Every business relies on steady cash flow to stay healthy, but that becomes difficult when payments don’t arrive on time. Many companies deal with outstanding invoices that linger long after the original due date. These unpaid balances slow down operations, create stress, and make it harder to plan for future expenses. Understanding what outstanding invoices are and how to manage them can help you stay organized, protect your revenue, and keep your business running smoothly.

Table of Contents

ToggleWhat Is an Outstanding Invoice?

An outstanding invoice is a bill that hasn’t been paid by the time its due date arrives. It remains open in your accounts receivable records until the customer settles it. Since the work has already been completed or the product has already been delivered, your business has met its end of the agreement while waiting for the client to fulfill theirs. Keeping a close eye on outstanding invoices helps you maintain accurate books, anticipate cash flow, and avoid unexpected financial setbacks.

Common Reasons Invoices Become Outstanding

Invoices can become overdue for a variety of reasons. The most common include customers simply overlooking the bill, unclear payment terms, or delays in sending the invoice in the first place. Sometimes the issue is as simple as incorrect details or missing information on the invoice. Clients may also be dealing with cash flow challenges of their own, or there may be internal miscommunication either on your side or theirs. Understanding these causes makes it easier to prevent overdue invoices before they happen.

Why Outstanding Invoices Are a Problem for Businesses

When outstanding invoices start piling up, they affect more than your accounting records. Delayed payments slow down your cash flow, which can make it harder to pay suppliers, cover payroll, or invest in growth opportunities. Your team may also find themselves spending extra time chasing payments instead of focusing on more productive work. If the issue continues, it can strain relationships with vendors, disrupt budgeting, and even push you toward costly collection efforts. Staying ahead of outstanding invoices is essential for keeping your business financially stable.

How to Track Outstanding Invoices Effectively

The key to managing outstanding invoices is staying organized. Many businesses use a combination of tools and consistent monitoring to stay on top of their accounts receivable. Helpful steps include:

- Keeping all invoices stored in one centralized system

- Using invoicing or accounting software that shows real-time payment status

- Setting up reminders for upcoming and past-due invoices

- Reviewing accounts receivable reports regularly

- Sorting invoices by aging groups such as 0–30 days, 31–60 days, and 61+ days

A clear tracking system makes it easier to spot overdue payments early and address them before they turn into costly delays.

Tips to Handle Outstanding Invoices

Dealing with outstanding invoices requires a balance of professionalism, consistency, and good communication. Some effective approaches include:

- Sending a friendly reminder right after the due date

- Following up with additional messages or a phone call if needed

- Confirming that the client received the invoice and understands the charges

- Offering convenient payment methods to speed up the process

- Working out a payment plan for clients who need extra time

- Applying late fees when your terms allow it

- Keeping all communication polite, clear, and documented

Taking a firm but respectful approach helps you get paid without harming the relationship.

How to Prevent Outstanding Invoices in the Future

Prevention starts with strong, reliable invoicing practices. You can reduce the number of outstanding invoices by:

- Providing clear payment terms from the beginning

- Requesting deposits for large projects

- Sending invoices immediately after the work is completed

- Setting up automated reminders

- Offering online payment options

- Making sure your invoices are accurate and easy to understand

When clients know exactly what to expect and have easy ways to pay paying on time becomes much more likely.

How ReliaBills Can Help You Manage Outstanding Invoices

ReliaBills helps businesses take control of outstanding invoices by automating the entire billing and follow-up process. Instead of manually reminding clients about overdue payments, ReliaBills sends automatic reminders, schedules recurring invoices, and follows up on unpaid bills so customers stay informed every step of the way.

The platform also provides clear, real-time reporting so you always know which invoices are current, which are overdue, and what needs attention. With built-in online payment options and customizable workflows, ReliaBills makes it simple for clients to pay and easier for your business to stay on top of accounts receivable. By automating the time-consuming parts of invoicing, ReliaBills helps reduce overdue payments and strengthen your cash flow.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

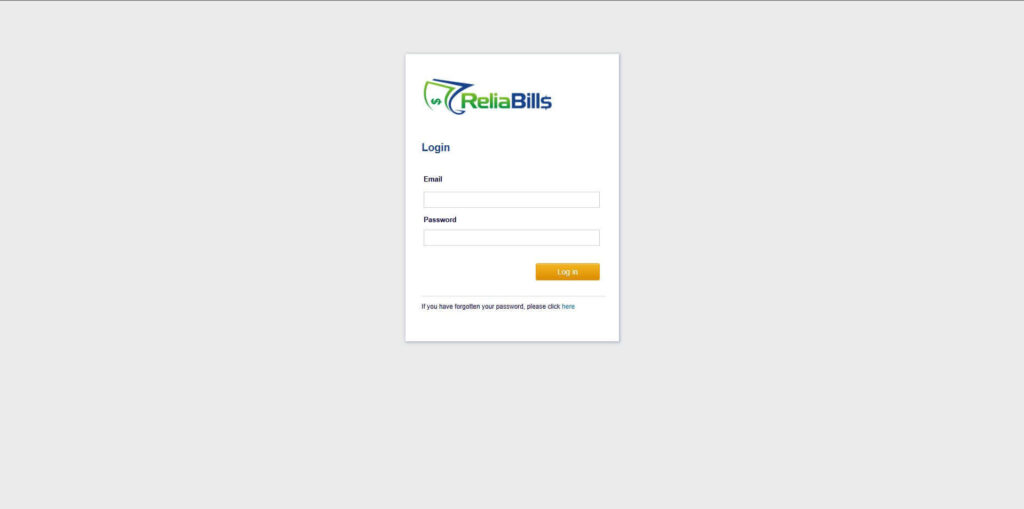

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

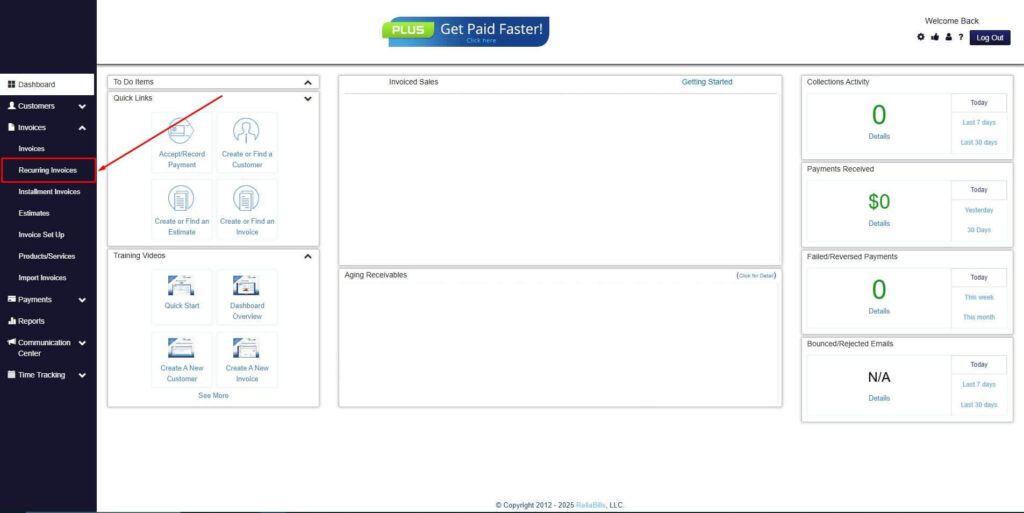

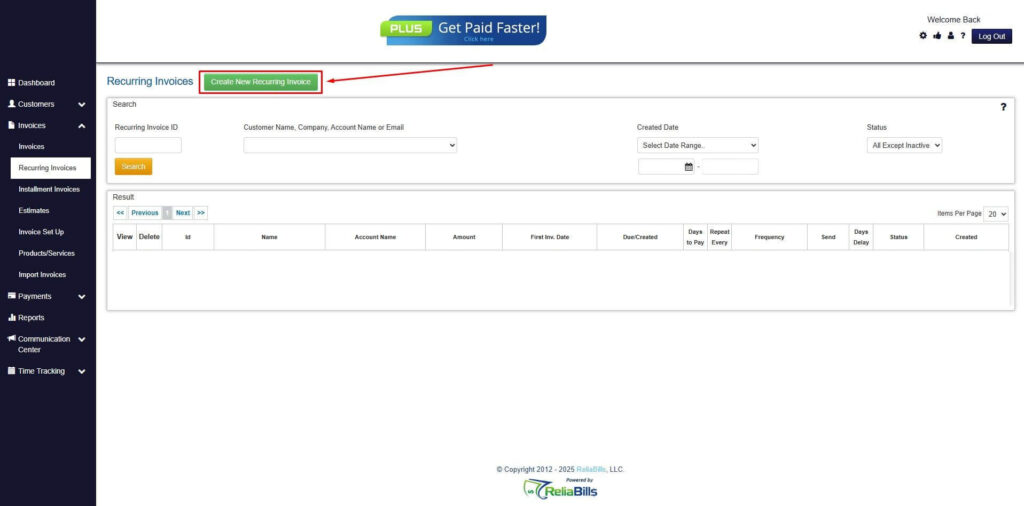

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

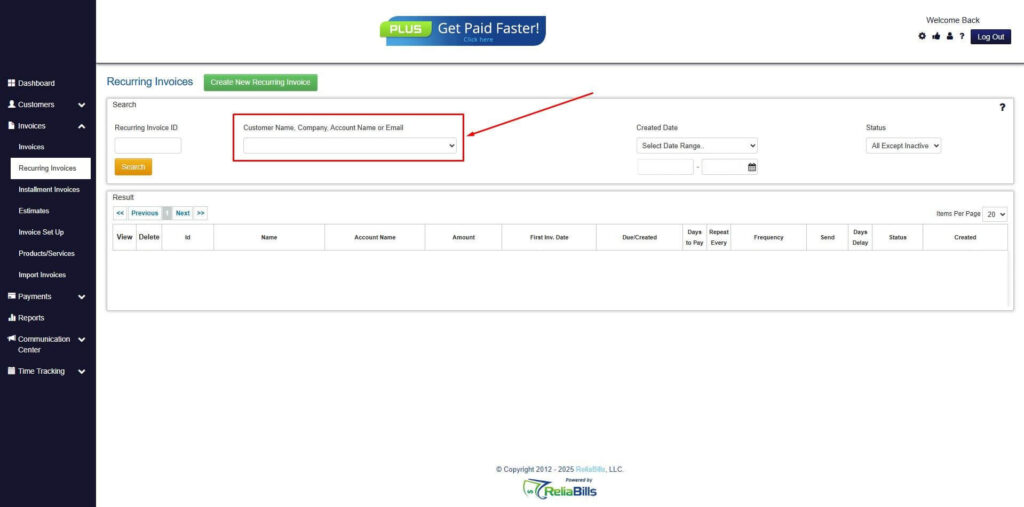

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

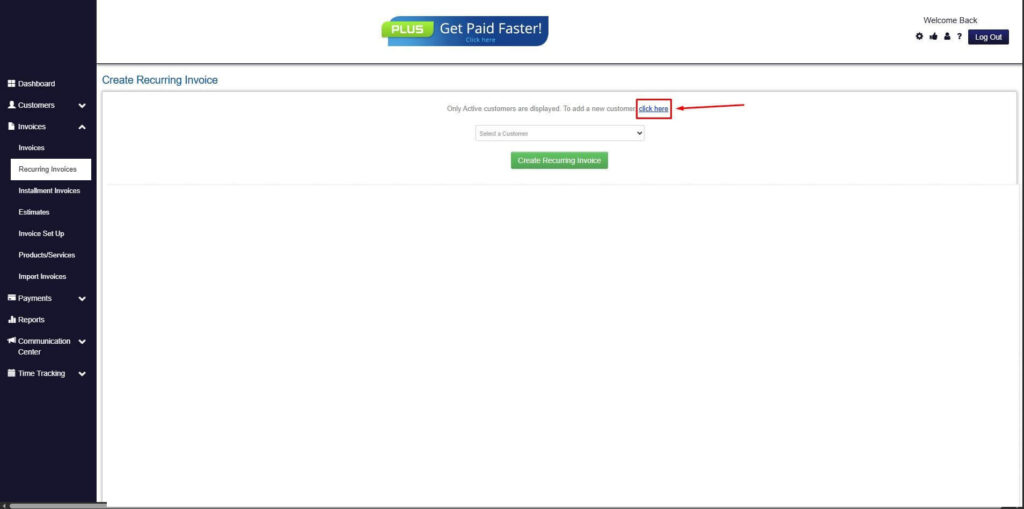

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

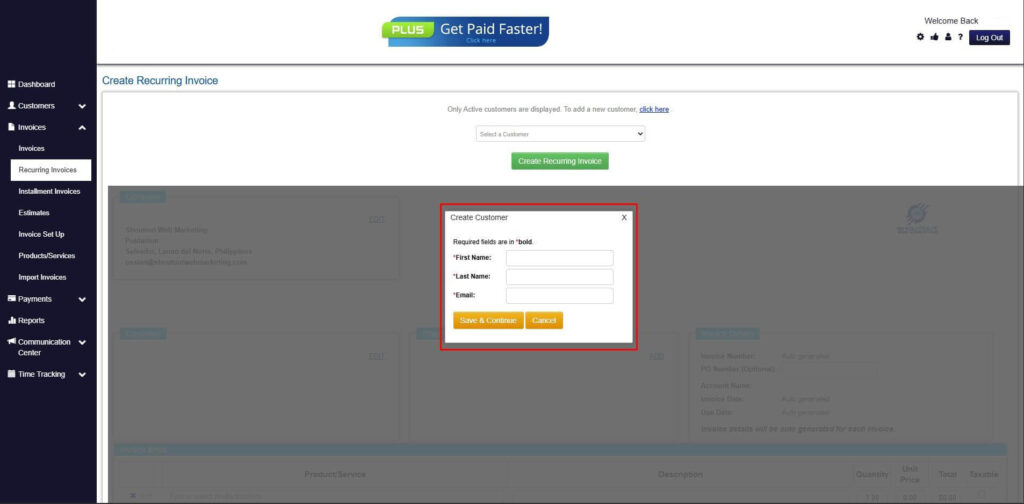

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

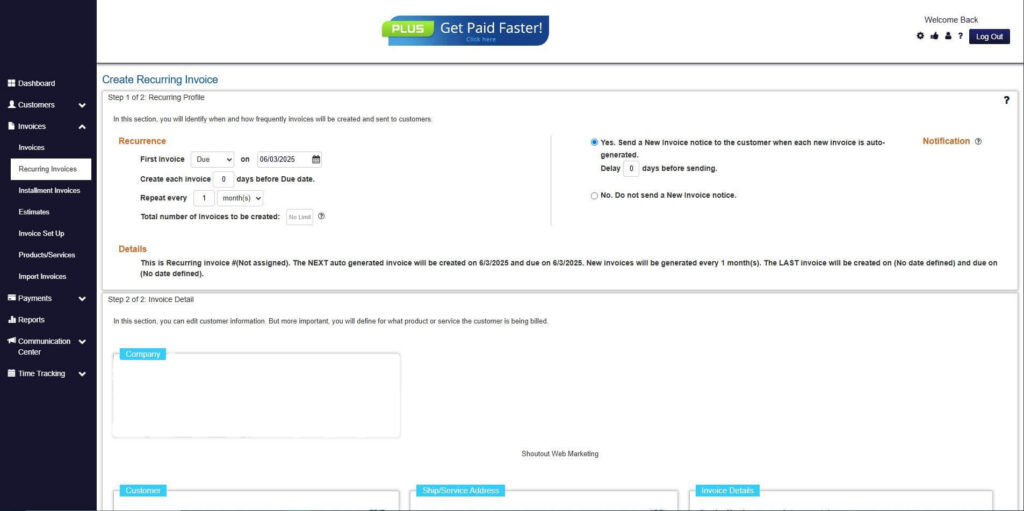

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

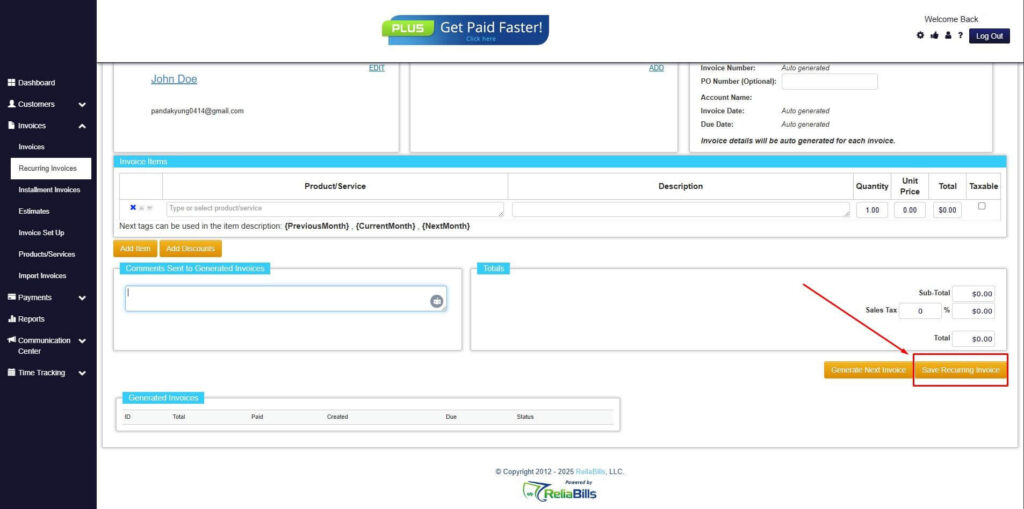

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

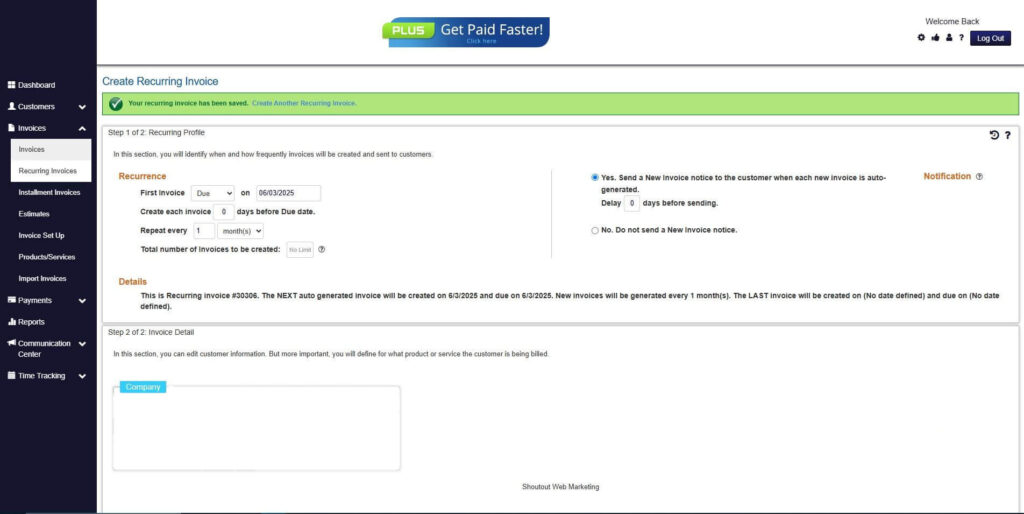

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. How long before an invoice is considered outstanding?

An invoice becomes outstanding the moment the due date passes without payment.

2. Can I charge late fees on overdue invoices?

Yes, but only if your payment terms clearly explain any late fee policy before work begins.

3. What is the best way to follow up on an outstanding invoice?

Start with a friendly reminder, then follow up with additional messages or a phone call if the invoice remains unpaid.

4. Do automated reminders really reduce outstanding invoices?

Yes. Automated reminders help clients stay aware of their obligations and prevent accidental delays.

Conclusion

Outstanding invoices are a common challenge for many businesses, but they don’t have to disrupt your cash flow. With consistent tracking, clear communication, and strong invoicing practices, you can handle overdue payments more effectively. Tools like ReliaBills make the process even easier by automating reminders, tracking, and follow-ups so you can focus on running your business. Managing outstanding invoices well keeps your operations steady and helps support long-term growth.