The accounts payable process is one of the most important financial workflows in any small business. It controls how bills are reviewed, approved, and paid, and directly affects cash flow, vendor relationships, and financial accuracy. As businesses move into 2026, the need for a structured and reliable accounts payable process continues to grow.

Many small businesses struggle with late payments, duplicate invoices, or limited visibility into what they owe. These problems often come from manual processes or disconnected systems that do not scale well. A clear understanding of the accounts payable process helps business owners stay organized and make better financial decisions.

In today’s environment, accounts payable is no longer just about paying bills. It is about timing payments strategically, maintaining compliance, and aligning outgoing expenses with predictable revenue. When managed correctly, the accounts payable process becomes a powerful tool for financial stability.

Table of Contents

ToggleWhat Is Accounts Payable?

Accounts payable refers to the outstanding bills a business owes to vendors, suppliers, and service providers. These obligations usually arise after goods or services are received but before payment is made. On financial statements, accounts payable is recorded as a short-term liability.

The accounts payable function plays a key role in day-to-day operations by ensuring vendors are paid accurately and on time. It also helps businesses track expenses, manage cash flow, and prepare for audits or tax reporting. Without a structured approach, payables can quickly become disorganized.

Accounts payable is often compared to accounts receivable, but the two serve opposite purposes. Accounts payable focuses on outgoing payments, while accounts receivable tracks money coming into the business. Both must work together to support healthy cash flow.

The Accounts Payable Process Explained

The accounts payable process begins when an invoice is received from a vendor. Invoices may arrive by email, through vendor portals, or by mail, which makes centralizing invoice intake especially important. A consistent intake process reduces the risk of lost or duplicate invoices.

Once received, invoices are reviewed for accuracy and approved according to internal policies. This step ensures that charges match agreed pricing and that expenses are authorized. Approval workflows help prevent errors and unauthorized payments.

After approval, invoices are recorded, scheduled for payment, and ultimately paid using the selected method. The final step involves reconciling payments with accounting records to maintain accurate financial data. Each stage supports transparency and financial control.

Common Accounts Payable Challenges for Small Businesses

Manual data entry and paper-based invoices

Many small businesses still rely on spreadsheets, email inboxes, or physical paperwork to manage invoices. This increases processing time and raises the risk of data entry errors. As invoice volume grows, these manual systems become harder to maintain.

Late or duplicate payments

Without centralized tracking, invoices can be overlooked or paid more than once. Late payments may result in penalties, strained vendor relationships, or service disruptions. Duplicate payments directly impact cash flow and require additional time to resolve.

Limited visibility into outstanding liabilities

Businesses often lack a real-time view of what is owed and when payments are due. This makes cash flow planning more difficult and increases the likelihood of missed deadlines. Poor visibility also limits financial forecasting accuracy.

Vendor communication and dispute issues

When payment records are unclear or documentation is incomplete, vendor disputes become more common. Resolving these issues manually takes time and can damage trust. Clear records and consistent processes help prevent misunderstandings.

Accounts Payable Best Practices in 2026

Standardize invoice submission and approval workflows

Establishing consistent procedures for how invoices are received, reviewed, and approved reduces confusion. Standardization ensures every invoice follows the same path, improving accuracy and accountability across teams.

Automate invoice capture and data entry

Automation minimizes manual input and reduces errors caused by retyping invoice details. Automated systems also speed up processing times, allowing invoices to move through approval faster.

Maintain clear payment terms and schedules

Clearly defined payment timelines help businesses avoid late fees while maintaining good vendor relationships. Visibility into due dates allows finance teams to plan payments more strategically.

Use digital payment methods whenever possible

Digital payments improve efficiency, security, and tracking. They also simplify reconciliation by creating electronic records that are easy to audit and review.

Align payables with predictable revenue

Best-in-class AP processes are supported by stable incoming cash flow. Recurring billing and consistent invoicing help businesses schedule outgoing payments with greater confidence.

Accounts Payable Automation

Accounts payable automation reduces administrative workload by handling repetitive tasks automatically. Automation tools can capture invoice data, route approvals, and schedule payments with minimal manual input. This improves both speed and accuracy.

By reducing human error, automation also lowers the risk of duplicate payments or incorrect amounts. It allows finance teams to focus on oversight rather than data entry. As transaction volume increases, automation supports scalability.

Small businesses benefit from automation even at lower volumes. Early adoption creates a foundation for growth and prevents process breakdowns later. In 2026, automation is a key driver of efficient accounts payable management.

Managing Cash Flow Through Accounts Payable

Accounts payable directly impacts how and when cash leaves the business. Paying invoices too early can strain cash reserves, while paying too late can damage vendor relationships. Timing payments carefully helps maintain balance.

Using accounts payable data allows businesses to forecast upcoming obligations more accurately. This visibility supports better budgeting and financial planning. When combined with predictable revenue, cash flow becomes easier to manage.

Aligning payment schedules with income cycles is especially important for small businesses. A well-managed accounts payable process helps avoid cash shortfalls and unexpected disruptions.

Security, Compliance, and Risk Management

Invoice fraud and unauthorized payments are growing risks for small businesses. Accounts payable controls such as approval workflows and vendor verification reduce exposure. Digital records also improve traceability and accountability.

Compliance depends on accurate documentation and record retention. A structured accounts payable process ensures invoices and payments are properly recorded for audits and tax reporting. This reduces stress during financial reviews.

Risk management improves when businesses maintain clear audit trails. Consistent processes make it easier to identify errors and resolve issues quickly. Security and compliance should be built into the process from the start.

How Billing and Revenue Systems Support Accounts Payable Efficiency

Accounts payable works best when revenue is predictable and well-tracked. When incoming payments are inconsistent, it becomes harder to plan outgoing expenses. Reliable billing systems help stabilize cash flow.

Recurring billing plays a key role in supporting accounts payable planning. Predictable revenue allows businesses to schedule payments with confidence. This reduces the risk of missed payments or cash shortages.

Platforms like ReliaBills help businesses maintain organized billing records that support accounts payable efficiency. With clear visibility into receivables, businesses can better manage liabilities and financial obligations.

Common Mistakes to Avoid

Paying invoices without proper approval

Skipping approval steps increases the risk of fraud, incorrect charges, or unauthorized spending. Approval workflows are essential for financial control, even in small teams.

Missing early payment discounts

Poor tracking can cause businesses to overlook discount windows offered by vendors. Over time, missed discounts add up to unnecessary costs.

Relying on manual tracking systems

Spreadsheets and email folders do not scale as businesses grow. Manual tracking leads to errors, inefficiencies, and limited visibility into payables.

Failing to document payments and adjustments

Incomplete records make audits, reconciliations, and dispute resolution more difficult. Clear documentation supports compliance and financial accuracy.

Poor communication with vendors

Not informing vendors about payment status or delays can damage long-term relationships. Transparent communication helps maintain trust and prevents escalation.

How ReliaBills Helps Small Businesses Manage the Accounts Payable Process

ReliaBills helps small businesses improve accounts payable efficiency by strengthening the foundation of their billing and payment workflows. By centralizing invoicing, payment tracking, and customer communication, businesses gain clearer visibility into incoming revenue. This clarity makes it easier to plan outgoing payments, avoid cash flow gaps, and maintain control over financial operations as the business grows.

Recurring billing plays a critical role in stabilizing cash flow, which directly supports a more predictable accounts payable process. With automated recurring invoices and consistent payment schedules, businesses can better anticipate when funds will be available to cover vendor obligations. This predictability reduces late payments, minimizes financial stress, and allows AP teams to schedule payments with greater confidence.

ReliaBills also simplifies financial oversight by providing centralized records of invoices, payments, and customer activity. Clear audit trails and real-time reporting reduce the manual effort required for reconciliation and compliance. As a result, small businesses spend less time reacting to cash flow issues and more time proactively managing their accounts payable process with accuracy and efficiency.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

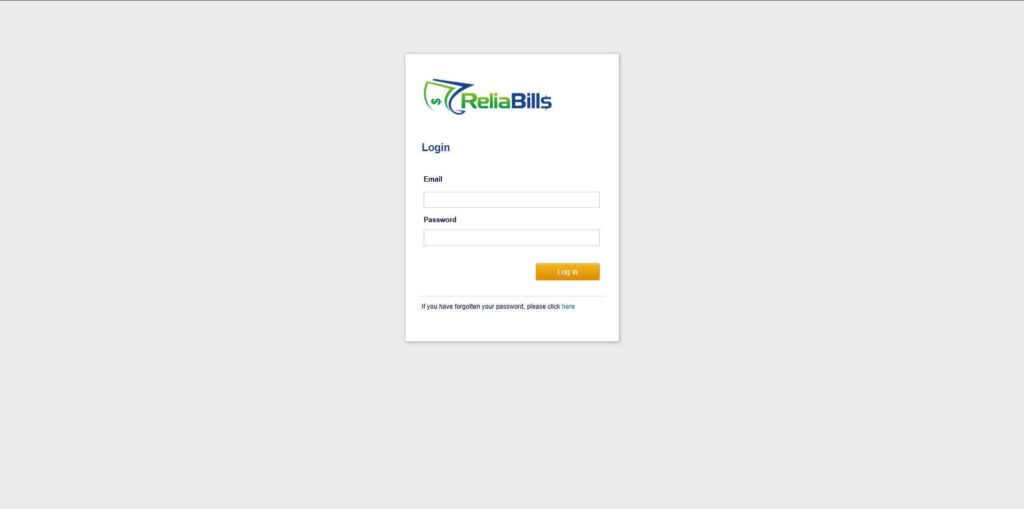

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

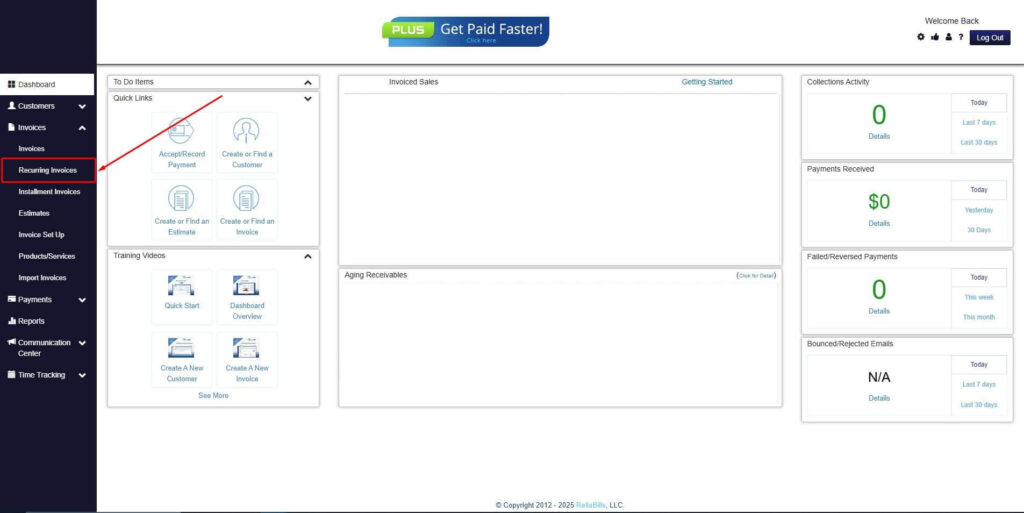

Step 2: Click on Recurring Invoices

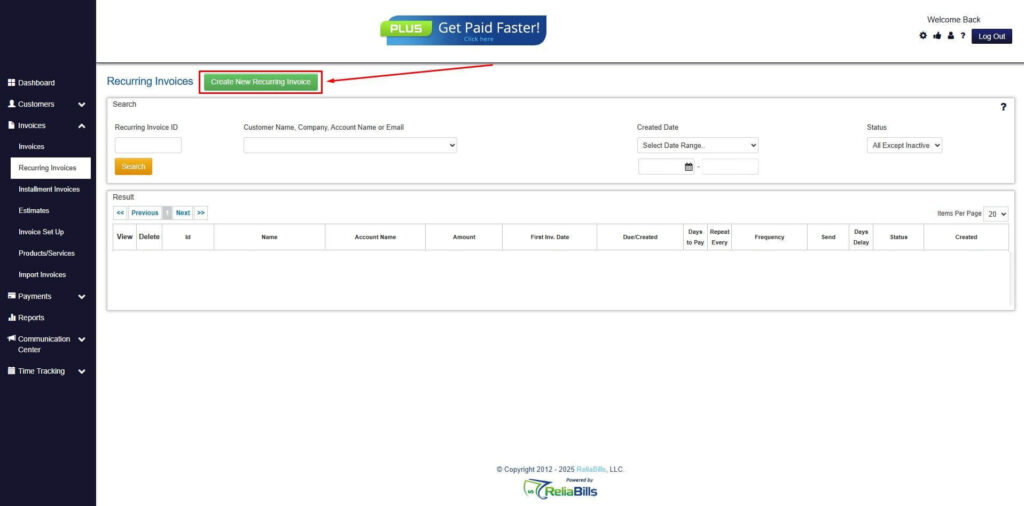

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

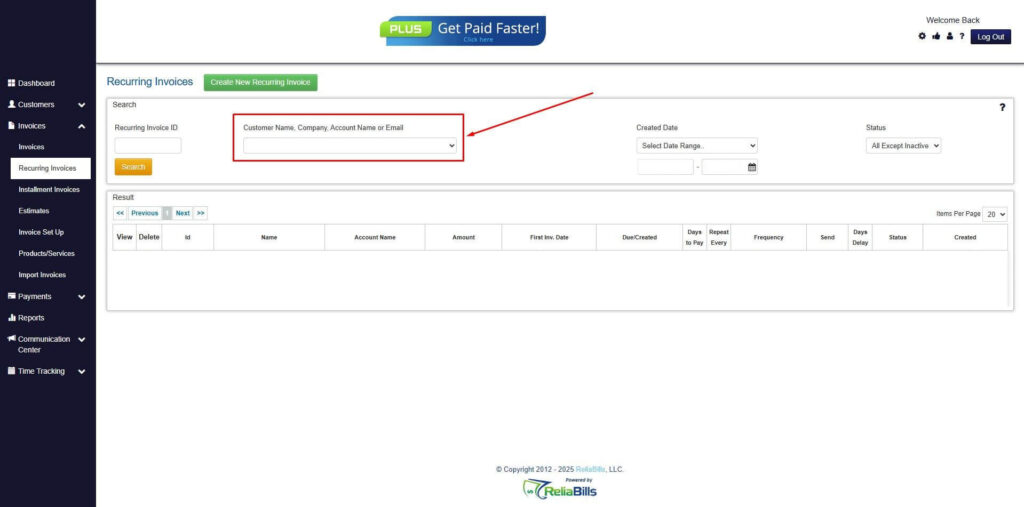

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

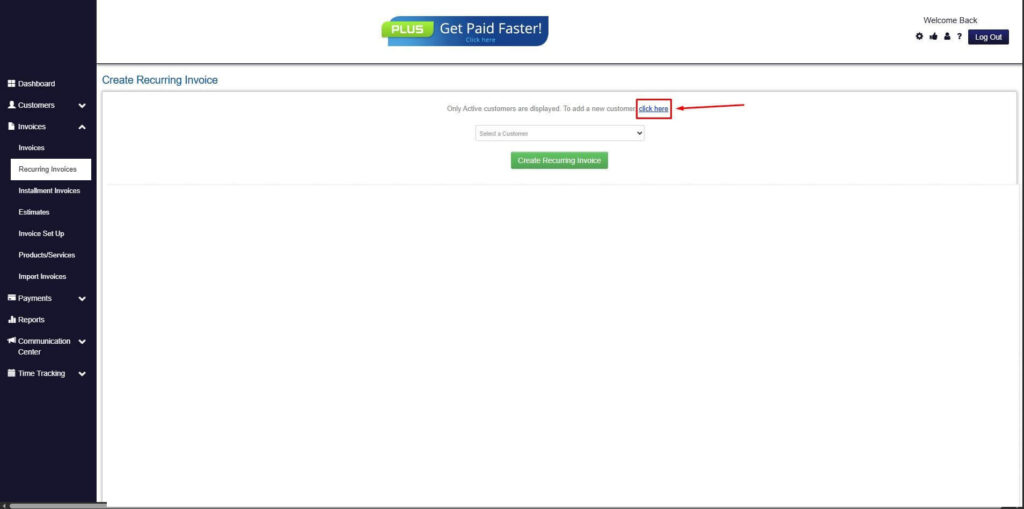

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

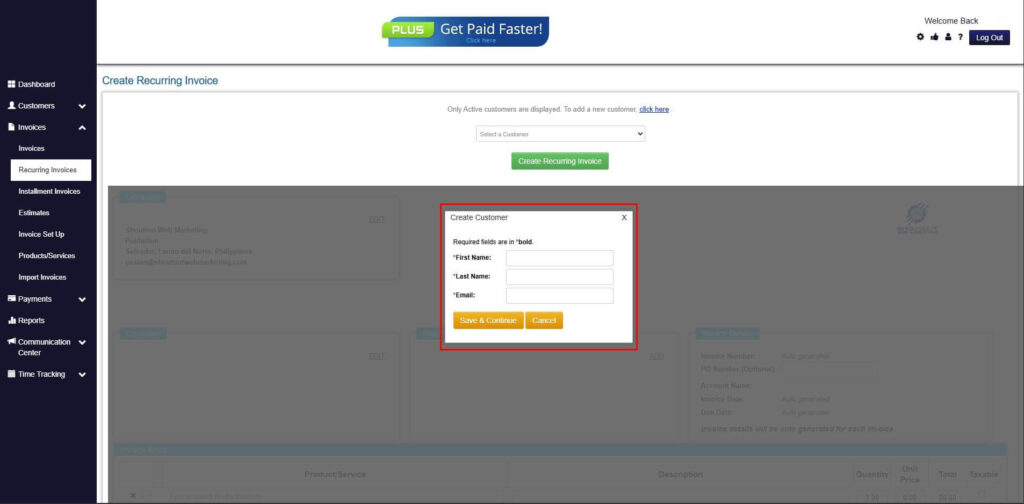

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

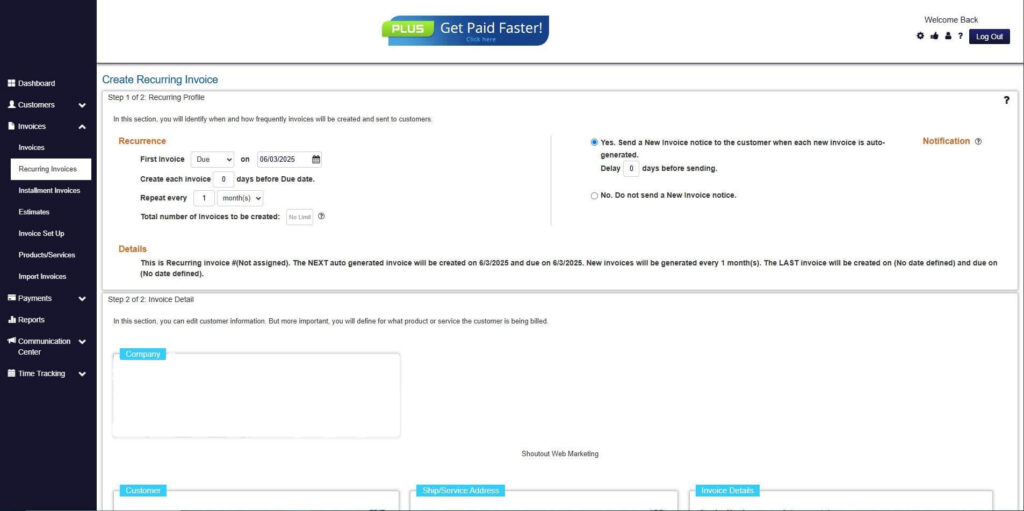

Step 7: Fill in the Create Recurring Invoice Form

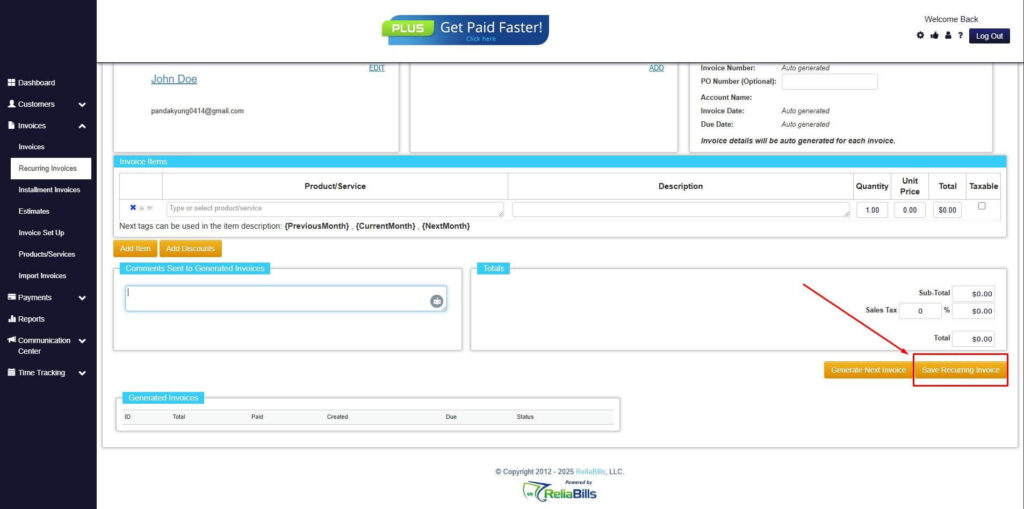

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

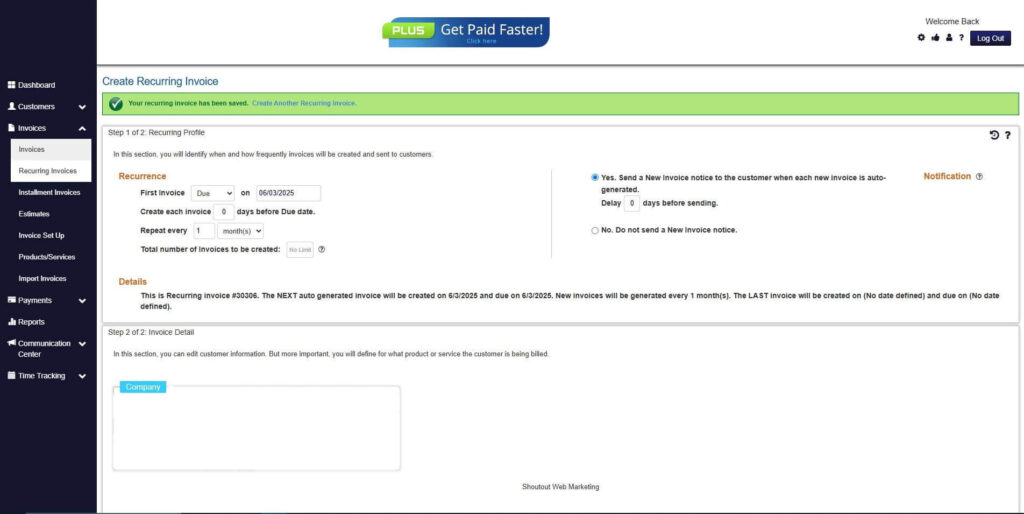

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How can small businesses speed up invoice approvals?

Invoice approvals can be accelerated by using standardized workflows and automated routing. Clearly defined approval roles prevent delays and confusion.

2. Should accounts payable be handled in-house or outsourced?

Many small businesses manage AP internally, especially when supported by automation tools. Outsourcing may be considered as volume increases, but internal control often provides better visibility.

3. What tools are best for managing accounts payable in 2026?

The best tools integrate invoice capture, approval workflows, payment scheduling, and reporting. Solutions that align with billing and revenue systems provide added value.

4. How often should accounts payable processes be reviewed?

AP processes should be reviewed at least once a year or whenever the business experiences growth. Regular reviews help ensure the process remains efficient and scalable.

5. How does recurring billing support accounts payable planning?

Recurring billing creates predictable income, making it easier to plan outgoing payments. This stability reduces cash flow uncertainty and improves AP decision-making.

Conclusion

The accounts payable process is a critical foundation for small business financial health in 2026. When managed effectively, it supports cash flow, compliance, and strong vendor relationships. Clear workflows and automation make the process easier to maintain as businesses grow.

Aligning accounts payable with predictable revenue is essential for long-term stability. Tools that improve billing and payment visibility help businesses make smarter decisions. A strong accounts payable process reduces risk and improves control.

By combining best practices with modern billing solutions like ReliaBills, small businesses can create a more reliable and scalable financial operation. Investing in the right processes today supports sustainable growth tomorrow.