terms and Conditions Upfront

Every financing arrangement should clearly outline payment schedules, due dates, late fees, and consequences of missed payments. Clear documentation protects both the business and the customer and reduces disputes later.

Choose Financing Options That Match Your Business Model

Not all financing options suit every business. Service based businesses often benefit most from installment or recurring billing, while retail businesses may prefer BNPL solutions. Financing should align with pricing, margins, and cash flow needs.

Use Automated and Recurring Billing Systems

Automation is critical for managing customer financing at scale. Automated invoices, reminders, and payment tracking reduce human error, save time, and significantly improve on time payment rates.

Monitor Performance and Adjust Policies Regularly

Businesses should regularly review payment behavior, default rates, and customer feedback. This data helps refine financing terms, identify risk early, and improve long term outcomes.

Communicate Consistently With Customers

Ongoing communication helps maintain trust. Automated reminders, clear invoice descriptions, and easy access to billing history ensure customers always understand their payment status.

How Automated Billing Supports Customer Financing

Automated billing plays a central role in managing customer financing efficiently. Scheduled invoicing ensures payments are issued consistently without manual effort. This reduces errors and improves on time collections.

Automated reminders and notifications help keep customers informed and accountable. When reminders are sent automatically, businesses reduce awkward follow ups and improve payment compliance.

Automation also creates accurate records for reporting and dispute resolution. Clear invoice history and payment tracking are essential for managing financed accounts at scale.

Common Mistakes to Avoid

Offering Financing Without Clear Policies

One of the most common mistakes is offering financing informally without documented terms. This often leads to confusion, disputes, and delayed payments that strain customer relationships.

Relying on Manual Billing Processes

Manual invoicing and tracking do not scale well. As financing volume increases, manual processes lead to missed invoices, inconsistent follow ups, and inaccurate records that directly impact cash flow.

Underestimating Administrative and Compliance Effort

Customer financing involves ongoing management, documentation, and sometimes regulatory considerations. Businesses that underestimate this workload often struggle to keep records accurate and up to date.

Ignoring Cash Flow Timing

Financing spreads revenue over time, which can create short term cash flow gaps if not planned properly. Businesses must ensure they have sufficient working capital to cover expenses while payments are collected.

Failing to Integrate Billing and Payment Systems

Disconnected tools make it difficult to track financed balances accurately. Without centralized visibility, businesses lose insight into outstanding payments, customer history, and overall financing performance.

How ReliaBills Helps Manage Customer Financing

ReliaBills helps small businesses manage customer financing by simplifying how installment and payment plan billing is created, tracked, and collected. Instead of handling financing manually, businesses can generate structured invoices that reflect agreed payment schedules, ensuring customers are billed accurately and consistently. This reduces confusion, minimizes disputes, and creates a more professional financing experience for both sides.

Recurring billing is a key advantage when offering customer financing, and ReliaBills is built to support it at scale. Businesses can automate installment payments, schedule invoices in advance, and apply consistent billing rules across all financed customers. This automation helps maintain steady cash flow while eliminating the need for manual follow ups, missed invoices, or inconsistent collections.

ReliaBills also provides centralized visibility into customer payment activity, which is critical for managing financed accounts. Business owners can easily track outstanding balances, payment history, and upcoming invoices from one dashboard. This real time insight makes it easier to identify late payments early, adjust billing schedules when needed, and make informed decisions about extending or modifying financing terms.

By combining automated invoicing, recurring billing, and clear payment tracking, ReliaBills allows businesses to offer customer financing with confidence. The platform helps reduce administrative effort, improve cash flow predictability, and maintain strong customer relationships while supporting growth in 2026 and beyond.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

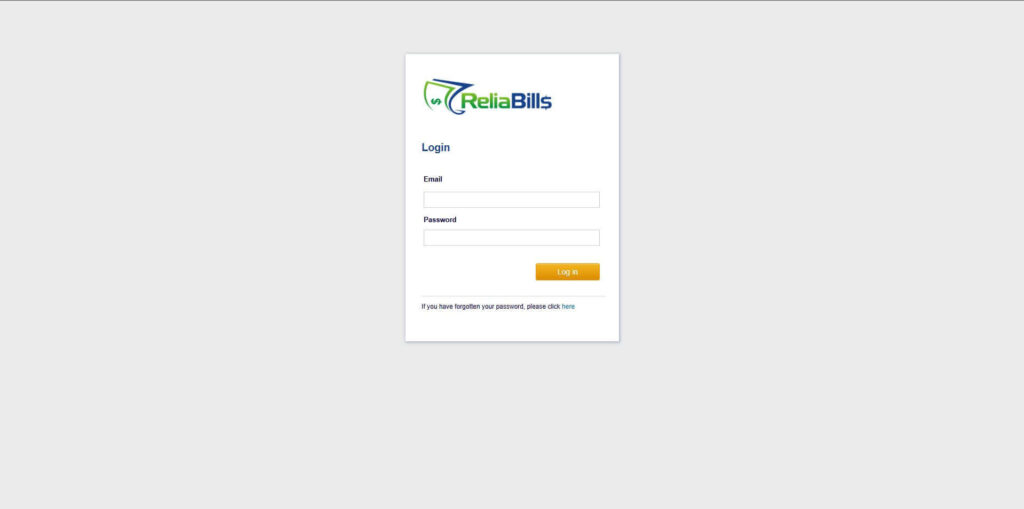

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

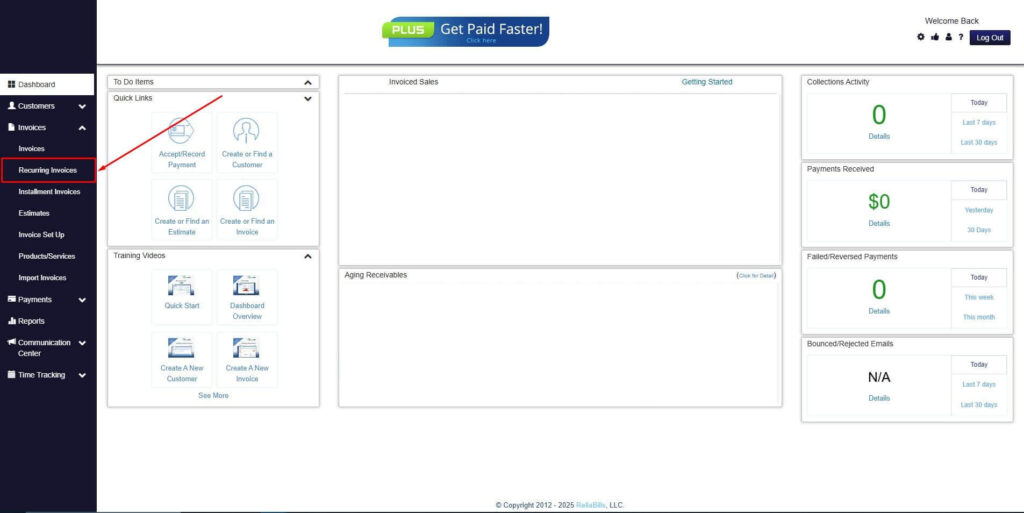

Step 2: Click on Recurring Invoices

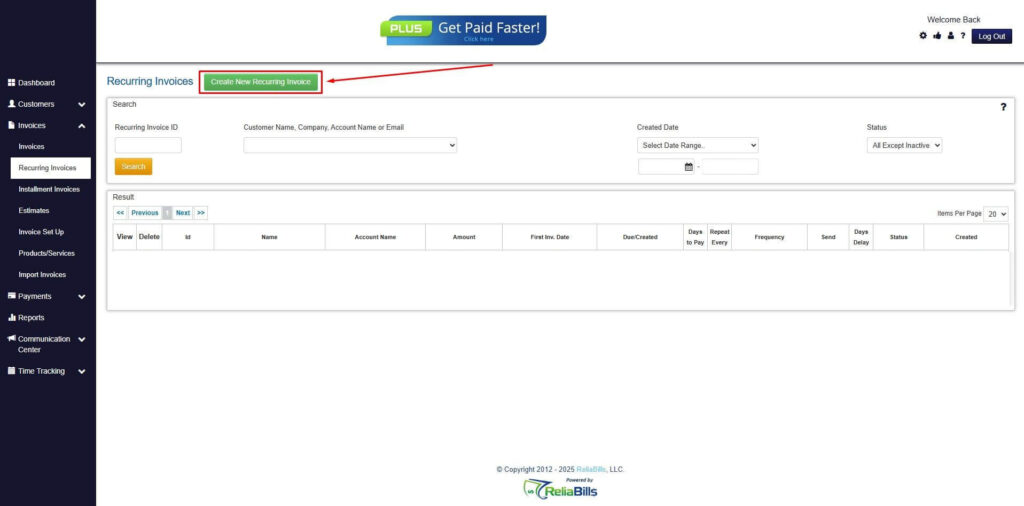

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

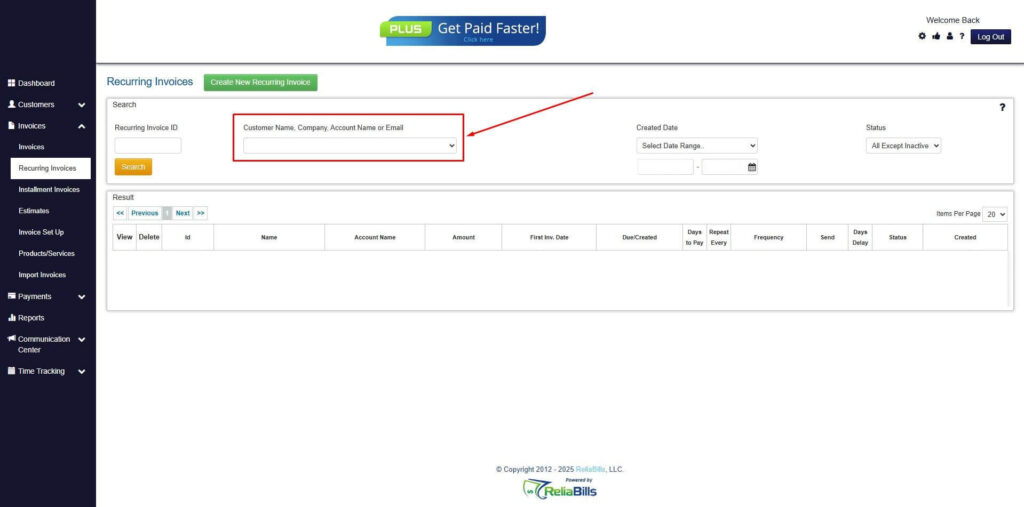

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

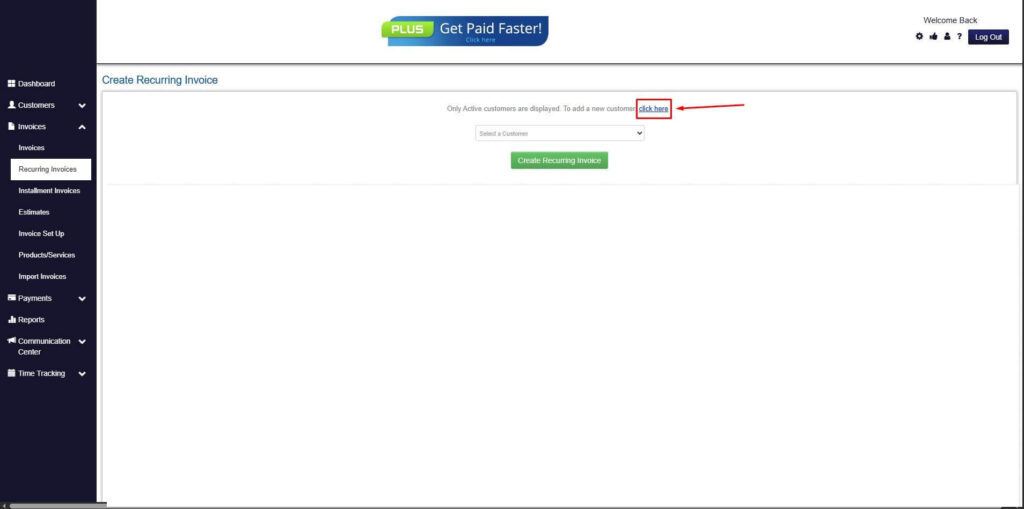

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

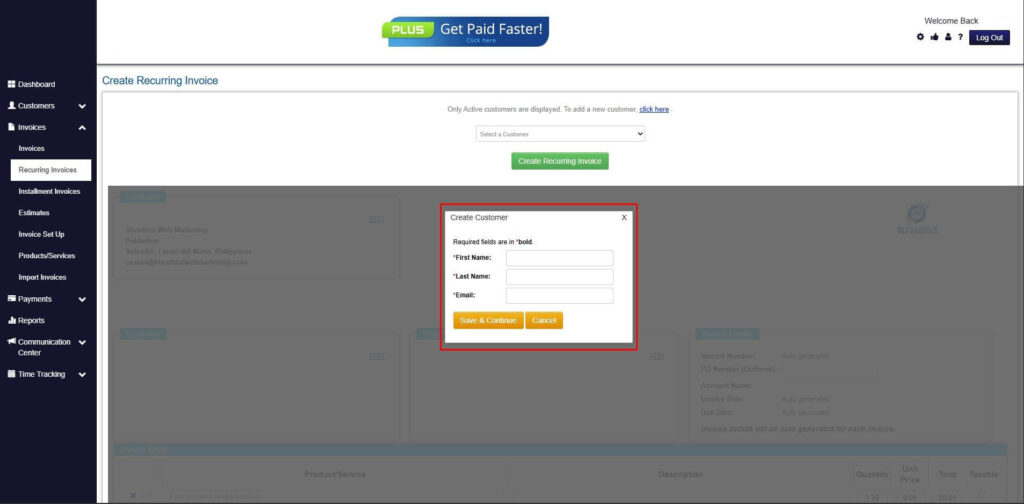

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

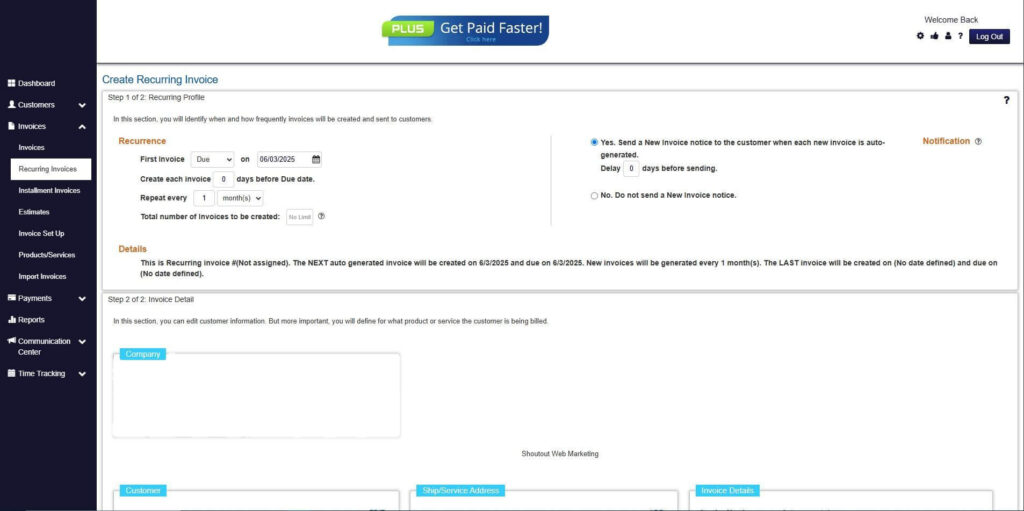

Step 7: Fill in the Create Recurring Invoice Form

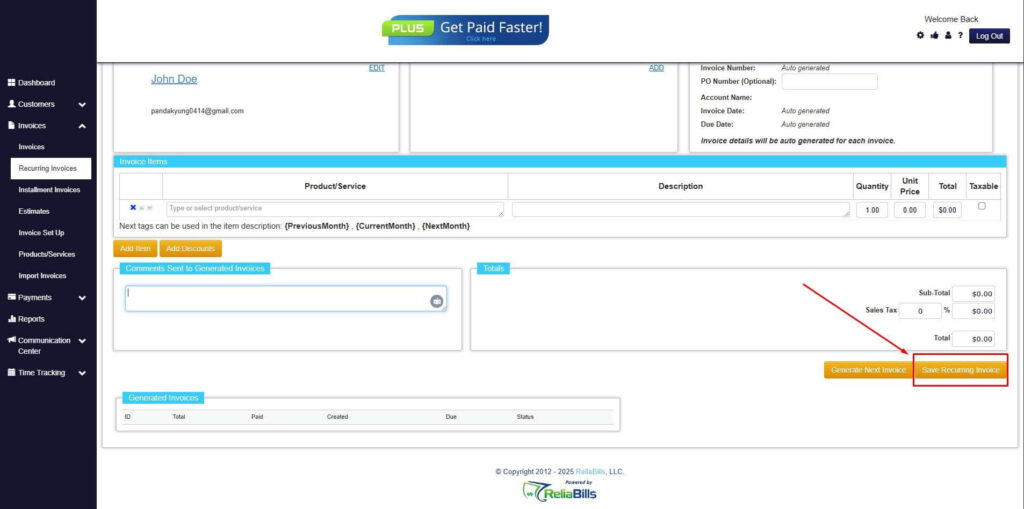

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

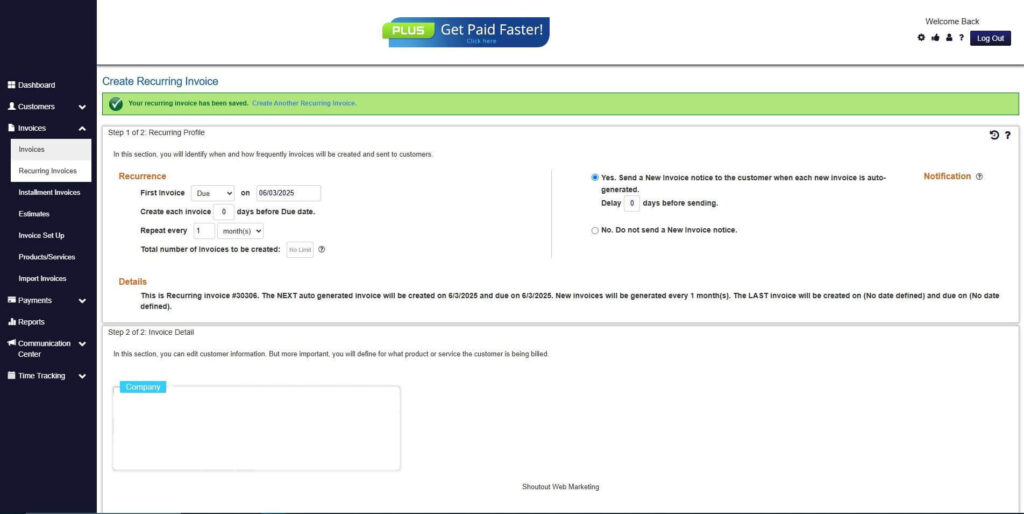

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Is customer financing suitable for all small businesses?

Customer financing works best for businesses offering higher value products or services, but it can benefit many industries when managed properly.

2. How do financing options affect cash flow?

Financing can improve cash flow predictability when payments are scheduled and automated, but it requires careful planning.

3. Can customer financing be automated?

Yes, automated invoicing and recurring billing systems make financing far easier to manage.

4. What industries benefit most from customer financing?

Service providers, subscription businesses, and B2B companies often see strong results from financing options.

Conclusion

Customer financing is becoming a standard expectation for small businesses in 2026. When implemented correctly, it increases sales, improves customer satisfaction, and supports predictable revenue.

By combining clear financing terms with automated billing and recurring payment tools, small businesses can offer flexible payment options without added complexity. Platforms like ReliaBills help businesses manage customer financing efficiently while maintaining control over cash flow and growth.