Tenant billing is one of the most time-consuming responsibilities for landlords and property managers. Between rent, utilities, maintenance fees, and adjustments, managing invoices manually often leads to delays, errors, and tenant frustration. As property portfolios grow, these challenges only become harder to control.

Manual rent and fee invoicing commonly results in late payments, missing records, and inconsistent communication. Paper invoices can be misplaced, emails overlooked, and spreadsheets quickly become outdated. This lack of structure makes it difficult to maintain accurate billing and predictable cash flow.

Digital invoices for tenant billing offer a modern solution by automating routine tasks and improving visibility. This guide explains how digital invoicing simplifies tenant billing, improves accuracy, and supports scalable property management operations.

Table of Contents

ToggleWhat Are Digital Invoices?

Digital invoices are electronic billing documents created, sent, and stored through billing software rather than on paper. They include all rent and fee details in a structured format that tenants can access online. This approach reduces reliance on manual entry and physical records.

Compared to paper-based tenant invoices, digital invoices are faster to deliver and easier to track. Tenants receive invoices instantly, while property managers gain real-time visibility into billing and payment status. This improves transparency on both sides.

For property management, digital invoices typically include features such as recurring billing, automated calculations, payment links, and invoice history. These tools are essential for managing rent and variable charges efficiently across multiple tenants.

Common Tenant Billing Challenges

Late Rent Payments and Missed Invoices

Many landlords struggle with late payments because invoices are sent manually or inconsistently. Paper invoices can be misplaced, while emailed invoices may be overlooked or sent late. This disrupts cash flow and forces property managers to spend time chasing payments instead of managing properties.

Manual Calculations for Utilities and Additional Fees

Utility charges, maintenance costs, parking fees, and shared expenses often require manual calculations. This increases the risk of incorrect amounts, especially when charges vary month to month. Even small errors can lead to tenant disputes and loss of trust.

Lack of Real-Time Payment Visibility

Without digital systems, tracking who has paid and who has not usually involves spreadsheets or bank statement checks. This makes it difficult to follow up efficiently and increases the chance of missed outstanding balances.

Inconsistent Communication with Tenants

Billing details, due dates, and reminders are often communicated inconsistently. When tenants are unsure about what they owe or when payment is due, disputes and delays become more common.

Difficulty Scaling Across Multiple Units or Properties

As the number of tenants grows, manual billing processes become unmanageable. What works for a few units quickly breaks down when managing dozens or hundreds of tenants.

How Digital Invoices Improve Billing Accuracy

Digital invoices reduce errors by automating rent, utility, and fee calculations. Instead of re-entering numbers each month, property managers can rely on predefined billing rules. This ensures consistent and accurate charges for every tenant.

Standardized invoice formats also improve clarity. Each invoice follows the same structure, making it easier for tenants to understand what they are being billed for. Clear line items reduce questions and disputes.

By minimizing manual data entry, digital invoicing significantly lowers the risk of duplicate charges or missing fees. Accurate billing builds tenant confidence and reduces administrative corrections.

Simplifying Recurring Rent Billing

Recurring rent billing is one of the biggest advantages of digital invoices for tenant billing. Monthly rent invoices can be scheduled automatically, ensuring they are sent on time without manual effort. This eliminates the risk of forgotten invoices.

Recurring charges such as parking, storage, or amenities can also be included automatically. Tenants receive a complete and consistent invoice each billing cycle, which simplifies budgeting on their end.

Automated recurring billing creates predictability for both landlords and tenants. Property managers benefit from steadier cash flow, while tenants know exactly when and what they need to pay.

Managing Variable Charges with Digital Invoices

Variable charges such as utilities, maintenance, and shared expenses are easier to manage with digital invoices. Charges can be added as line items with clear descriptions, improving transparency.

Prorated charges for move-ins, move-outs, or lease changes can be calculated accurately using digital billing rules. This prevents overbilling or underbilling during partial periods.

Detailed line-item breakdowns help tenants understand how charges are calculated. Transparency reduces disputes and improves overall satisfaction with the billing process.

Faster Invoice Delivery and Payment Collection

Digital invoices are delivered instantly, removing delays associated with printing or mailing. Tenants receive notifications as soon as invoices are issued, allowing them to act quickly.

Integrated online payment options make it easier for tenants to pay. When invoices include payment links, tenants are more likely to complete payments on time.

Faster delivery and easier payments shorten the overall payment cycle. This improves cash flow consistency for landlords and property managers.

Automated Payment Reminders and Follow-Ups

Automated reminders play a critical role in reducing late payments. Reminders can be scheduled before due dates and after missed payments without manual follow-up.

This reduces the need for uncomfortable or time-consuming payment chases. Tenants receive consistent and professional notifications instead.

Regular reminders help establish better payment habits over time, leading to more reliable rent collection.

Improving Tenant Communication and Transparency

Clear communication is essential in tenant billing. Digital invoices provide detailed explanations of charges, reducing confusion and misunderstandings.

Tenants can access invoice history at any time, making it easier to review past payments. This transparency builds trust and accountability.

With fewer billing questions and disputes, property managers can focus on tenant relationships rather than administrative issues.

Tracking Payments and Outstanding Balances

Digital invoicing systems provide real-time updates on payment status. Property managers can instantly see which invoices are paid, overdue, or partially settled.

Outstanding balances are easier to manage with centralized tracking. This improves follow-up efficiency and reduces missed collections.

Better visibility into cash flow helps landlords make informed financial decisions and plan for property expenses.

Digital Invoices for Multi-Property Management

Managing billing across multiple properties is challenging without automation. Digital invoices allow property managers to centralize billing for all units in one system.

Consistent billing processes ensure fairness and accuracy across different tenants and locations. This standardization reduces errors as portfolios grow.

Digital invoicing supports scalability, allowing property managers to handle more tenants without increasing administrative workload.

Best Practices for Implementing Digital Tenant Billing

Standardize Billing Policies and Charge Structures

Clearly define rent schedules, due dates, late fees, and additional charges before going digital. Standardization ensures consistency across all tenants and reduces confusion once digital invoices are introduced.

Automate Recurring Rent and Fixed Charges

Use digital invoicing tools to automate monthly rent and recurring fees. Automation ensures invoices are sent on time every billing cycle and eliminates the risk of forgotten or delayed invoices.

Clearly Communicate the Transition to Tenants

Inform tenants in advance about the move to digital invoices. Explain how invoices will be delivered, how payments can be made, and where invoice history can be accessed. Clear communication helps avoid resistance and confusion.

Use Detailed Line Items for Variable Charges

Break down utilities, maintenance, and shared costs into clear line items. Transparency helps tenants understand charges and significantly reduces billing disputes.

Enable Automated Payment Reminders

Schedule reminders before and after due dates to encourage on-time payments. Automated reminders reduce awkward follow-ups and improve overall payment consistency.

Review Billing Reports Regularly

Monitor payment trends, overdue balances, and tenant behavior using digital reports. Regular reviews help identify issues early and improve long-term billing performance.

How ReliaBills Supports Digital Tenant Invoicing

ReliaBills makes digital tenant billing effortless by providing a centralized platform for automating invoices and recurring payments. Property managers can set up standardized templates for rent, utilities, and additional fees, ensuring invoices are sent consistently on schedule. This eliminates manual work, reduces calculation errors, and keeps tenants informed with clear, professional billing.

With integrated payment options, tenants can pay online immediately, while automated reminders and notifications help reduce late payments. ReliaBills tracks each invoice in real time, giving landlords visibility into outstanding balances, partial payments, and completed transactions. This improves cash flow predictability and minimizes disputes without requiring extra follow-ups.

For property managers overseeing multiple units or properties, ReliaBills centralizes all tenant billing in one dashboard. From recurring rent to variable charges like prorated utilities, the platform supports accurate record-keeping, audit-ready reporting, and scalable invoicing. By combining automation, transparency, and reliable tracking, ReliaBills ensures tenant billing is faster, more accurate, and easier to manage overall.

How to Create a New Recurring Invoice Using ReliaBills

Creating a New Recurring Invoice using ReliaBills involves the following steps:

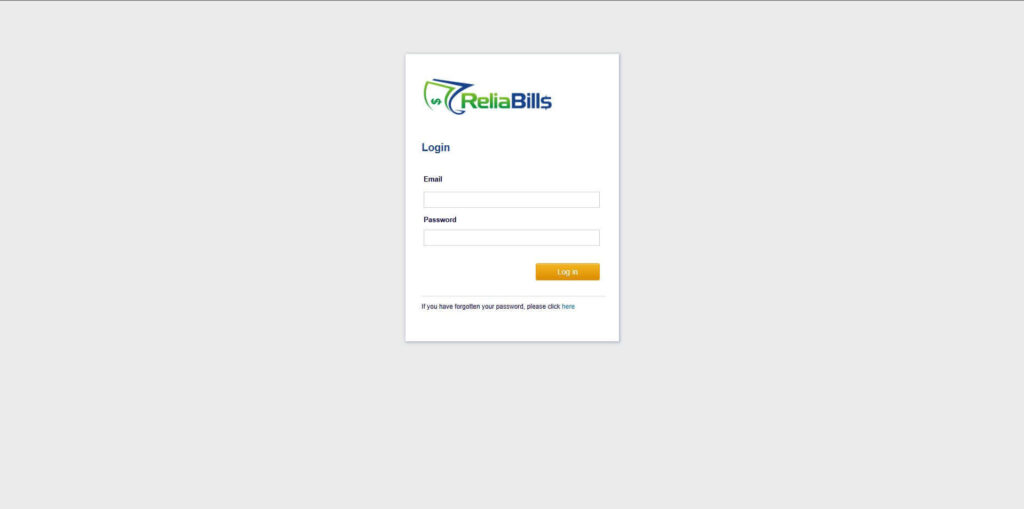

Step 1: Login to ReliaBills

- Access your ReliaBills Account using your login credentials. If you don’t have an account, sign up here.

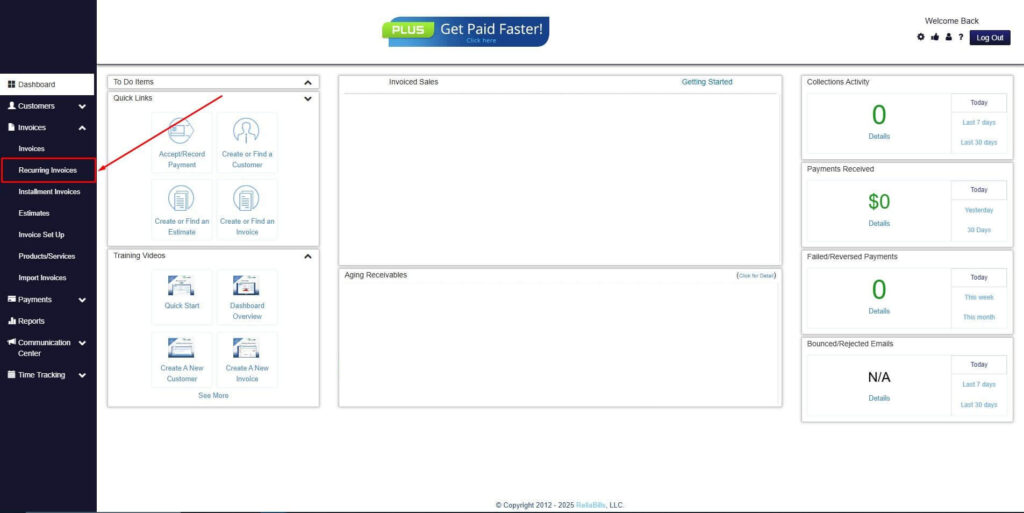

Step 2: Click on Recurring Invoices

- Navigate to the Invoices Dropdown and click on Recurring Invoices for an overview of the list of your existing customers.

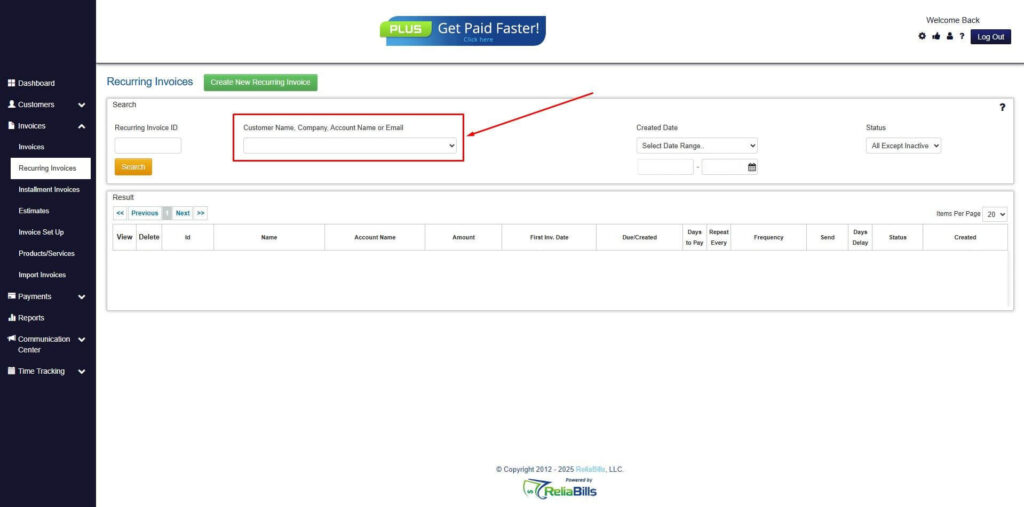

Step 3: Go to the Customers Tab

- If you have already created a customer, search for them in the Customers tab and make sure their status is “Active”.

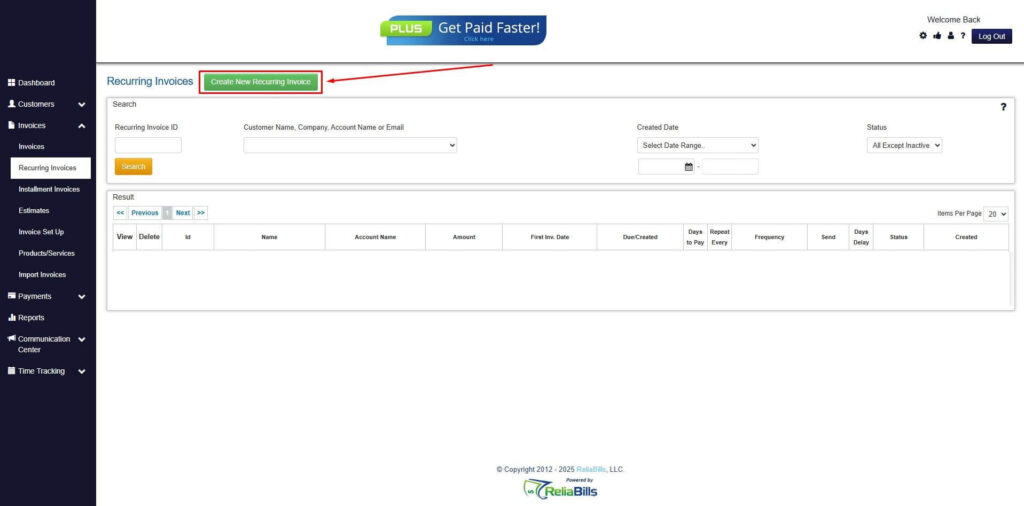

Step 4: Click the Create New Recurring Invoice

- If you haven’t created any customers yet, click the Create New Recurring Invoice to create a new customer.

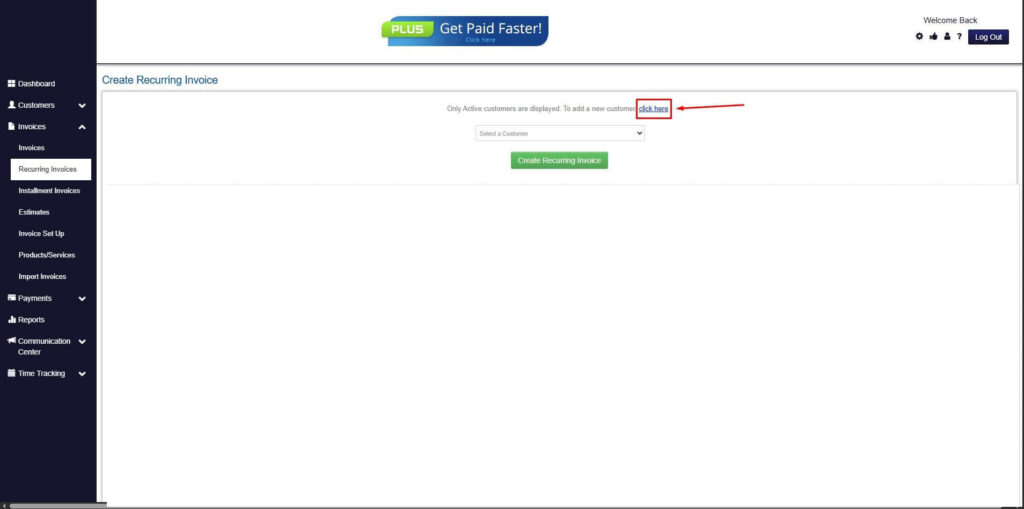

Step 5: Click on the “Click here” Button

- Click on the “Click here” button to proceed with the recurring invoice creation.

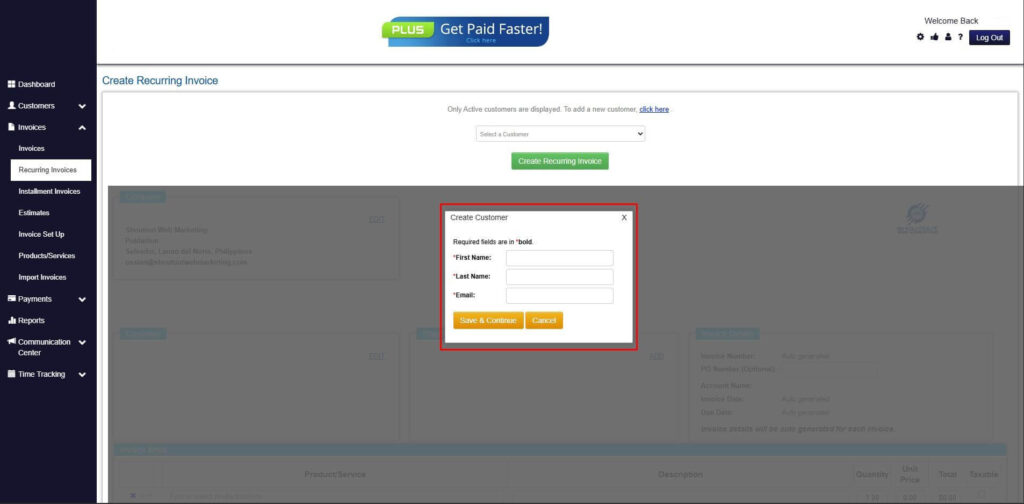

Step 6: Create Customer

- Provide your First Name, Last Name, and Email to proceed.

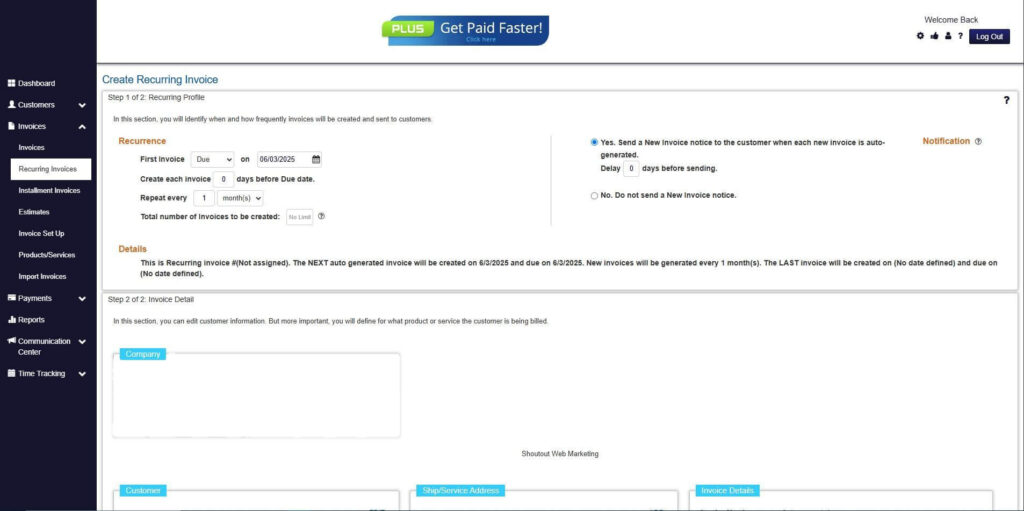

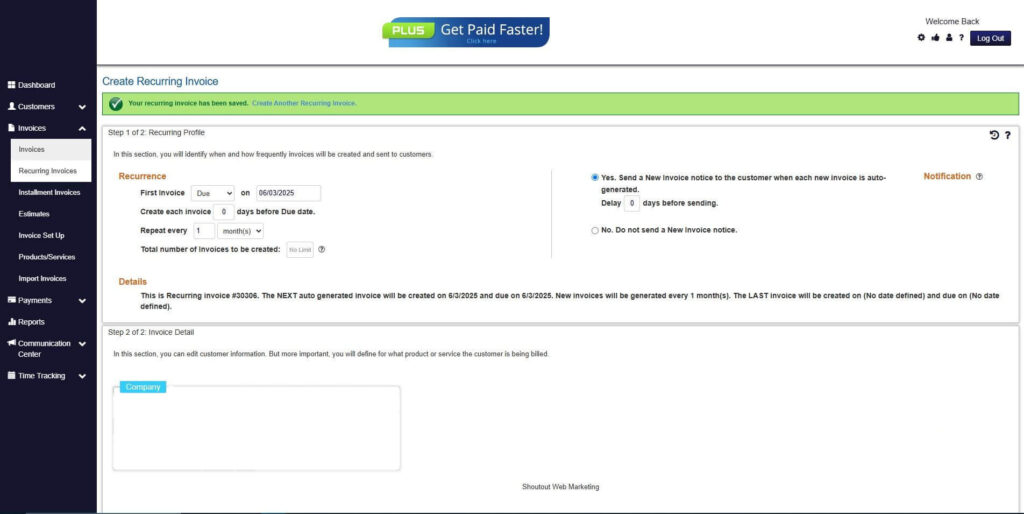

Step 7: Fill in the Create Recurring Invoice Form

- Fill in all the necessary fields.

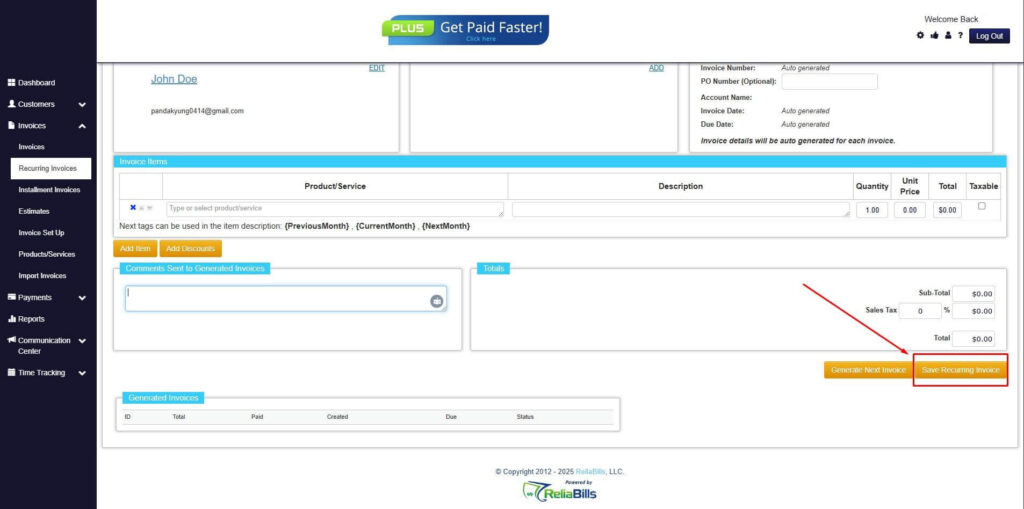

Step 8: Save Recurring Invoice

- After filling up the form, click “Save Recurring Invoice” to continue.

Step 9: Recurring Invoice Created

- Your Recurring Invoice has been created.

Frequently Asked Questions

1. Are digital tenant invoices legally valid?

Yes, digital invoices are legally valid in most jurisdictions as long as they include required billing details and are properly stored. Many regulatory bodies accept electronic records for audits and compliance purposes.

2. Can digital invoices handle variable charges like utilities?

Digital invoicing systems are well-suited for variable charges. Property managers can add or adjust line items each billing cycle while maintaining accurate records and transparent breakdowns.

3. How do tenants access their invoice history?

With digital invoicing, tenants can access current and past invoices online. This reduces billing-related questions and allows tenants to manage their own records easily.

4. Will digital billing reduce late rent payments?

Digital invoices combined with automated reminders and online payments significantly reduce late payments. Tenants receive invoices on time and have fewer barriers to completing payments.

5. Is digital tenant billing suitable for small landlords?

Yes, digital billing benefits both small landlords and large property managers. Automation saves time, improves accuracy, and creates a more professional billing experience regardless of portfolio size.

Conclusion

Digital invoices for tenant billing simplify one of the most complex aspects of property management. By improving accuracy, speeding up payments, and enhancing transparency, digital invoicing reduces administrative strain and tenant disputes.

For landlords and property managers, adopting digital invoicing is no longer optional. It is a practical step toward efficiency, scalability, and predictable cash flow. With the right tools in place, tenant billing becomes easier to manage and easier for tenants to understand.