If you are building or expanding a car rental business, finding the best possible purchase price is essential. Vehicles are one of your biggest investments, so understanding the car invoice price can help you save thousands and negotiate more confidently. Many buyers rely only on sticker prices, but savvy business owners know that the invoice price is the number that really matters. Learning how it works can give you a clear advantage when selecting vehicles for your rental fleet.

Table of Contents

ToggleWhat Is the Invoice Price of a Car?

The car invoice price is the amount the dealership pays the manufacturer for the vehicle. It reflects the dealer’s cost before markups, incentives, advertising credits, and manufacturer bonuses. While it is often lower than the retail price, it does not always represent the dealer’s true net cost. Manufacturers sometimes offer incentives that reduce what the dealer ultimately pays. Even so, the invoice price is a strong reference point when negotiating because it gets you closer to the real cost behind the sticker.

What Is the MSRP of a Car?

The MSRP stands for Manufacturer Suggested Retail Price. This is the price printed on the window sticker and is often called the sticker price. It includes the base cost, extra features, delivery fees, and optional packages. While the MSRP gives you a general idea of value, it is not the final price you should accept, especially when you are purchasing multiple vehicles for a car rental business. The MSRP is meant to guide dealers, but it leaves plenty of room for negotiation.

What Does Fair Market Value Mean?

Fair market value is the price that most buyers are willing to pay for a vehicle based on current market conditions. It takes into account factors such as supply, demand, features, mileage, region, and the car’s overall popularity. Fair market value sits somewhere between the MSRP and the car invoice price. For business owners, understanding this number is helpful because it shows whether a dealer’s price is reasonable and how competitive the offer truly is.

How Do I Get a Dealer to Offer the Car’s Invoice Price?

Getting a dealer to match or come close to the car invoice price requires preparation and timing. Here are strategies that increase your chances:

- Research prices in advance. Use reliable websites that show invoice pricing, incentives, and fair market values.

- Leverage fleet or business buyer status. Car rental businesses often qualify for fleet discounts.

- Negotiate with multiple dealerships. Request written quotes to compare and use as leverage.

- Shop at the right time. End of month or end of quarter deals often push dealers to offer better pricing.

- Be firm but professional. When dealers see you understand the numbers, they are more willing to offer a near-invoice deal.

While some dealerships may not go all the way down to the exact invoice price, you can often get very close, especially when buying several vehicles at once.

Why Car Rentals Should Use an Invoicing Software like ReliaBills

Car rental businesses handle ongoing payments, deposits, damage fees, add-ons, and long-term rental contracts. Managing these manually can lead to errors and slow down your operations. Using an invoicing software like ReliaBills helps automate billing, track customer payments, and manage recurring charges with precision. This is especially valuable when you are scaling your fleet and adding more vehicles, since your customer base and billing volume also grow.

ReliaBills allows you to create professional invoices, schedule recurring billing charges, and track overdue payments all in one system. It also provides automated reminders, online payment options, and detailed reporting so you can stay on top of your cash flow. For car rental owners who are focused on purchasing vehicles at the best car invoice price and reducing operational costs, automation gives you more control and frees up time to focus on fleet management and customer service.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

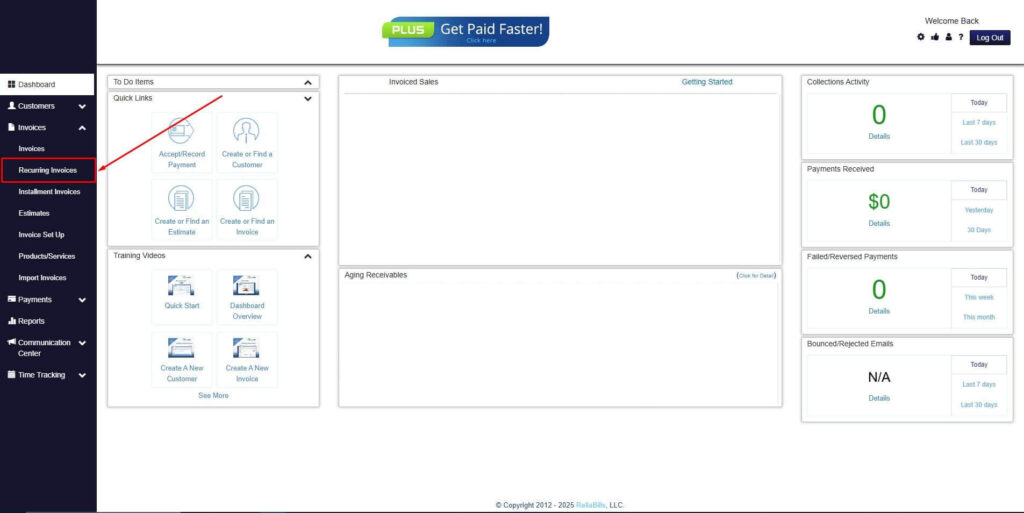

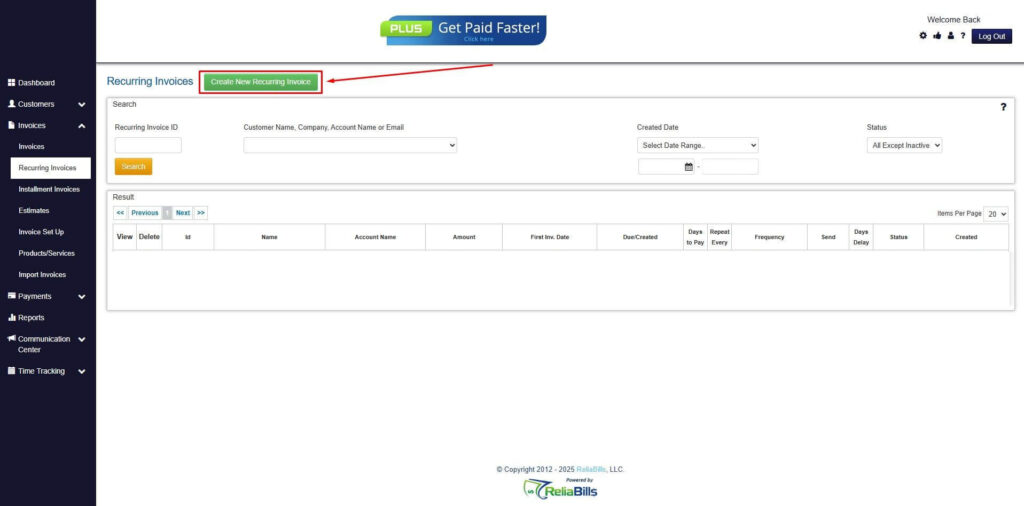

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

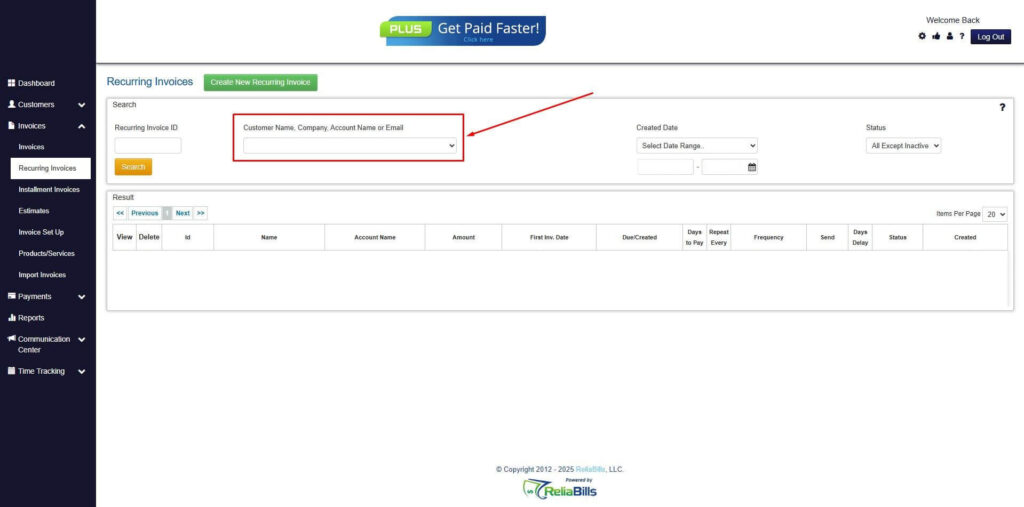

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

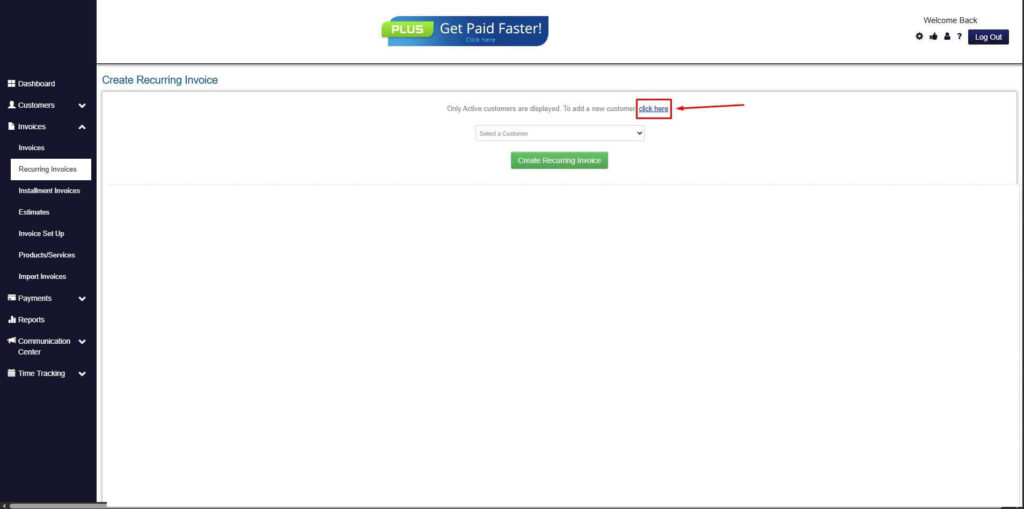

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

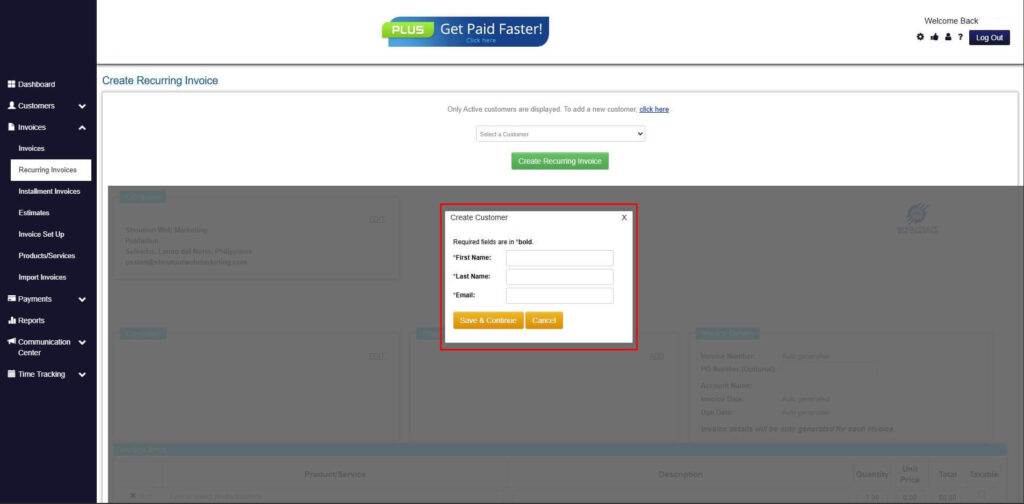

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

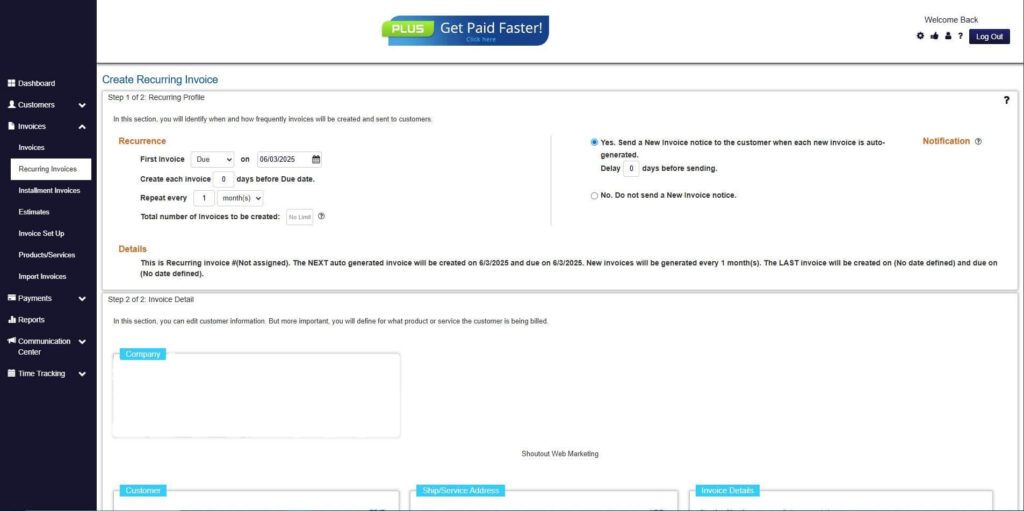

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

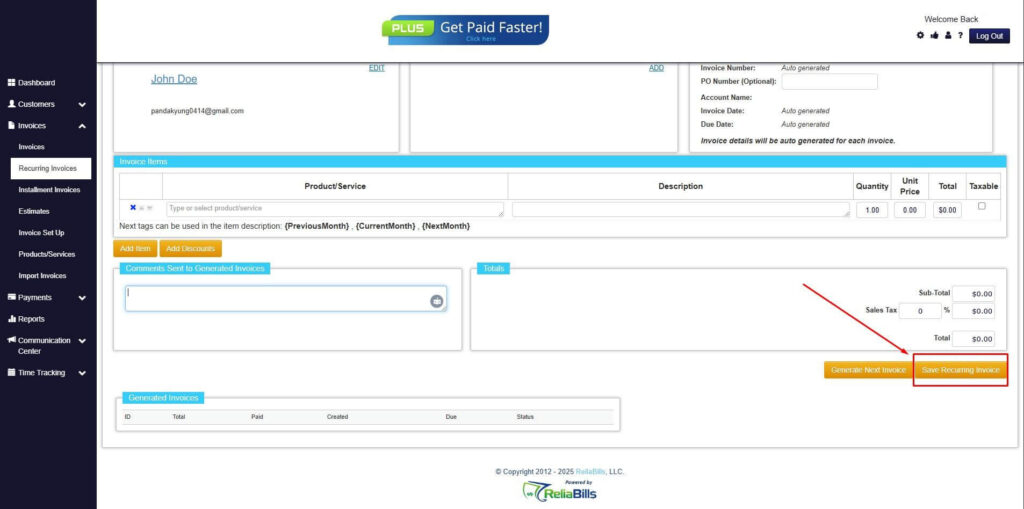

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

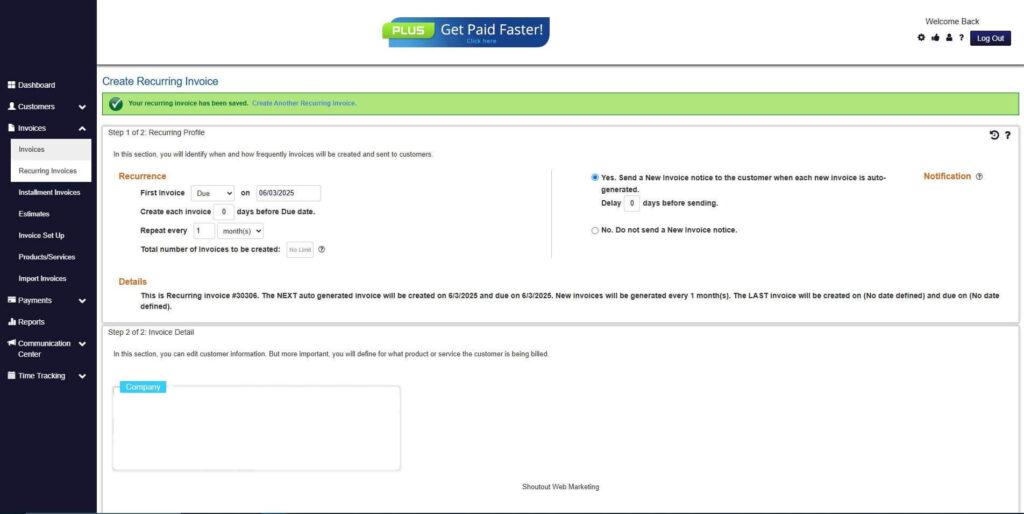

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Do dealerships always reveal the car invoice price?

Most will if asked, especially when you show that you have already researched pricing.

2. Is the invoice price the lowest price I can get?

Not always. Incentives and dealer bonuses can push the true dealer cost even lower.

3. How does knowing the invoice price help my rental business?

It allows you to negotiate smarter and lower your upfront investment per vehicle.

4. Does the invoice price include fees or taxes?

No. It only reflects the dealer’s cost to acquire the vehicle.

Conclusion

Understanding the car invoice price is one of the smartest steps when purchasing vehicles for a car rental business. It helps you negotiate confidently, avoid overpaying, and make informed decisions that protect your budget. When combined with strong financial tools like ReliaBills, your business becomes more efficient, organized, and ready for growth. By doing your research and leveraging automation, you can build a more profitable and professional rental operation.