When running a business, it’s common to request partial or full payment from clients before providing goods or services. This process is made official through a prepayment invoice, also known as a prepayment bill.

Prepayment invoices help secure your business against non-payment, improve cash flow, and establish trust with clients. In this article, we’ll discuss what a prepayment invoice is, how to use one, how to create one, and why it’s beneficial for your business.

Table of Contents

ToggleWhat Is a Prepayment Invoice?

A prepayment invoice, also called a prepayment bill, is a document sent to a client before the goods or services are delivered. It serves as a request for advance payment, allowing businesses to secure partial or full payment upfront before the project begins.

Unlike a standard invoice, which is issued after the service is completed or the product is delivered, a prepayment bill confirms the client’s commitment and provides the business with working capital to start the job.

For example, if you run a catering business and a client books your service for an upcoming event, you may issue a prepayment invoice requesting a 50% deposit before confirming the reservation. Once the service is completed, you would then issue a final invoice deducting the prepayment from the total amount.

A typical prepayment invoice includes:

- The business name, address, and contact information

- The client’s details

- A description of goods or services to be provided

- The prepayment amount requested

- Payment methods and due date

- Reference number or invoice ID

This type of billing document provides a professional and transparent way to request upfront payments.

How Should Prepayment Invoices Be Used?

A prepayment bill is best used when there’s an agreement between you and your client to make an advance payment before the full service is rendered. It’s common in industries such as:

- Event planning and catering

- Construction and contracting

- Freelancing and consulting

- Manufacturing and custom orders

Prepayment invoices are typically used in situations where the business needs to purchase materials, allocate labor, or secure resources before the job begins.

Here’s how it usually works:

- You and your client agree on the total project cost and prepayment terms.

- You issue a prepayment invoice that specifies the amount due upfront.

- Once the client pays, you record the payment and proceed with the project.

- After completing the job, you issue a final invoice showing the total cost minus the prepayment received.

Using a prepayment bill ensures both parties are clear about financial expectations and commitments.

How to Create a Prepayment Invoice

Creating a prepayment invoice or prepayment bill is similar to making a regular invoice, but with specific details related to advance payment. Here’s how to do it:

Start with Business and Client Details

Include your company name, logo, contact information, and your client’s details. This gives your invoice a professional touch.

Add Invoice Header

Clearly label the document as a “Prepayment Invoice” or “Prepayment Bill” to avoid confusion with standard invoices.

Include Payment Details

State the total amount due, the portion that must be paid in advance, and the due date for that prepayment.

Describe the Goods or Services

Provide a clear outline of what the prepayment covers, including service descriptions, materials, or specific milestones.

Add Payment Methods

Include details about how clients can make payments, whether through bank transfer, card payment, or an online payment link.

List Terms and Conditions

Outline your refund or cancellation policy, especially for prepayments that are non-refundable.

Assign a Unique Invoice Number

This helps track your prepayment invoices and ensures proper documentation in your accounting system.

If you use online invoicing software like ReliaBills, the process becomes even easier. You can select a prepayment invoice template, customize it, and send it directly to clients in minutes.

Record of Prepayment

Once the client pays the prepayment bill, you’ll need to record it properly in your accounting system. The prepayment amount should be treated as a liability until the product or service is delivered.

Here’s how it typically works:

- When the client pays the prepayment invoice, record the payment under “Customer Deposits” or “Unearned Revenue.”

- Once you deliver the product or complete the service, transfer that amount to your “Revenue” account and issue a final invoice showing the balance due.

Accurate record-keeping of prepayment bills helps maintain transparency, supports audit compliance, and ensures your books reflect real-time financial activity.

Advantages of Prepayment Invoices

Using a prepayment bill offers several benefits for both businesses and clients.

Improved Cash Flow

By receiving partial or full payment in advance, your business gains immediate working capital to fund materials, labor, or resources.

Reduced Risk of Non-Payment

A prepayment invoice ensures that clients are financially committed before work begins, minimizing the chance of late or missed payments.

Better Resource Management

With prepayments, you can allocate resources confidently, knowing the project is confirmed and partially funded.

Enhanced Professionalism

Issuing a prepayment bill shows your clients that your business operates with structure and clear financial processes.

Client Trust and Commitment

Prepayment arrangements assure clients that you are prepared to deliver once their initial payment is made, creating mutual trust.

Key Takeaways

A prepayment invoice, or prepayment bill, is an essential financial document for businesses that need to collect advance payments before rendering services or delivering products. It formalizes the prepayment agreement, provides a clear record for both parties, and ensures smoother transactions.

By using prepayment invoices, businesses can improve cash flow, reduce financial risks, and establish stronger professional relationships with clients.

For modern businesses, using an automated invoicing platform like ReliaBills makes creating and managing prepayment invoices much easier. With automation, you can track payments, send reminders, and even set up recurring billing for clients who pay regularly.

Frequently Asked Questions

1. Is a prepayment invoice the same as a regular invoice?

No. A prepayment invoice is issued before goods or services are delivered to request advance payment. A regular invoice is issued after the service is completed.

2. Can I issue multiple prepayment bills for one project?

Yes. Some projects require several prepayments based on milestones or phases. Each prepayment bill can reflect a specific portion of the total cost.

3. Are prepayment invoices legally binding?

Yes, as long as they are agreed upon by both parties and include the proper terms and conditions.

4. Can ReliaBills create prepayment invoices automatically?

Absolutely. ReliaBills allows you to create, send, and track prepayment bills automatically, saving time and improving accuracy.

How to Create a New Invoice Using ReliaBills

Creating an invoice using ReliaBills involves the following steps:

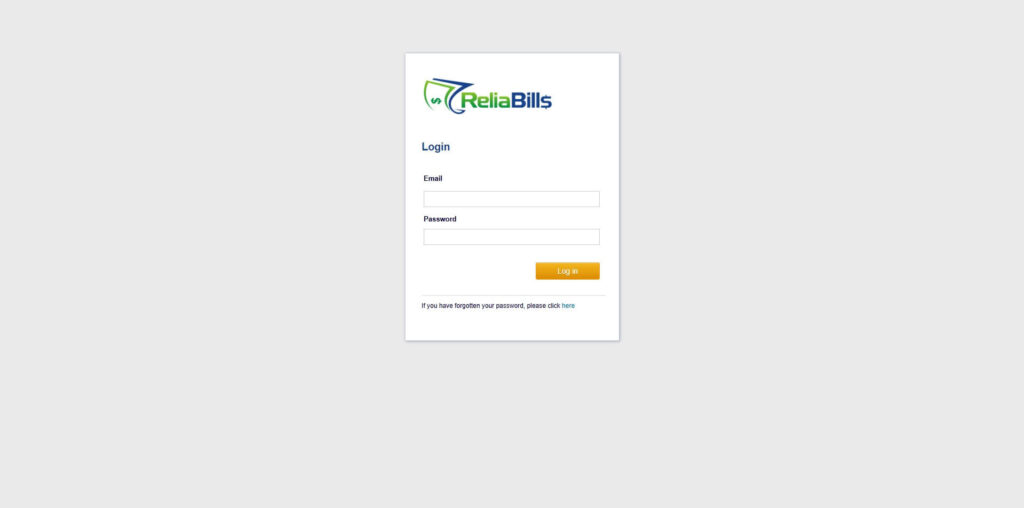

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

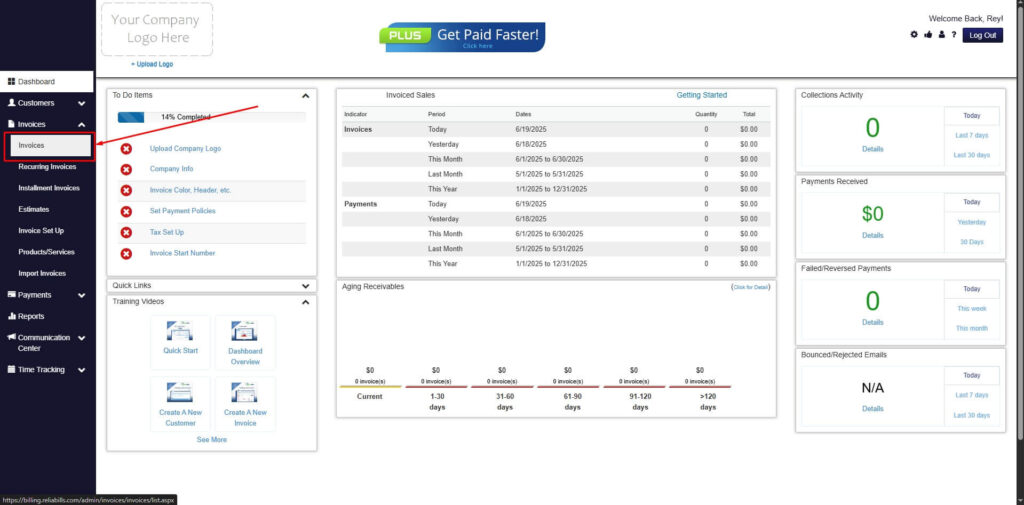

Step 2: Click on Invoices

- Navigate to the Invoices Dropdown and click on Invoices.

Step 3: Click ‘Create New Invoice’

- Click ‘Create New Invoice’ to proceed.

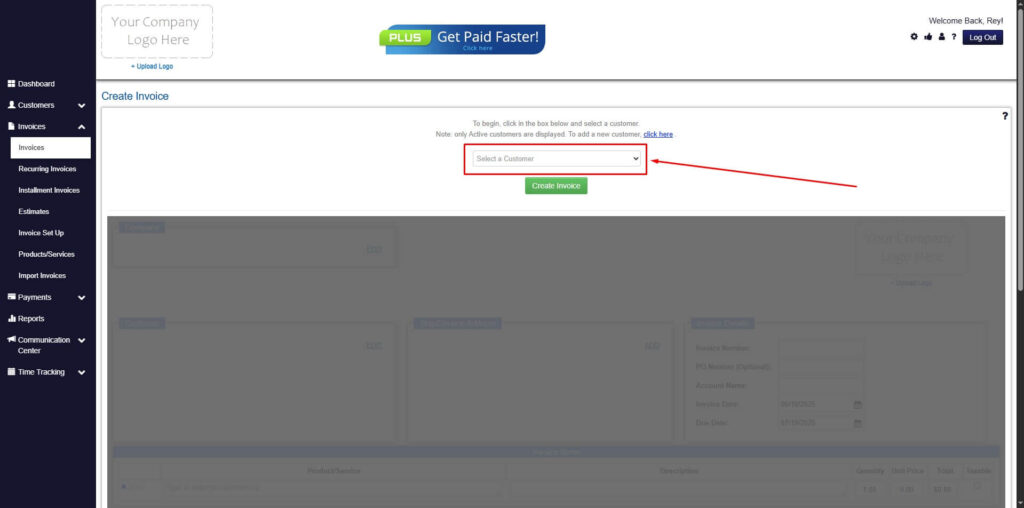

Step 4: Go to the ‘Customers Tab’

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

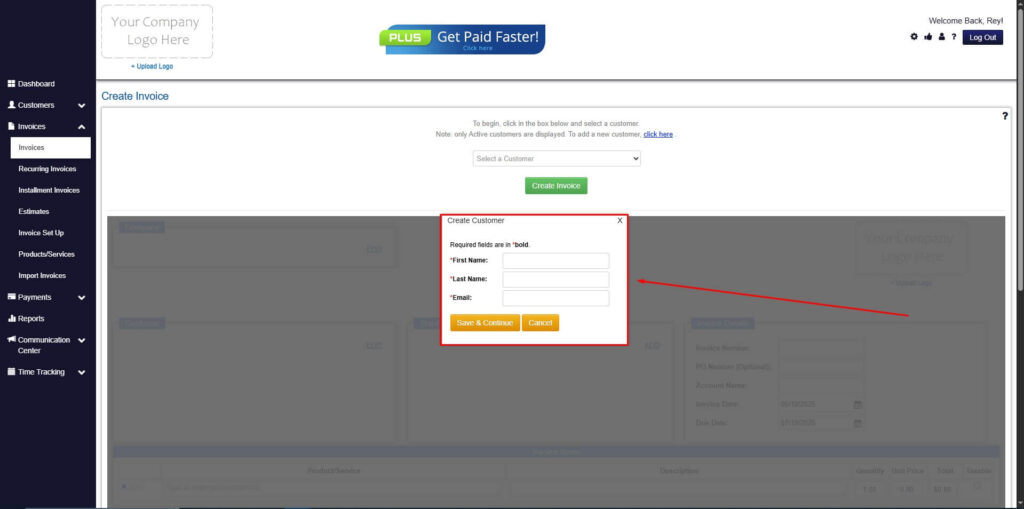

Step 5: Create Customer

- If you haven’t created any customers yet, click the ‘Click here’ to create a new customer.

- Provide the First Name, Last Name, and Email to proceed.

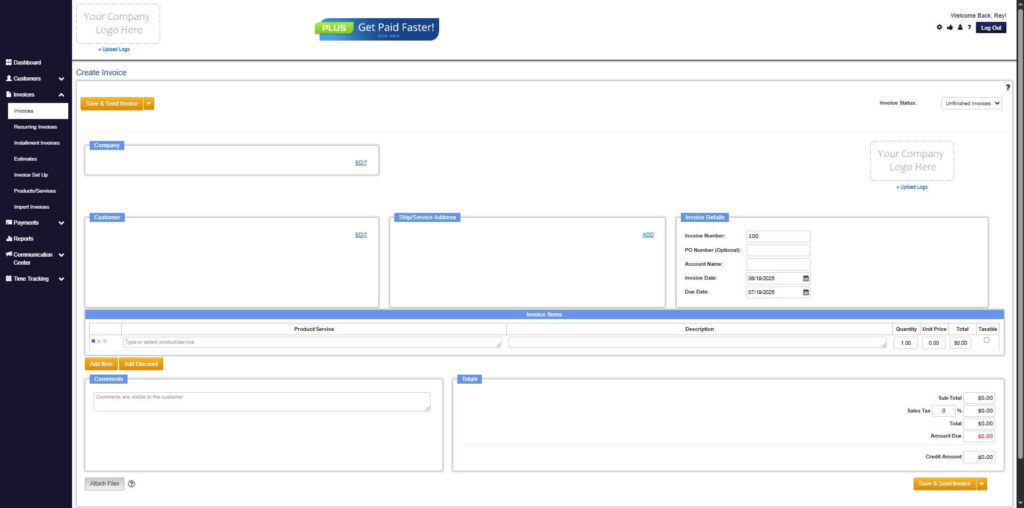

Step 6: Fill in the Create Invoice Form

- Fill in all the necessary fields.

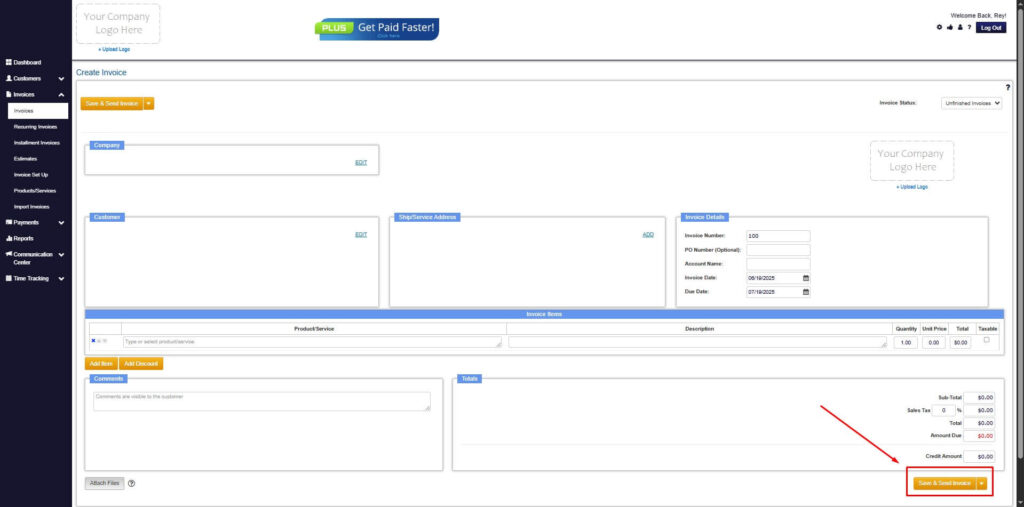

Step 7: Save Invoice

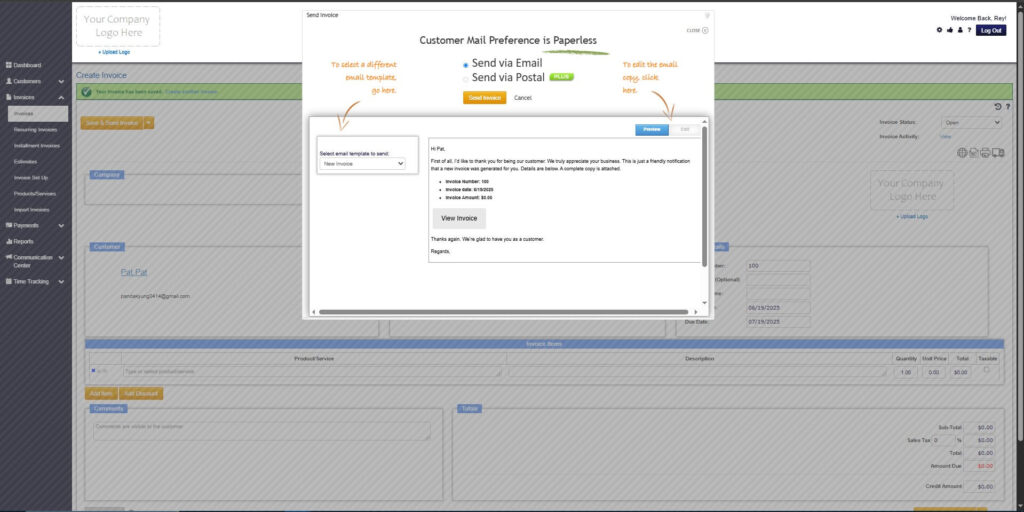

- After filling out the form, click “Save & Send Invoice” to continue.

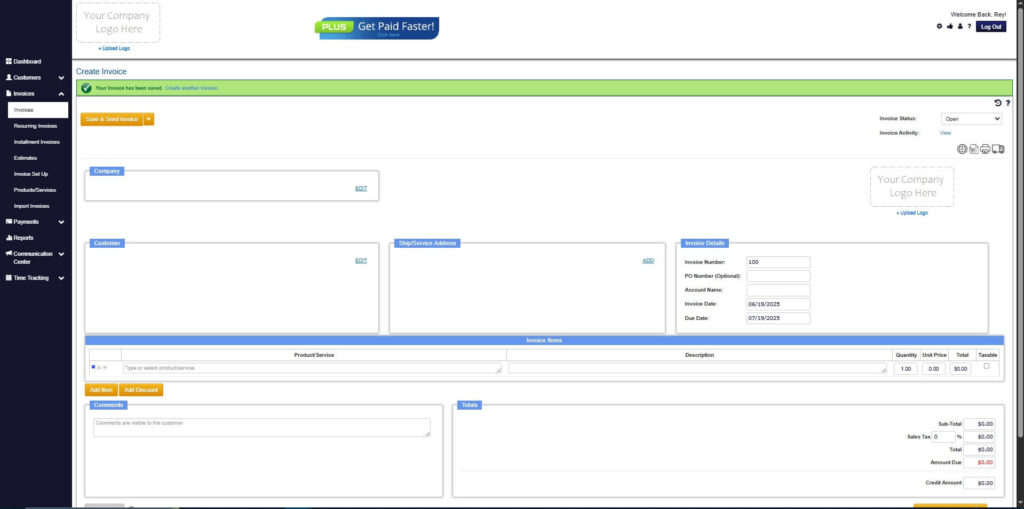

Step 8: Invoice Created

- Your Invoice has been created.

Conclusion

A prepayment invoice or prepayment bill is more than just a request for early payment. It’s a financial tool that helps businesses maintain healthy cash flow, minimize risks, and foster strong client relationships.

By automating your prepayment invoices with tools like ReliaBills, you can ensure faster, more accurate, and more efficient payment processes. ReliaBills simplifies the entire invoicing cycle, from prepayment requests to final billing, so you can focus on growing your business instead of managing paperwork. Start creating professional prepayment bills today with ReliaBills and enjoy smoother, more secure transactions every time.