Accurate invoicing is essential for keeping your business organized and ensuring you get paid on time. Whether you are running a small business or working as a freelancer, following a clear invoicing checklist helps you create professional invoices that clients understand and respond to quickly.

In this guide, you will learn exactly how to fill out an invoice, how to list discounts correctly, and why using invoicing software like ReliaBills can make your billing process smoother, faster, and far more efficient.

Table of Contents

ToggleHow to Fill Out an Invoice: Small Business Checklist

A well-prepared invoice establishes trust with your clients and ensures clarity for both parties. Using a detailed invoicing checklist helps eliminate errors and presents your business professionally.

Below is a complete small business invoicing checklist:

1. Add Your Business Information

Begin your invoice with your business name, address, phone number, email, and website. Including your logo makes your invoice look more polished and reliable.

2. Include Your Client’s Details

Add the customer’s name, business name if applicable, address, email, and any internal reference numbers needed for processing payments.

3. Assign a Unique Invoice Number

Every invoice should have its own identification number. This helps you track transactions and makes accounting more manageable.

4. Add the Invoice Date and Payment Due Date

Record the date the invoice was created and specify when payment is due. Clear due dates greatly reduce confusion and late payments.

5. Provide a Clear Description of Services or Products

List each service or item you provided. Include short descriptions, quantities, rates, and the cost for each line item. Clarity reduces back-and-forth communication between you and your client.

6. Calculate Subtotals and Taxes

Add up all line items before tax. Then apply the appropriate sales tax rate if required by your region.

7. Display the Total Amount Due

Make the total amount easy to see. This is one of the most important parts of your invoicing checklist because it tells clients exactly what they owe.

8. Add Payment Instructions

Inform your client how they can pay you. This may include bank details, online payment links, accepted card types, or digital wallet methods.

9. Include Terms and Additional Policies

Note your late payment fees, refund conditions, project scope, or any other important reminders. These details help protect your business and set clear expectations.

10. Add a Personal Message

A friendly thank-you note can improve client relationships and increase the chance of repeat business.

How to Include Discounts on an Invoice

Offering discounts is a great way to build customer loyalty, encourage early payments, or close deals more easily. Including them properly ensures that clients clearly understand the savings they are receiving.

Here is how to add discounts correctly on your invoice:

1. List the Original Price First

Before showing the discount, display the full price of your service or product as the initial line item total.

2. Add a Separate Line for the Discount

Name the discount clearly. Examples include Early Payment Discount, Referral Discount, or Volume Discount. Then show the discount as a negative amount.

3. Adjust the Subtotal Automatically

Once you apply the discount, the invoice subtotal should update to reflect the new amount.

4. Add Taxes After Discounts

Taxes should be calculated on the discounted amount, not the original price, unless your local regulations state otherwise.

5. Highlight the Final Total

Make sure the final total is easy to read so there is no confusion during payment.

Clear discount visibility helps promote transparency and improves customer satisfaction.

Why Professionals Use ReliaBills for their Invoicing Solutions

Many small business owners and freelancers rely on ReliaBills because it makes the billing process simple, organized, and completely automated. Instead of manually tracking payments or creating invoices from scratch, ReliaBills handles these tasks with ease.

Here is why ReliaBills stands out:

Automated Invoicing and Billing

ReliaBills helps you create invoices quickly and sends them automatically to your clients. This is especially helpful when you need an ongoing or recurring billing system.

Recurring Billing Options

If you work with clients on a subscription or monthly service arrangement, ReliaBills allows you to set up recurring billing so invoices are sent without any manual effort.

Professional and Customizable Invoice Templates

You can personalize your invoices with your logo, colors, and preferred layout. This helps strengthen your brand identity.

Automatic Payment Reminders

Late payments can interrupt your cash flow. ReliaBills sends reminder emails so you never have to chase clients again.

Multiple Payment Methods

Clients can pay using credit cards, ACH transfers, or other online methods. This flexibility increases the chances of receiving fast payments.

Secure, Reliable, and Easy to Use

ReliaBills protects your financial data and offers a user-friendly interface that even non-technical users can navigate effortlessly.

Using ReliaBills saves time, improves financial accuracy, and creates a more professional billing experience, especially when paired with a solid invoicing checklist.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

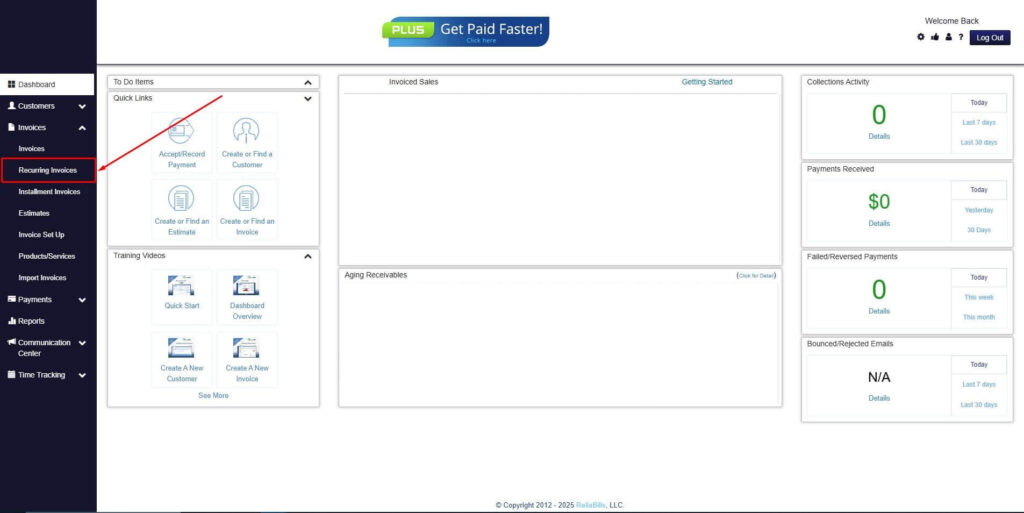

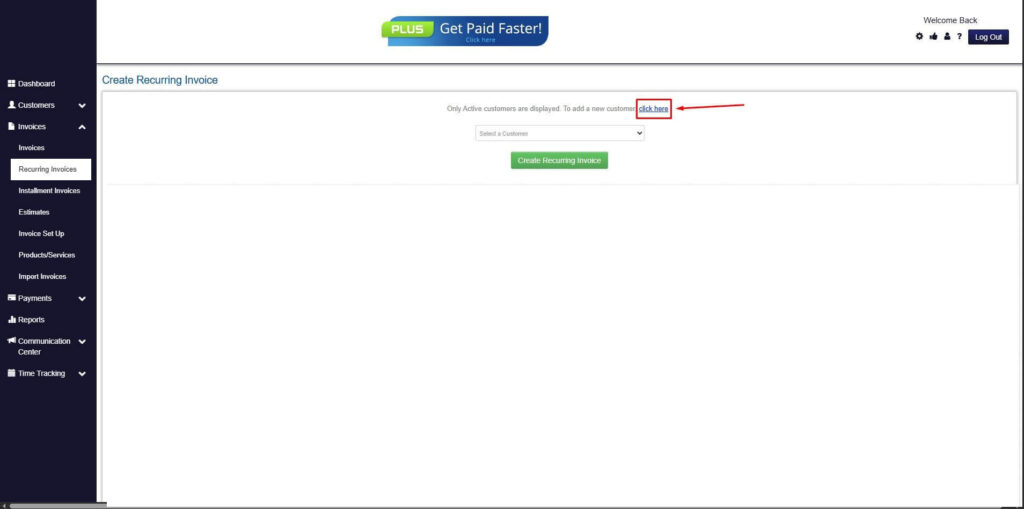

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

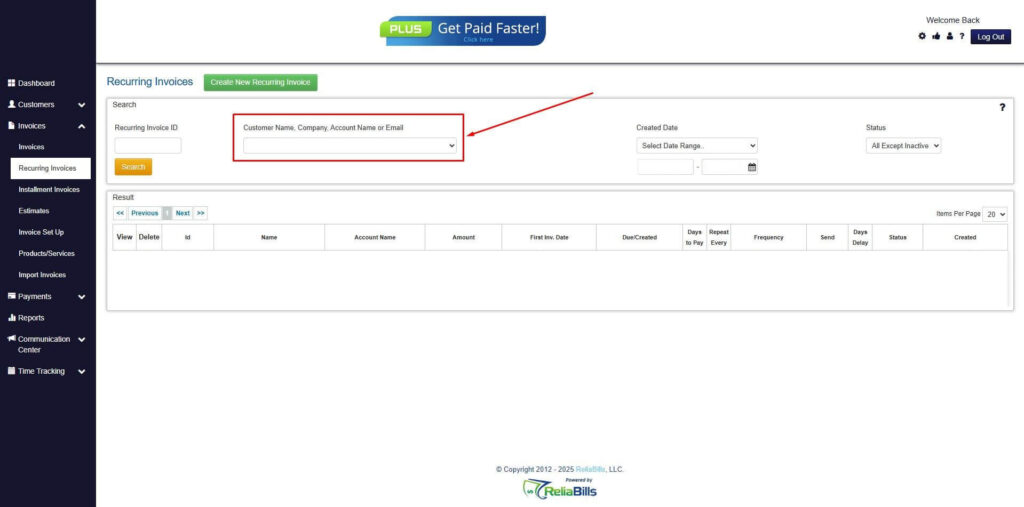

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

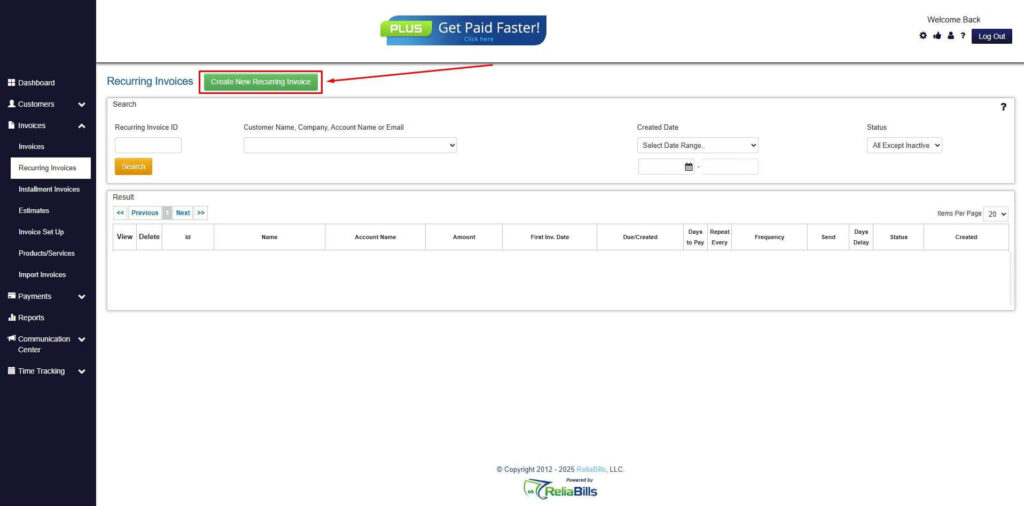

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

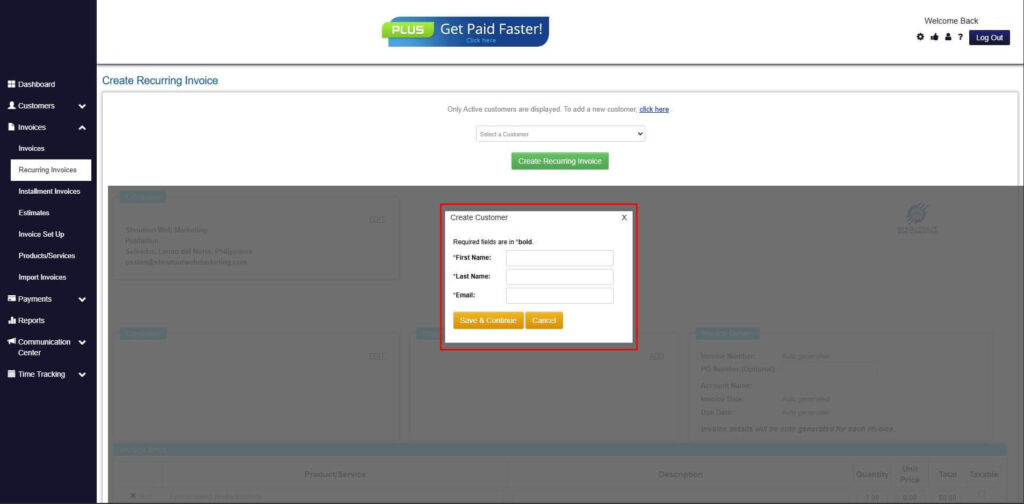

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

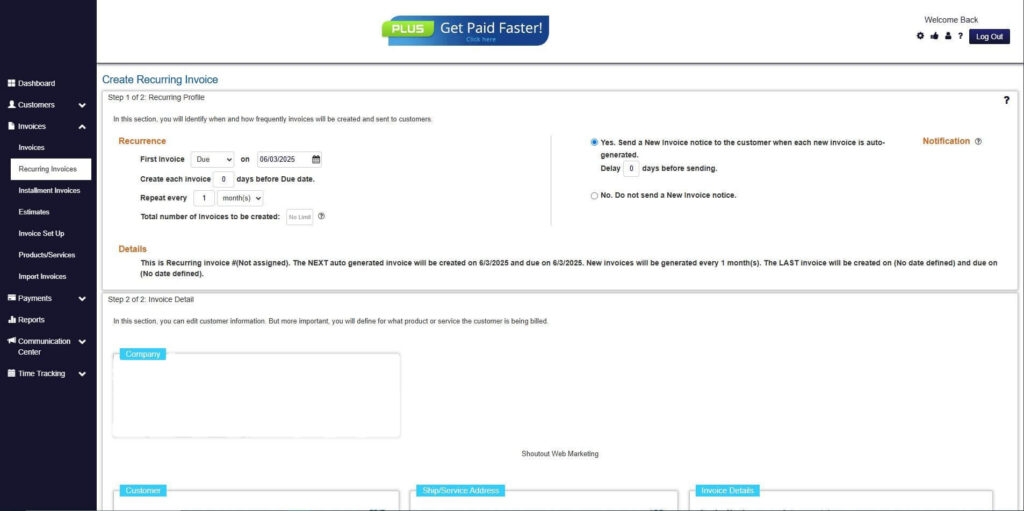

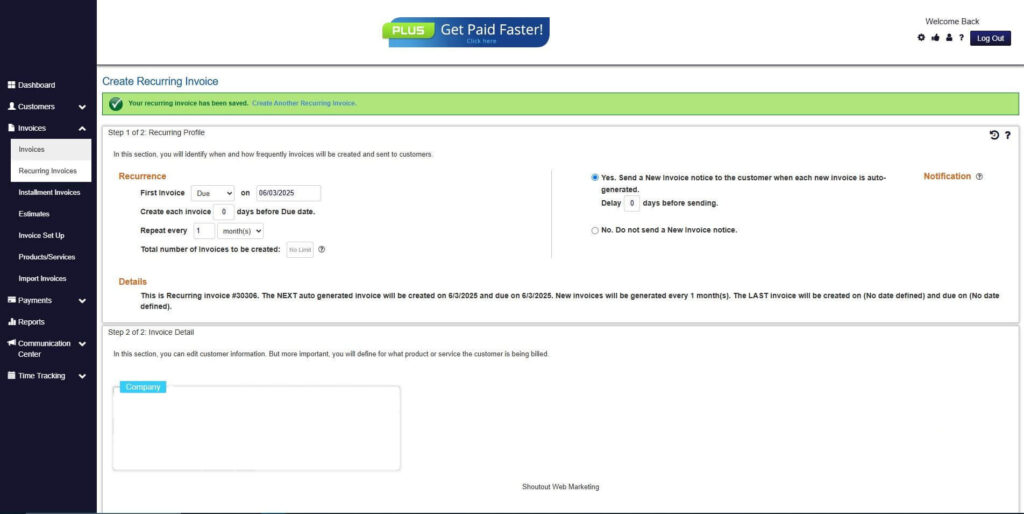

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

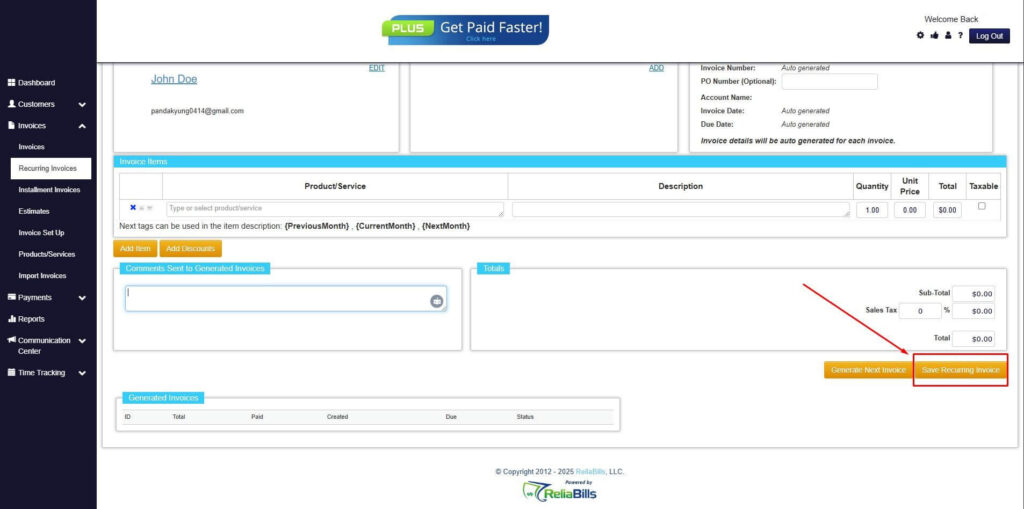

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What information is mandatory in an invoice?

You must include your business information, client details, invoice number, invoice date, description of services or products, totals, taxes, and payment instructions.

2. Why do small businesses need an invoicing checklist?

A good invoicing checklist reduces errors, saves time, and ensures that every invoice is complete, professional, and ready for client processing.

3. How can I speed up payments from clients?

Use clear payment terms, offer online payment methods, and use automated reminders through invoicing software like ReliaBills.

4. Can I invoice clients before completing a project?

Yes. Many businesses send deposits or prepayment invoices to secure upfront payment. Your terms should explain how and when these payments are applied.

5. Does ReliaBills offer a free plan?

Yes. You can start with a free ReliaBills account and upgrade to ReliaBills PLUS if you want advanced features like automation and recurring billing.

Conclusion

Using a complete invoicing checklist helps you stay organized, present your business professionally, and ensure that every invoice is accurate and ready for processing. When paired with smart tools like ReliaBills, invoicing becomes faster, cleaner, and more efficient.

From generating professional invoices to automating reminders and supporting recurring billing, ReliaBills provides everything you need to streamline your billing workflow. With the right tools and a reliable invoicing process in place, your business can operate smoothly and get paid faster.