Billing infrastructure is the backbone of any SaaS business. Subscription models rely on recurring payments, and even small errors can disrupt cash flow, confuse customers, and increase churn. Ensuring that invoices are accurate, timely, and automated is essential for both operational efficiency and long-term growth.

Manual invoicing in subscription environments carries significant risks. Human error can lead to missed or duplicate invoices, incorrect proration for plan changes, and delays in revenue recognition. For SaaS businesses that scale quickly, these errors can compound, creating financial inconsistencies and frustrating customers.

Automated invoicing for SaaS resolves these challenges by systematizing billing processes. By automatically generating invoices, applying correct charges, and handling recurring payments, businesses can focus on growth rather than manual tasks. Automation ensures accuracy, consistency, and a reliable revenue stream that scales with customer adoption.

Table of Contents

ToggleUnderstanding SaaS Billing Models

SaaS businesses often operate on subscription-based pricing, where customers pay monthly, annually, or based on usage. These models provide predictable income but require careful tracking to manage billing cycles and service levels effectively.

Some SaaS platforms also use tiered or hybrid pricing structures. Customers may choose from multiple plans or add optional features, creating variable billing scenarios that require precise tracking and adjustment.

Accurate automated invoicing for SaaS ensures that every pricing model is reflected correctly. Regardless of plan type or customer choice, the system calculates the appropriate charges without manual intervention, protecting revenue and improving customer trust.

What Are Automated Invoices?

Automated invoices are system-generated billing documents created without manual entry. They ensure that subscription fees, taxes, and adjustments are calculated and delivered consistently at scheduled intervals.

Unlike manual billing, which is prone to errors and delays, automated invoicing for SaaS uses predefined rules and integration with subscription management systems to produce accurate invoices automatically.

Core automation components include recurring invoice generation, proration calculations, automated reminders, and payment tracking. These features reduce human error, accelerate collections, and improve overall billing transparency.

The Complexity of SaaS Billing

SaaS billing can be complicated due to proration during plan upgrades or downgrades, add-ons, usage-based features, and global customers requiring multi-currency support.

Handling these variables manually is time-consuming and increases the risk of errors. Automated invoicing for SaaS systems calculates proration instantly, applies relevant taxes, and generates accurate invoices for every scenario.

By simplifying complex billing, automated invoicing ensures customers are charged correctly and on time, improving revenue predictability and reducing support inquiries.

Ensuring Billing Accuracy at Scale

Automated invoicing for SaaS eliminates many common errors in recurring billing. Subscription charges are calculated automatically, reducing duplicate or missed invoices and ensuring consistency across thousands of accounts.

By removing manual calculations, SaaS companies minimize the risk of human error. This consistency is particularly important for businesses scaling globally or serving a large subscriber base.

Accurate billing strengthens customer trust. Clear, error-free invoices improve transparency and help SaaS companies maintain positive relationships while protecting revenue streams.

Supporting Predictable Recurring Revenue

Recurring revenue is the lifeblood of SaaS businesses. Automated invoicing ensures consistent invoice generation, aligning billing cycles with subscription terms and improving monthly recurring revenue (MRR) stability.

Automation reduces delays in collections and enables precise tracking of revenue. Businesses can forecast income more confidently and plan operational spending without worrying about late payments.

Reliable revenue streams also support strategic growth initiatives. Predictable cash flow allows companies to invest in product development, marketing, and customer success more effectively.

Managing Upgrades, Downgrades, and Plan Changes

SaaS customers often change plans or add features mid-cycle. Automated invoicing for SaaS calculates proration adjustments in real-time, ensuring customers are charged accurately for partial periods.

Subscription updates are reflected immediately in the system, providing transparent invoice documentation for both customers and internal teams.

This automation not only reduces billing errors but also enhances the customer experience by providing clarity and avoiding disputes over plan changes.

Reducing Involuntary Churn

Failed or missed payments can lead to involuntary churn. Automated invoicing systems include payment reminders, retry logic for failed transactions, and alerts for overdue accounts.

By preventing service interruptions due to billing issues, SaaS companies retain more customers and maintain recurring revenue streams.

This proactive approach minimizes revenue leakage and strengthens long-term customer relationships.

Enhancing Customer Experience

Automated invoices are formatted consistently and delivered on time, improving professionalism and trust. Customers can easily access their billing history and view transparent pricing breakdowns.

Clear communication reduces confusion and support requests. Customers feel confident that they are being charged accurately, increasing satisfaction and loyalty.

The resulting customer experience is a key competitive differentiator in the SaaS market, where smooth subscription management is expected.

Improving Financial Forecasting and Reporting

Automated invoicing for SaaS provides real-time visibility into revenue, MRR, and outstanding payments. This transparency supports better forecasting, budget planning, and financial decision-making.

Metrics from automated billing systems allow leadership to measure growth, spot trends, and prepare for scaling operations.

Audit-ready documentation ensures that companies can quickly reconcile accounts, support compliance, and demonstrate accurate revenue recognition.

Supporting Global SaaS Expansion

Serving international customers adds complexity, including multi-currency billing, taxes, and compliance requirements. Automated invoicing systems handle these challenges seamlessly.

By standardizing global billing processes, SaaS companies can expand into new markets without creating administrative bottlenecks.

Scalable billing infrastructure ensures consistent revenue recognition and smooth operations, even as the customer base grows across multiple regions.

Best Practices for Implementing Automated SaaS Invoicing

Align Invoicing with Your Subscription Pricing Strategy

Ensure that automated invoices reflect your exact subscription models, whether monthly, annual, usage-based, or tiered plans. Clear alignment prevents misbilling, supports accurate revenue recognition, and maintains customer trust.

Monitor Key SaaS Metrics Regularly

Track metrics like Monthly Recurring Revenue (MRR), churn rates, Average Revenue Per User (ARPU), and lifetime value (LTV). Using automated invoices in conjunction with these metrics helps businesses spot trends, adjust pricing strategies, and maximize revenue potential.

Conduct Routine Billing Audits

Periodically review automated invoice reports to catch inconsistencies or errors. Even with automation, audits ensure accuracy in proration, discounts, tax calculations, and multi-currency handling. Regular checks reinforce customer confidence and prevent revenue leakage.

Implement Automated Payment Reminders and Retry Logic

Set up reminders for upcoming or overdue payments and enable automatic retries for failed transactions. These measures reduce involuntary churn and minimize missed revenue without adding manual follow-ups.

Maintain Transparent and Professional Invoice Templates

Design automated invoices with clear formatting, line-item breakdowns, and subscription details. Transparency reduces disputes, improves the customer experience, and strengthens trust in your SaaS brand.

Integrate Billing with Financial Reporting Tools

Connect automated invoices to accounting or reporting systems to create real-time visibility into revenue and cash flow. This integration enhances forecasting accuracy and supports strategic planning for growth initiatives.

Ensure Compliance and Tax Accuracy

Configure automated invoicing systems to handle applicable taxes, VAT, and multi-currency conversions. Compliance-ready automation prevents legal penalties and simplifies reporting for global SaaS expansion.

Customize Billing Workflows for Different Customer Segments

Tailor automation rules to different subscription tiers, enterprise clients, or trial-to-paid conversions. Segmented billing ensures invoices are accurate, relevant, and appropriately scheduled for each customer type.

Educate Your Team on the Automated Billing System

Provide training for finance, customer success, and sales teams to understand the automation workflow. Proper training ensures everyone can respond to customer inquiries and interpret automated invoice reports effectively.

Continuously Optimize and Scale Your Automated Invoicing

Review system performance, customer feedback, and billing trends regularly. Update rules, templates, or workflow settings to support growth, new pricing models, or international expansion without disruption.

How ReliaBills Supports SaaS Automated Invoicing

ReliaBills makes automated invoicing for SaaS seamless by removing manual workflows and helping teams focus on subscription growth instead of administrative tasks. With recurring invoice scheduling, the platform automatically generates and sends bills according to your subscription terms, so you never have to manually create the same invoice each month. Built‑in templates and flexible billing configurations let you tailor invoices to match your SaaS pricing structures and customer expectations, keeping billing consistent and professional.

For SaaS businesses that depend on predictable recurring revenue, ReliaBills’ automated invoicing features help stabilize cash flow and reduce churn caused by billing issues. The platform supports scheduled reminders and payment tracking, which gently nudge customers about upcoming or overdue payments without extra effort from your team. With payment processing and retry logic integrated, ReliaBills helps maximize collection rates, ensuring more invoices convert to actual revenue with fewer service interruptions.

ReliaBills also provides centralized dashboards and reporting tools that bring subscription revenue tracking into one place, making it easier to spot trends, forecast growth, and reconcile accounts efficiently. Automated reporting helps SaaS leaders measure key metrics like recurring revenue, overdue balances, and payment performance without sifting through spreadsheets. This level of financial visibility supports smarter decision‑making and lets teams scale billing operations confidently as their customer base grows.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

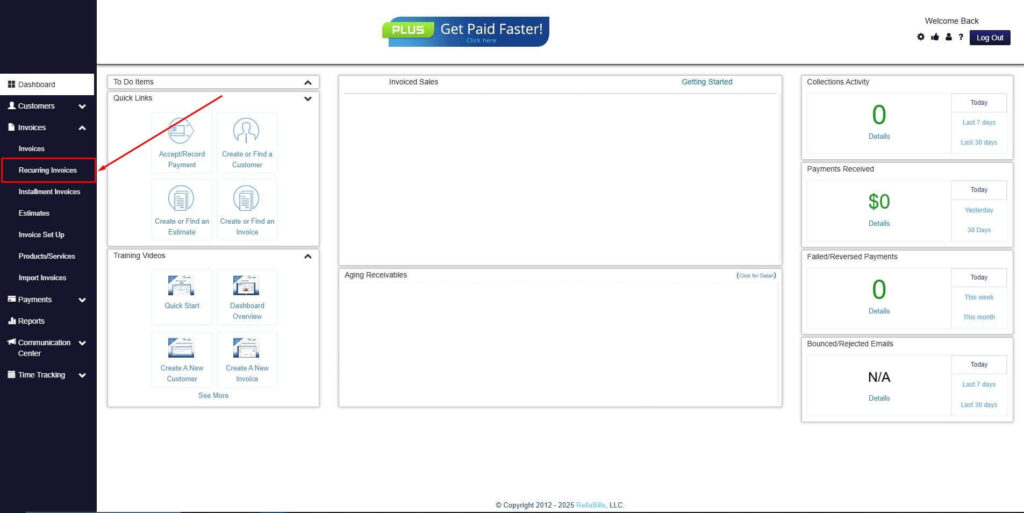

Step 2: Click on Recurring Invoices

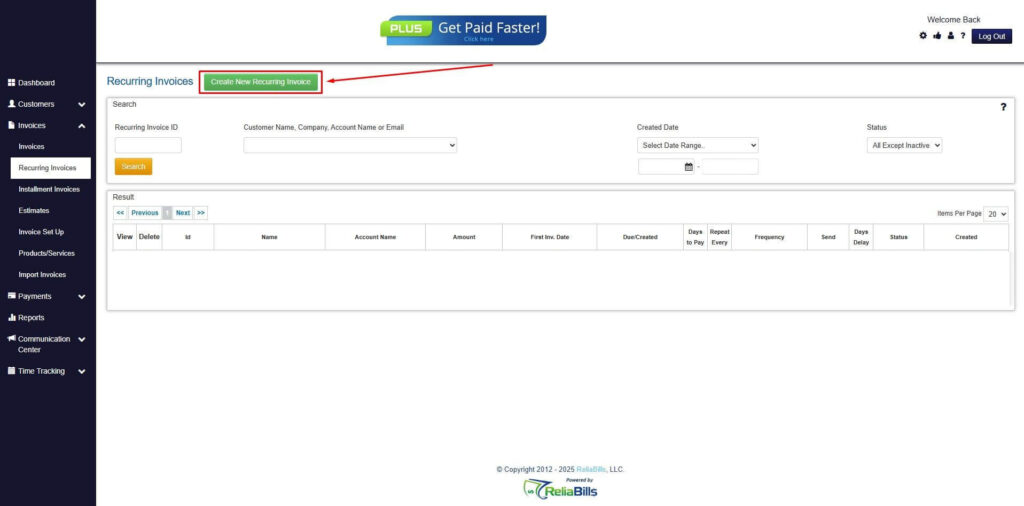

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

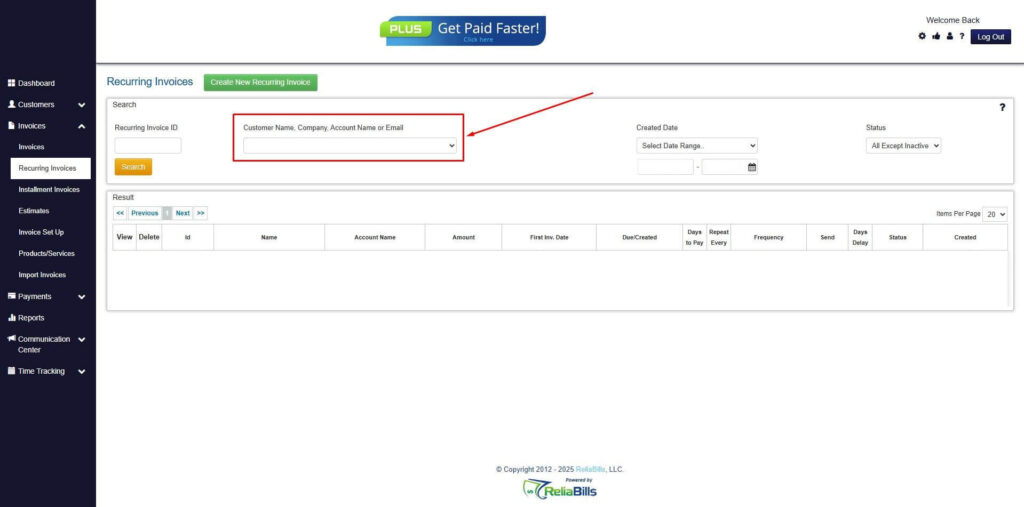

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

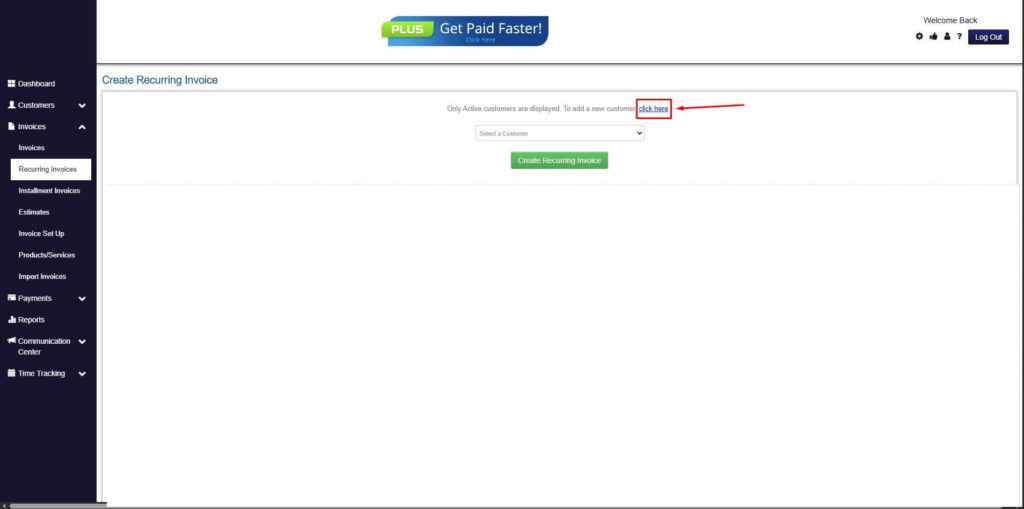

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

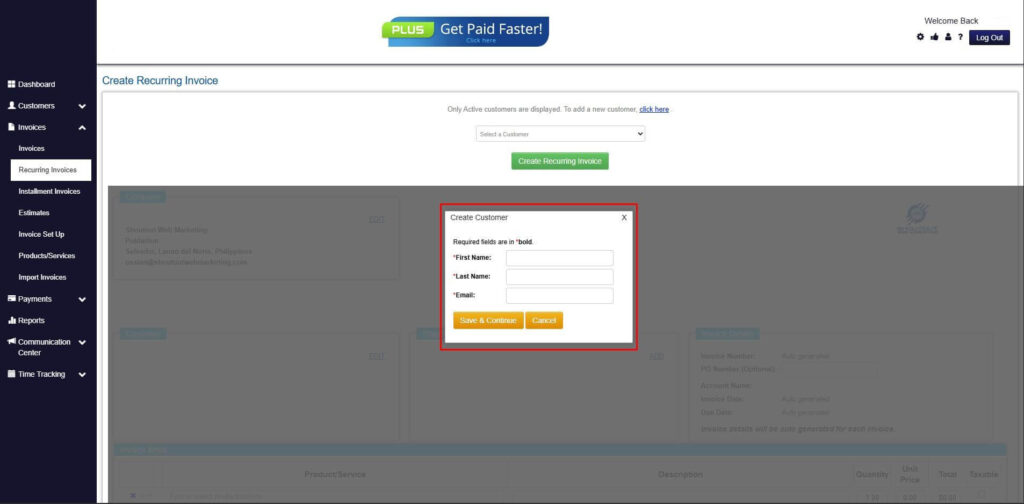

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

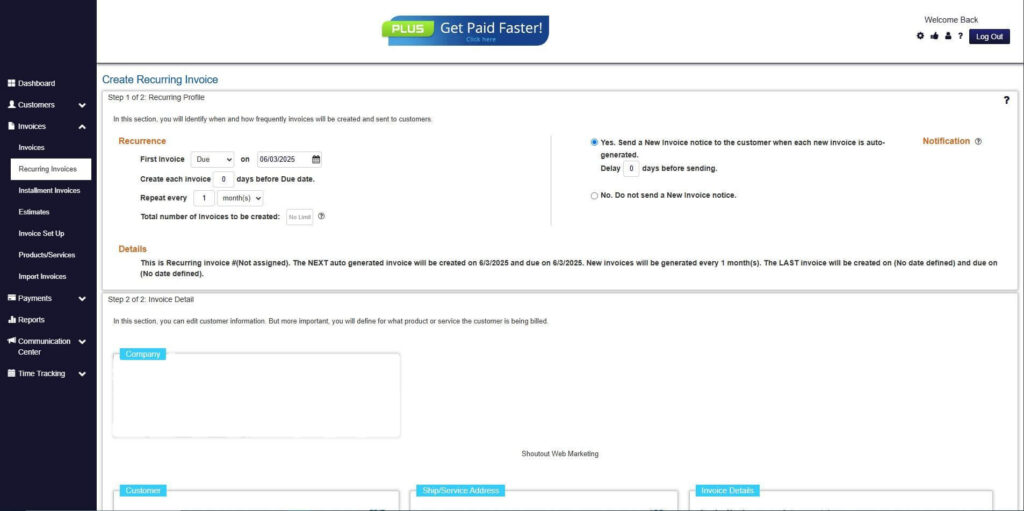

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

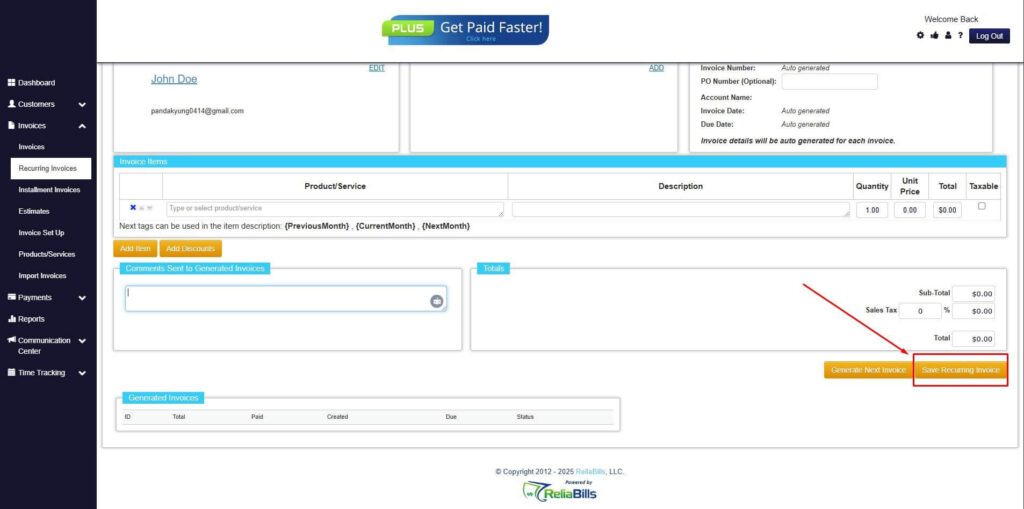

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

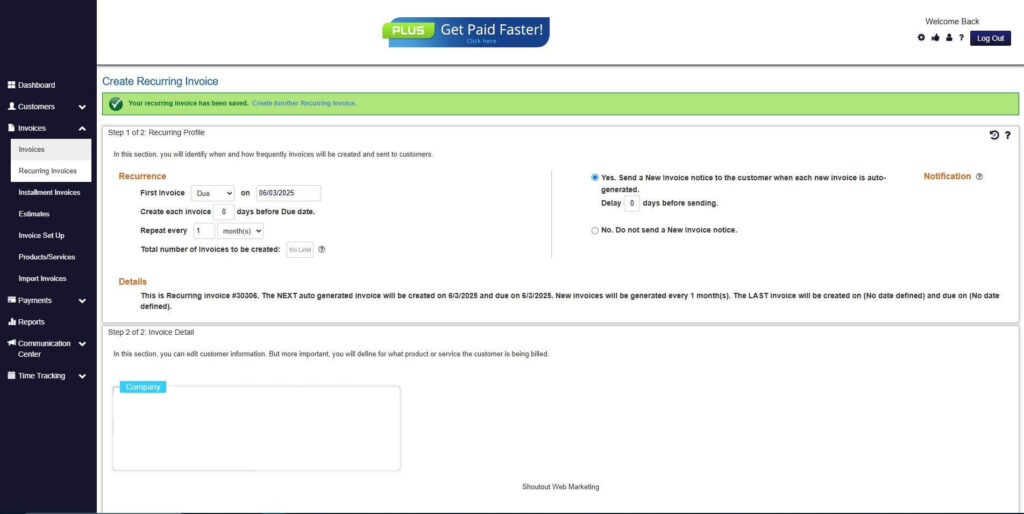

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. What is automated invoicing for SaaS?

It is system-driven invoice generation that calculates charges, applies taxes, and delivers recurring invoices without manual input.

2. How does automation reduce billing errors?

By calculating subscription fees, proration, and taxes automatically, the system eliminates common human errors and ensures consistency.

3. Can automated invoicing improve revenue predictability?

Yes. Regular, accurate invoices reduce delayed payments and support stable monthly recurring revenue.

4. Is it suitable for global SaaS businesses?

Absolutely. Automation handles multi-currency billing, taxes, and compliance requirements across regions.

5. How does it affect customer experience?

Automated invoices provide clear, professional billing with consistent delivery, improving transparency and reducing disputes.

6. Why is automation critical for scaling SaaS operations?

As customer volume grows, manual billing becomes impractical. Automation ensures accuracy, efficiency, and predictable revenue at scale.

Conclusion

Automated invoicing is essential for SaaS businesses to maintain accurate billing, reduce errors, and support recurring revenue. By handling proration, plan changes, and multi-currency billing automatically, these systems protect both revenue and customer relationships.

The long-term benefits include improved financial visibility, predictable cash flow, and scalability. Companies that implement automated invoicing for SaaS can focus on growth, product development, and customer success rather than manual administrative tasks.

With tools like ReliaBills, SaaS businesses can confidently scale their operations while ensuring precise, reliable billing and robust revenue tracking.