Fleet operations are more complex today than ever before. Companies manage multiple vehicles, drivers, service schedules, fuel expenses, tolls, and maintenance contracts across different locations. Each moving part generates financial transactions that must be accurately recorded and billed.

As fleets grow, billing volume increases significantly. Every vehicle can produce dozens of chargeable events each month, from fuel purchases to scheduled repairs. Without a structured system, tracking these transactions manually becomes inefficient and risky.

Traditional invoicing methods simply cannot keep up at scale. Paper-based systems and spreadsheets slow down processing and increase the likelihood of errors. This is why many companies now rely on fleet management billing software to streamline digital invoicing and maintain financial control.

Table of Contents

ToggleWhat Is Fleet Management Billing?

Fleet management billing refers to the structured process of charging for all fleet-related expenses and services. It includes tracking, allocating, and invoicing operational costs associated with vehicles and drivers. The process must ensure accuracy across contracts and usage records.

Typical billing components include fuel usage, preventive maintenance, emergency repairs, vehicle leasing fees, toll charges, telematics services, and insurance allocations. Each of these elements may follow different pricing structures. Managing them together requires centralized oversight.

Multi-vehicle and multi-location operations create additional complexity. Costs must be allocated correctly per vehicle, department, or client. Without reliable fleet management billing software, financial tracking becomes fragmented and difficult to reconcile.

What Are Digital Invoices?

Digital invoices are electronically generated billing documents created and delivered through automated systems. Unlike paper invoices, they are processed, stored, and tracked within software platforms. This reduces manual intervention and improves consistency.

Paper-based billing often relies on physical documentation and manual approvals. Digital systems standardize formatting, automate calculations, and provide secure storage. This ensures faster processing and easier retrieval during audits.

Modern digital invoicing integrates directly with accounting systems and fleet management platforms. Data flows automatically from operational systems into billing workflows. This integration is a key feature of advanced fleet management billing software.

Common Billing Challenges in Fleet Operations

High Invoice Volume Per Vehicle

Each vehicle generates multiple chargeable events every month, including fuel purchases, preventive maintenance, toll fees, repairs, insurance allocations, and leasing costs. When multiplied across an entire fleet, invoice volume increases rapidly. Without structured fleet management billing software, tracking and consolidating these transactions becomes overwhelming.

Variable and Usage-Based Costs

Fleet expenses fluctuate based on mileage, fuel consumption, route changes, seasonal demand, and unexpected breakdowns. These variable inputs make billing calculations more complex than fixed monthly services. Manual systems struggle to consistently apply accurate usage data across all invoices.

Delayed Data Entry from Field Operations

Drivers and technicians often submit fuel receipts, service logs, or repair documentation after the fact. Delayed reporting slows invoice generation and can disrupt billing cycles. This lag directly affects revenue timing and cash flow predictability.

Disputes Over Fuel, Repairs, and Service Charges

Clients may question unexpected maintenance costs or higher-than-usual fuel charges. Without detailed breakdowns and digital tracking, resolving disputes becomes time-consuming. Transparent documentation is essential for reducing friction and maintaining trust.

Multi-Vehicle and Multi-Location Complexity

Fleets operating across different regions must account for varying tax rates, toll systems, and service providers. Allocating costs accurately per vehicle or department requires centralized oversight. Fragmented billing systems increase reconciliation challenges.

Missed Recurring Contract Charges

Ongoing maintenance agreements, telematics subscriptions, and lease payments must be billed consistently. Manual tracking increases the risk of skipped or delayed recurring invoices. This leads to revenue leakage and accounting discrepancies.

Duplicate or Inconsistent Invoices

Spreadsheet-based processes can result in duplicate entries or inconsistent invoice numbering. These errors complicate audits and financial reporting. Structured automation significantly reduces these risks.

Why Manual Fleet Invoicing Increases Risk

Manual invoicing introduces data entry errors. Even small mistakes in mileage logs or service charges can result in inaccurate billing. Over time, these errors accumulate and impact profitability.

Recurring service charges are also easily missed without automation. Maintenance contracts and vehicle lease payments require consistent scheduling. Missing one billing cycle disrupts revenue flow.

Duplicate invoices and inconsistent records create compliance risks. Without real-time visibility, finance teams struggle to track revenue performance. Fleet management billing software reduces these risks through structured automation.

How Digital Invoices Streamline High-Volume Billing

Digital systems enable automated invoice generation based on predefined rules. Once expenses are recorded, invoices are created automatically. This significantly reduces processing time.

Billing can also be consolidated per vehicle or per client. Instead of sending multiple separate invoices, companies can group related charges. This improves clarity and simplifies reconciliation.

Real-time cost tracking allows finance teams to monitor expenses instantly. Standardized invoice templates maintain consistent formatting and branding. Fleet management billing software ensures accuracy while handling high transaction volumes.

Supporting Recurring Billing for Fleet Contracts

Many fleet operations rely on recurring contracts. Monthly vehicle leases and ongoing maintenance agreements require predictable billing schedules. Automation ensures these recurring invoices are issued on time.

Subscription-based fleet services, such as telematics or fleet tracking platforms, also require structured billing cycles. Automated scheduling reduces the risk of missed invoices. It also supports contract-based recurring terms without manual intervention.

By automating recurring billing, fleet management billing software stabilizes revenue streams. Businesses gain predictable cash flow while reducing administrative effort.

Improving Cash Flow in Fleet Management

Faster invoice delivery leads to faster payments. Digital invoices can be issued immediately after service completion or cost confirmation. This shortens the billing cycle significantly.

Automated payment reminders reduce late payments. Customers receive timely notifications, improving collection efficiency. Reduced accounts receivable aging strengthens financial stability.

Improved collection cycles allow fleet operators to reinvest in vehicle maintenance and expansion. Fleet management billing software plays a critical role in sustaining consistent cash flow.

Enhancing Accuracy and Compliance

Automated tax calculations reduce compliance risks. Digital systems apply tax rules consistently across invoices. This minimizes calculation errors.

Centralized digital recordkeeping ensures audit-ready documentation. All invoices are securely stored and easily accessible. This simplifies regulatory reporting requirements.

Transparent cost breakdowns improve accountability. Detailed invoice line items help prevent disputes. Fleet management billing software supports both operational transparency and compliance standards.

Integration with Fleet and Accounting Systems

Modern billing systems sync with fleet tracking platforms. Telematics data can automatically populate invoice details. This eliminates manual data transfer.

Accounting software integration ensures financial records stay updated. Revenue entries, payments, and adjustments sync seamlessly. This reduces reconciliation errors.

Automated reporting dashboards provide clear performance insights. Businesses can analyze revenue trends and operational costs in real time. Integrated fleet management billing software creates a unified financial ecosystem.

Reducing Administrative Overhead

Paper-based workflows require printing, mailing, and manual filing. Digital systems eliminate these steps entirely. This reduces operational expenses.

Manual reconciliation consumes significant staff hours. Automated systems match payments to invoices instantly. Finance teams can focus on strategic initiatives instead of routine tasks.

Scalable billing processes allow fleets to expand without increasing administrative headcount. Fleet management billing software supports growth without operational bottlenecks.

Improving Customer and Vendor Transparency

Digital billing summaries provide detailed cost breakdowns. Customers can clearly see fuel, maintenance, leasing, and service allocations. This builds trust.

Online invoice access allows clients to review billing history anytime. Self-service access reduces inbound billing inquiries. It also improves overall client experience.

Clear cost allocation per vehicle reduces disputes. When information is transparent, disagreements decline. Fleet management billing software enhances both communication and accountability.

How ReliaBills Supports Fleet Management Billing

ReliaBills provides automated digital invoicing designed to simplify high-volume fleet operations. Businesses can generate professional invoices quickly while eliminating manual processing errors. The platform centralizes billing data for improved financial visibility.

Recurring billing is especially valuable for fleet contracts and vehicle leases. ReliaBills enables flexible recurring billing setups that automatically schedule monthly invoices for ongoing agreements. This ensures predictable revenue without manual tracking.

ReliaBills also supports branded invoice communication and real-time reporting tools. Fleet operators can monitor receivables, track revenue, and maintain paperless billing processes aligned with sustainability initiatives. The result is efficient fleet management billing software that saves time and supports long-term growth.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

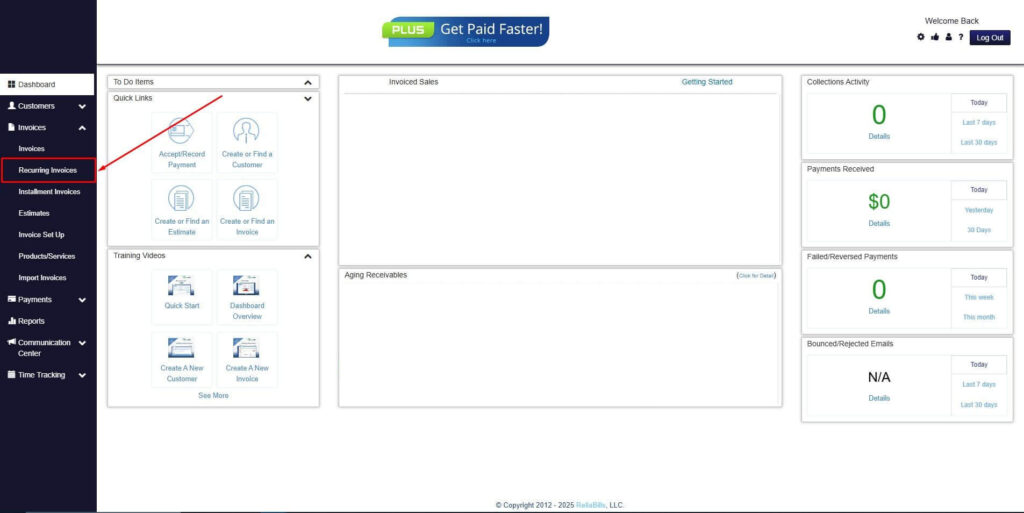

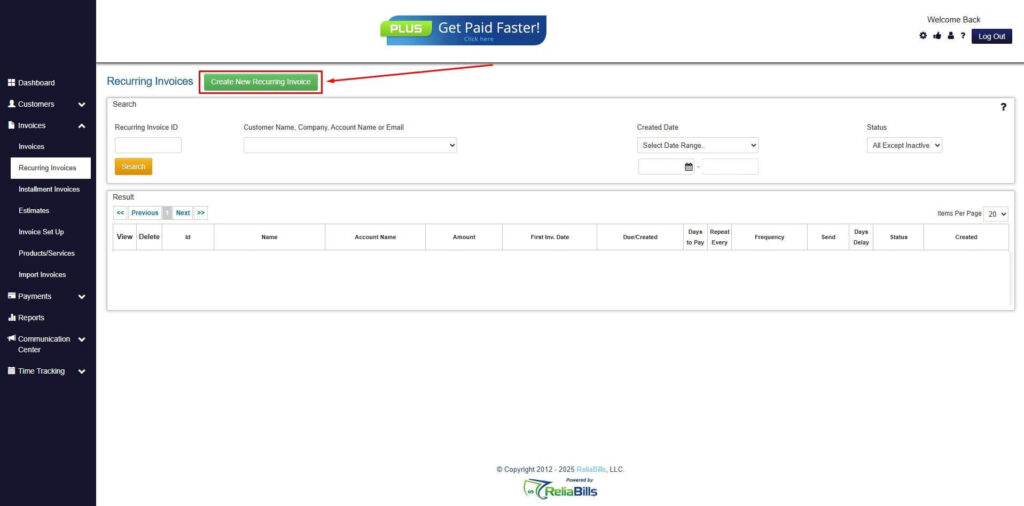

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

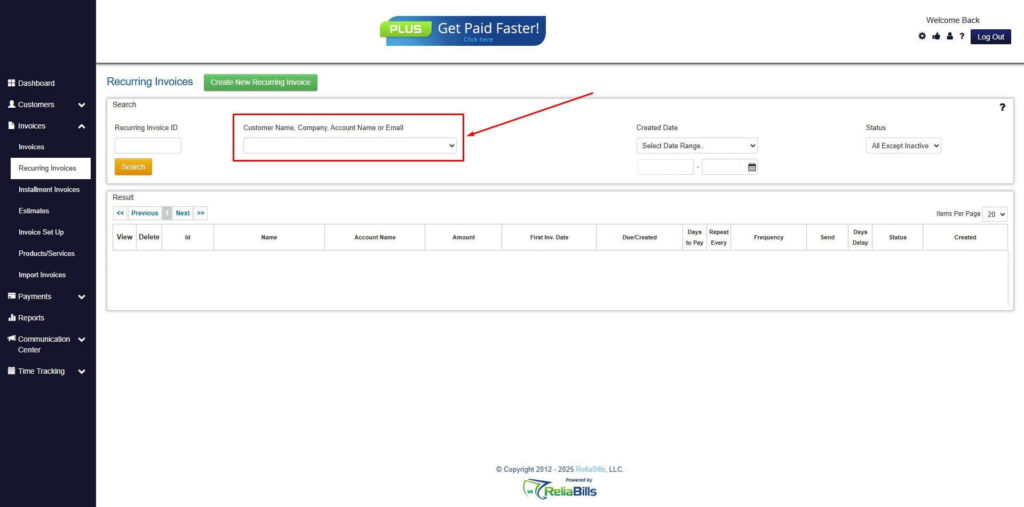

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

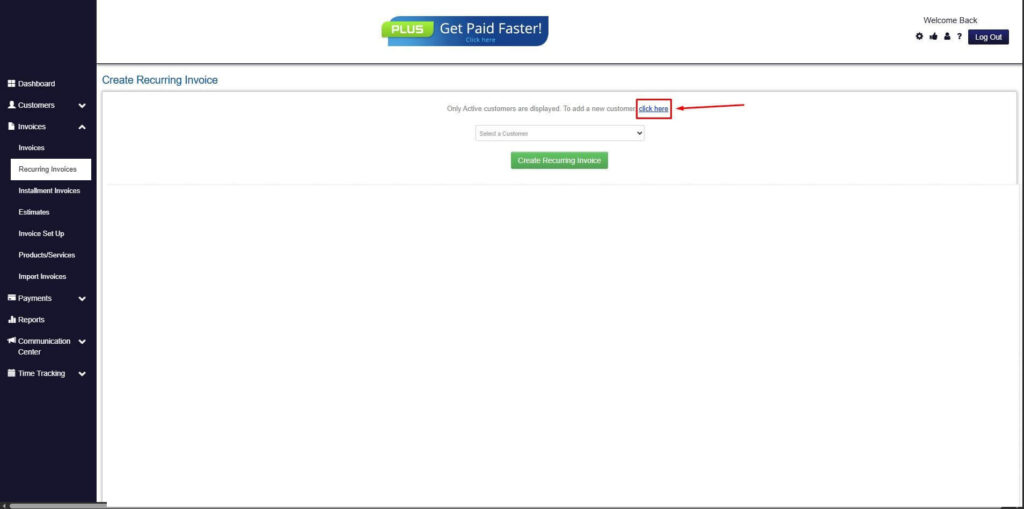

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

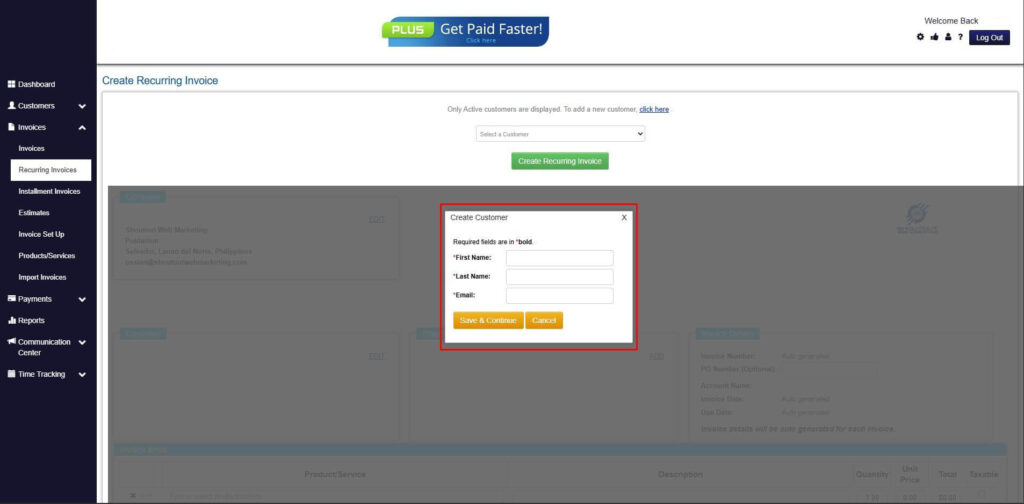

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

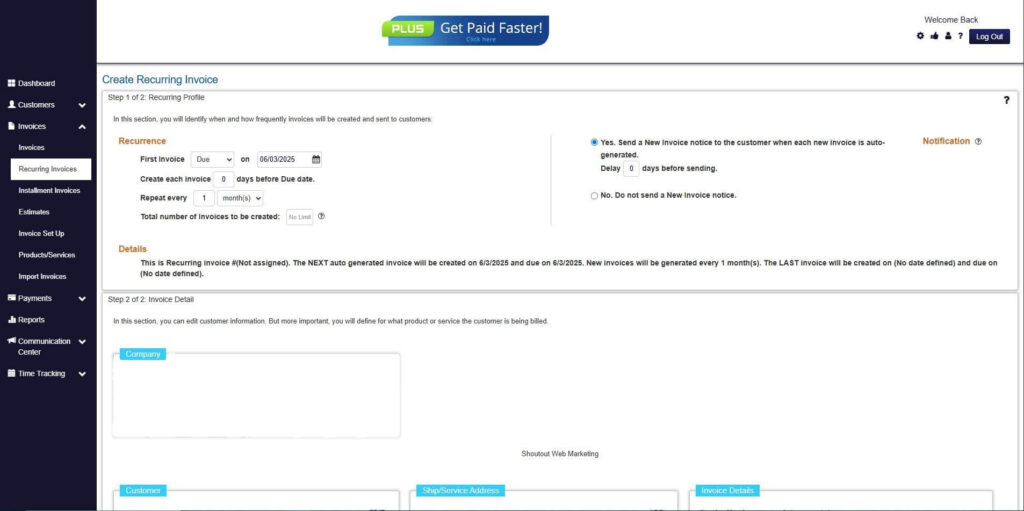

Step 7: Fill in the Create Recurring Invoice Form

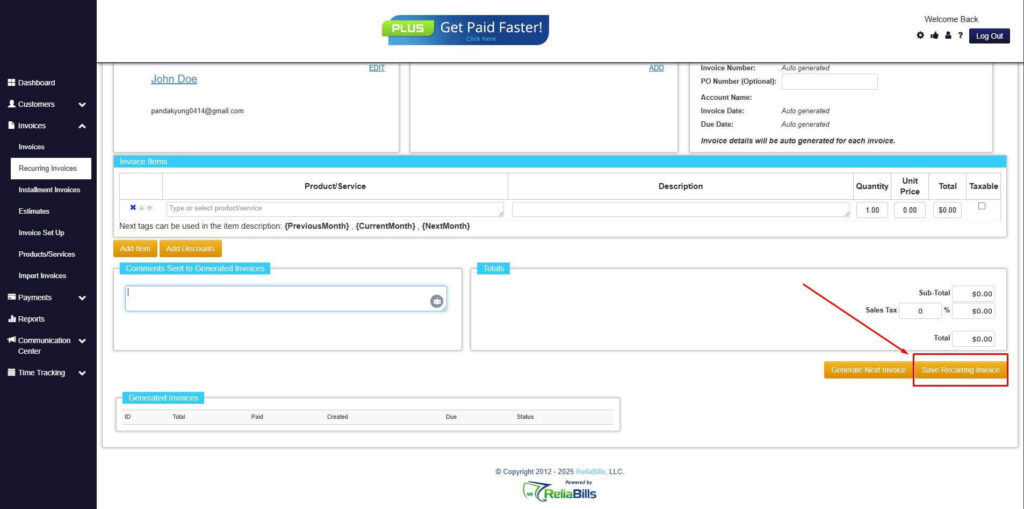

- Fill in all the necessary fields.

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

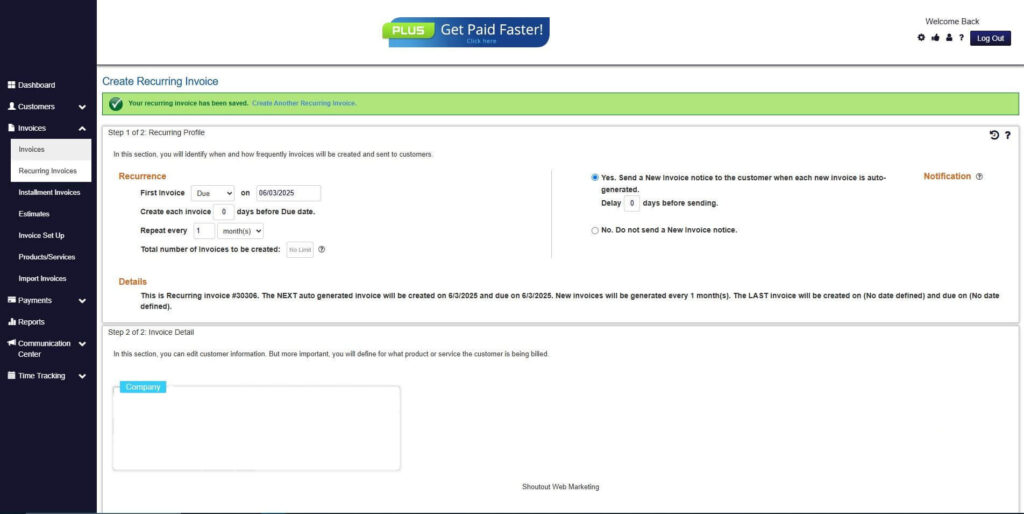

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What is fleet management billing software?

It is a digital system that automates invoice generation, recurring billing schedules, payment tracking, and financial reporting for fleet-related expenses. It centralizes operational data to improve accuracy and efficiency.

2. Why do fleet operations need automated billing?

Fleet environments generate high transaction volumes and variable costs. Automation reduces human error, accelerates billing cycles, and improves revenue visibility.

3. Can fleet billing systems handle recurring contracts?

Yes. Modern systems support automated recurring invoices for leases, maintenance contracts, telematics services, and subscription-based fleet solutions.

4. How does digital invoicing reduce billing disputes?

Digital invoices provide detailed cost breakdowns, standardized formatting, and centralized recordkeeping. This transparency makes it easier to verify charges and resolve concerns quickly.

5. Does fleet management billing software improve cash flow?

Yes. Automated invoice issuance, integrated payment processing, and reminder systems help shorten collection cycles and reduce accounts receivable aging.

6. Is digital fleet billing scalable for growing operations?

Absolutely. Automated systems allow businesses to manage more vehicles and transactions without significantly increasing administrative workload.

Conclusion

Digital invoices are no longer optional in modern fleet operations. High transaction volumes and recurring service contracts demand structured automation. Manual systems simply cannot provide the speed and accuracy required.

By implementing fleet management billing software, businesses gain operational efficiency and improved financial control. Automated invoicing reduces errors, accelerates collections, and strengthens revenue predictability.

Choosing scalable billing software ensures fleets can grow without increasing administrative complexity. Automation is not just a convenience. It is a competitive advantage.